In May, the sales data of cars in Europe came out first. Under the current background, there is no doubt that the demand for electric vehicles in 2021 is only a matter of whether the monthly data looks good or not. Currently, I am tracking seven major European countries, including Germany, France, the United Kingdom, Norway, Sweden, Italy, and Spain. The total number of new energy vehicle registrations in May was 141,700, an increase from 129,000 in the previous month.

Note: In the future, I will import pictures from Toutiao for better effects.

Overview of the Main New Energy Vehicle Data in Europe

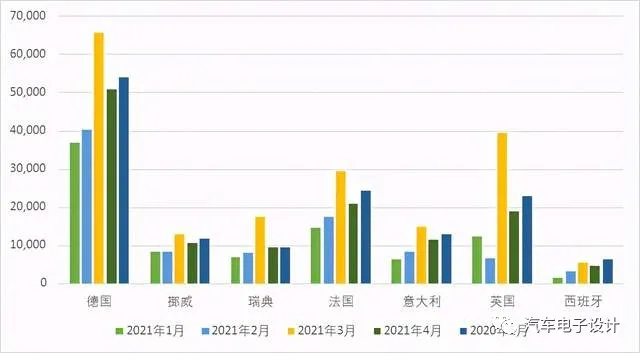

1) Monthly Data Comparison

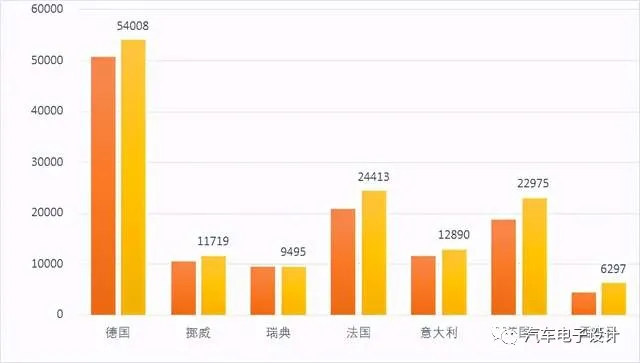

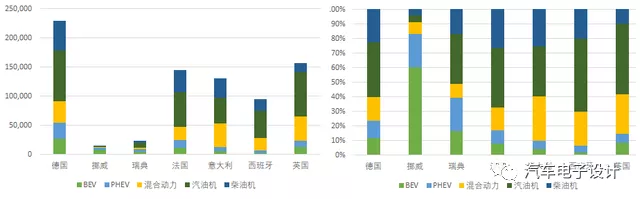

Starting from May, preparations need to be made to prepare for sales in the second half of the year. From the perspective of new energy vehicles, Germany, Norway, Sweden, France, Italy, the United Kingdom, and Spain sold 54,008, 11,719, 9,495, 24,413, 12,890, 22,975, and 6,297 new energy vehicles respectively. The data in May was slightly lower than the temporary high point at the end of Q1, but overall, it is on an upward trend.

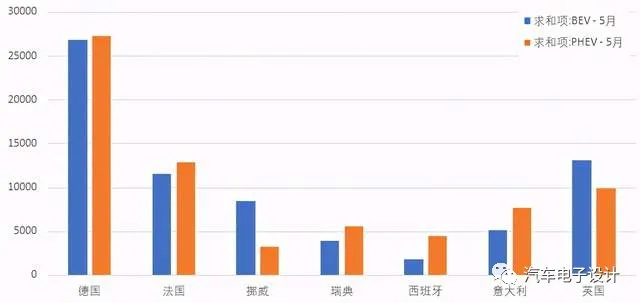

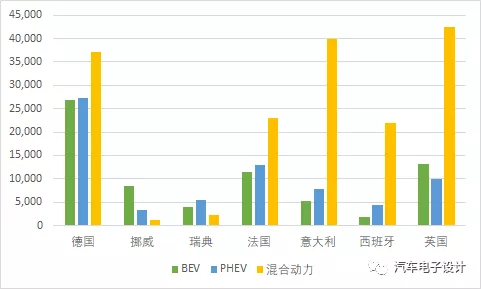

2) Comparison of BEV and PHEV

In May, the number of pure electric and plug-in hybrid vehicles sold in the seven major countries was about 70,000. In Norway, the number of BEVs was more than PHEVs, while Sweden, Spain, and Italy are still in the stage where PHEVs are more than BEVs.

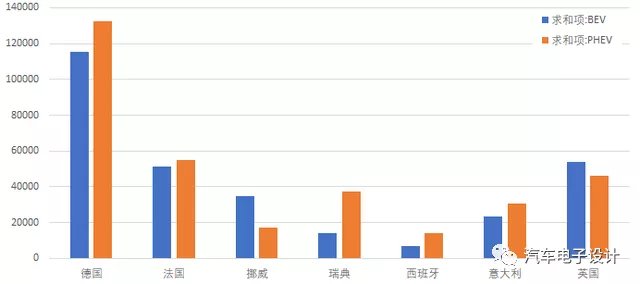

From the data’s perspective, this trend is expected to continue throughout 2021. Currently, car companies still provide a more comprehensive product line for PHEVs in the market, and are still in the subsidy transition period. In 2021, the total number of BEVs and PHEVs in the seven major countries is 290,000 and 330,000, respectively. The specific data for these countries are: Germany 115,296 BEVs and 132,257 PHEVs, France 51,592 BEVs and 55,226 PHEVs, Norway 34,880 BEVs and 17,142 PHEVs, Sweden 13,927 BEVs and 37,390 PHEVs, Spain 6,704 BEVs and 14,346 PHEVs, Italy 23,327 BEVs and 30,871 PHEVs, and the United Kingdom 54,051 BEVs and 46,040 PHEVs.

3) Overall Quarterly Penetration Rate

Looking at the total market size and quarterly penetration rate together, we can see that the larger European car markets have already started to steadily improve their penetration rates. Germany currently maintains a penetration rate of 20%+ for BEV+PHEV, while France and the United Kingdom are both approaching 20%. Italy and Spain have begun to move towards 10%. Success in smaller markets, such as Norway, is basically a replica of the later Nordic automotive market, where the small scale makes it easy to quickly increase the penetration rate.

Note: Currently, China’s restricted cities are rapidly moving in this direction similar to smaller markets.

4) Hybrid Data

Compared to BEV and PHEV, the HEV (including 48V) increment is in a higher data state in large car markets (Germany, France, Italy, Spain and the UK). As they do not require subsidies, this change is permanent in Europe. Basically, after all car companies have switched their models from ICE to HEV and 48V, there is no turning back.

Monthly Data for Major Companies

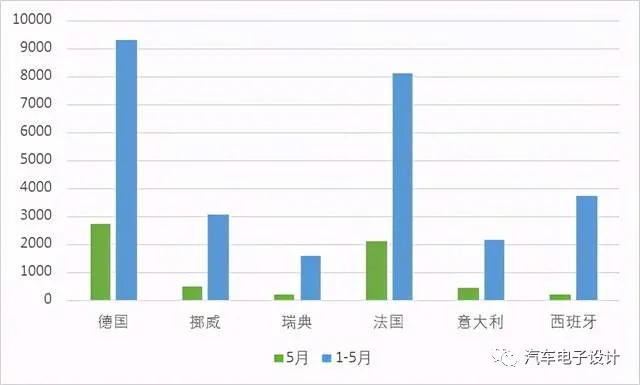

5) Tesla’s May Data in Major Countries

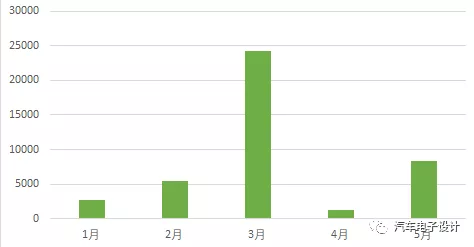

As the number of vehicles stocked up, Tesla’s sales in Europe in May increased from 2744 units in Germany and 2111 units in France to 504, 228, 426, and 218 units in Norway, Sweden, Italy, and Spain, respectively.

As the sales of Model 3 in the seven countries above totaled 6231 units, it is estimated that the Model 3 in Europe will surpass 8000 units, which is higher than the February data in Q1.

6) Estimation of BEV sales in the French, Swedish, and Norwegian markets

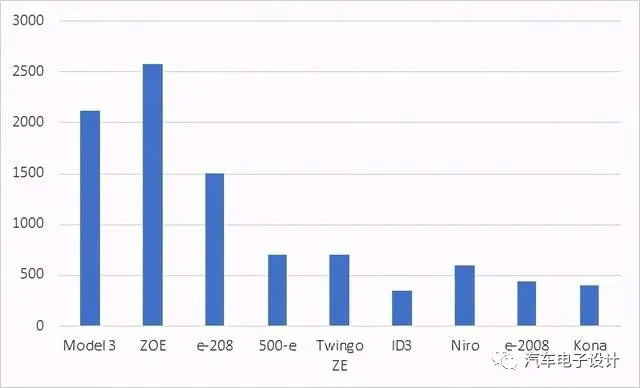

In the French market, Renault ZOE sold 2,577 units in May and ranked second with a cumulative sales volume of 7,448 units. Tesla Model 3 sold 2,119 units in May and 8,083 units in 2021, ranked first. Volkswagen ID.3 sold 347 units in May, with a total of 1,768 units. It is estimated that Peugeot e-208 will maintain its recent sales volume of approximately 1,500 units per month and achieve an estimated sales volume of about 7,500 units in 2021, which is the same as ZOE. Among the top 5 BEVs, Renault Twingo ZE is estimated to sell 700 units in May (with a total of 3,700 units in 2021), while Fiat 500e is expected to sell about 700 units (about 3,300 units from the beginning of the year). It is estimated that Kia Niro (~600/month), Peugeot e-2008 (~440), Hyundai Kona (~395), and Mini Cooper SE (~350/month) will be sold in May.

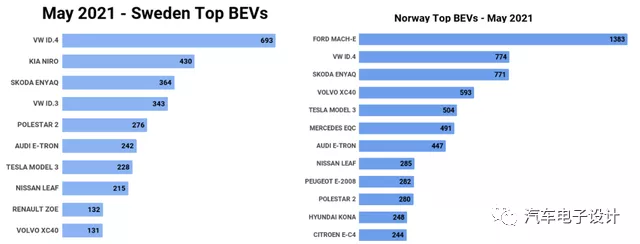

In the Swedish and Norwegian markets, the sales data for BEVs is relatively clear. The dark horse is Ford’s Mustang Mach-E, with sales of 1,383 units. Due to fierce competition, it seems that the competition for BEVs in Norway may develop toward the same trend as in China.

Conclusion: The value of European data actually lies in driving the data of power batteries in China. The objective reflection of car companies’ attempts is reflected in the data pull in Europe. It is worth noting that Volkswagen’s promotion of pure electric vehicles in Europe has achieved the most obvious results.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.