This article is reproduced from the public account “新车一讲”, author’s Weibo: @不是郑小康

Over the past week, the cooperation and investment dynamics in the global autonomous driving field have been concentratedly bombarded, giving us an illusion of returning to the large-scale outbreak of autonomous driving in 2016. However, different from five years ago, the current revitalization in the autonomous driving field may indicate that the maturity of the required supply chain, algorithm iteration, and hardware and software for commercialization of autonomous driving cars has progressed towards mass production.

In this context, every new dynamic is worth our re-examination. For example, the global strategic partnership between Waymo and Volvo Group.

Waymo’s No Retreat

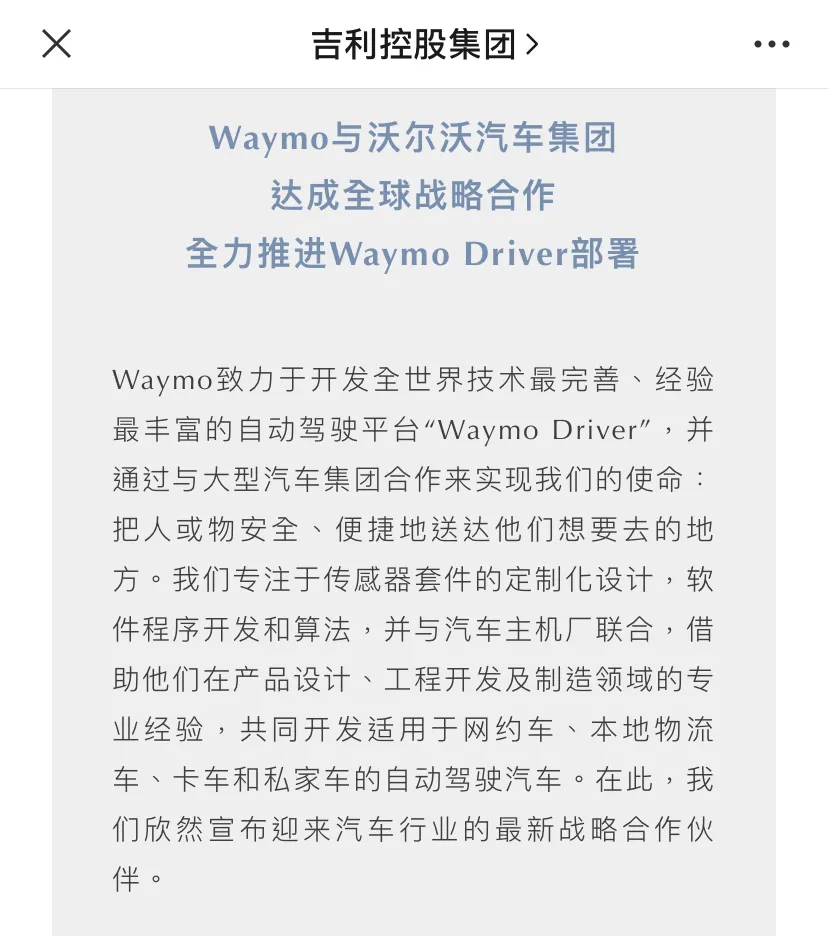

On June 26, 2020, Waymo and Volvo Group announced a global strategic partnership.

A month earlier, Waymo CEO John Krafcik had already publicly disclosed the cooperation between the two sides on Twitter: a Volvo V90 with the Waymo logo and the topics of the two companies.

From Waymo’s perspective, how should we view this partnership?

The first key word in the partnership announcement was “global exclusive“, and Waymo became the “global exclusive” partner of Volvo Group for L4-level autonomous driving technology. This reflects Waymo’s super-strong attitude towards cooperation and the latest development of commercialization is almost satisfactory.

Going back to 2016, the global autonomous driving field began to surge. However, judging from the technology, General Motors – Cruise, Uber – Otto, and Ford – Argo.ai were all in the early stages, and Tesla was almost blank in the L4 autonomous driving field. Waymo was in a dominant position in fact.

In the past five years, Waymo has had contacts with Ford, Honda, and Volkswagen. However, in the end, Ford formed an autonomous driving alliance with Volkswagen and Argo.ai, and Honda joined the General Motors – Cruise alliance.To help Waymo accelerate commercialization and make breakthroughs in finding automotive manufacturing partners, Alphabet founder Larry Page hired John Krafcik, who has 30 years of experience in the automotive industry and has served as the modern North America CEO, as Waymo CEO.

John Krafcik, as Waymo’s spokesperson, is well-versed in the rules of the automotive industry and is an excellent candidate for promoting alliances. However, the negotiations between Waymo and Honda, which were personally promoted by John Krafcik, ultimately came to nothing.

This to some extent indicates that Waymo’s commercial breakthroughs are hindered, and the problem is not with the personnel.

In October 2018, an informed source told Automotive News that in the negotiations with Honda, Waymo clearly stated that “it will not share its developed substantial technology and seeks to reach an agreement requiring Honda to focus on providing cars.”

Waymo is responsible for the brain, and the automakers are responsible for the brawn. This is Waymo’s position on commercialization.

According to the announcement released by Geely Holding Group, Waymo will be responsible for “customized design of the sensor kit, software development, and algorithms,” while Volvo will be responsible for “product design, engineering development, and manufacturing.”

This statement shows that Waymo’s commercialization attitude is consistent: providing a complete solution of autonomous driving system software and hardware named Waymo Driver, and Volvo’s work is to integrate the system into the whole vehicle.

In the announcement, Waymo specifically mentioned the previous collaborations with FCA, Jaguar Land Rover, and the Renault-Nissan-Mitsubishi Alliance.

However, regardless of whether it is 20,000 Pacifica cars ordered from FCA or 62,000 Jaguar I-PACEs ordered from Jaguar Land Rover, these companies play the role of “product design, engineering development, and manufacturing” in their cooperation with Waymo.

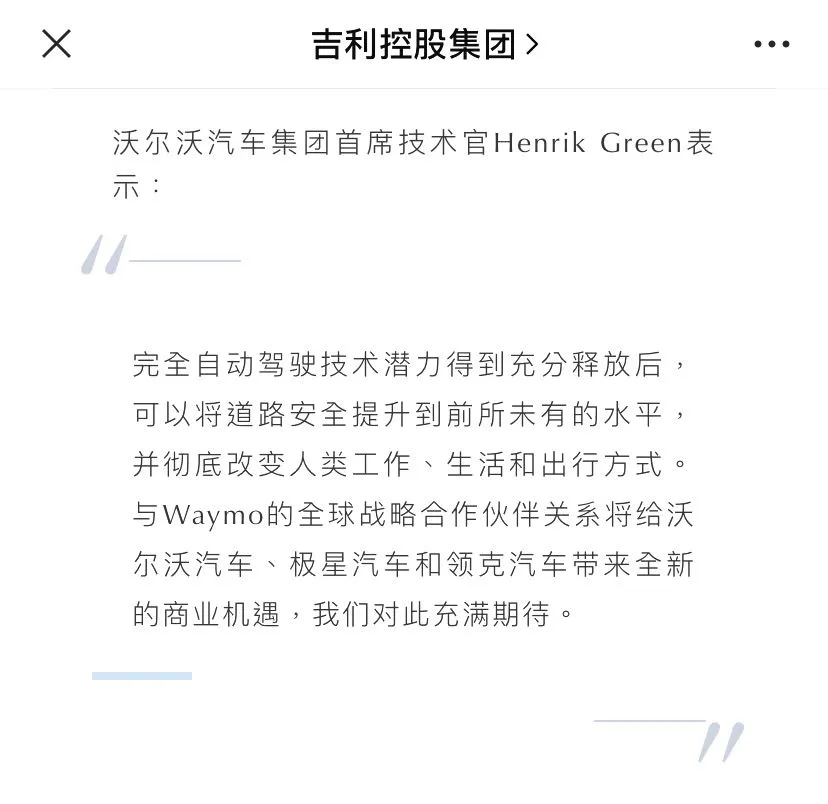

To put it in words that automakers least want to hear, it is “contract factories”.The cooperation between Waymo and Volvo has a detail: in the cooperation with Waymo, in addition to the Volvo brand, Polestar and Lynk & Co. under the Volvo Car Group will also benefit, while Geely Auto, which is completely rooted in the Chinese market, will be absent. So, why isn’t this cooperation led by Geely Holdings, which covers all brands?

By comparing the Chinese and English announcements, we will find that Polestar and Lynk & Co. International in the English announcement are translated as 极星 and 领克, respectively, without translating International. As a large multinational automotive group, Geely Holdings would not have such negligence.

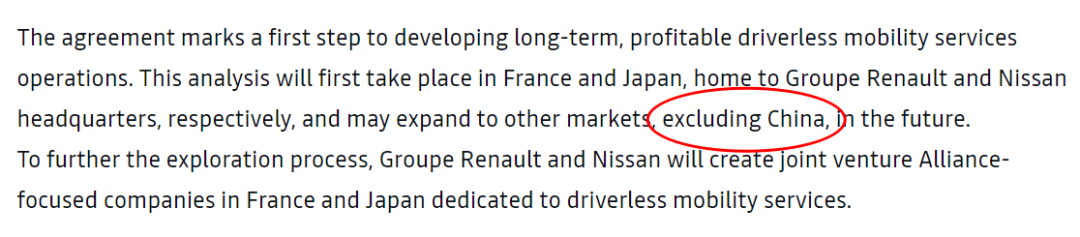

If we compare the previous announcement between Waymo and the Renault-Nissan Alliance, it also states that “it will start from France and Japan, and will further expand to other markets in the future, excluding China.”

This somewhat indicates that although Waymo had registered a wholly-owned subsidiary in Shanghai as early as 2018, Waymo in 2020 still has not fully figured out how to enter China, the world’s largest automotive market.

Volvo’s Best Partner

For Volvo spokespersons, the first question to answer may be: why choose to accept the comprehensive solution offered by Waymo that Ford, Honda, and Volkswagen have successively declined?

To answer this question, we may need to mention another news in the field of autonomous driving: On June 19, Mercedes-Benz and BMW announced the suspension of their cooperation in the field of autonomous driving for the time being, stating that “due to the costs required to establish the shared technology platform and the current commercial and economic conditions,” It is not the right time to implement successful cooperation.

For most automakers, 2020, under the epidemic, is an unusual year.

- On March 20, Volvo closed four factories in Sweden and Belgium due to the epidemic;

- On March 26, Volvo revised its annual outlook report for 2020 and expects sales, cash flow, and profits to be lower than in 2019;- On April 29th, Volvo Cars announced to accelerate its structural transformation plan, including cutting 1300 positions in its Swedish operations and continuing to review and reduce consultancy contracts;

- On May 20th, Volvo Cars signed a 2-year credit agreement worth SEK 10.666 billion with the Nordic Investment Bank Group.

Volvo Cars is making every effort to cope with the impact of the global pandemic, which is a microcosm of the entire automotive industry in the past few months.

Volvo has always attached great strategic importance to autonomous driving. In January 2017, Volvo jointly formed a joint venture, Zenuity, with Tier 1 supplier Autoliv, dedicated to the development of assisted driving and autonomous driving systems.

Volvo injected ADAS intellectual property and early-stage research and development resources into Zenuity, while Autoliv planned to invest SEK 1.1 billion in Zenuity. The shareholding ratio between the two parties is 50:50. Dennis Nobelius, former Managing Vice President of Volvo’s large cars (XC90, S80, S80L, V70, XC70) and Managing Director of Volvo Cars Switzerland, assumed the position of Zenuity CEO.

On April 2, 2020, Volvo and Autoliv jointly announced that Zenuity will be split into two companies again. The team focusing on the development of assisted driving systems will be incorporated into Autoliv’s subsidiary Veoneer, while the team dedicated to the development of autonomous driving systems will become an independent subsidiary of Volvo Cars.

At that time, Volvo stated in the announcement that the new company after the split would be put into operation no later than the third quarter of 2020.

So, does Volvo have the ability to independently develop autonomous driving systems?

On February 6, 2020, Volvo released its 2019 full-year financial report. The report showed that Volvo Cars’ operating profit in 2019 was SEK 14.3 billion (about USD 1.5 billion).

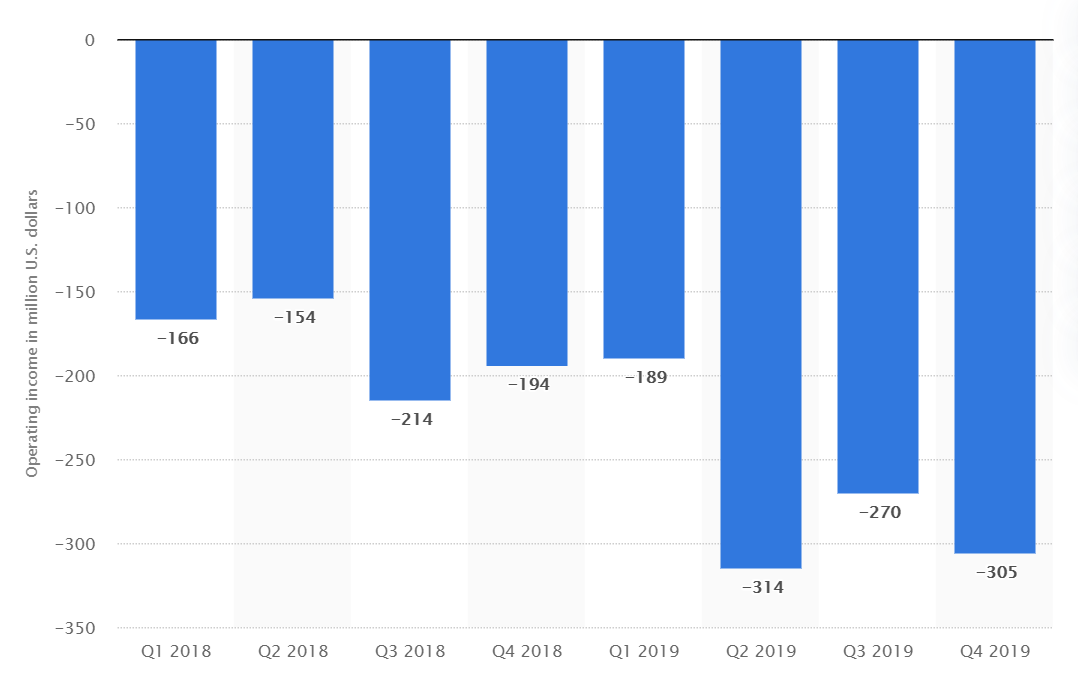

Let’s take a look at the R&D investment of the top companies in the autonomous driving field. General Motors’ 2019 financial report shows that its autonomous driving R&D department Cruise invested USD 1.078 billion in 2019.

In other words, a truly large-scale investment to support the R&D of a top autonomous driving company would consume two-thirds of Volvo’s annual operating profit.

As mentioned earlier, Volvo stated in its annual outlook report that it expects its sales, cash flow, and profits in 2020 to be lower than in 2019.

Considering that the split of Zenuity and the announcement of its strategic partnership with Waymo occurred in the same quarter, we have reason to believe that these two events were a unified adjustment made by Volvo under the backdrop of the global pandemic and an acceleration of corporate restructuring.

From Volvo’s perspective, despite the uncomfortable conditions offered by Waymo that may not suit traditional automobile manufacturers used to speaking for the industry chain, Waymo’s industry-leading technical capabilities are still unmatched.

What’s more, in 2020, Waymo announced its first external financing, upgraded its fifth-generation Waymo Driver autonomous driving system, and gradually strengthened cooperation with Google Search, Google Brain, and the top artificial intelligence research institution DeepMind.

Taking into account external and internal factors, joining the Waymo camp as teammates is the optimal solution for Volvo in terms of its autonomous driving strategy, compared to competing with a group of autonomous driving development companies, including Waymo.

Finally, whether it is the parting of ways between Mercedes-Benz and BMW, Tesla’s race to self-develop its architecture, Amazon’s full acquisition of Zoox, or DiDi’s acceleration of commercializing its autonomous driving technology, they all indicate that the competition in the autonomous driving industry is just beginning. The positioning of the Volvo-Waymo duo in the final battle of this war remains to be seen.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.