*This article is reproduced from the autocarweekly account

Author: Financial Street Laoli

It is only a matter of time for the market value of Techrui and Star Charge to explode.

As one of the seven directions of the new infrastructure, new energy vehicle charging piles are the most forgotten one. Compared with high-tech technologies such as 5G base stations and ultra-high voltage, the technical threshold of new energy vehicle charging pile is very low, and it is almost negligible compared with core components such as power batteries. However, the country still regards it as one of the seven directions of the new infrastructure, indicating its uniqueness.

A stone stirs up thousands of waves, and the recent sound waves in the charging pile field have shown the expected enthusiasm for the new infrastructure. First, Techrui officially announced that it would compensate for car damage caused by charging, and then completed a 300 million yuan financing, with its parent company Techrui Technology’s stock price soaring by 18.8% and its market value rising by 5.1 billion yuan in a day. Many people exclaimed that the era of charging piles has finally come.

The investment in the stock market comes from life, such as buying Guizhou Maotai for drinking, using Haitian seasoning for cooking, visiting Eral Eye Clinic for eye-checking, and eating Jin Long Yu for dining. Many people ask Laoli, in the future, should we buy Techrui for charging? Today we will discuss together why charging piles can enter the new infrastructure? Is charging pile really a good business? Can Techrui become the next money-maker in the A-share market?

Charging Piles: More Than Just Charging

Laoli has always been looking at investment in the field of intelligent electric vehicles. Starting from 2020, he has been frequently dissed by partners for not being able to find investment projects. Laoli is also helpless, every industry has its own cycle, and companies that can be invested in the direction of electrification of automobiles have basically developed. Now, investment projects have slowly shifted to intelligence, and even to the usage end and the post-market. There are no longer so many entrepreneurial opportunities in the market, and naturally, there are no longer so many projects.

Many people have this problem. A while ago, Laoli had a discussion with some industry researchers, what is the next direction that can be speculated in the smart electric vehicle track? Someone said it was autonomous driving, and someone said it was OTA, but everyone agreed that there will be opportunities in the charging pile operation field, but the timing is not good to judge.

Although the new energy vehicle market is strong, in the past two years, from raw materials to power batteries, from components to whole vehicles, almost all the areas that can be speculated on in the new energy vehicle sector have been pulled up. Looking to the future, as long as the number of new energy vehicles increases, the operation of charging piles will be the most certain business, and the profitability of charging pile operators is only a matter of time. In this field, there will definitely be 1-2 unicorn companies born, most likely Techrui and Star Charge, with no State Grid.

Everyone didn’t expect that TELD’s financing meeting would be so fast. On June 20th, TELD’s parent company, TGOOD, announced that TELD, a subsidiary specializing in charging piles, plans to introduce strategic investors such as Prologis, SDIC, and CTG through capital increase and share expansion, with a total amount of approximately 300 million yuan and a post-investment valuation of approximately 13.6 billion yuan.

Everyone didn’t expect that TELD’s financing meeting would be so fast. On June 20th, TELD’s parent company, TGOOD, announced that TELD, a subsidiary specializing in charging piles, plans to introduce strategic investors such as Prologis, SDIC, and CTG through capital increase and share expansion, with a total amount of approximately 300 million yuan and a post-investment valuation of approximately 13.6 billion yuan.

Among many investors, there is a familiar enterprise– EVE Energy, a battery giant, which has also become one of TELD’s shareholders.

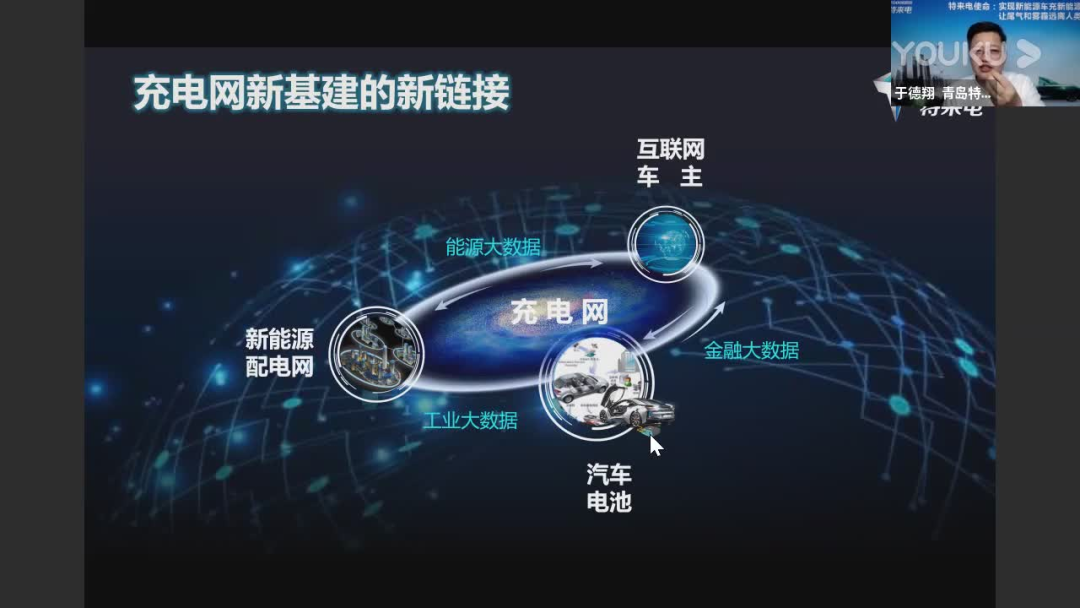

EVE Energy’s investment this time can be described as far-sighted. As an entry point for energy trading, charging piles connect energy and vehicles. For power battery companies, investing in charging pile companies means achieving comprehensive coverage of the vehicle-pile-network, not only connecting the energy chain, but also connecting the battery life cycle. Charging pile operators not only provide charging, but can also integrate the energy system.

This judgment is not groundless. Earlier, TELD’s car burning compensation policy caused heated discussions in the industry, and many people thought that TELD was a gimmick, playing to the gallery for financing empowerment. Mr. Li also discussed with some industry experts, and many experts believed that TELD’s compensation strategy had a logical basis.

Let’s first take a look at the specific content of TELD’s all-inclusive service. The official language is: relying on the “two-layer protection technology of the charging network”, that is, charging equipment-side protection and big data modeling, providing “love car safety protection service” to electric vehicle users nationwide for free:

-

Real-time safety protection during the charging process and fault warning based on long-period battery data.

-

Vehicle health examination report in the TELD APP.

-

Accident guarantee service (i.e., the burning compensation service promoted by TELD).

Mr. Li here translates some of this public relations article for everyone, that is, TELD can collect power battery health data through vehicle fast charging. When the data volume is large enough, TELD can provide battery fault warnings and health reports to everyone, and can also provide some guarantee services.

This means that TELD is no longer just a single charging operator, but also a power battery life cycle value management service provider. TELD has laid out in advance what CATL wants to do. EVE Energy’s investment in TELD this time is also reasonable.

What business is a charging pile?

The purpose of the capital market is very strong. Faced with certain problems, they will be very patient. Faced with uncertain problems, they will also be extremely ruthless. Although they have been losing money, they have enough patience for charging pile operators because the profitability of charging pile operators is a certainty.In the automotive industry, gas stations, charging stations, and future hydrogen refueling stations are all the same business model, and can all be calculated using the simple “cost-volume-profit” model. The cost-volume-profit model has been around for many years and is used to analyze the relationship between cost, volume, and profit in order to make decisions.

Taking a charging station operator as an example, the company’s costs are the construction and operation of the charging stations. User charging generates revenue, and if users charge less frequently, revenue is reduced, and the company loses money. The more users charge, the more revenue is generated, leading to profit.

Any new industry follows this model. In the early days of gasoline-powered vehicles, gasoline stations did not earn money due to the low fuel consumption of automobiles. Later, as the number of automobiles increased, the profits of gasoline stations gradually increased. Currently, the operation of charging stations is very similar to early gasoline stations. As a reference, the complete construction cost of a 150 kW charging station owned by State Grid Corporation is around 110,000 yuan, including the cost of purchasing the charging station, site fees, grid capacity fees, and so on, which requires a large investment.

High investment and market demand are contradictory. Due to the low proliferation of electric vehicles, low user usage rates have resulted in low utilization rates of charging stations, leading to losses for operators. Using data from Shanghai EV Data as an example, the utilization rate of public charging stations in Shanghai, excluding buses, has remained between 1% and 3% in recent years. However, charging utilization rates generally need to exceed 5% to have the opportunity to achieve breakeven, so there are currently no companies that can withstand heavy asset investments and early losses in the market, except for State Grid, Teld and Star Charge.

From 2016 to 2020, Teld lost 29.4 million yuan, 19.5 million yuan, 136 million yuan, 111 million yuan, and 77.696 million yuan respectively, with a total loss of 374 million yuan over the five years. Although the loss is still relatively large, the overall amount is decreasing. In comparison, Teld’s revenue is relatively optimistic. In 2020, Teld had revenue of 1.52 billion yuan.

Despite the continuous losses, the development situation of top charging station operators is getting better and better, mainly for three reasons:

Firstly, the demand for users is constantly increasing. In May of this year, the penetration rate of new energy vehicles exceeded 11%, reaching a new high in the industry. According to the plan of the Ministry of Industry and Information Technology, the sales ratio of new energy vehicles will reach around 20% by 2025, and the stock of new energy vehicles will also increase, which will bring the time for charging station operators to reach breakeven earlier.

The second point is that the leading operators in the industry have realized the issue of refined operations.

It is no exaggeration to say that the early development of the charging pile operation industry was very rough. However, after experiencing a series of actions such as running the horse, the leading operators (Star Charge, TELD) have become more stable in their development, paying more attention to refined operation, light assets such as traffic data value, and the direction towards their own profitability in charging pile construction. They center on user demand, enhance charging pile utilization, and increase profitability.

The third point is that industry concentration is increasing. Areas without high technical thresholds are more likely to produce industry giants. After experiencing a phase of growth, TELD, Star Charge, and State Grid’s market share have increased. The big three have formed a dominant pattern in the industry, the scale barrier of the charging pile operation field is gradually forming, and a pattern similar to that of China Mobile, China Unicom, and China Telecom is emerging.

The emergence of leading enterprises is driving the transformation of the business of charging pile operators. As Old Li mentioned earlier, charging pile operators have access to a large amount of charging data and service data. The charging pile operators will gradually transform into smart energy service providers.

How much is TELD worth after its IPO?

Before this round of financing for TELD, everyone knew that TELD and Star Charge were going to IPO, but they didn’t expect it to come so soon. As early as November last year, TELD announced that it had launched preparations for the domestic spin-off listing of TELD. In Old Li’s opinion, the reasons why Star Charge and TELD are eager for an IPO may be as follows:

The first point is that the charging pile operation business has been incurring losses. TELD’s parent company, TGOOD, and Star Charge’s parent company, SGCC, have invested heavily. Over the past few years, the cumulative investment of the two companies has exceeded RMB 10 billion. The two parent companies are not large utilities like State Grid, so external fundraising is a necessary way of development.

The second point is that the charging pile operator is seeking a good window for going public. Currently, it may be a good time. Although the company has been losing money in its financial statements, there is currently a favorable external environment. The primary and secondary markets have a high enthusiasm for the new energy vehicle sector, and the entire industry is booming, including both leading stocks and growth stocks. Even charging pile manufacturers such as Shenghong have gained attention in the secondary market despite having no technical threshold, no industry barriers, and no market size. TELD does not want to miss out on this favorable window.

Many brokerage analysts are also researching Techrules. In the early days, due to low business volume, people did not think that operating charging piles was a good business. However, since last year, some forward-looking researchers have keenly felt the changes. They believe that the valuation code of charging pile operators has two aspects: one is to maintain a relatively high market share, which is the certainty of valuation; the other is to transform from charging pile operation to digital energy services, which is the imagination of valuation.

Compared with Southern Star Charging, which is located in the south, Techrules does not have good storytelling ability in the capital market. The official statement of Techrules is: the spin-off listing is to realize the dual-wheel drive of intelligent manufacturing and charging network operation, give full play to the function and advantages of direct financing in the capital market, broaden financing channels, improve financing efficiency, enhance the profitability and comprehensive competitiveness of the company and Techrules.

Some of Mr. Li’s friends also participated in the research and roadshow of Techrules. Many friends said that Techrules can tell a very good story, but did not manage to convey it. According to Mr. Li’s understanding, this has a historical reason. Techrules has been telling the story of smart energy for a long time, but because it was too forward-looking, many people in the financial industry could not understand it. A risk control officer of a large bank said to Mr. Li: Techrules applied for credit, talked about the blueprint of smart energy, but the risk control personnel found out that a certain branch of Techrules had poor management and it was difficult to pay the salaries, so they did not provide credit.

Although they are all in the financial industry, banks, primary market, and secondary market are three completely different circles. Researchers in the primary and secondary markets have higher research level, stronger individual ability, and better grasp of the company’s direction. Techrules is still very popular in the primary and secondary markets, the more difficult it is for people to understand, the more likely it is to be an opportunity.

In March last year, Techrules raised RMB 1.35 billion in Series A financing, which was used for R&D investment in charging and energy management technology, construction of charging network, and improvement of operating efficiency. Since then, the primary and secondary markets have become interested in smart energy management.

These backgrounds can help us better locate the company and judge its market value. As of this round of financing, the valuation of Techrules is about RMB 13.6 billion, which is approximately one-third of the market value of its parent company, Techrules.Just now, it was mentioned that TELD’s market value is divided into charging and smart energy businesses. From a financial perspective, some of TELD’s southern branches have achieved good operating profits, but the northern branches are still losing money. Overall, TELD’s losses have been continuously narrowing in the past five years. Annual revenues might soon exceed 2 billion, and the profit growth from economies of scale will also be very optimistic. From this perspective, TELD is worth more than 20 billion.

On the smart energy front, TELD’s imagination is even stronger. As a key node in the vehicle-pole-network system, charging operators can act as intermediaries for smart energy and can explore a variety of scenarios in the future integration of charging and storage. In addition, they can master the big data of the vehicle-pole network. TELD’s burning-car insurance is essentially a big data service, so the car-network interactive business model will bring a brand new business outlook. But to be honest, this business cannot be valued and can only be based on imagination.

Domestic researchers like to study overseas or similar companies as valuation references. However, in recent years, the development of domestic intelligent electric vehicles has been too fast, and there is no benchmark for charging station operators like TELD. The story of smart energy is also the first time introduced in China, so it is not easy to gain recognition from the capital market, but this will eventually change.

In the past, when a researcher saw a project, they would first ask the entrepreneur if there were any reference cases overseas for this model. Now, no one asks anymore, and that is progress.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.