Yesterday evening, NIO Investor Relations website released an announcement, announcing the completion of another $235 million convertible bond financing project.

This is NIO’s third financing project in 2020. With the previous two, a total of $435 million of convertible bonds have been issued, which is equivalent to RMB 3 billion.

In addition, on February 25, NIO also signed a framework agreement with the Hefei City government for a financing of RMB 10 billion.

Is this extraordinary 2020 a good start for NIO?

$435 million convertible bonds

Let’s first take a look at these three convertible bonds.

On February 6, 2020, NIO issued $70 million of convertible bonds to an independent Asian investment fund. Earlier in January, NIO had issued a similar convertible bond to a non-Asian investment fund. The total amount of the two bonds was approximately $100 million.

The bonds were issued to the buyer at an interest rate of 0%, and will mature on February 4, 2021. The bondholders can convert their bonds into Class A shares at a price of $3.07 per share within six months.

On February 14, 2020, NIO issued $100 million of convertible bonds to two Asian investment funds at a 0% interest rate. The bonds will mature on February 4, 2021, and bondholders can convert their bonds into Class A shares at a price of $3.07 per share within six months.

On March 5, 2020, NIO announced another completion of $235 million of convertible bond financing project. The bonds were issued to the buyer with a 0% interest rate and will mature on March 5, 2021. Prior to the maturity of the bond, the bondholders have the right to convert some or all of the principal into Class A shares, starting from September 5, 2020 (six months after the issue), at a conversion price of $3.5 per share, which may be adjusted.A-share mentioned below refers to one of the ordinary stocks of NIO. NIO has set up three types of stocks in its equity structure, namely A, B, and C, each corresponding to different voting rights. Each share of A-share represents one vote, each share of B-share represents four votes, and each share of C-share represents eight votes. Although the 435 million convertible bonds issued in these three rounds of financing account for 10\% of NIO’s market value, it will not affect NIO’s overall decision-making. At the same time, it has been explicitly stated that investors are “unrelated parties” to NIO, which means pure financial investment.

From another perspective, these investment institutions all see the value of NIO and believe that NIO’s stock can meet their own profit targets in the coming year.

Looking back on September 2019, in order to provide financial support to NIO, Li Bin had to sell Yiche to Tencent for cash and subscribe for $100 million of convertible bonds himself.

The subscription of multiple capital sources in early 2020 shows the change in the attitude of the capital market towards NIO.

Difficult 2020

Affected by the epidemic of COVID-19, all car companies in the country have been struggling. Suppliers have not resumed work, leading to factory shutdowns and a decrease in consumers’ desire to buy cars while they stay at home. Sales have also dropped sharply, causing losses.

With the passage of time, the impact continues to expand. SAIC Group has released the “2020 Salary and Benefits Adjustment Statement”, WM Motor has canceled the year-end bonus for all employees, and some car companies with insufficient risk resistance have even begun to lay off employees.

It can be said that this is when everyone’s funds are most tight. As for NIO’s attitude towards layoffs, Li Bin said in an interview with Automotive Business Review:

It’s definitely not the right time now. If you lay off people now, where can they go for work?

Therefore, the financial pressure on NIO, which was already on the verge of deficit, is even greater.

Although on February 25, 2020, NIO and the Hefei government signed a cooperation framework agreement for a RMB 10 billion financing project, the project is currently in progress and has not been finalized, so the funds have not been received.

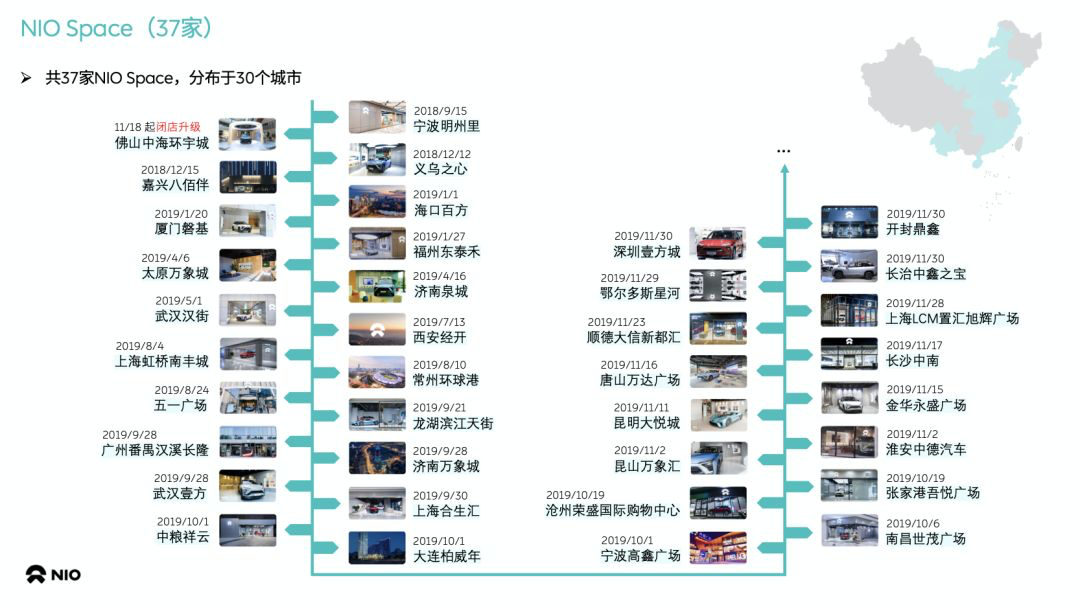

Therefore, for NIO, this RMB 3 billion financing is critical. It can not only effectively alleviate the current financial pressure, but more importantly, sustain it through the most difficult stage, until the RMB 10 billion financing is in place.The data released in NIO’s Q3 2019 financial report shows a loss of 2.5217 billion yuan. With gradually increasing sales and shrinking expenses such as the cancellation of NIO House construction and replacing it with the more cost-effective and efficient NIO Space, NIO earned a revenue of $435 million (about 3 billion yuan) which is enough to support NIO until Q2 2020. By then, substantial progress is expected in cooperation with the Hefei municipal government according to plan.

The delivery quantity of NIO cars in February 2020 has not been announced, but considering the overall situation of the automobile market in February affected by the epidemic, there will undoubtedly be a huge drop in delivery volume compared to January.

From the current situation, it is difficult for the market to quickly recover the prosperity seen at the end of 2019. Therefore, all brands need to prepare funds for a prolonged battle, and NIO is no exception. However, NIO is not as cash-strapped as it was in 2019.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.