Overview of the overall situation

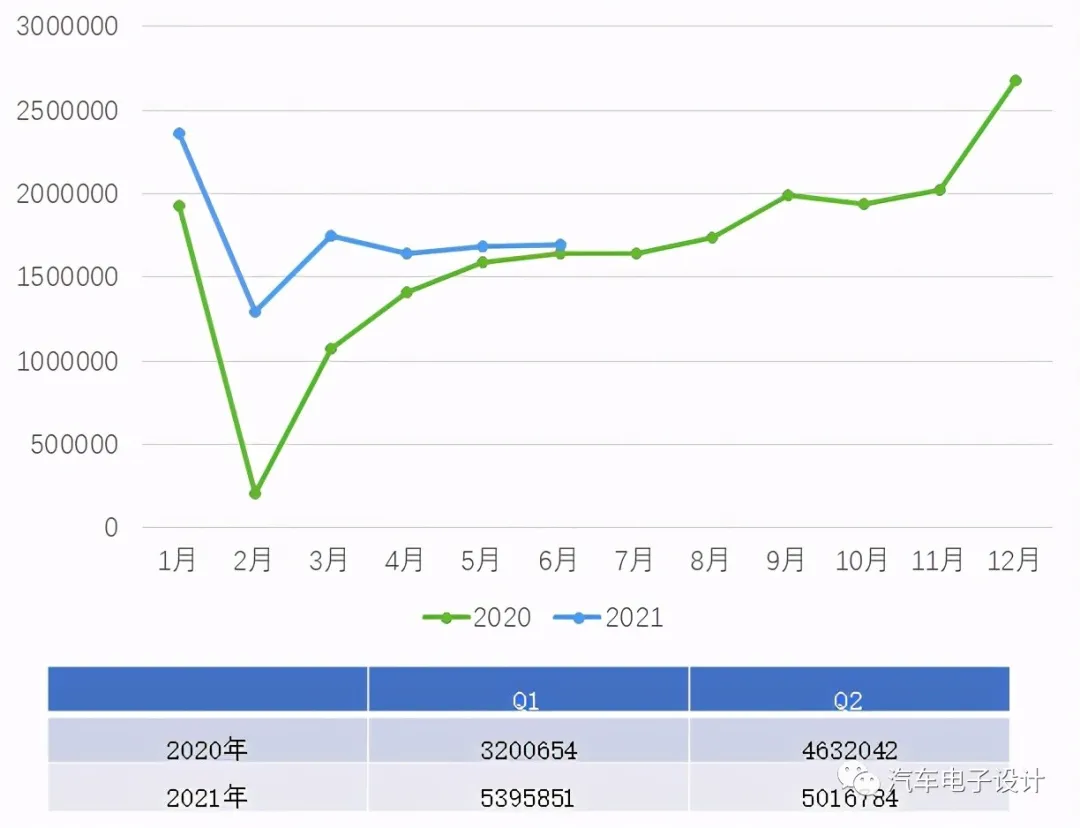

From the perspective of overall data, the number of passenger cars insured in June was 1.6888 million. The shortage of chips still has a great impact on car companies, as evidenced by the fact that the year-on-year growth rate in June has been the same as last year. Therefore, looking at the second quarter as a whole, there were 5.01 million insured passenger cars, 380,000 fewer than the first quarter. However, the overall data for July and August, which are traditionally the slow season, are not very optimistic.

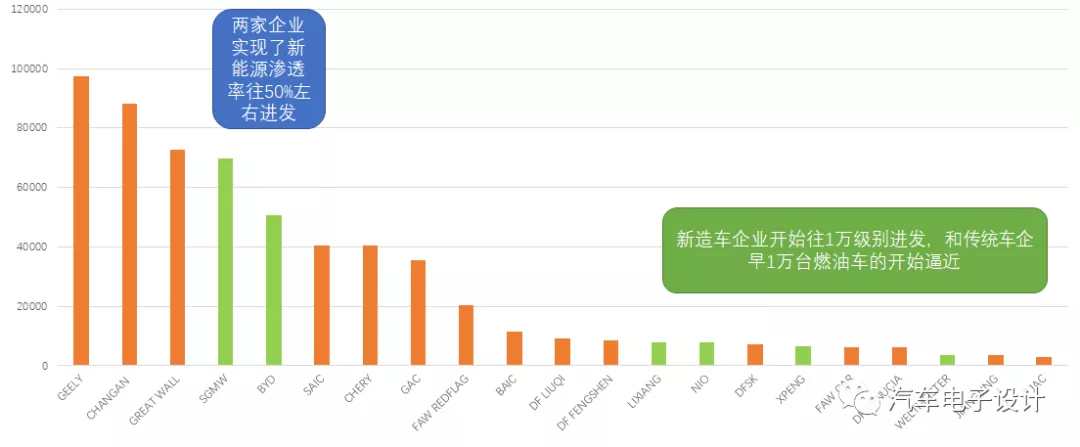

Among domestic automakers, Wuling has reached or exceeded 50% online data (with around 70,000 vehicles, including 35,000 pure electric vehicles), which not only shows the potential of A00 cars but also reflects the situation of traditional fuel cars objectively. Byton and several other automakers are similar to traditional fuel cars with 10,000 insured vehicles. From the operating condition of independent automakers, the process of electrification is very fast. Starting in 2022, major automakers such as Geely, Changan, and Great Wall will also accelerate their electrification pace, and the penetration rate of independent electrification will be further improved.

Key data on insured new energy vehicle makers

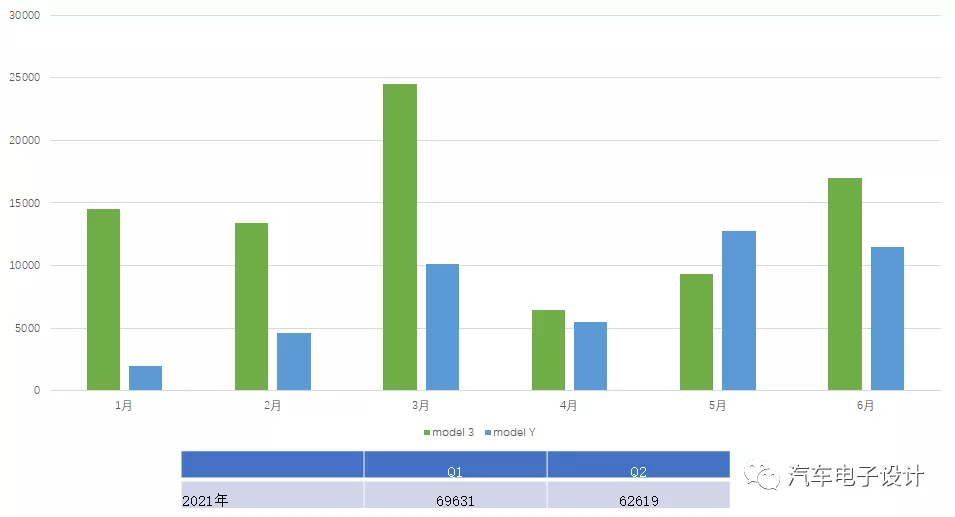

1) Tesla:

The 28,000 insured vehicles in June maintained a level of 62,600 insured vehicles in China for Q2. Under the shortage of chips, Tesla will also enter a cycle of price reduction, further challenging the price system of B-class car products. As Tesla’s prices gradually go down, it will have a significant impact on the basic plate of fuel cars. In my opinion, Tesla’s greatest value is to promote the cost-effectiveness of new energy vehicles in China and convert many consumers from fuel cars, which has influenced a considerable part of people.

2) BYD:

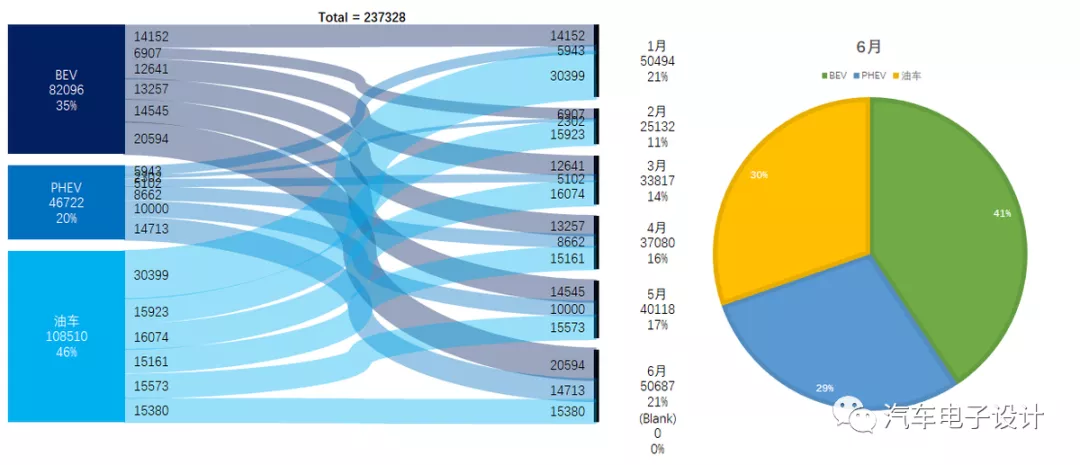

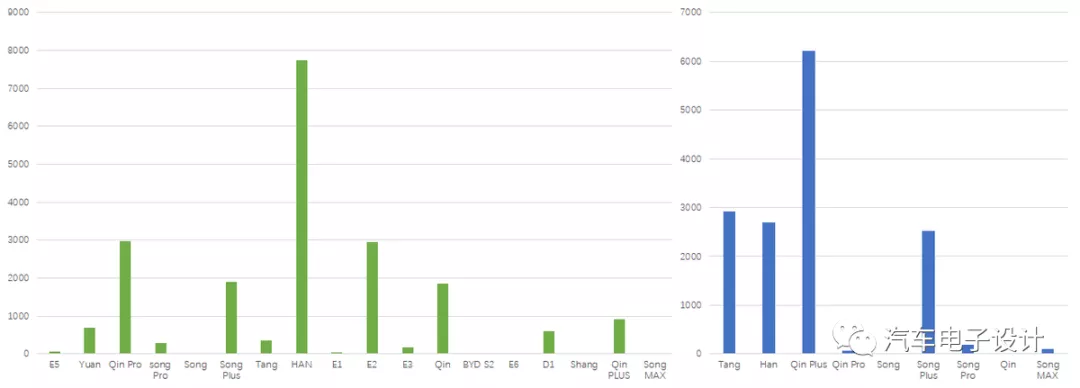

The chart shows that BYD’s fuel cars currently account for 46% of the overall proportion in the first half of the year, and the proportion of fuel cars dropped to 30% after the launch of DMi (i.e., new energy vehicles account for 70%).

In June, the sales of Han EV unexpectedly dropped 7k units. As I understand it, there were support policies launched in Guangdong in June, which squeezed part of the demand. However, the insurance data of DMi models increased significantly. Qin DMi sold 6212 units, Song DMi sold 2518 units, and Tang as a whole increased from 1720 to 2930 units. The speed of sales volume increase was quite fast.

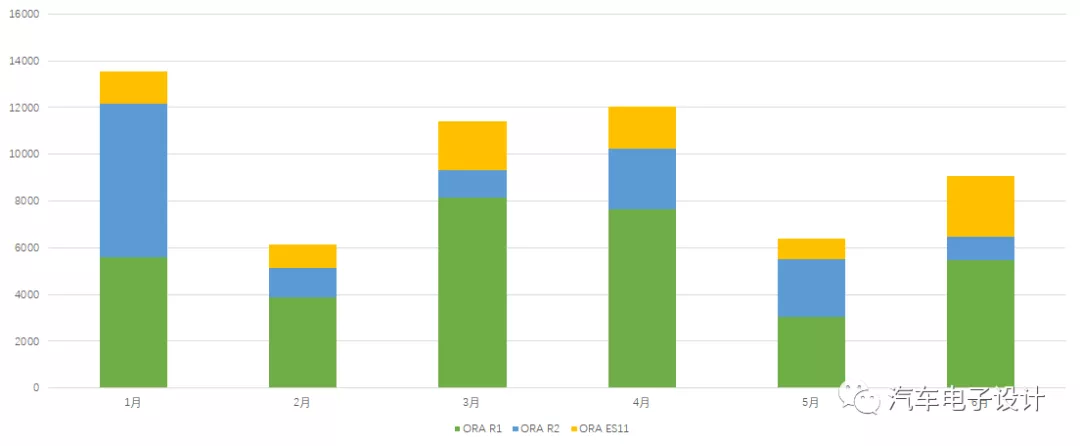

3) Great Wall

In June, the sales of Great Wall’s new energy vehicles began to recover month-on-month, and it is interesting that HAOMAO received preferential treatment. Currently, the target is to reach 10,000 units. An interesting piece of news is that Great Wall will soon release a model that directly targets the B-class cars at the existing price level, which is benchmarking Tesla Model 3. Therefore, the centralized launch of pure electric vehicles in the B-class in 2022 or so will further attract customers of conventional cars.

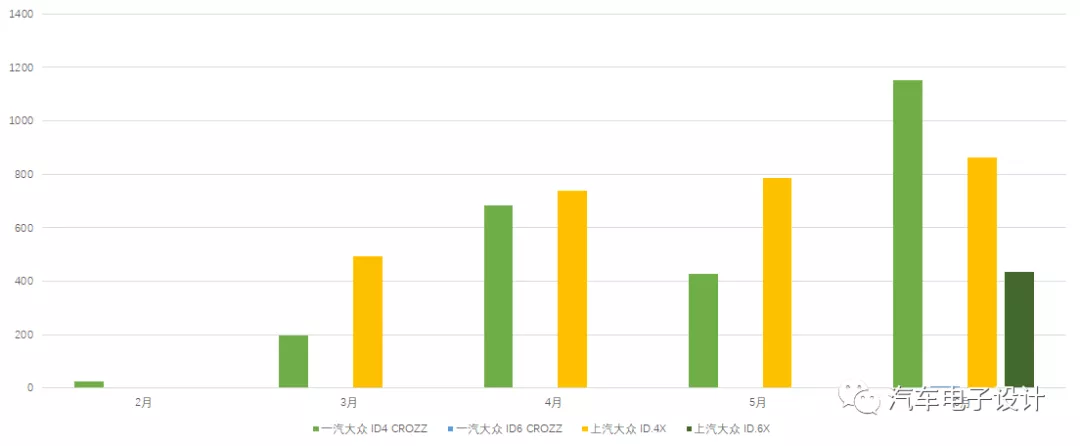

4) Volkswagen

The sales performance of several MEB products of Volkswagen is still improving. SAIC-Volkswagen’s ID.6X is still expected to perform well. Currently, the total sales volume is over 2,000 units. It is expected that the sales volume will continue to increase in the second half of the year, and the first step is to sell 4 units within 2-3 months and then increase to 5,000 units. The target for the end of the year is to sell 10,000 units.

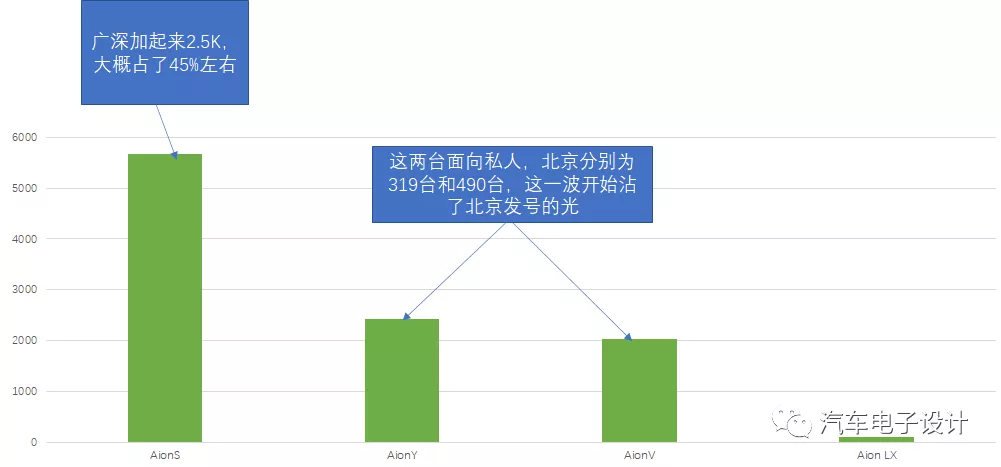

5) GAC

This year, GAC has become a leading player in new energy vehicles. The insurance data in June is shown in the figure below. Currently, Aion S is still focusing on Guangdong Province and the B2B market. Aion Y and Aion V have a tendency to break the boundary.

6) Huawei EffectIn June, the efficiency of the Ceriz SF5 reached 455 units, and its performance in Huawei stores objectively exists, gradually converting into deliveries. The two cars of the Beiqi BJ40 Plus were 135 and 124, respectively, and we will continue to observe whether the package car with a markup of RMB 100,000 will be accepted by the market.

Summary: The insurance data in June still contains a lot of useful information. Tomorrow we will discuss the trend of the second half of the year and whether it can further exceed our expectations.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.