Author: IHS Markit

Seamless integration of hardware and software will make cars the ultimate mobile terminal, surpassing phones or computers. To fully tap into the potential of cars, automakers such as Daimler and Volkswagen have clearly decided to independently build and develop vehicle operating systems. Software-driven vehicle architectures will become the starting point for all new car projects in the medium-to-long term.

By combining cars with cloud and Internet of Things (IoT), the future software architecture will have a universal hardware layer at the vehicle level, a universal middleware layer at the software level, and an operating system that can add different functions in a scalable way. In order to maintain future profitability, automakers are seeking to offer on-demand payment and subscription-based features at sales points, as well as enhance the driving experience.

Introduction

Autonomous driving, connected cars, and electric vehicles (ACE) are accelerating, prompting automakers and their suppliers to embrace non-traditional thinking and new business strategies. The key to dominating the market is controlling the integration of systems and software.

Seamless connection between hardware and software will provide tremendous opportunities in the future. Apart from vehicle electrification, automakers are putting a lot of effort into software and digital fields, because of their significant impact on areas such as in-car entertainment, driving assistance, and IoT functions.

In order to fully unleash the potential of cars, many automakers have clearly decided to independently develop operating systems. For example, Volkswagen and Daimler have both confirmed their strategic intentions to develop their own software operating system according to recent news releases. In addition, ZF Friedrichshafen and TTTech Auto, who provide hardware platforms for autonomous driving and steering systems, are also developing operating systems and software ecosystems.

The results of these strategic decisions indicate a profound shift in the automotive supply chain. The automotive industry is likely to evolve from a supplier-driven end-to-end solution into a multi-layered “software technology stack” in many ways similar to the personal computer industry.

Today, the added value of cars is related to hardware developed by suppliers – chassis, powertrain systems, interior and exterior design – but the new paradigm mentioned above means that vehicle differentiation and profitability will shift to technology and related software stacks. In this context, we base our market research and analysis on the ECI Supply Chain and Technology conducted, focusing on two key questions:

-

What are the key driving factors behind the growth of automakers’ self-developed software?

-

How will these driving factors affect the growth of future supply chain value mapping?

Software continues to be the core of vehicle and user driving experience

A series of social forces, coupled with advances in ACE and shared mobility technologies, have begun to reshape consumers’ expectations and demands for mobile travel. In terms of automation, the application of intelligent sensors is moving closer to the “central computing system”, which poses higher requirements for reliability, processing power and data storage.Just like advanced driver assistance systems (ADAS) that are available for purchase on demand, these systems also support location-based services and need to remain connected to support cloud interfaces and infrastructure communication as part of the intelligent multimodal transportation service.

The automotive industry is also improving the application level of artificial intelligence (AI) and machine learning (ML) algorithms, not only for ADAS functions but also for battery management systems in electric vehicles (EVs) to predict energy saving and manage battery lifecycles.

Regarding shared mobility applications, software-driven vehicles will bring double-digit growth to the automotive software market, driven by needs such as shared ownership, digital keys, identity verification, and personalized vehicle functions.

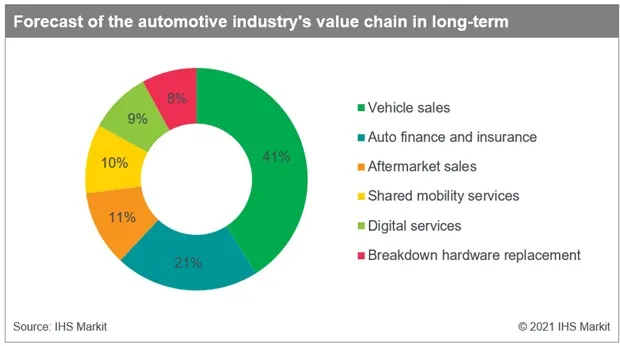

It is worth noting that as a standalone product, the automobile industry will not generate sufficient revenue between the bill of materials and retail pricing in the future. Therefore, automakers are looking for new revenue streams. In this regard, digital services provide a new revenue source for automakers that vertically integrate software development to further monetize or improve cost efficiency.

In addition, evidence shows that automakers and their suppliers will invest more in software development from 2021 onwards in the short to medium term compared to traditional supply chain methods. These surveys clearly illustrate a pattern: automakers are reluctant to invest budgets in hardware or hardware-oriented features unless they can significantly improve quality or cost over the medium to long term.

The meaning of these survey data is clear: for those in the automotive industry, they must recognize the forthcoming changes, especially in software and application-level areas that can bring higher income and profits, and take corresponding action to accelerate their adaptation to the new software fusion market landscape.

A change in business model – turning from point of sale to subscription-based features.The business model around automobile functionality sales is undergoing a transformation. Many upcoming features will be offered through a subscription model. This requires car manufacturers to further integrate hardware and software in vehicles to support future add-ons or on-demand services.

Many experts believe that with the help of Software Over-the-Air (SOTA) updates, the overall logic of the vehicle is transitioning from fixed-point updates to continuous updates. Vehicle performance is no longer at its best when purchased, but gradually improves with machine learning, artificial intelligence, and big data-based learning.

Traditional car manufacturers are borrowing from Tesla’s experience. Tesla owns the rights to its vehicle operating system and has a strong internal software development capability. It also actively collaborates with third-party content providers, whereas traditional car manufacturers heavily rely on supplier-developed operating systems as one pathway for integrating content.

The new business model will help car manufacturers achieve sustainable development. If the functionality and experience of a premium car always remain up-to-date, it will also be used and enjoyed longer. Car manufacturers will still seek to establish strong collaboration with leading companies in the field, especially in connectivity and automation, but are more likely to define standards and retain control over system and standard integration.

Responding to Obvious Industry Challenges – How to Move Toward the Future

Facing long-term income declines, car manufacturers and suppliers are accelerating the development of integrated domain controllers to improve reliability and reduce operating costs while maintaining quality and safety and leading innovation.

The result of this strategic initiative is that, while car manufacturers are facing some challenges, these challenges in turn become drivers for independent software operating system development. In the following chapters, we will discuss the considerations and reasons for independent software development.

Growing Software Demands and Lack of Implementation Skills

In the next two to three generations of cars, car manufacturers will increase the feature and functionality requirements of cameras and displays. These growths provide sufficient reasons for excellent performance requirements for vehicle cockpit software related graphics and display resource management.

Innovations such as augmented reality projection and virtual reality information integration will affect the design of future software and data-driven information architecture. The latter will enhance user experience – information in the driver’s line of sight on the windshield will be dynamically displayed – and help eliminate displays in the center console and dashboard. However, this information-based instantaneous architecture will significantly increase the requirements for graphics and information processing.

Looking to the future, applications of higher-level autonomous driving (L3 and above) will greatly reduce the driver’s active involvement during the journey. Therefore, car manufacturers are seeking value-added services to make the “driver” more efficient during the journey and compete for customers with attractive amenities and excellent features.

Therefore, “in-car games” and related online interactive services may become a key feature of future travel by car. This will further increase the demand for data-driven software and graphics processing.The demand for cloud connections and IoT services continues to grow, which will also drive significant growth in software application coordination management, system initialization/shutdown, and voice applications (including cloud voice assistants).

To support the growing processing demands, system-on-chip (SoC) suppliers will introduce integrated processing that combines video, computer vision, and artificial intelligence into the same hardware to promote the development of heterogeneous computing architectures.

These integrated computing architectures provide significant hardware efficiency and cost advantages and allow multiple operating systems to be integrated into a single electronic control unit (ECU) with the help of system management software such as Automotive Android, Linux, Automotive Graded Linux (AGL), Classic AUTOSAR, Adaptive Platform AutoSAR, and their combinations.

However, this kind of computing architecture using special processors requires specialized programming and maintenance knowledge. Automotive suppliers have found it challenging to recruit and retrain software engineers and developers in the transition from agile development environments to process-driven environments while leveraging their creativity.

The requirements of this scenario will become even higher when it comes to maintaining and updating legacy systems. Because incumbent suppliers need to manage human resources to keep young programmers and developers who have mastered more programming skills motivated in an old dedicated software architecture environment.

This will ultimately put pressure on development costs, with mid-term development costs expected to increase by 35-45%. To minimize costs, especially in areas where design work is extremely complex, controlling the explosive growth of future automotive software maintenance costs while generating new digital services is one of the key factors driving automakers to take ownership of the software process.

Open source has become a growth engine for innovation, but it is not sustainable.In recent years, many manufacturer alliances have emerged in the automotive industry to jointly promote the development of future automobiles. Therefore, open source software has become one of the preferred platforms for driving innovative technologies such as connectivity, In-Vehicle Infotainment (IVI), and driver information systems. This also enables automakers to benefit from the free contributions of experts to open source code repositories.

However, integrating with open source platforms has a clear downside. As open source code repositories and software tools are available for free, many companies tend to merge them without realizing that doing so can lead to a lack of support architecture for fixing vulnerabilities and performing post-maintenance.

Because agile development carried out by the open source community is mainly aimed at non-automotive markets, this problem is even more dangerous for automotive applications. Therefore, in many cases, finding technical support for potential major problems in automotive applications will be challenging.

In addition, in the past decade, the automotive industry has set very high standards for automotive quality and recognized the importance of achieving a reliable process in industry culture. For example, automotive standards such as “SPICE”, ISO 26262, or the upcoming ISO/SAE 21434 safety standard are highly concerned with process maturity and provide in-depth evidence in the assessment process.

On the other hand, some industries outside the automotive industry, including the open source community, adopt different approaches in approving software usage. These methods can cause conflicts and risks in terms of responsibility and quality, especially in the field of Level 2 and above autonomous driving. Therefore, many automakers are forced to abandon open source platforms and support their own software code resources to expand internal capabilities.

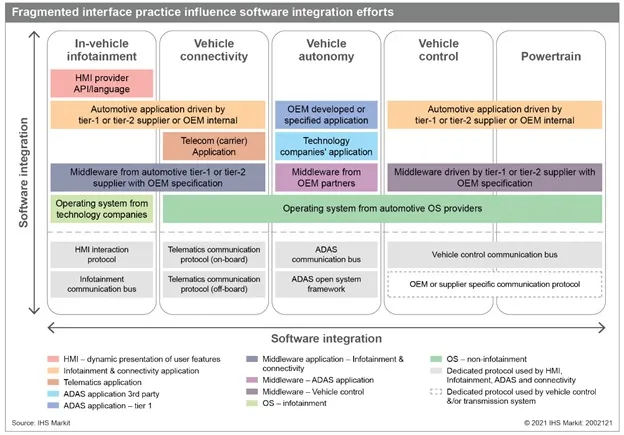

The fragmented software framework makes system integration tasks expensive

In the past decade, software complexity has increased significantly, which is likely to accelerate by 2030. For example, new technology trends such as ACE, online retention, augmented reality, and virtual reality fusion data are driving the growth of software functions and increasing the complexity of vertical and horizontal system integration.

It is worth noting that significant system integration is not solved at the hardware level but at the software and protocol communication level. Other issues also include updates, enhancements, and maintenance required for non-differentiated software. Non-differentiated software refers to software that automakers or suppliers do not use to improve product competitiveness or differentiation but need to support basic system behavior. The ratio of differentiated and non-differentiated software is around 40:604.

Nowadays, many automakers not only need to cope with the speed and complexity of launching differentiated software for vehicles but also solve the basic non-differentiated software module problems. Although automakers have started to reduce the complexity of software, there is still a long way to go.Traditionally, automotive manufacturers manage supplier interactions through a defined system behavior, confirming ECU boundaries, ECU functionality, and using functional catalogs to define restrictions on protocols. In many cases, message sequences outline how integration is executed between suppliers to complete system behavior.

However, the traditional approach faces bottlenecks in ECU connections to different communication bus ways including Ethernet, MOST, Controller Area Network (CAN), Local Interconnect Network (LIN), etc. Each sequence requires specific communication protocols to achieve a functionality.

To complete a full use case, automotive manufacturers employ many features, operation services and send signals through communication network services using different protocols. Each protocol parsing at a working point will increase functionality delays and decrease system performance. Therefore, system integration costs are expensive, ultimately affecting the time of vehicle mass production and revenue.

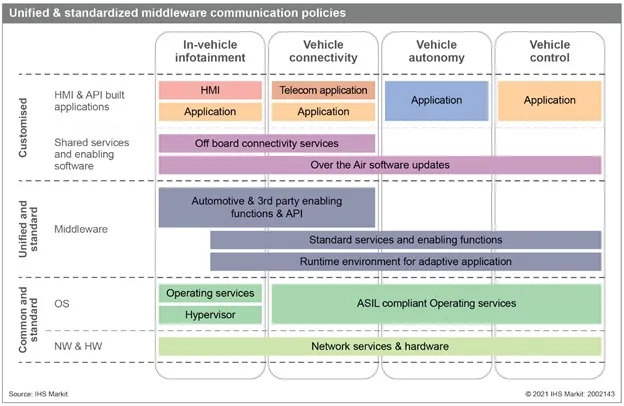

Middleware is the Key to Future Software Value Growth

As software becomes increasingly important, middleware plays a critical role in supporting vehicle reconfiguration, product differentiation software installation and upgrades. Operating System (OS) and middleware are fundamental software components that promote software/hardware separation. Middleware also acts as a bridge between Human Machine Interface (HMI) application software and lower-level software.

In recent years, Operating System systems and middleware have become a battleground among well-known tier-1 automotive suppliers and technology companies. This trend is likely to continue in the mid-term until the market converges into a niche market in the distant future.

Currently, automotive manufacturers are facing significant challenges in middleware and software integration; suppliers and technology providers are using their own Application Programming Interfaces (APIs) to define and work on software.

To reduce costs and complexity, many automotive manufacturers and alliance partners are defining more unified middleware communication and services or leveraging open-source content to define the core of the system and create their own usage standards. Volkswagen’s VW.OS or Daimler’s MB.OS is a good example.

From the perspective of automotive manufacturers, this approach has many advantages, including avoiding overlap between vehicle projects, simplifying software development processes, reducing reliance on external support, and lowering development costs. As automotive manufacturers develop services and HMIs that enter the market in a scalable way, this will further simplify the integration level when adding new features or updating existing software functionality.The following Markdown text in Chinese is translated into English Markdown text in a professional manner, preserving the HTML tags within Markdown, and only outputting the results.

This method benefits not only car manufacturers but also suppliers, as sharing underlying software and hardware means increasing supply and reducing brand customization at the SoC level.

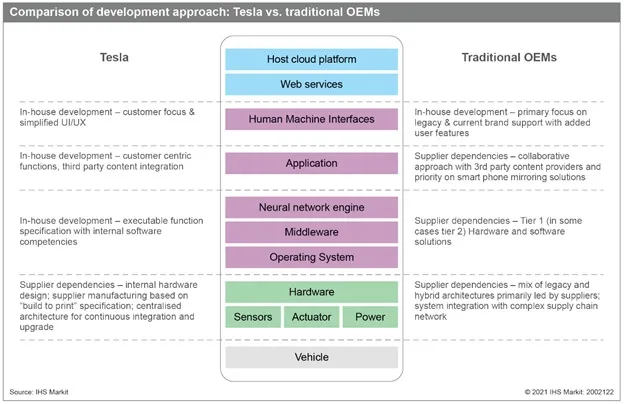

Building on Tesla’s Success

Many within the automotive industry admire Tesla’s software-driven approach to cars, which has shifted the competitive focus from vehicles as a product to customer-centric content and service monetization. This vertically integrated approach to hardware design and in-house software development has been rewarded with improved responsiveness and innovation advantages, as well as the ability to rapidly improve system performance using OTA updates. These strategies have proven to increase customer loyalty and satisfaction.

While Tesla’s internally service-oriented architecture benefits from advantages brought by vertical integration and technology stacks, traditional car manufacturers remain heavily reliant on supplier solutions and their efforts. Considering all functional use cases ahead of hardware design can help control system costs, simplify the user interface and use in-house software development to connect functional units.

Additionally, continuous integration and improvement achieved through OTA software have enabled Tesla to increase product development speed and flexibility, simplify digital services, improve brand image, and create higher value propositions for customers.

Many automotive companies have been influenced by Tesla’s success case and its next-generation, service-oriented customer experience. With car software functionality being such an important selling point, it is hardly surprising that traditional car manufacturers and new entrants decide to have full ownership of operating systems and system integration.

To further develop, some high-end car manufacturers fully embrace their advantages in vehicle design and manufacturing. While traditional car manufacturers are slower to adopt new technologies than Tesla, this is mostly because they try to avoid hardware or software failures caused by new technology that could lead to any potential recalls and on-site issues.

Our analysis indicates that traditional car manufacturers believe Tesla and other automotive startups have not yet experienced vehicle recalls, which, in turn, will affect their production speeds.

Scale Forecast

Although the current in-house software development strategy is mostly limited to high-end car manufacturers, in the long run, other large-scale automotive manufacturers will also follow in their footsteps.

The Supply Chain and Technology (SCT) division of Evercore ISI offers a new automotive software forecasting service on the AutoTechInsight platform to track such developments. The service also provides in-depth insights, contextual data, and analysis on middleware and operating system integration cost forecasts.Additionally, the service provides supply chain information and scale forecasting for the car audio and entertainment system host, cockpit domain controller, dashboard, and remote information processing system, including operating system development costs (forecasted by car model year) and relevant application software specifications for each automobile manufacturer.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.