Recent plans involve tracking battery, charging, and vehicle planning, as well as incorporating some intelligent cabin and autonomous driving technology tracking. One interesting aspect is that currently, European and American automotive companies are combining various cabin and autonomous driving technologies with flagship all-electric versions to determine the overall combat effectiveness of the vehicle based on comprehensive capabilities in several areas. The battery remains a fundamental aspect and deserves monthly tracking and summarization. Preferred content selection includes: in-vehicle displays, domain controllers, and perception technology.

Note: Some information on hardware can be obtained through recordation, and preliminary evaluations can be performed from the perspective of hardware design.

Domestic Battery Industry in May

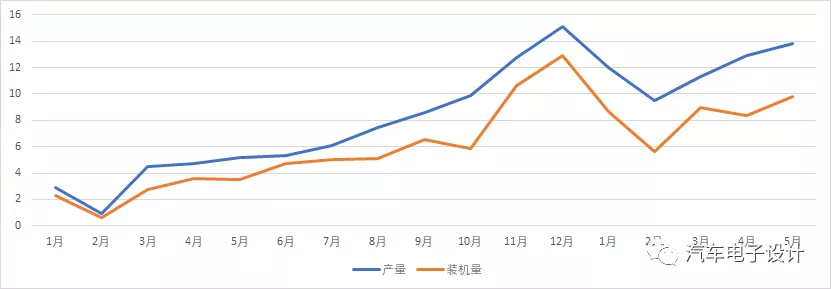

In May, the output of power batteries was 13.8GWh, and the battery loading volume was 9.8GWh, which continued to maintain the difference of 4GWh. From the current perspective, there will always be a difference between the domestic installation volume and the actual output.

SNE provided an answer, namely, the overseas installation volume of CATL (Tesla Model 3 (exported from China to Europe), Peugeot e-2008, Opel Corsa) and BYD. According to SNE’s data, the cumulative installation volume of the two has reached 3.8GWh, explaining the 14GWh difference from January to April, of which one-third was used overseas.

Note: In the first five months, the cumulative output of power batteries was 59.5GWh, the cumulative installation volume was 41.4GWh, and the cumulative difference was 18.4GWh, of which an estimated half is stocked in warehouses of battery and automotive companies to cope with the demand for the second half of the year.

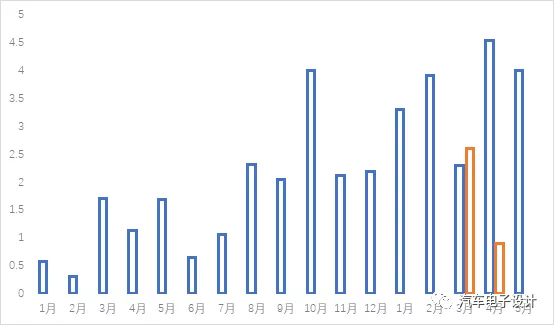

Currently, there is still an important feature, which is the situation with lithium iron phosphate.According to the data, the production of ternary batteries was 5.0GWh, accounting for 36.2% of the total production, and decreased by 25.4% compared to the previous period; the production of lithium iron phosphate batteries was 8.8GWh, accounting for 63.6% of the total production, and increased by 41.6% compared to the previous period. The installed capacity of ternary batteries was 5.2GWh, up 1.0% from the previous period; the installed capacity of lithium iron phosphate batteries was 4.5GWh, up 40.9% from the previous period.

In terms of actual situation, the production of lithium iron phosphate batteries has been greater than the installed capacity for several consecutive months, indicating that this difference should be the main force for export. Another possibility is that there will be a large demand for lithium iron phosphate batteries in the future. Due to the current stability of ternary battery production, the installed capacity of ternary batteries has remained stable at 5GWh for the past 3 months, and the installed capacity of lithium iron phosphate batteries has rapidly increased.

From the current situation, it may indicate that the next wave of existing models might all have an entry-level lithium iron phosphate version, or many car companies are making the switch. For the optimistic expectations of growth in the second half of the year, a large part of it should be based on the rapid rise of lithium iron phosphate, which can further push down car prices and expand demand. Simply put, the price reduction and sales surge in passenger cars depend on the switch to lithium iron phosphate, and the increase in production proves that the investment in this area will be faster.

From other data, lithium iron phosphate has also been required for special vehicles and buses, and in terms of overall electrification in all areas, the demand for lithium iron phosphate is growing much faster than that for ternary batteries. In the following months, the increase in demand in other areas has also boosted demand for lithium iron phosphate.

Looking at the overall situation in 2021, the cumulative production of ternary batteries from January to May was 29.5GWh, accounting for 49.6% of total production, with a year-on-year cumulative growth of 153.4%; the cumulative production of lithium iron phosphate batteries was 29.9GWh, accounting for 50.3% of total production, with a year-on-year cumulative growth of 360.7%. Comparing these two data, we can see the current differences in the domestic market. In the first five months, the cumulative installed capacity of ternary batteries was 24.2GWh, accounting for 58.5% of the total installed capacity, with a year-on-year cumulative increase of 151.7%; the cumulative installed capacity of lithium iron phosphate batteries was 17.1GWh, accounting for 41.3% of the total installed capacity, with a year-on-year cumulative increase of 456.6%. Under the guidance of comprehensive marketization, the previous solution based on subsidies for ternary batteries is no longer attractive.

Battery suppliers

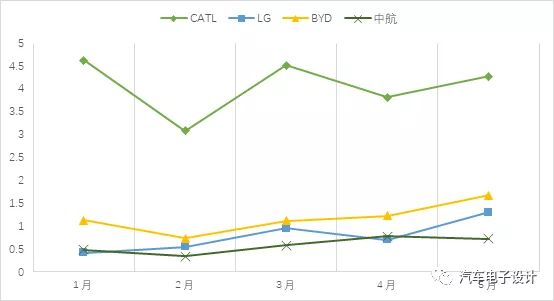

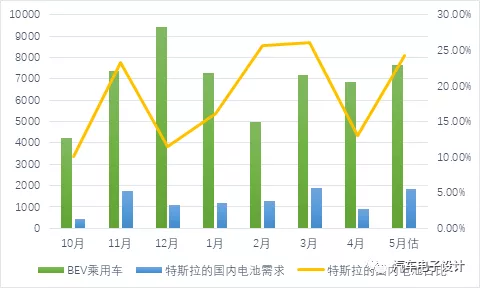

As shown in the picture below, there is a situation of 1+3 dominance in China’s domestic demand for batteries. It’s really amazing that LG has reached this position with just one Model Y.

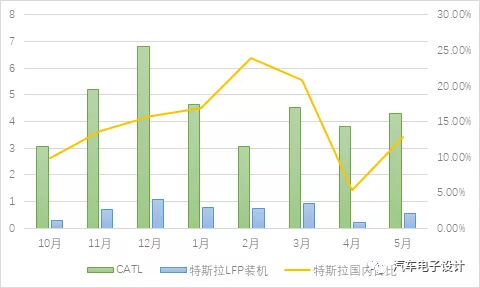

There is an interesting phenomenon here, where the amount of Ningde’s iron-lithium version of Model 3 accounts for about 15% of their total supply.

Note: In May, Tesla’s domestic insurance data estimated 10,000 units, equivalent to 550 MWh.

Based on Tesla’s demand for passenger EV power batteries from domestic enterprises (excluding exports), it accounts for less than 20%, which shows Tesla’s strong bargaining power.

In conclusion, from different perspectives, we can see the current situation of the battery industry where different automakers have significantly different demands, and those with greater demand directly determine the direction of enterprises.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.