Great Wall Motors learns from Huawei.

Huawei’s founder Ren Zhengfei once asked: Will Huawei be the next to fall?

Great Wall Motor’s Wei Jianjun asked: Can Great Wall Motors survive next year?

It seems like imitating and copying, but for someone like Wei Jianjun, if he says he wants to learn from Huawei, he’ll definitely really learn – both the form and the spirit.

The latest example is the 2025 strategy of Great Wall Motors.

On June 28th, at the Haval Technology Center in Baoding, Great Wall Motors held a press conference on the 2025 strategy and the opening ceremony of the 8th Science and Technology Festival. Wei Jianjun, Chairman of Great Wall Motors, announced the main content and strategy of the 2025 strategy goals:

By 2025, Great Wall Motors will achieve global annual sales of 4 million vehicles, 80% of which will be new energy vehicles, and revenue will exceed 600 billion yuan;

By 2023, the number of global R&D personnel at Great Wall Motors will reach 30,000, including 10,000 software development talents. In the next five years, cumulative R&D investment will reach 100 billion yuan…

Later, Meng Xiangjun, rotating president of Great Wall Motors, specifically introduced the “Green Smart Trend” 2025 strategy of Great Wall Motors and comprehensively introduced its strategy at the business level.

In terms of enterprise management, strategic goals and business strategies are not isolated. A corporate strategy is not just a goal, nor can it be carried out only at the business level. It represents the vision, mission, and values of the enterprise, and needs business, organization, and reward and punishment mechanisms to help implement it. Only with such a strategy can we ensure that we will not deviate and that we can achieve our goals.

This is my experience after reading “IPD: Huawei’s R&D Approach”. IPD (Integrated Product Development) is a system that Huawei learned from IBM in 1998. It is not just a product development strategy, but also has the effect of reshaping company processes and management for research and development-oriented companies.

Using the IPD management model, let’s analyze Great Wall’s 2025 strategy.

Above the Strategy

Strategy is not supreme authority. It must serve the company’s vision, mission, and values.

From Wei Jianjun’s speech, we can see Great Wall Motor’s vision, mission, and values.

[Vision]: A new generation of smart cars based on clean energy will form a new pattern of future automotive industry development.

[Mission]: Representing China to lead the new race in the automotive industry.

Wei Jianjun said, “If Chinese automotive brands want to really surpass others, they must quickly consolidate their existing advantages in the next 3-5 years to have a chance to lead in the new fields of new energy and intelligence. And Chinese automotive brands only have one chance.”

[Values]:

Strategic Goals

Under the vision, mission, and values, Wei Jianjun proposed the strategic goals of Great Wall Motors in 2025.

“We will realize the target of a global annual sales volume of 4 million vehicles, 80% of which will be new energy vehicles, with revenue exceeding RMB 600 billion by 2025 through global deployment.”

To achieve this goal, Wei Jianjun first emphasized research and development investment.

“Total research and development investment will reach RMB 100 billion over the next 5 years,” Wei Jianjun said. He listed the areas of research and development investment, including:

- New energy fields, such as pure electric, hydrogen, hybrid, etc. to enhance the application of green energy, and accelerates the pace from low carbon to zero carbon;

- Focusing on the investment in third-generation semiconductors such as low-power, high-computing chips and silicon carbide;

- Combining modern sensing information fusion, artificial intelligence, etc. to promote software and hardware integration.

Wei Jianjun stated that the goal of research and development investment is “to ensure technological advantages in the fields of new energy and intelligence, and to create more environmentally friendly, smarter, and safer products for users worldwide.”

In order to implement the strategic goals, Wei Jianjun proposed other measures, which will be discussed below.

Business Planning

The strategic goals need to be broken down into business objectives. Meng Xiangjun, the rotating vice president of Great Wall Motors, summarised them into four aspects – “green”, “intelligence”, “trendy”, and “recreation”.

Green

“Our goal is to achieve 80 % new energy penetration by 2025,” Meng Xiangjun said.

He first introduced the current situation. Great Wall now has two new energy brands – Euler and Salon.

As of today, Euler has sold 52,000 new energy vehicles, ranking first in the new energy market. Euler’s goal is to achieve global sales of 1 million vehicles by 2023.

Salon is positioned as a high-end brand, and its first product will be launched in 2022.

Meng Xiangjun also revealed that Great Wall’s other brands are also synchronously reserving the Pure Electric Vehicle (BEV) platform and related technologies.

In addition to BEV, Great Wall Motors will also promote the hybridization comprehensively. It has already released the DHT hybrid transmission and 1.5t hybrid engine, and is about to launch Mocha, Latte, Macchiato, Chestnut, Haval XY, and other hybrid models.

Great Wall will also release the power combination of a 3.0T engine with a 9HAT gearbox with peak torque of 750 N-m, which will be used in the tank brand, “making the tank the world’s most powerful off-road vehicle model.”

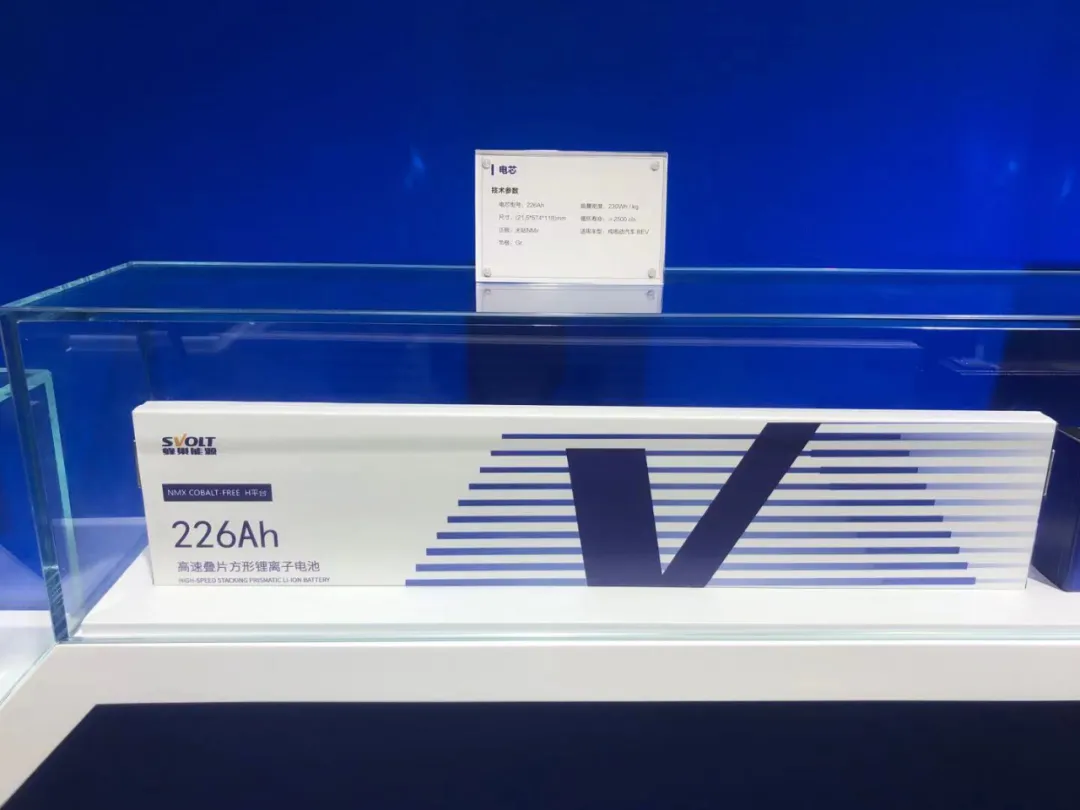

In addition to vehicles, Great Wall Group has also laid out its energy saving and new energy industrial chain. The cobalt-free stacked cell battery independently developed by Honeycomb Energy is expected to have a capacity of 215GWh by 2025.

“We have also independently developed new energy motors and motor controllers, which have reached the international leading level in terms of integration, efficiency, lightweight and cost-effectiveness. Our products can meet the power needs of passenger cars from A00 to D class, as well as pickup trucks and logistics vehicles,” said Meng Xiangjun.

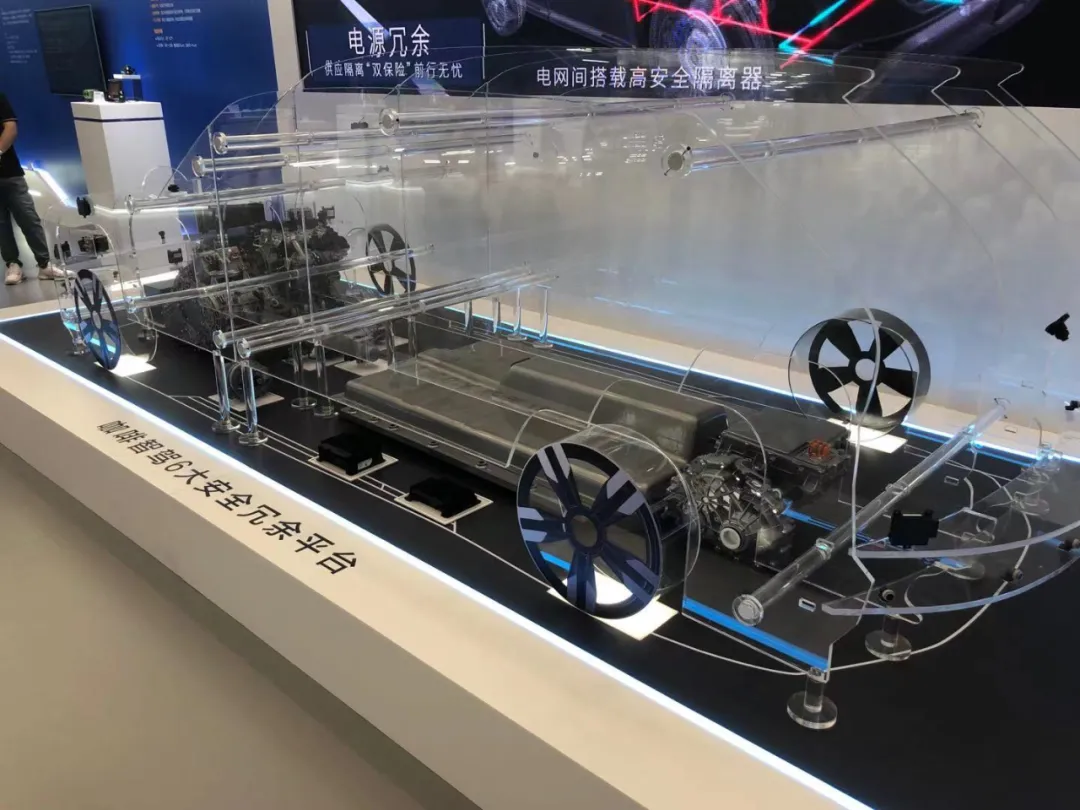

In the hydrogen energy field, UNI Energy Technology under Great Wall Motors has mastered a full set of key technologies including fuel cells, stacks, membrane electrodes, storage systems, etc. The goal is to build an integrated industry chain ecosystem for hydrogen production, storage, transportation, refueling, and application, and achieve a top 3 global market share in the hydrogen energy market by 2025.

[Intelligence]

Meng Xiangjun said that Great Wall Motors will firmly accelerate its intelligent transformation, and build a full-station resource capability around intelligent driving, intelligent cockpit, and intelligent service, making cars a thinking and sustainable growth partner through the evolution and upgrade from perceptual intelligence to cognitive intelligence.

Great Wall Motors currently has four intelligent organizations: Product Digital Center, Hm Auto Intelligence, Xundao Intelligence, and Inovoices Technology, with a software development team of more than 3,000, and it will reach 10,000 in the future.

In the field of intelligent driving, Great Wall Motors has already completed the mass production of multiple-scenario functions such as high-speed automatic navigation assistance, memory parking, and narrow road autonomous exploration. Their goal is to achieve a penetration rate of more than 40% for advanced automatic driving by 2025.

In the field of intelligent cockpit, the goal of Great Wall Motors is to deeply integrate with hardware plug-and-play, software reuse, and create a growing intelligent cockpit ecological system.

By 2022, Great Wall Motors will gradually complete software capabilities in multiple areas such as voice, vision, navigation, maps, and scene engines, and reshape value through software capabilities to create product differentiation.

In the field of intelligent services, with the continuous enhancement of the intelligent terminal attributes of automobile products, we will also combine users’ needs to build an intelligent service ecosystem around the full life cycle of user car use, and achieve the transformation from one-time consumption to sustained service. The goal is for the software revenue of the automotive industry to rise from the current 15% to 60%.

Meng Xiangjun first states that “China will enter the era of personalized consumption. The future main force of car purchases will be the new generation of consumers. They are confident in the big country, the natives of the Internet era, and have a more urgent demand for national tide intelligent and personalized customization. They not only seek novelty and diversity in products to meet their usage requirements, but also require the product to become a carrier of their values.”

He introduced that due to Great Wall Motor’s long-term research and development investment, it has mastered strong industry chain integration capabilities, core technologies and software and hardware coordination capabilities. “We can control the development cycle of a new product in as fast as 11 months, while most brands are more than double ours.”

Great Wall Motor will continue to innovate based on product categories and build brands based on categories. “We have formed six brand matrices: pickup trucks, Haval, WEY, Ora, Tank, and Salon, which will create new era trends and products for global consumers in 10 major regional markets such as China, Russia, ASEAN, the EU, and North and South.”

Under the total goal of producing and selling 4 million vehicles and revenue of 600 billion in 2025, the six brands each have their own responsibilities.

Pickup Trucks:

Great Wall Pickup Trucks is positioned as the leader in the pickup truck market and aims to create one of the top three global brands. It has been the domestic sales champion for 23 consecutive years and the export champion for 22 consecutive years, with a domestic market share close to 50%. The Great Wall Cannon has created a new category of passenger platform and continuously expanded the boundaries and group of the pickup truck market.

Haval:

The brand is positioned as the global leader in Chinese SUVs and has been the Chinese SUV sales champion for 11 consecutive years. Haval will continue to deeply cultivate the economy SUV market.

WEY:

Positioned as the new generation of intelligent automobiles, committed to providing users with an intelligent control experience. In 2021, the brand introduced three new SUVs: Mocha, Mach-e, and Latte, to enhance enjoyment through intelligence, intelligent service, and intelligent travel.

Ora:

The brand is positioned as the world’s first automobile brand that loves women the most, deeply loved by female users due to its retro and fashionable appearance and product design that cares more about women.

Ora focuses on new energy vehicles and focuses on urban boutique travel. By 2023, it will achieve the first place in the new energy market segment and global sales exceeding 1 million vehicles.

Tank:

The brand is positioned as trendy off-road SUVs. Last year, we launched the 300, igniting the Tank phenomenon. The Tank brand takes the entry point of “toughness and tenderness” to create a new subdivision category. Great Wall will also launch more good products on the market in the future to build the Tank into the world’s number one off-road brand.

Salon:# Markdown Text in English

Positioning as a luxury intelligent brand, we will create ultimate value experience with the concept of intelligent luxury, extreme technology, and extreme comfort. Meanwhile, we will develop a full-scenario ecological tourism centered on users, and create ultimate exclusive services, challenging the global luxury market.

2021:

This year, Great Wall will launch more than 10 new car models.

2023:

Over 60 new products will be introduced, achieving an annual production and sales volume of 2.8 million.

“Both inheriting the excellent engineer culture and daring to innovate, we want to engage with users and upstream and downstream players to create a new value proposition through collective intelligence and collaboration,” said Meng Xiangjun.

Regarding user co-creation, Great Wall is conducting dialogues with users around four dimensions, including product service and brand value.

Regarding industry chain co-creation, Great Wall hopes to build a multi-dimensional and multi-party win-win forest-style industrial ecology.

Organizational Structure

In Wei Jianjun’s speech section, he also introduced other measures to ensure the implementation of strategic guarantees.

“Over the past three years, we have reconstructed the company’s organizational mechanism, process, and enterprise ecosystem, forming a 3.0 version organizational structure of strong backstage, large-middle stage, and small front desk,” said Wei Jianjun.

He explained that the strong backstage aims to reserve the best and most advanced technology and to keep us ahead through a large amount of cutting-edge research investment. The backstage includes not only technology but also mechanisms, human resource policies, strategic layout, and capital operations.

The large-middle stage is to provide timely replenishment and support to the front desk.

Based on the small front desk facing users, Great Wall has now formed an organizational form of “one-van, one-brand, one-company”, creating several operating organizations and new types of organizations, and restructuring business models. Each small front desk organization relies on digital technology to agilely connect with users.

Wei Jianjun revealed that Great Wall now has a user group of tens of millions, with a registration volume of 5 million on the operation platform, and the daily activity rates of major brands are leading in the industry, taking a key step towards transforming from an automobile manufacturing company to a user operation company.

Human Resources

Regarding human resources, Wei Jianjun emphasized the investment in R&D personnel.

“We will also increase the investment in global R&D talents. By 2023, the number of R&D personnel worldwide will reach 30,000 on the existing basis of 15,000, among which the software development talent will reach nearly 10,000,” said Wei Jianjun.

As a traditional automobile manufacturing background company, Great Wall now emphasizes both R&D and operation, and introduces the management concept of R&D-based companies. Therefore, an obvious trend is that the structure of excellent vehicle companies’ human resources will be large at both ends and small in the middle: more talents in R&D and marketing, and less in production.

## Evaluation, Rewards and Development

Wei Jianjun and Meng Xiangjun both mentioned the two equity incentive plans implemented by Great Wall Motors.

In 2020 and 2021, Great Wall Motors implemented two consecutive equity incentive plans, benefiting more than 12,000 stakeholders and covering 50% of core employees. “In the future, we will roll out equity incentive models with wide coverage, which will cover 100% of rewarding employees and achieve a transformation from employees to partners,” said Wei Jianjun.

Importance of Realistic Strategies

When attending the strategic release and technology festival of Great Wall Motors, I communicated with investors and media colleagues about the opinions on Great Wall Motors’ 2025 strategy. Some thought that Wei Jianjun was just making empty promises, while others believed that Great Wall’s packaging and promotion were not enough.

Setting an ambitious and inspiring goal is necessary for entrepreneurs who intend to build a great company. As stated by Kazuo Inamori, “Without a strong desire, you will never get close to what you want.”

However, a strategy requires systematic support. Therefore, in terms of funding, talent, organizational structure, and incentive mechanism, there must be a design that aligns with the strategic implementation.

In the era of intelligent electric vehicles, building cars is no longer solely a large group operation. Both software and hardware capabilities are required, and the value chain has expanded from production to services and operations, which requires a more diverse and larger-scale talent pool.

Great Wall Motors has been successful over the past 30 years. However, the biggest challenge for a successful enterprise is internal sluggishness and efficiency loss, known as “entropy increase.” From Great Wall Motors’ transformation, both in form and spirit, it bears similarity to Huawei.

Great Wall Motors is not only a sample of an intelligent electric vehicle enterprise transformation, but also an observation sample of corporate management reform.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.