Author: James Yang Jianwen

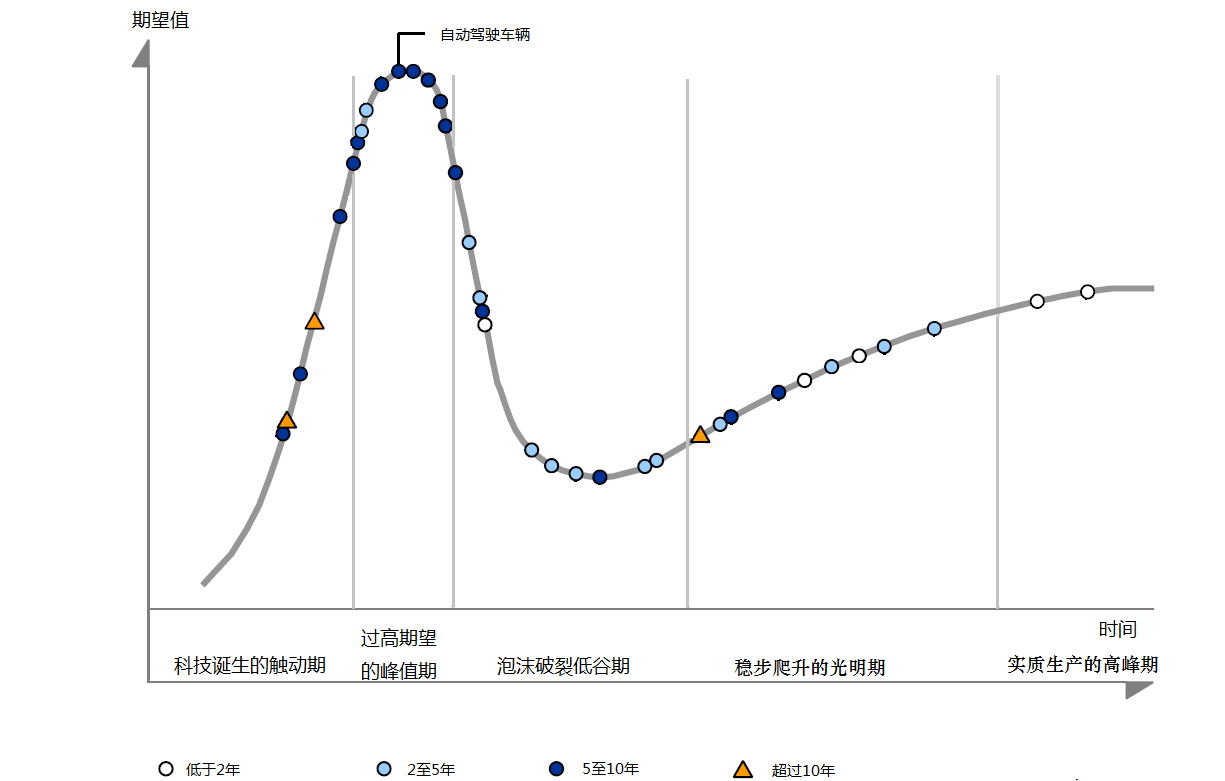

In the autonomous driving industry, there is a technology maturity curve called the Gartner curve. Consulting firm Gartner divides new technologies from the nascent to mature stages into 5 phases:

- Technology Trigger

- Peak of Inflated Expectations

- Trough of Disillusionment

- Slope of Enlightenment

- Plateau of Productivity

Looking closely at the current autonomous driving industry, after experiencing capital frenzy, capital winter, and even the “baptism” of the pandemic black swan, from the initial crowd frenzy, it has now returned to rational calmness, and everyone has started to focus on their own things.

If the autonomous driving industry was in chaos and was wandering in the fog a few years ago, we can now gradually see some trends.

M&A

Just this month (July 20), WeRide fully acquired Moohee Technology. The latter was established in June 2018 and is a self-driving company focused on the logistics field. It has built a fleet of more than 20 self-driving passenger cars and trucks. After acquiring Moon in the Sky, WeRide gradually made up for the shortcomings of its layout in the freight field.

Coincidentally, two days later (July 22), international supplier giant Magna officially acquired another international leading ADAS supplier giant Veoneer. This acquisition will continue to enhance its autonomous driving research and development capabilities, improve its influence and position in the active safety field, and expand Magna’s ADAS business with its main customers, providing opportunities to acquire new customers and enter new regions, including opportunities in Asia.

Moreover, such acquisitions are not only happening in autonomous driving companies themselves, but also involve the upstream and downstream of the industry.In July of this year, it was reported by the media that Xiaomi had acquired DeepMotion, an automated driving technology company. As for Xiaomi, which officially announced its entry into the automobile manufacturing industry in April of this year, starting from scratch, there are many abilities that need to be improved, and intelligent driving is one of the cores. Moreover, it is more sensible to acquire an automated driving company than to start automated driving research from scratch, as time waits for no one. Just today, Lei Jun personally posted on Weibo, stating that they will independently research and develop L4 automated driving technology.

The same thing actually happened to Apple. When Apple acquired the startup automated driving company–Drive.ai, they also did it to incorporate talents and build their own automated driving cars.

Now, industry participants are all using this kind of acquisition to either fill their own gaps, continue to improve relevant abilities or to dig up industry talents.

It can be foreseen that as industry competition becomes increasingly fierce, mergers and acquisitions will become the norm.

Multiple Giants Have Emerged

As mentioned earlier, the industry has experienced high expectations and bubble bursts, gradually returning to rationality. The enterprises that have held on have gradually become new small giants, each with different development trajectories.

After starting commercial vehicle business, Pony.ai has adopted a strategy of steady development. They have formally developed two major business sectors, passenger cars (Pony.ai) and commercial vehicles (Pony.ai Card), and even directly cooperated with the international giant, ZF, with Pony.ai Card. Pony.ai has also expanded its service coverage, covering five major cities in China and the US, including Beijing, Guangzhou, Shanghai, Irvine, and Fremont.

WeRide has obtained the ride-hail license and its Robotaxi business has started charging fees. After acquiring MoonX.AI, WeRide has gradually completed the layout of Robotaxi, Mini Robobus, and automated driving trucks. They have new ideas for future development, making it easier to tell a story to capital.Translate the following Chinese Markdown text into English Markdown text while preserving the HTML tags inside the Markdown. Only output corrections and improvements in a professional manner. Do not include explanations.

You are a translator in the automotive industry responsible for English translation, spelling proofreading and wording modification, and answering me in more elegant and concise English to ensure that the meaning remains the same. Only correct and improve the text. Do not write explanations.

Translate the following Chinese Markdown text into English Markdown text while preserving the HTML tags inside the Markdown.

Yutong Technology is more like a low-key ascetic monk. It silently takes money to develop and mass-produce. Currently, Yutong has cooperated with more than ten industry giants such as Chang’an Minsheng Logistics, FAW Logistics, and BASF BASF in commercial cooperation. Unmanned driving solutions have been implemented in many fields such as airports, factories, and chemical industry. In addition, Yutong has also launched Robotaxi services with Dongfeng Motor, which is developing on multiple fronts.

After Baidu Apollo jointly released the new generation of mass-produced shared autonomous vehicles (the fifth generation) with ARCFOX, it officially opened up its own high-level autonomous driving and assisted driving using a set of architectures. “As long as it is a mass-produced car that supports Baidu ANP, adding a roof-mounted pick-up screen and a customized laser radar on it, this is a shared autonomous vehicle.”

AVP and ANP two intelligent driving products have cooperated with several mainframe manufacturers. According to Li Zhenyu, senior vice president of Baidu Group and general manager of Intelligent Driving Business Group, “In the second half of 2021, Baidu Apollo autonomous driving will usher in a peak production period, and a new car will be launched every month.” In the next 3-5 years, it is expected that the front-end production will be equipped with one million units.

Apart from these companies, there are also companies like Yuanrong Qihang and AutoX that are developing rapidly at their own pace.

At least for now, the self-driving industry has not shown oligopolistic effects.

Global Development

When we praise a student, we usually say that he has a comprehensive development in “morality, intelligence, physique, art, and labor.” This is also the case for self-driving companies.

You will see that companies that make autonomous driving are beginning to “roll” towards the all-powerful direction.

Manufacturers who used to only be involved in the camera perception layer are now involved in the control layer; those who used to only promote L2 assisted driving are now pushing for the development of L4 unmanned driving; companies that do L4 autonomous driving are starting to seek “dimensionality reduction” L2 to achieve commercialization and monetization; L4 Robotaxi companies are starting to expand towards cargo and commercial minibuses; even some companies are starting to seek to build their own cars… (Match it yourself)

Uh, it’s really “rolling.”

In fact, all these measures are for a better way to “survive.” As an initial startup company for autonomous driving, it needs to constantly try various attempts to obtain new monetization and blood-making methods. On the other hand, it is also to better tell the story of “unmanned driving” to capital, in order to obtain capital injection.From an objective point of view, autonomous driving has always been a long process. The commercialization of landing scenarios has been almost found out by everyone, and the only remaining challenge is the breakthrough at the technical level.

At this stage, long-tail scenarios are still a problem that autonomous driving companies cannot overcome. Moreover, autonomous driving is a money-losing business. Some companies eventually withdrew from the battlefield due to their inability to maintain such huge expenses (such as Drive.ai).

Furthermore, capital is no longer so impulsive, and investment logic has returned to rationality. This may not be good news for autonomous driving companies that urgently need a large amount of funds to survive.

At least for now, we need to give autonomous driving and unmanned driving enterprises more time. I am very curious about what the endgame of these companies will be – will they self-destruct, be acquired, or become true unicorns?

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.