In the business world, there has been a saying that “the industry without the participation of Chinese companies as the first cannot be considered as the true first”. With the huge domestic car market and policy support, the gathering effect and scale effect achieved by Chinese companies in a short period of time are unattainable by companies in other countries.

In the lithium-ion battery industry, although it was invented by Japan and developed by South Korea, China is still necessary to achieve the world’s first ranking.

At the beginning of 2020, affected by the epidemic, the automotive market continued to decline, and it became even more difficult for new energy automotive companies and industry chain companies. In such a market environment, CATL (Contemporary Amperex Technology, Ltd.) thrived.

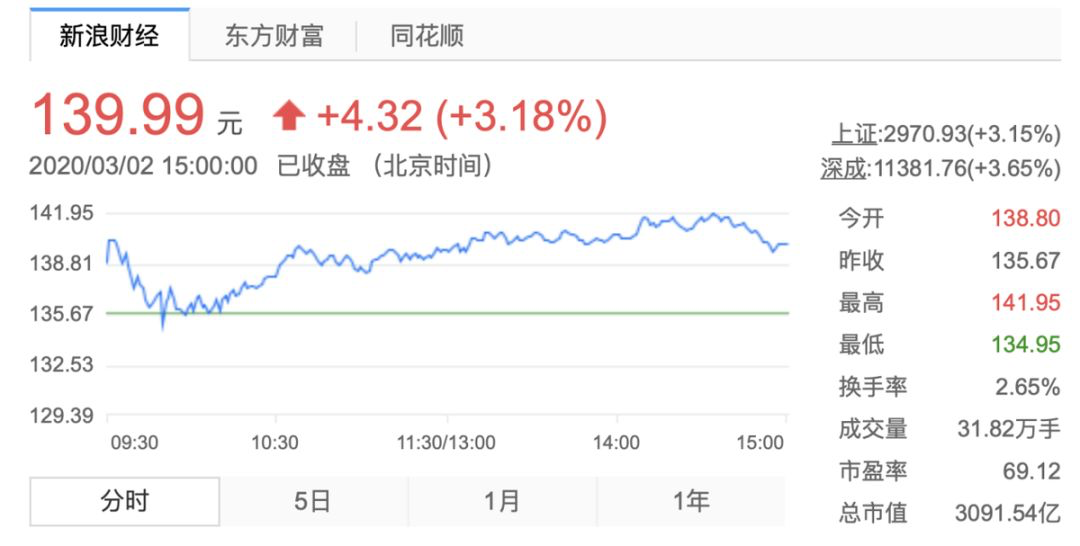

As of March 2, 2020, CATL’s stock price was still at 139.99 yuan, with a total market value of 309.154 billion yuan. On February 10, the company’s stock price reached its highest ever at 165.26 yuan per share, with a market value of 364.991 billion yuan, surpassing the Industrial and Commercial Bank of China.

Now is the shining moment of CATL. It only took CATL eight years, from no-name company to the world’s largest power battery company, relying on the Chinese new energy automotive market and its global potential.

Like other industries, when the “Chinese team” enters, it dominates the territory at the first sight.

CATL is not short of money

In the past few years, CATL has always been in acceleration. In 2016, CATL’s power battery production capacity reached 6.8 GWh, second only to BYD at that time.

However, in 2017, CATL surpassed BYD in market share.

In 2018, while new energy vehicle subsidies and other policies were still in the dividend period, although both CATL and BYD achieved stable growth, CATL’s pace was faster, with a total installed capacity of 23.52 GWh, taking the first place.

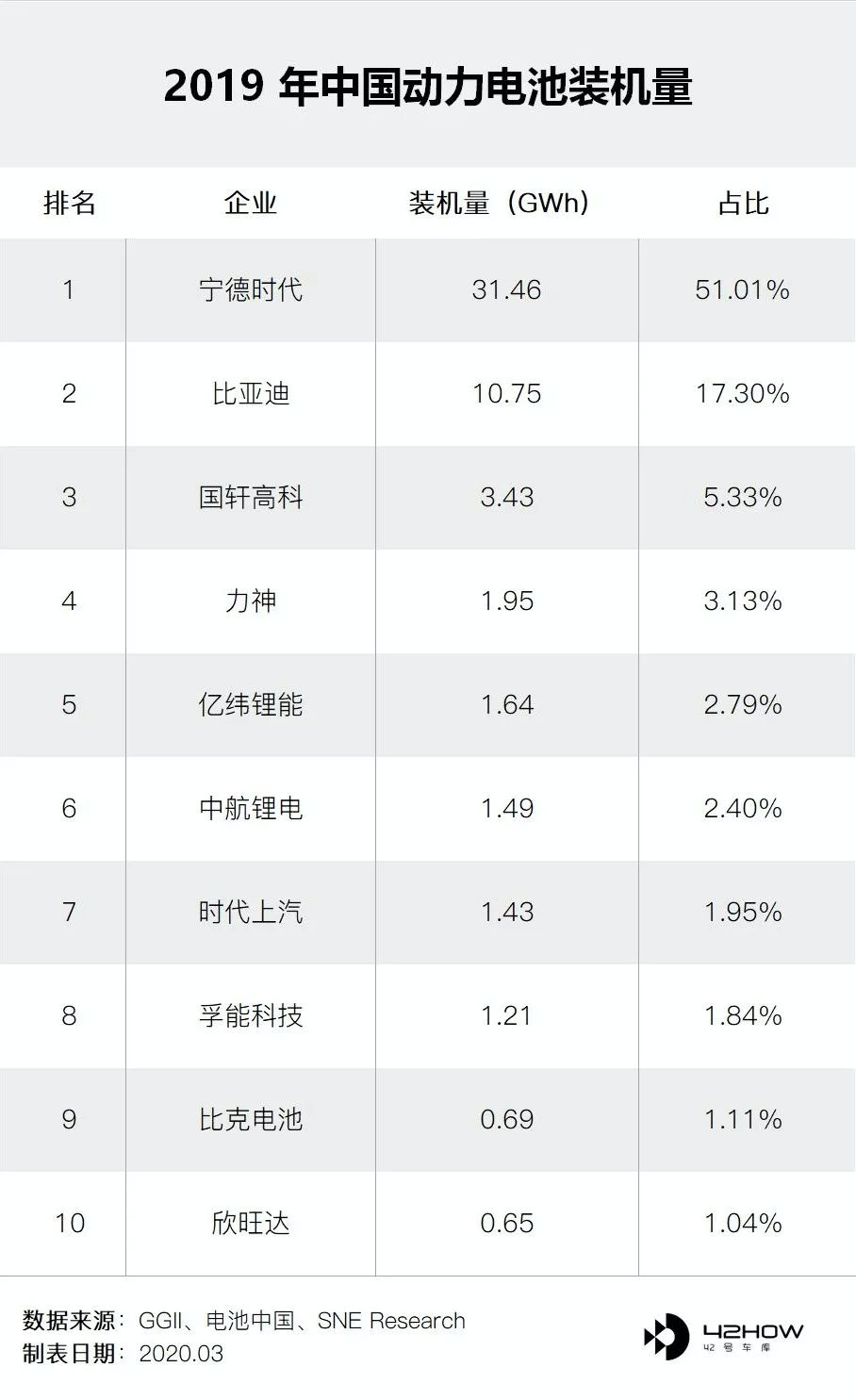

In 2019, CATL’s installed capacity was 31.46 GWh, almost half of the domestic total installed capacity of 62.38 GWh. CATL was the dominant player in the market share.

Since then, CATL has demonstrated an unprecedented “Chinese speed” in the field of power batteries.

In 2020, CATL is accelerating again. It entered the Tesla supplier list, triggering the debate on the technical route of power batteries. Lithium iron phosphate batteries are in the center of attention. Recently, as a giant of power batteries, CATL issued three announcements in two days on February 26-27:

-

On February 27, CATL announced its 2019 annual results.+ On February 26th, CATL announced a non-public fundraising of 20 billion yuan for expanding production.

-

On February 26th, CATL also announced a targeted investment of 10 billion yuan in the expansion of lithium battery projects.

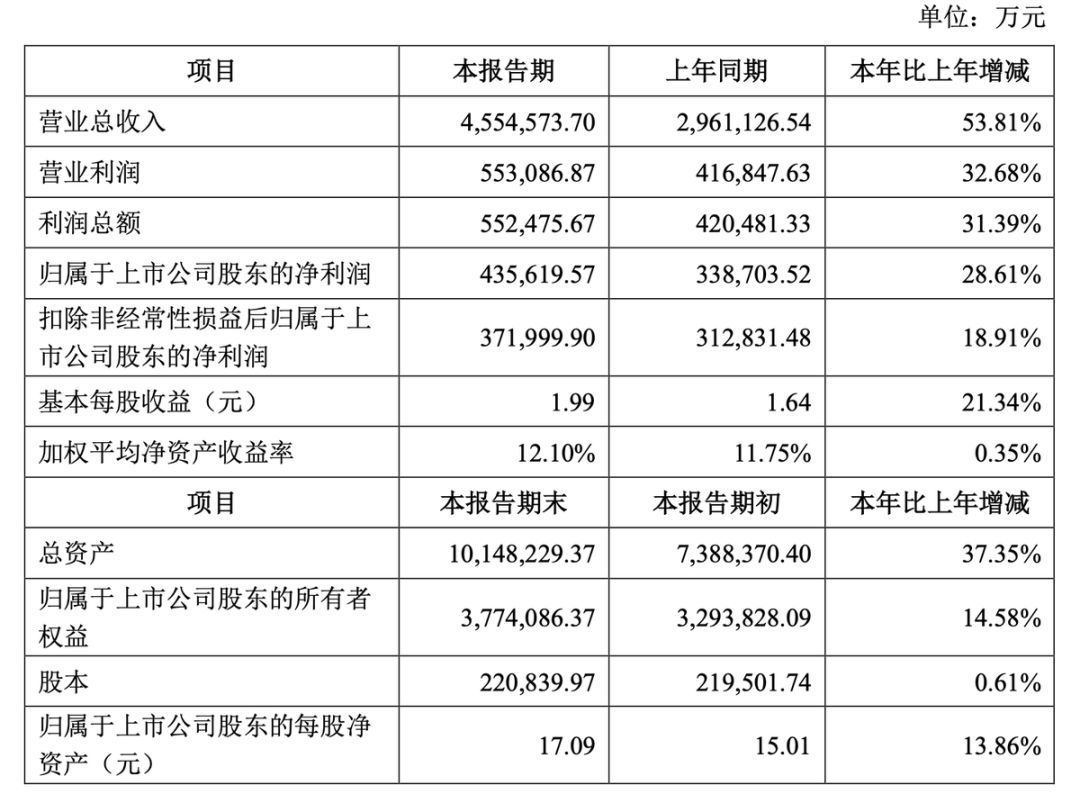

According to the 2019 annual report, CATL’s revenue was 45.546 billion yuan, a year-on-year increase of 53.81%; the net profit attributable to shareholders of listed companies was 4.356 billion yuan, a year-on-year increase of 28.61%.

They say money is always an issue in manufacturing, but CATL seems to have an unlimited supply of it!

One reason for the increase in performance in 2019 was the rapid growth of the new energy vehicle industry, and as a result the demand for power batteries increased compared to the same period. Despite the first decline in production and sales of new energy vehicles in the second half of 2019 in 10 years, the installed capacity of power batteries still increased to a certain extent due to the upgrading of products and the improvement of cruising range, as indicated by CATL’s revenue growth.

The second reason is the expansion of the market and the release of production capacity due to early investments, which led to increased sales. The behind-the-scenes growth driver was CATL’s expanding customer base, which has been expanding and optimizing its oEM client base since achieving comprehensive market dominance over its competitors in 2018.

Since January 2019, FAW and CATL have established a joint venture company, “FAW CATL Power Battery Co., Ltd.,” to achieve deep cooperation in the field of power batteries.

CATL’s major domestic customers, including NIO, Geely, SAIC, GAC, BAIC, Dongfeng, and others, cover most mainstream auto manufacturers. As for international corporations, BMW was the starting point. Shortly after it came Volkswagen, Honda, Toyota, Jaguar Land Rover, and Volvo.

When CATL officially announced its entry into Tesla’s supplier list, a fundamental change in the pattern of the power battery field occurred. “Getting Tesla means getting the world,” according to Cyber Analytics & Metrics (CAM)’s German sources. Tesla’s 2019 electric vehicle delivery surged by 50% to 367,000 units, making it the world’s largest electric vehicle manufacturer. In China, 45,372 Tesla cars were insured in 2019, with the Model 3 accounting for 33,903 of them.

Apart from the direct increase in business, the most important contribution of this cooperation was the brand effect it brought, further strengthening CATL’s international reputation. Becoming a BMW supplier not only opened up CATL’s international market, but it also greatly enhanced foreign brands’ trust in CATL. This was also one of the reasons why CATL’s stock experienced two consecutive limit-up trades at the beginning of the year.The expansion of “Friend Circle” will inevitably bring about an increase in business volume. Just one day before releasing annual performance results, CATL announced plans to raise RMB 20 billion for the expansion of four lithium-ion battery projects. According to the announcement, the funds raised for capacity expansion would be as high as RMB 12.5 billion, with an additional 52 GWh of output capacity. At the same time, CATL also announced plans to invest RMB 10 billion in building a lithium-ion battery production base in Ningde Chilwan through targeted investments.

According to the content disclosed in the previous two announcements, the expansion of lithium-ion battery production is still the core content. With a fundraising goal of RMB 20 billion and a targeted investment of RMB 10 billion, the total investment amount for the “Ningde Times Huxi lithium-ion battery expansion project,” “Jiangsu Times Power and Energy Storage lithium-ion battery R&D and production project (Phase III),” and “Sichuan Times Power Battery Project Phase I” has reached RMB 4.624 billion, RMB 7.4 billion, and RMB 4 billion, respectively. The funds raised will be separately used to invest RMB 4 billion, RMB 5.5 billion, and RMB 3 billion. Adding in the targeted investment in the Ningde Chilwan lithium-ion battery project, the funds for battery R&D and production have reached RMB 22.5 billion.

In fact, the demand for the power battery industry is growing, but the production capacity of the power battery industry has been insufficient, which has been a persistent problem for automakers and has also constrained their transition to electrification. LG Chemicals’ power battery production capacity was inadequate, leading to Jaguar’s pure electric model I-Pace experiencing more than a week of continuous production stoppage starting from February 17, and Audi and Daimler also reduced the production capacity of their pure electric cars, the e-tron and Mercedes-Benz EQC, due to capacity problems.

CATL’s decision to expand on a large scale at this time is not only releasing their own production capacity but also enhancing the confidence of the new energy vehicle market. Moreover, the more difficult the times, the more the effect of industry leaders will be demonstrated. Financing ability and expanded cooperation will gradually expand market share through the gathering of superior resources.

During the downturn of the new energy vehicle market, CATL’s strategic planning laid out a path towards a rapid scaling up of operations, significantly enhancing core competitiveness for the future.

CATL as an Oligopolist

Currently, CATL has left the majority of its competitors behind in terms of market, technology, existing production capacity, and planned capacity. According to data from GGII cited on CATL’s official website, as of 2019, China’s power battery installed capacity was approximately 62.37 GWh, with a year-on-year growth of 9.5\%.

CATL alone contributed 31.46 GWh of installed capacity, with a year-on-year growth of 37\%, accounting for almost half of the market and a 52\% market share. CATL is still expanding its investment, further consolidating its market position.

In business competition, “only the first one remembered” is usually the case. Judging from the actions of CATL (Contemporary Amperex Technology), it aims to be the industry leader, and its momentum of being far superior to others has already begun.

According to data from the China Power Battery Industry Innovation Alliance, 79 power battery companies achieved supporting production in 2019, and CATL’s 31.46 GWh supported production surpassed all, with BYD coming in second with 10.75 GWh and Guoxuan High-tech with 3.43 GWh. The rest of the companies’ supported production was less than 2 GWh.

From this, two points can be seen: 1. CATL’s leading position has been further consolidated, and there is a Matthew effect of the strong becoming stronger in the industry; 2. According to statistics and analysis from the Power Battery Application Branch of the China Chemical and Physical Power Sources Industry Association, there were 79 companies producing lithium-ion batteries for new energy vehicles in China in 2019, which is 13 less than in 2018, indicating that the industry is accelerating its elimination of underperforming players.

CATL’s blueprint as an oligopoly is gradually becoming apparent. If in 2019, CATL’s competitors were on the same level, then the following years will be the real period for CATL to establish itself as the superpower of the power battery industry.

According to publicly available data from CATL, its production capacity could reach 58 GWh in 2019 and could reach 100 GWh by the end of 2020. By 2023, it could reach 240 GWh. This marks the beginning of a golden decade for China’s power battery industry.

As power batteries almost change with new energy vehicles, although the overall car sales have shown a significant decline, it will not affect the long-term growth of the basic level, according to the prediction of the China Association of Automobile Manufacturers.

Judging from CATL’s existing and planned production capacity, it is optimistic about the future of new energy vehicles in China or globally, apart from maintaining its leading position in the long term.

According to data from the International Organization of Motor Vehicle Manufacturers (OICA), global car sales reached 95.06 million units in 2018, a year-on-year decrease of 0.6%. It was the first decline since 2009, and in 2019, China’s new energy vehicles also showed a decline due to subsidy cuts.

However, it can be expected that the global GDP and the GDP of China will maintain long-term stable growth. Assuming that the global vehicle sales can reach 100 million by 2030.

According to “New Energy Vehicle Industry Development Plan (2021-2035) (Draft for Soliciting Opinions)” released by the Ministry of Industry and Information Technology in 2019, the sales of new energy vehicles in China will account for 25% of the total sales by 2025.

Volkswagen Group plans to have new energy vehicles account for over 20% of the total sales by 2025. It is estimated that the penetration rate of new energy vehicles will reach 30% by 2030.

Therefore, assuming that the global sales of new energy vehicles can occupy 30% of the total sales by 2030, the sales volume will reach 30 million, calculated at an average of 13 kWh per 100 km based on the current mainstream range of 500 km, and the future battery technology may reduce the electricity to 11-12 kWh per 100 km. If each car is equipped with about 65 kWh of batteries, 30 million electric vehicles will require at least 1,900 GWh. This will create a huge demand gap.

Based on current production capacity and planned production capacity, Contemporary Amperex Technology Co. Limited (CATL) will have an absolute advantage. From a long-term perspective, other domestic players except BYD are not capable of challenging CATL, and BYD seems to have fallen behind since being surpassed in 2018.

According to public data, BYD’s current production capacity is 40 GWh, while CATL is 58 GWh, which is 18 GWh less than CATL even if the construction efficiency is the same in China. Moreover, CATL cooperates with global car companies, while BYD’s power battery is mainly self-sufficient, with limited external cooperation.

Looking at foreign power battery companies, LG Chem, Panasonic, and Samsung SDI etc. at present cannot compare with CATL in terms of production capacity.

LG Chem currently has six factories with a production capacity of 37 GWh: 5 GWh in South Korea, 12 GWh in Nanjing (Binjiang, Xingang), 5 GWh in Poland, and 2 GWh in the US (Holland, LG Chem). The planned production capacity is 100 GWh by the end of 2020, but currently, it can only reach 24 GWh.However, there is an issue here. The capacity planning seems very luxurious, but 4 out of the 6 factories are located overseas. This brings us to the level of infrastructure in China, which is recognized for its infrastructure madness. For example, the Shanghai Tesla factory achieved new car deliveries in just a year, while the German Tesla factory was stopped due to environmental issues, which is a case where its qualification was approved by the Ministry of Environmental Protection but was reported by environmentalists.

Panasonic, Samsung SDI, SK Innovation, and others will also face greater challenges in building foreign factories than Ningde Times. Moreover, the customer base established by Ningde Times in the early stages will make it more difficult for them to challenge Ningde Times, and in the short term, Ningde Times has a capacity advantage. In the long term, these advantages will only become more pronounced.

The technical system that Japanese and Korean power battery companies have always been proud of is also facing the possibility of being disintegrated.

Forming an oligopoly is not just a matter of luck, and voices such as the stock market surge have covered up the fact that Ningde Times is actually a technology-based company. Since Ningde Times announced its entry into Tesla’s supplier list, the dispute over the technology route of power battery technology has been ongoing, and the so-called dispute over technology route is premature.

Because it seems that the industry has taken Tesla as a bellwether, can Tesla alone determine the technology route of power batteries? This is something worth considering.

First of all, we need to look at what Tesla needs: first, low cost; second, sufficient supply; and third, reliability. Tesla’s domestic production must reduce costs so that the entire vehicle has room for price reductions. Currently, the reliability of power batteries on the market is becoming unified, and the most important thing is to improve energy density while reducing costs.

So it can be seen that what Tesla needs is actually low cost with high energy density. In terms of cost control, Ningde Times’ CTP technology is different from the traditional production model of cell-module-PACK, it saves the battery module assembly process, and improves the overall battery pack volume utilization efficiency by 15%-20%, reduces the number of battery pack components by 40%, and reduces the estimated cost by 20%-30%, while the energy density of the battery pack reaches 200 Wh/kg.

Currently, Ningde Times has CTP+LFP and CTP+ternary programs in the CTP scheme. Adopting CTP+LFP can achieve high cost reduction while maintaining good quality, volume energy density. Adopting CTP+ternary can achieve higher quality, volume energy density, and effectively improve the overall vehicle’s endurance, performance, and other aspects.Tesla may plan to adopt CATL’s LFP batteries based on its breakthroughs in CTP technology, which can be compatible with relatively high-energy density battery cells, and the energy density of the battery system can reach 140-160 Wh/kg, which is equivalent to the standard range version of the domestically produced Model 3. This can maximize the balance of cost, range, safety, and other factors for the standard version of the vehicle.

Conclusion: The technological advantages of Japanese and Korean power battery companies have gradually declined, while CATL has a balanced position in technology, market expansion, and production capacity.

Most importantly, China will have the most complete lithium battery industry chain in the future, with the ability to control upstream raw material resources and the largest potential market for new energy vehicles. Coupled with CATL’s unparalleled cost control capabilities, the clustering effect of CATL will continue to strengthen in the future.

CATL is also strengthening its scale-up capabilities through investment to respond to the potential demand for hot-selling products and potential competitive threats.

The Greatest Benefit of Scale-Up: “Reducing Costs”

Expanding scale is not only what CATL is doing, LG Chem, Panasonic, Samsung SDI, and others are building factories around the world. The significance of scale-up is easy to understand: the demand for power batteries in the market is only increasing, and whoever can satisfy the market demand in a short period of time can obtain more autonomy.

CATL has invested 260 million yuan to acquire shares of an Australian mining company to lay out upstream lithium mine resources actively through joint ventures or investments. CATL has also made significant investments in building factories to expand production capacity, which are both aimed at strengthening scale-up.

Scale-up can reduce the comprehensive energy consumption of the production process, increase the utilization rate of individual equipment, and improve the output value of comprehensive personnel units. The most important benefit of scale-up is the increase in production capacity, which correspondingly enhances the bargaining power of suppliers and can strengthen the loan duration of car companies.

In terms of manufacturing, the greatest benefit of scale-up is “cost reduction,” which shares the comprehensive energy consumption of the production process.

Summary:

Looking at the big problems simply, although CATL has shown outstanding performance, there are still major potential risks. The rapid breakthrough of new energy vehicle technology and the expected increase in penetration rate will require the reevaluation of the value of the new energy vehicle industry chain.

Moreover, although the country has policy support, the decline of new energy vehicles after the subsidy cut in 2019 has caused uncertainty about major policies to be a risk.

But risks coexist with opportunities. CATL is laying out for the future, and the long-term growth of global new energy vehicle production and sales is a certainty and has huge potential. CATL is just waiting for hot-selling products to arrive. The power battery technology route has not yet been unified, and the potential elimination rate is high. The current situation of the three-way competition of power batteries between China, Japan, and South Korea will not change in the short term. Therefore, increasing technological research and development and increasing cash flow are still essential.The core logic behind CATL’s construction expansion is to achieve economies of scale. This means CATL is one step ahead of its competitors and can increase the deployment of its products. Only by reducing the price of power batteries and increasing deployment can CATL maintain a healthy business. Additionally, this strategy allows CATL to better control costs and gain bargaining power in the upstream and downstream supply chain layout.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.