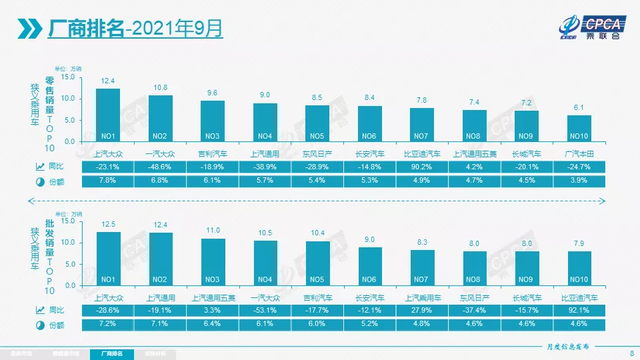

On October 12th, the latest production and sales data from the China Association of Automobile Manufacturers (CAAM) was released. According to the data, retail sales of passenger vehicles in China for September were 1.582 million units, a year-on-year decrease of 17.3%. Domestic brands sold 690 thousand units, a year-on-year increase of 5% and a month-on-month increase of 16% in August. The retail market share was 44.3%, an increase of 9.4 percentage points from the previous year, while the wholesale market share was 47.7%, an increase of 11 percentage points from the same period last year.

At the same time, from the data, the resilience of the industrial chain of head domestic brands is relatively strong, effectively resolving the pressure brought by the chip shortage, and turning adversity into opportunity. In terms of brands, Geely, Changan, and Great Wall Motors continue to be the most noteworthy.

Specifically, in September, Geely, Changan, and Great Wall Motors all showed a growth trend in sales, with all three surpassing 100,000 units for the month. Among them, Geely sold approximately 103,900 units, a year-on-year decrease of 18%; Great Wall Motors sold 100,022 new cars, a year-on-year decrease of 15.10%; and Changan automobile, due to a complex sales structure, sold approximately 100,000 domestic brand passenger cars in September, roughly the same as last year.

In terms of sales gaps, the gap between Geely and Great Wall has narrowed from 14,000 units in August to less than 4,000 units. The cumulative sales of Changan and Geely in the third quarter have also narrowed to less than 10,000 units. In other words, although Geely and Great Wall’s sales in September showed different degrees of decline, the overall performance of these three brands is gradually closing the gap, and future competition may be more intense.

All Have Entered a Strong Cycle

As we all know, the automotive industry is a cyclical industry, and the operations of each car company show clear cyclicality, which is also an important reason for the fluctuations in the rankings of domestic brands in the past few years.

From the market performance of September, the three brands of Geely, Changan, and Great Wall Motors have all entered a period of strong product cycle. According to the data, Geely’s car sales in September were approximately 103,900 units, with a cumulative sales of about 921,800 units in the first three quarters of this year, an increase of 5.3% year on year, maintaining its leading position.

Meanwhile, from the Geely Auto September production and sales poster claiming 「Continuously winning the sales crown of Chinese brand passenger cars for four consecutive years,」 it seems confident about locking up the sales crown position ahead of schedule this year, by changing 「4」 to 「5」.

On the product side, the Geely car division has performed well, particularly in September when Geely Emgrand sales exceeded 20,000, and cumulative sales of the Emgrand, which has held the top spot in Chinese brand car sales for nine consecutive years, have reached close to 3.3 million. The position of the Emgrand family in the domestic A-class car market may be more stable with the launch of the brand new Emgrand L.

On the product side, the Geely car division has performed well, particularly in September when Geely Emgrand sales exceeded 20,000, and cumulative sales of the Emgrand, which has held the top spot in Chinese brand car sales for nine consecutive years, have reached close to 3.3 million. The position of the Emgrand family in the domestic A-class car market may be more stable with the launch of the brand new Emgrand L.

Furthermore, the China Xing lineup of high-end products consisting of Xingrui, Xingyue, and Xingyue L under Geely also achieved good results in September, with Xingyue L and Xingrui each exceeding 10,000 units sold.

In 2017, Changan Automobile, which foresaw the ceiling of the domestic automobile market’s growth, started transitioning towards the three major directions of new energy, upward brand, and intelligence with a cry of “The times will eliminate you, but it’s not about you.” In short, the past four years for Changan Automobile can be described as a thrilling life-and-death race.

Fortunately, Changan Automobile has performed decently in this race. Despite the impact of the epidemic, Changan Automobile has achieved a cumulative output of 2.0037 million vehicles in 2020, among which the Changan brands have sold a cumulative total of 1.5036 million Chinese brand cars, an increase of 12.9% year-on-year.

This year, the performance of the Changan brand Chinese cars under Changan Automobile is still relatively strong. Specifically, in the first nine months of this year, the Changan CS75 family sold a total of 225,000 new vehicles; the Yidong family sold a total of 138,000 new vehicles; the UNI family sold a total of 91,000 new vehicles; the CS55 family sold a total of 86,000 new vehicles; the Oshan auto sold a total of 179,000 new vehicles.

In terms of overall sales, in the first three quarters of this year, Changan Automobile’s Chinese brand passenger cars sold a cumulative total of 900,000 vehicles, not only surpassing Geely by a margin of over 20,000 vehicles but also recording a growth rate that far exceeds that of Geely, reaching 40.1%. If this growth rate can be maintained for the remaining time of this year, it remains unclear who will win by the end of the year.

As for Great Wall Motor, since its statement in July 2020 “Can Great Wall Motor make it through next year?”, it has begun to transform from its product to its brand image, and the brand has also entered a strong cycle. In terms of sales, Great Wall Motors sold a cumulative total of 884,000 vehicles in the first three quarters of this year, with 543,900 from the Haval brand, an increase of 22.2% year-on-year, and 84,731 from the Ola brand, an increase of 254% year-on-year.

The competition for high-end cars will become more fierce

“There won’t be too many players left for Chinese brands in the end, only two or three.” This is the industry’s judgment on the competition among independent brands. Regardless of whether this judgment is correct or not, it is certain that facing the constantly changing market, no car company dares to be complacent.How should domestic automobile brands respond to the surging wave of the “new four modernizations” in the automotive industry and the whirlpool of the global automotive industry? To move upward and march towards the high-end market is the best choice.

Focusing on Geely, Changan, and Great Wall, all three automakers have launched their own high-end brands. Among them, the high-end brands “WEY” and Lynk & Co under Great Wall and Geely Automobile were born in 2016 and 2017 respectively. After nearly five years of development, WEY and Lynk & Co have both established a good user base.

In terms of sales, Geely’s high-end brand Lynk & Co sold 15,823 new cars in September, with cumulative sales reaching 148,000 in the first three quarters of this year, a year-on-year increase of 39.67%, showing promising growth momentum. Although WEY’s sales in the first three quarters of this year were only 36,158 units, its brand positioning and new product lineup including Machi and Latte are helping the brand rise.

In addition, Great Wall’s off-road brand Tank also has impressive performance. In the first three quarters of this year, the brand delivered 52,572 new cars, and Tank 300 had a sales volume of 8,021 units in September. It seems that this rising “internet celebrity” is unstoppable except for the chip shortage.

Compared to Geely and Great Wall, although Changan Automobile’s layout of high-end products came relatively late, its first model, the UNI-T, was quickly recognized by the market after its launch in June 2020. The annual sales volume of the UNI series reached 68,556 in 2020, becoming another main vehicle series under Changan Motor after models such as CS75. Currently, with the latest UNI-V, Changan UNI series has three models, covering the compact, mid-to-large SUV, and sedan markets.

It is worth mentioning that, with Changan’s “Avita Technology”, Great Wall’s “Salon”, and Geely’s “Ji Ke” brands taking turns to enter the market, the second half of the high-end competition among the top three domestic brands may also extend to the high-end new energy field. Compared with struggling low-end automakers and mid-market brands still desperately seeking sales volume, Geely, Changan, and Great Wall seem to have entered another track. As to who will become the leader of the domestic brand camp, only time will tell.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.