Shanghai New Vehicle Registration Data for October

The new data for October 2021 vehicle registration in Shanghai is out and an update is necessary.

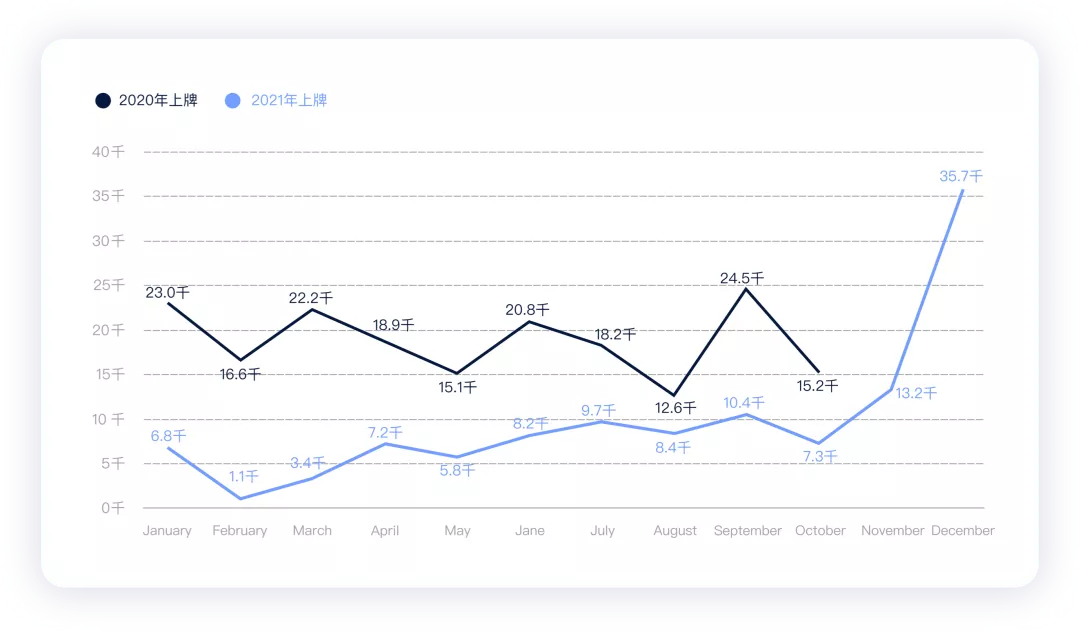

Shanghai’s overall vehicle registration for October was 37,351 (down 29.25% from the previous month and down 14.02% from the same period last year); 15,200 of which were new energy vehicles (NEVs). Excluding the special circumstances in September when Tesla delivered a large number of orders, Shanghai’s overall vehicle registration declined.

The cumulative total number of NEVs in Shanghai for 2021 is 187,000, an astonishing figure of 38.8% of all vehicle registrations for the year at 483,000.

Shanghai Vehicle Registration Data

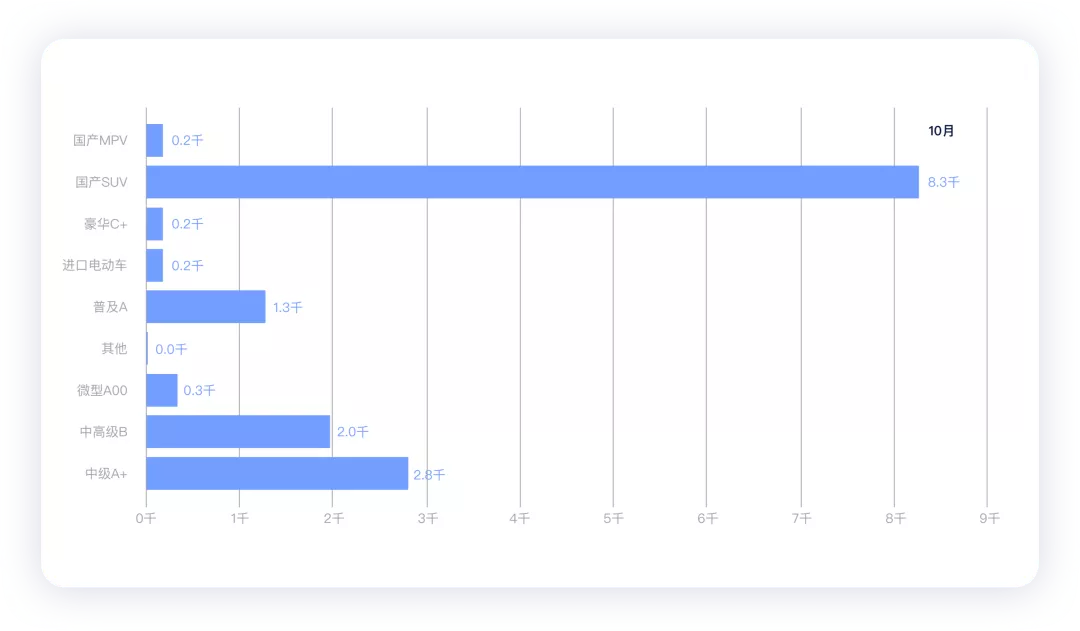

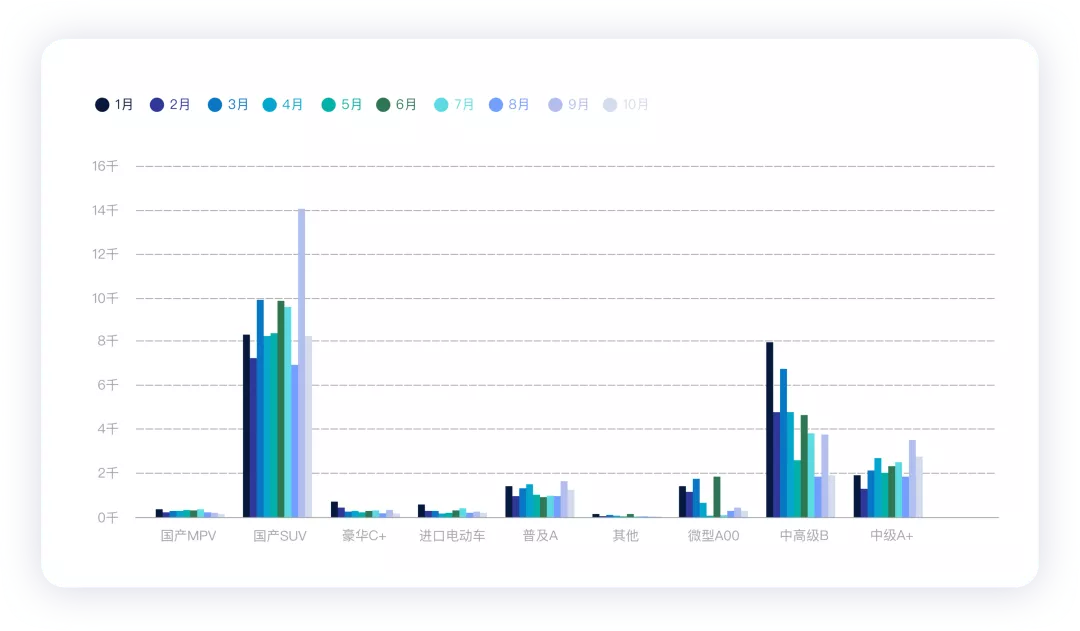

In September, SUVs accounted for over 50% of NEV registrations at 8,264 vehicles, while mid and high-end vehicles accounted for 2,000 to 3,000, and popular models less than 1,000.

However, the situation for October should have been much better considering it is usually the peak season for car purchases. From a macro perspective, it appears that with changes in the education and service industry towards the end of the year, this wave of auto consumption growth from major cities may be nearing its end, as indicated by the response of NEVs.

Looking at the data for 2021, it is clear that demand for models like the Model 3 is continuously decreasing in Shanghai. Excluding the abnormal 9th month, the market for pure electric SUVs has been relatively stable.

As Tesla’s sales in Shanghai are a significant factor, starting from June, a reverse relationship between new vehicle registrations (which mainly includes a large number of Tesla vehicles) and Tesla export volumes appeared – that is, the more Tesla exports, the lower the new vehicle registration in Shanghai becomes. When Tesla export numbers decrease and vehicle deliveries are concentrated, new vehicle registration in Shanghai increases. This is a very interesting phenomenon.## Analysis of data from China Passenger Car Association

A) Overall Analysis

The data for new energy passenger cars in October was very good according to the China Passenger Car Association:

- Wholesale sales reached 368,000 units, a MoM increase of 6.3% and a YoY increase of 148.1%;

- Retail sales reached 321,000 units, a YoY increase of 141.1% and a MoM decrease of 3.9%;

- Export of new energy vehicles was 56,400 units (30% of 188,000), of which Tesla exported 40,666 units, SAIC passenger cars exported 6,659 units, BYD exported 1,026 units, and FAW Hongqi exported 424 units.

Note: I have cited the data from the China Passenger Car Association for reference only.

B) Classification of Pure Electric and Plug-in Vehicles

In terms of classification, plug-in hybrids are currently stronger in China, with wholesale sales of pure electric vehicles reaching 303,000 units, a YoY increase of 142.2%, and plug-in hybrid sales of 65,000 units, a YoY increase of 179.9%.

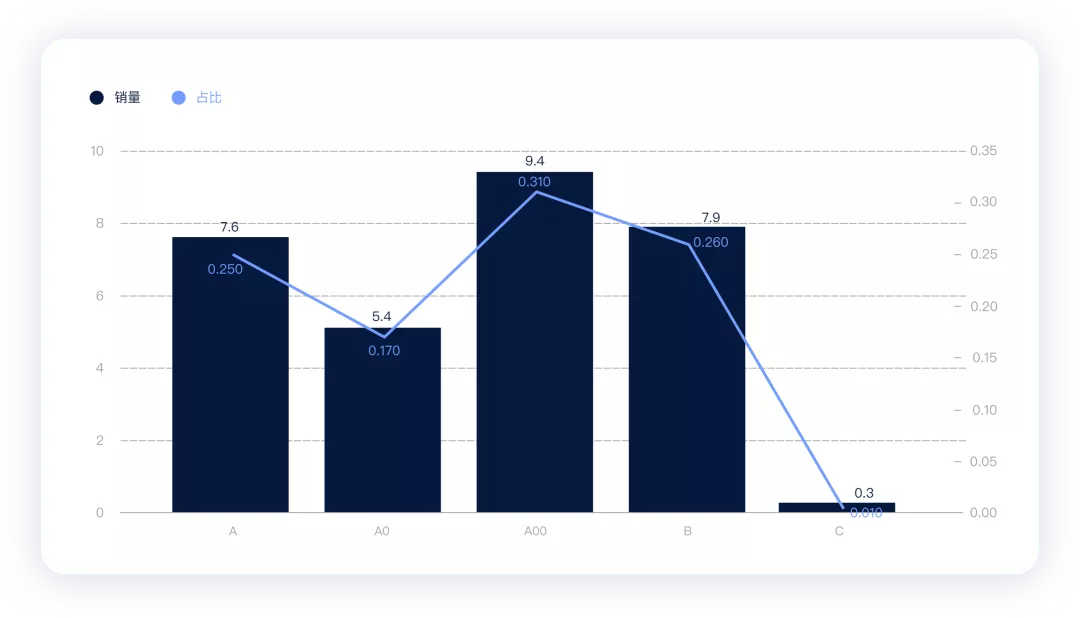

Currently, the classification of pure electric vehicles is as follows:

- Wholesale sales of A00-level vehicles reached 94,000 units, accounting for 31% of pure electric vehicles;

- Wholesale sales of A0-level vehicles reached 51,000 units, accounting for 17% of pure electric vehicles;

- A-level electric vehicles accounted for 25% of pure electric vehicle sales;

- B-level electric vehicles reached 79,000 units, accounting for 26% of pure electric vehicle sales.

From the following graph, it can be seen that the A0 level has risen significantly during this period, and many automakers have found ways to differentiate themselves from Wuling’s popular electric vehicle.

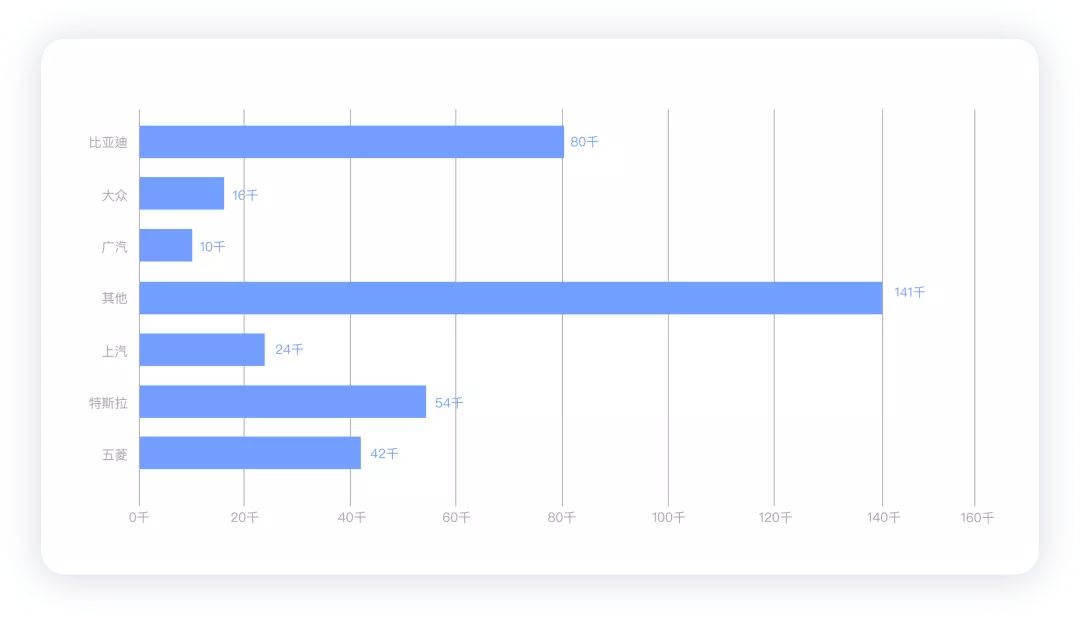

C) Ranking of Automotive Companies

Companies with distinctive wholesale sales included:

- BYD with 80,373 units (including 38,641 plug-in hybrids)

- Tesla China with 54,391 units

- SAIC-GM-Wuling with 42,133 units

- SAIC passenger cars with 24,085 units

- GAC Aion with 12,064 units

- XPeng Motors with 10,138 units

- If Volkswagen is counted as a whole, the total sales of new energy vehicles for FAW-Volkswagen and SAIC-Volkswagen were 16,318 units.

## Summary

## Summary

I think new energy vehicles are destined for a bumpy ride in 2022. It could be a year of differentiation, and many players may not be able to continue playing.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.