As the policy regarding carbon emissions in the transportation industry in Europe is changing rapidly, every European automaker has to update their electrification strategy. Renault, Stellantis, Volkswagen, Volvo, and Jaguar Land Rover have recently been “forced” to take a more aggressive strategic direction.

Daimler has always been relatively conservative in terms of electrification strategy, so it has only recently updated its roadmap. Overall:

(1) Product matrix: In terms of electric vehicle technology, the strategic plan has shifted from “EV first” to “EV only”: By 2025, the sales of pure electric BEVs will increase by twice that of the original plan from 25% to 50%, and all models will have pure electric versions. By 2030, under the appropriate conditions, the goal is to only sell pure electric vehicle models.

(2) Technology and production readiness: Plans to invest in 200GWh and 8 battery factories – Daimler also needs to define its own battery cell standard and prepare its own Giga factory at such a large scale. Currently, the three major German carmakers have their own future-oriented battery cell research and development cooperative units, which is also a bet on the future. Such a large investment must have a return, and the massive investment will push battery technology to make progress.

(3) Talent and funds: On the one hand, it is necessary to gradually transform or replace traditional automotive talents, such as engine development experts, with electrification talents. Among them, there is a shortage of 3,000 software engineers for the transition to software-oriented development. On the other hand, funds need to be prepared sufficiently. The most important thing is in response to the decline in profits from the market for internal combustion engines due to this kind of turbulence.

Next, let’s discuss in detail the following aspects:

Five electric vehicle platforms

The platform plan for October 2020 is shown in the figure below, including the EVA+MMA two electric vehicle platforms. From the timeline, the strategic plan for 2020 is still on the EQS under EVA in 2021, and the MMA platform will be upgraded to 800V between 2023-2024. Within 10 months, from “EV first” to “EV only,” Mercedes-Benz’s strategy changed. The sales target for pure electric EVs has also increased from the original plan of 25% by 2025 to 50% in2021.

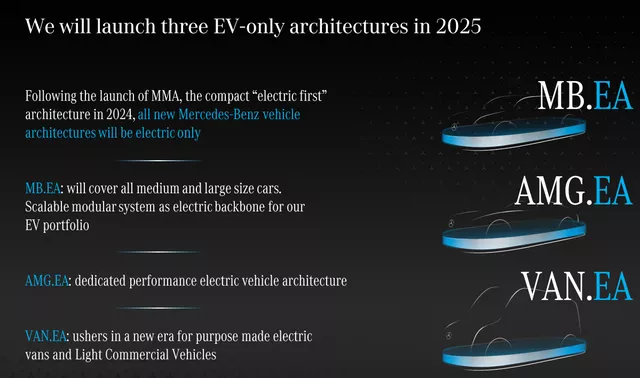

Due to its plan of selling only pure electric vehicles from 2025 to 2030, Mercedes-Benz has announced the release of three new EV dedicated electric platforms, based on the previous two platforms:

Due to its plan of selling only pure electric vehicles from 2025 to 2030, Mercedes-Benz has announced the release of three new EV dedicated electric platforms, based on the previous two platforms:

(1) MB EA: This platform, defined in 2024, is specifically designed for mid-to-large sized vehicles. The EVA is designed for large-sized vehicles, the MMA for compact to mid-sized vehicles, and the EA for mid-to-large sized vehicles.

(2) AMG EAPerformance: This platform is designed for high-performance AMG branded sports cars.

(3) VAN EACommercial: This platform is designed for commercial vehicles.

In light of the current trend of all automakers turning to more aggressive electrification efforts, Mercedes-Benz has announced three representative electrification platforms. Who would have thought that even when planning for pure electric platforms, one company could plan out 5 exclusive platforms, proving Mercedes-Benz’s expertise.

Battery Layout and Transformation

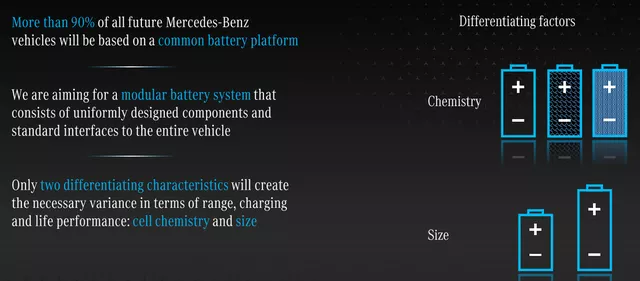

Currently, all European automakers have a standard template for their battery strategies, as follows:

Firstly, determine the demand- Mercedes-Benz has an annual demand of 200GWh for batteries. Then build their own battery factories – Mercedes-Benz plans to build 8 Giga Factories all over the world, 1 in the United States, 4 in Europe, and 3 in other regions. The third step is to define their own standard cell- Mercedes-Benz defines a highly standardized cell. Finally, entering into the battery material supply chain.

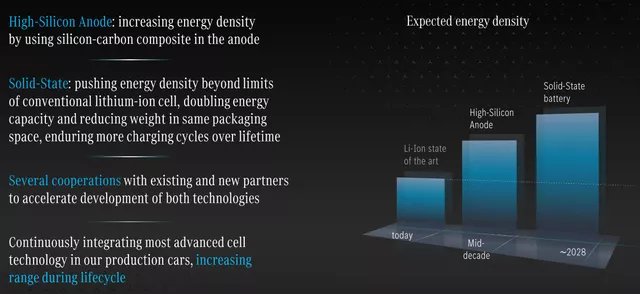

Looking at the batteries and new supplier system, Mercedes-Benz’s approach is similar: cooperate with the mainstream CATL, support Farasis to supply on a large scale, and work with a US battery start-up, Sila Nano, to jointly develop a 900Wh/L silicon-carbon anode system that can support fast charging. They are also developing a high-silicon-content anode, and solid-state batteries that can achieve 1200Wh/L and 400Wh/kg, supporting more charging cycles and longer battery life.

Developing a 1000 KM Range EV

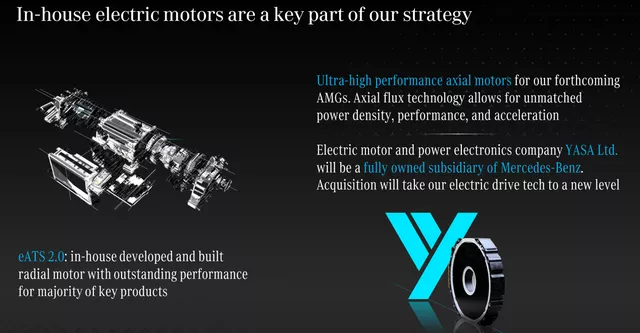

For luxury carmakers, seeking the best has always been a norm. As far as Mercedes-Benz’s flagship models are concerned, developing electric cells that are of similar specifications and weight can achieve a range of over 1000 kilometers on a single charge – it is still unknown whether the EQXX concept car will fulfill this promise. Furthermore, Mercedes-Benz has acquired the British electric motor company Yasa, which will increase its investment in electric motors and continue to pursue in-house development in the three electric vehicle areas.

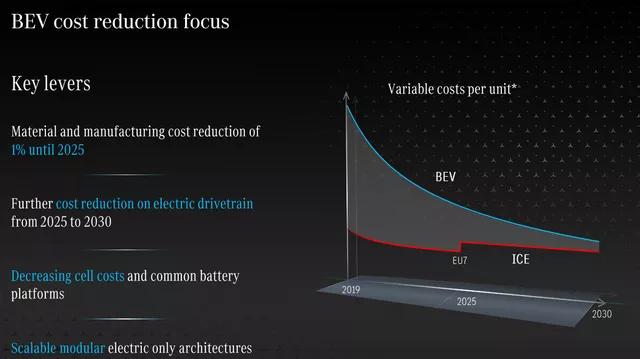

Looking at Mercedes-Benz’s plans for the cost of pure electric vehicles, the cost of existing internal combustion engines is still lower for luxury cars. Therefore, the profitability of battery electric vehicles (BEVs) poses a significant challenge for these luxury carmakers. It is still unclear whether the overall transformation will proceed smoothly.

Conclusion: In the current European market, OEM manufacturers have all adopted the same strategy – rapidly moving toward pure electric vehicles. Management at each automaker may face pressure from various avenues. Previously, European automaker executives only saw what Diess (Volkswagen CEO) was doing (MEB pure electric platform), but now, each automaker’s CEO is likely busy writing strategic PPTs and making similar changes.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.