Introduction

Today, SVOLT Technology announced a “strategic cooperation agreement” with Geely to establish a joint venture for the production of power batteries in the power battery industry, with a planned capacity of at least 20 GWh and an expected total capacity of 120 GWh. I find this interesting for two reasons: on one hand, it raises questions about Daimler’s previously announced plan to use Geely’s SEA platform to produce a small, all-electric SUV under the Smart brand; on the other hand, it sheds light on Geely’s battery layout.

Development of Smart between Daimler and Geely

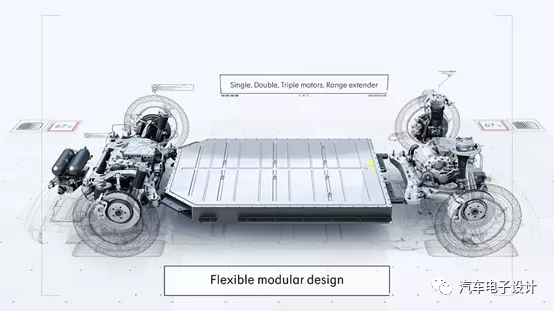

Given that Smart, in a recent LinkedIn post, revealed its plan to pursue a larger vehicle, which would be comparable to the BMW MINI countryman’s small all-electric version, I feel it’s hard to avoid discussing Daimler’s recent cooperation with SVOLT. The Smart EV, code-named HX 11, is expected to have a length greater than 4 m and will be the largest Smart vehicle ever, equipped with the Geely SEA system, rear-wheel drive, an electric motor with a maximum output of 200 kW, and a battery with a temperature of around 70°C. The vehicle will be produced at the Xi’an factory and go on sale in 2022.

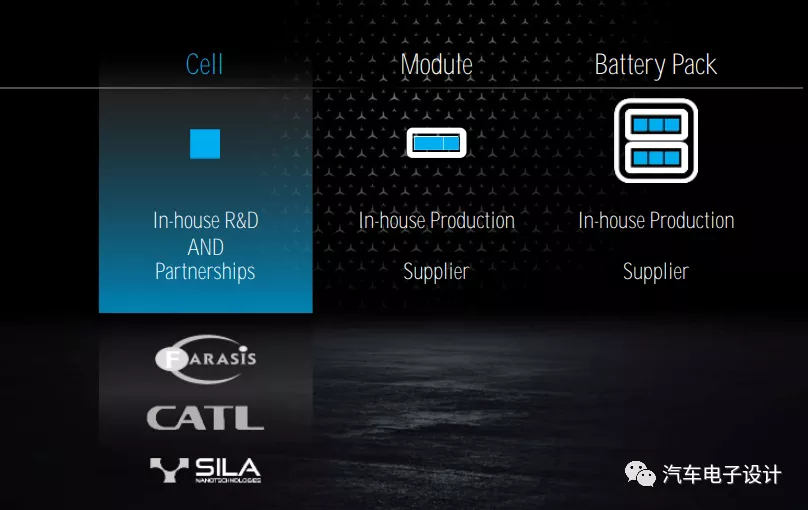

In this sense, it makes sense for Geely and SVOLT to enter into a joint venture to establish a battery factory, as SVOLT’s 811 chemical system will be used in Mercedes-Benz’s major batteries going forward.

As it currently stands, Geely has three battery suppliers under its base 590 module (which will be upgraded to a double 590 module): Contemporary Amperex Technology, LG Chem, and SVOLT, all of which are involved in joint ventures.

Geely’s Battery Supply

In September’s certification data, it can be seen that Geely’s battery selection is very diverse.

1) Plug-in hybrid vehicles: Volvo and Lynk & Co use soft-pack cells provided by Zhejiang Hengyuan Lithium Energy Technology Co., Ltd. While Geely’s own brand uses a dual-supplier strategy, utilizing NINGDE TIMES and Lishen’s cylindrical cells.2)Pure electric (old platform): Pure electric vehicles on the original old platform adopted a strategy of three suppliers, with the main supplier being CATL, and two backup suppliers being XWDT and CALB. This strategy basically achieved the replacement of three different battery capacities of 50, 60, and 70. For battery swapping and low-cost routes in Maple Leaf, GuoXuan’s batteries are used.

3)Pure electric (SEA): There is currently no data on this, but it is expected that CATL will be the first to provide batteries, followed by LG Chem and Funeng.

From the current situation, it seems that the improved system based on the 590 module will be the mainstream solution in the future. Under the 590 cell model, everyone is actively changing and combining. In fact, the number of car companies that really adopt CTP is relatively small. From the perspective of long-term life, retaining a certain module configuration and adopting a large module approach is the choice of most car companies in 2021. The biggest advantage here is that there are more choices as existing second-line battery companies gradually expand production.

This time, Geely’s investment in joint ventures has also accelerated its own progress. It is expected that from 2021, traditional car companies will accelerate the launch of pure electric vehicles. Otherwise, the negative impact on fuel consumption and new energy credits would be too great for the company.

Summary

Based on the current situation, the demand for batteries in Q1 2021 should be relatively high. After traditional car companies go through the peak of Q4 2020, they will devote more energy to BEVs. With economic recovery, the next round of high investment in electric vehicles is about to begin.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.