Introduction: In the past, car models with high-end intelligent configurations were priced at more than 300,000 yuan, including Tesla, NIO, Ideal, and XPeng P7. Now, starting with WmAuto W6, 200,000 yuan models will also begin to popularize high-end intelligent configurations, which is also a mainstream and large market in the traditional sense. We still cannot determine whether W6 will be very successful, but this at least shows that WmAuto is making efforts to move in the right direction, which is enough.

Since the second half of 2019, China’s new energy market has begun to abandon policy crutches and gradually shift towards a market-oriented development model. This development model is mainly reflected in two markets: high-end and low-end. Among them, consumers’ core demands for products in the high-end market include endurance, service, and intelligence, while brand power is not particularly important. This is a major advantage for Chinese brands with weak brand power.

Based on this market profile, NIO and Ideal have achieved unexpected success, and middle and high-end products such as BYD Han and XPeng P7 have also achieved good results. WmAuto, which relied on its first car EX5 to establish itself in the new force market, did not seize the opportunity in the high-end intelligent electric vehicle market, but its understanding of product definition behind it is not worse than that of other new forces. Therefore, on April 16th of this year, WmAuto launched the third car, W6.

Undoubtedly, the biggest feature of WmAuto W6 is that it is the first to achieve L4 autonomous driving technology in mass production, which not only reveals WmAuto’s leading position in autonomous driving technology research and development, but also to a certain extent shows that the overall development of China’s autonomous driving technology has changed from following to leading. Although WmAuto W6 has strong intelligent configurations, its price is more affordable than car models with the same performance, with a price range of 169,800 to 259,800 yuan, which can be regarded as the most powerful intelligent electric car with a price of around 200,000 yuan.

In the past, car models with high-end intelligent configurations were priced at more than 300,000 yuan, including Tesla, NIO, Ideal, and XPeng P7. Now, starting with WmAuto W6, 200,000 yuan models will also begin to popularize high-end intelligent configurations, which is also a mainstream and large market in the traditional sense. We still cannot determine whether W6 will be very successful, but this at least shows that WmAuto is making efforts to move in the right direction, which is enough.

WmAuto, opening the L4 era

If you were asked what the biggest change in the automotive market has been in the past decade, there is no doubt that it is electrification and intelligence, which is also the future development trend of the automobile industry. In terms of “two transformations”, Tesla was previously considered the industry leader, but with the rapid development of Chinese brands, especially new forces, we have approached or even surpassed Tesla in some subdivisions, such as intelligence.On April 16th, in the history of automated driving, it is destined to be a memorable day. This is because on this day, the world’s first L4 intelligent electric passenger car, the WM W6, was launched. Earlier this year, the California Department of Motor Vehicles stated that Tesla is currently at L2 level, meaning that WM’s overall autonomous driving technology may not be as good as Tesla’s, but at least in some important areas including voice interaction and automatic parking, it has surpassed Tesla.

So, how strong is the intelligence of WM W6? Why is WM the brand that achieved this milestone first in the industry? This breakthrough in achieving L4 first shows a lot. About L4, it means that the car has achieved high automation, which is only one step away from true L5 self-driving. The arrival of WM W6 means that we have entered the era of L4 self-driving.

The reason why WM W6 became the first new energy passenger car brand in the industry to achieve L4 is that it adopts the AVP technology, which includes two types: one is HAVP, which is autonomous learning parking, and the other is PAVP, which is high-precision map parking. According to Electric Momentum, currently only WM and other brands such as GAC Aion are equipped with similar technologies, while smart pioneers such as Tesla, NIO and XPeng have not yet equipped themselves.

Regarding HAVP, according to WM, it is suitable for fixed parking space scenarios such as residential areas and companies. The vehicle only needs to learn once and can autonomously find the parking route. Users can use the WM Go APP to call the car and return it with just one click. After experiencing it, it can be controlled either inside the car or by a smartphone. After the first learning, it can be used continuously, which is quite practical and fun.

As for PAVP, it is suitable for non-fixed parking space scenarios such as large shopping malls and office buildings. Based on high-precision maps and relying on cloud computing with millions of computing power, the vehicle can automatically plan the parking route, and achieve completely unmanned autonomous parking and retrieval through cross-layer cruising, which is more independent and powerful than HAVP. WM revealed that the PAVP function will be pushed to users via OTA at the end of the year.

WM emphasized that the HAVP+PAVP combination can solve various parking problems and create the most practical application of autonomous driving technology for users. Finding parking spaces/parking, as one of the most complex scenarios in Chinese road conditions, has always been a problem for drivers. The launch of WM AVP means that this industry challenge now has a practical solution, which is of great significance in leading the industry.Although the first car, the EX5, achieved great success and established WEY as a new force in the automotive industry, the failure of the EX6 still highlights WEY’s shortcomings as a new brand. However, the recent launch of the powerful W6 shows that WEY has not been deterred by the failure of the EX6 and is returning to familiar ways of building cars. Moreover, WEY’s positioning in the mainstream market is promising as the market is gradually recovering.

Staying Focused on Mainstream Markets

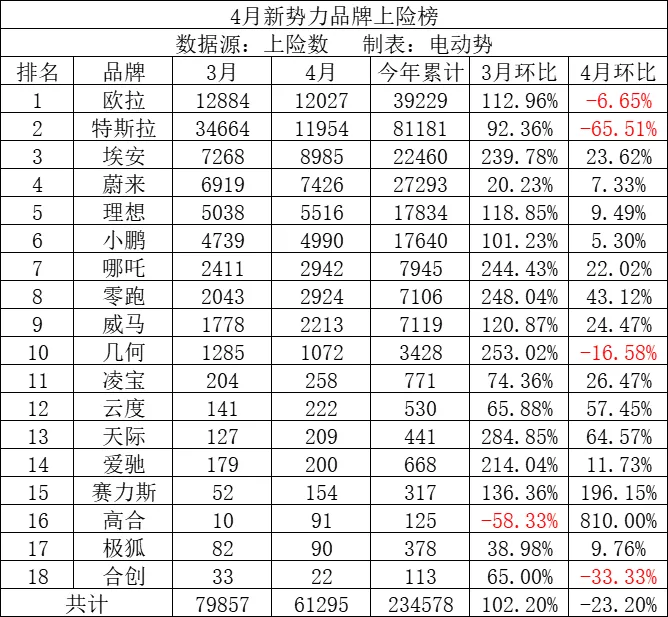

According to statistics by Electric Power, WEY ranked ninth in the April ranking of new brands in the new energy vehicle market. It lags behind not only the top three brands (WM Motor, XPeng Motors, and Li Auto), but also newer brands like NIO and Leapmotor. As a result, some questions have been raised about WEY’s development in the industry. However, Electric Power believes that WEY’s overall strategy is sound and only requires optimization at certain stages.

Other new energy vehicle brands have achieved significant growth by increasing the number of models offered, such as ES6/EC6, P7, and T03. Although WEY has also launched its second car, the EX6, its contribution to overall sales is almost negligible, as the EX5 alone accounts for the majority of sales. Furthermore, the EX5 targets the mainstream market priced at around 100,000 yuan, rather than the micro electric vehicles like the T03 and V that can sell in larger quantities.

Therefore, WEY’s success with only one model, the EX5, is already remarkable. Whether it is leading the new energy vehicle market with a single car or maintaining a realistic monthly insurance count of around two thousand units in the current low-end, A-class electric vehicle market, the EX5 showcases WEY’s strength and potential for making popular vehicles. Similarly, the W6 also has the potential to be a hit if WEY learns from the marketing setbacks of the EX6.

Whether it’s the EX5, EX6, or W6, they all target the middle to high-end market priced between 150,000 to 250,000 yuan. However, due to subsidy reductions, this market is currently sluggish compared to the high-end and low-end markets. Therefore, WEY’s current predicament is not entirely due to its lack of effort, as there is an element of market downturn compared to carmakers that have fallen into the abyss due to their lack of effort.No matter what, difficulties always exist for WM. To solve the problems, either seeking changes actively, waiting for the market to recover, or both are required. In terms of active changes, WM has released a heavyweight product W6, which carries the reputation of the world’s first mass-produced L4 intelligent EV. This demonstrates WM’s strong ability to create highly competitive products. Apart from W6, WM is also planning to launch two more sedans, aiming to enrich the product matrix.

As for the market, it’s also showing positive indicators. In the past two years, due to the subsidy reduction, A-class pure electric vehicles without any technological or cost advantages have been hit hard, and their market share was only around 10%. However, now, with the return of lithium iron phosphate batteries and the decline in the cost of ternary lithium batteries, the high cost barrier for A-class EVs is gradually being removed. Multiple high-performance and cost-efficient A-class EVs such as the GAC Aion Y and NIO U Pro have been launched, which has greatly activated the market.

Therefore, this year is highly likely to be the year that A-class EVs make a comeback. This is a significant positive signal for WM, who has always been embracing the mainstream market, and it may indicate that the era of WM is coming. As we all know, whoever wins the A-class mainstream car market wins the world. This is what Shen Hui has been hoping for. He believes that “WM does not make toys for the rich” at the launch event of W6.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.