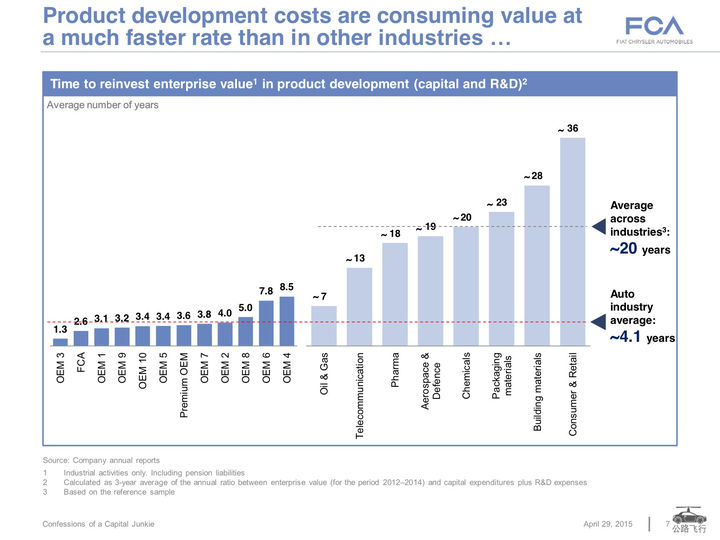

Compared with other industries, investment in research and development accounts for too much of the enterprise value for car brands. The average R&D spending every 4.1 years amounts to the company’s own enterprise value, while the industry average is around 20 years.

– From a research report by FCA Fiat Chrysler Group in 2015

When talking about this figure, FCA Chairman Marchionne pointed out the serious problem that the entire industry faces: companies are making a lot of repetitive investments that are meaningless to consumers.

That was during normal times.

In recent years, it’s obviously been an extraordinary situation.

Capital, talents, investors, speculators have energetically entered this field, and the investment scale of the domestic automobile industry has taken a huge leap forward.

The Internet venture stories went from e-commerce to O2O, from ride-hailing to bike-sharing, and now it’s finally the turn of the automobile industry.

Fortunately, finally, the long-suffering automotive industry practitioners who were paid mediocre salaries, had few communications with the outside, and had a low profile have finally entered a new era of “mass entrepreneurship and innovation”.

Since 2014, LeEco, NIO, WM Motor, CHJ Automotive, XPeng Motors, and Byton, one new name after another, have emerged. It is said that the entire China’s start-up automotive companies have exceeded 300, with more than 30 in Jiangsu Province alone.

Currently, the two originally benchmark start-up car companies – LeEco and NIO, one has already fallen, and the other is still standing.

In Wong Kar-wai’s “The Grandmaster,” there is a wonderful narration:

Kung Fu, two words.

One horizontal and one vertical. Yes for standing, no for falling.

Only those who stand have the right to speak.

LeEco’s automobile branch has already fallen. Today we will talk about NIO, which is still standing.

A friend of mine who works at McKinsey and I spent a week estimating NIO’s sales, revenue, and profit from 2017 to 2021 based on the public information and industry experience we obtained through various means, as well as consultations with external experts.

Sales

NIO ES8 was released at the end of 2017 as the first heavyweight work of the new start-up car building wave in China, and it will become NIO’s sales pillar in 2018.

The market it is entering is actually a segmented market that “looks uncompetitive, but the demand doesn’t seem clear.”

Critics believe that NIO ES8 is far from the level of the object it tries to emulate, the Tesla Model X, it is just a poor imitation.

Praisers believe that NIO ES8 is comparable to Xiaomi 1 to Xiaomi, and sales are not a problem.I believe both claims are exaggerated.

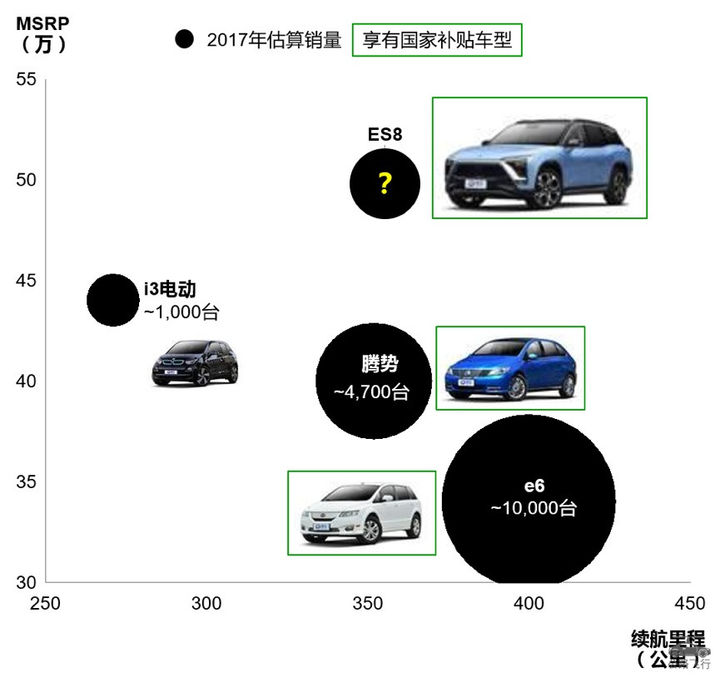

Taking a calm look at the 300,000-550,000 pure electric vehicle market, even with a discerning eye, we can only find three competitors – BYD e6, Tencent’s P7, and BMW i3.

Is NIO ES8 a perfect car? But may I ask, are its three competitors Sun Wukong or Zhu Bajie?

Objectively speaking, considering the significant advantages in size, performance, configuration, and service, NIO ES8 is far more competitive than Tencent’s P7, BYD e6, and BMW i3. It has the chance to sell more than the latter three. Though the total sales of these three in 2017 were only 16,000 units.

After the ES8, the five-seater SUV – the smaller size and the same platform ES6 – is no longer a secret. Considering cost sharing, it is expected that the third model will also be developed on the same platform and may launch in 2020 – as NIO has revealed that it will release a new model every year.

Many domestic start-up car companies are planning to expand at a similar pace. However, they are much faster than Tesla on the other side of the ocean. The first Tesla car, Roadster, was launched in 2008, and the fourth model was just released in late 2017, with an average of 2.5 years for a new model to be launched.

Compared with Tesla’s “slow and steady wins the race”, Chinese start-up car companies can be described as “making rapid progress in three years, surpassing the US in five years.”

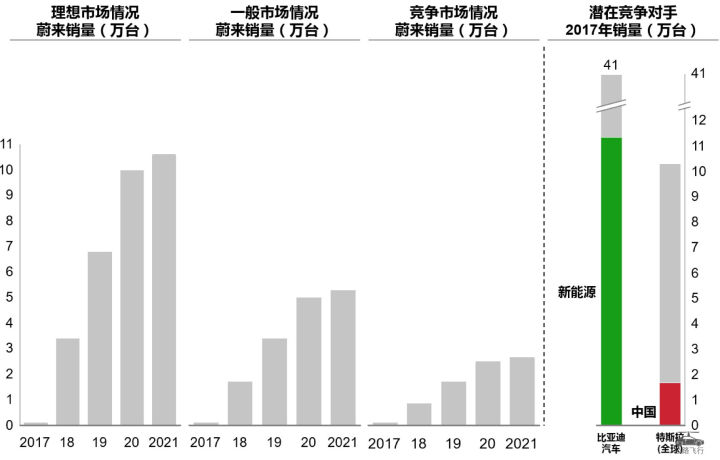

Based on the following assumptions: NIO will launch three new products before 2021, continue to expand its direct sales store scale, and continue ES8’s pricing strategy, and the Chinese new energy vehicle market will develop steadily.

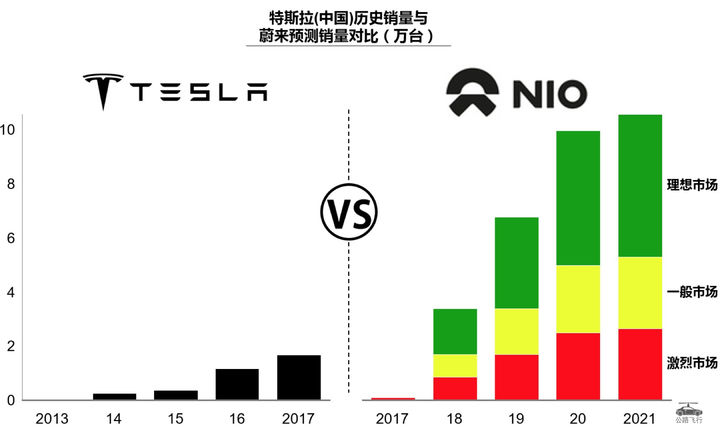

We have given sales volume forecasts for NIO in three situations – optimistic, neutral, and pessimistic – by 2021, which are more than 100,000, more than 50,000, and less than 30,000, respectively.

In the worst-case scenario, we also believe that NIO’s sales take-off speed will be faster than Tesla’s performance after entering China. Tesla, with the halo of Apple in the automotive industry, attracted business tycoons such as Li Xiang, the founder of Autohome and Chehejia, as its star car owners. With a more aggressive pricing strategy (obviously with lower profit margins) than imported BBA cars, it took five years to achieve nearly 20,000 units of annual sales in China.

RevenueSomeone once asked me on Zhihu why I said “automakers must rely on hardware to make money”? Can’t they rely on derivative services and so-called ecosystems?

Even for heavy-asset and heavy-service new OEMs like NIO, the answer is still: it really doesn’t work.

Unless one day automakers transform into transportation service operators, manufacturing cars on one hand while directly selling travel services to end consumers like Uber and Didi on the other hand – this dream is now present in the PPTs of every carmaker, including Toyota, Volkswagen, BMW, Mercedes-Benz, and NIO. But before it becomes a reality, we need to stay awake.

The service revenue of OEMs (including parts maintenance, insurance maintenance, charging and battery swapping, etc.) has always been lower compared to new car sales revenue. Unless the profit margin of this part of the business can reach the level of selling white powder, the entire vehicle OEMs must rely on the profits from new car sales to maintain the development of the enterprise.

There were once staunch fans of Jia Yueting who praised his “ecological anti” concept and the “no profit from hardware, rely on ecological profit” model.

Cost-effective sales of mobile phones, televisions to quickly drive user growth, and finally through the integration of hardware and software services, all clustered together, such as video services (LeTV), travel services (Yi Dao), e-commerce (LeTV Mall), etc. By continuing the stickiness, increasing the number of times users reach and stay, to obtain profits.

Actually, this is just an inflated balloon that seems huge and powerful, but in reality, it is fragile and frivolous.

Anyone who is in the top 20% of math scores in the college entrance examination will refuse to believe it at first glance.

Considering that LeTV is not the main character in this text, it will not be elaborated here.

What I want to illustrate is that this model is even more unrealistic in the automotive industry. For the entire vehicle manufacturers, the effective touch points with individual customers are very limited.

Many traditional automotive brands have only a few intimate interactions with consumers in their lifetime.

I have a Chevrolet Malibu. Apart from when I bought it and paid the full car payment at once, I only returned to the Chevrolet showroom three times during the years of use. One time was a free maintenance, one time was a paid maintenance, contributing 800 yuan in business, and the third time was for repairs, contributing 2000 yuan.

The total aftermarket revenue of 2800 yuan is extremely low compared to the car price of 150,000 yuan. Moreover, this income still needs to be shared with dealers.

This may not be a particularly typical case, but it shows that the automakers are largely engaged in a one-time transaction — revenue depends heavily on initial new car sales.The pattern of NIO is different from traditional automotive OEMs and is more like Tesla. Through its self-built direct sales channels and a package of self-operated services (including insurance, maintenance, repair, battery swapping, etc.), it extends the chain of contact with users, and its assets and human resources team become more important.

In optimistic, neutral, and pessimistic scenarios, NIO is expected to achieve revenue breakthroughs of RMB 50 billion, 25 billion, or 15 billion in 2021. However, regardless of the scenario, the proportion of service revenue is expected to be around 16%, and ultimately only reach around 20%. This is determined by the fundamental characteristic of high unit price of automotive products.

NIO is the domestic car company with the highest pricing strategy, even higher than the average car price of China’s only luxury brand, Hongqi. Under this premise, once it achieves initial scale, the expansion of its revenue scale will occur rapidly.

Profitability

NIO is initiated by serial entrepreneur Li Bin, with support from various capital players.

The greatest ultimate challenge is not sales or revenue, but profitability.

New energy vehicles represent the future, and electric vehicles are China’s national policy. Everyone knows these common sense arguments.

Geely, SAIC, VW, GM – all of them know this trend. It’s not just Li Bin, Li Xiang, Shen Hui, and Dai Lei who have seen the big picture of the industry.

But why have the vast majority of OEMs not been in a hurry to go all-in on electric vehicles?

The reason is just like Sun Hongbin of Sunac’s acquisition of LeEco’s car business. Sun Hongbin said:

“Electric vehicles are a huge market opportunity. We will take it seriously, but we will be careful when investing. We haven’t figured out LeEco’s car business. So we won’t invest.”

He specifically mentioned three factors, explaining why the automotive business is carefully considered:

Firstly, when will the inflection point of the electric vehicle market arrive? Under the correct direction, how long will it take the market to achieve volume? It is impossible to predict. Secondly, how can battery technology breakthroughs and corresponding cost reductions be realized? The direction of the battery industry is not yet clear; there are variables. Thirdly, the charging conditions and the construction of charging piles are a huge project.

The boards of traditional automotive companies, when faced with investment decisions worth billions of dollars, are accustomed to careful consideration and meticulous calculation. They generally do not invest in high-risk projects that do not make money.

Although I am personally an electric vehicle enthusiast, I have to admit that electric vehicle projects happen to be “high-risk projects that do not make money.” I can understand why multinational car manufacturers and domestic traditional large-scale car companies have respect for electric vehicles.

They will not give up trying, but they will not easily go all-in. A bold case from before was Dongfeng Nissan, which began producing the globally available Leaf model in 201X. The intention behind the project was to obtain government subsidies and market access to seize the Chinese electric vehicle market opportunity. However, the project failed miserably – product costs were high, performance could not meet consumers’ demands, infrastructure services could not keep up, and sales were poor.Volkswagen, Hyundai, Ford, etc., have chosen to wait and see. Until now, there have been few substantial actions.

However, companies like Tesla, NIO, and WM Motor have no choice. As start-up companies, they have to go All in.

By analyzing the cost of the NIO ES8, we conclude that the profit margin of this car is relatively limited.

You read that right, although the starting price of NIO ES8 is as high as 458,000 yuan, it is considered the highest among local brands, but its manufacturing cost is also astonishing.

There are several supporting factors here:

- Benchmark model: Tesla Model X

NIO ES8 often compares itself to Tesla Model X in public relations communications. In fact, whether from the size, performance, battery pack capacity, all-aluminum body, or advanced automatic driving hardware equipment, ES8 is indeed similar to Model X.

Although ES8 has the advantage of manufacturing costs in China, its starting price of 458,000 yuan is still significantly lower than that of Model X in the global market. Its single-vehicle gross profit is difficult to surpass Tesla.

- Another viable reference is the Volkswagen Touareg.

NIO ES8 is a full-size SUV with a length of more than 5 meters, and its supply chain is “internationalized,” adopting a similar supplier structure as foreign brands.

The top version with a guide price of 428,900 yuan, powered by a 2.0T engine and four-wheel drive, has size and configuration that are more similar to NIO ES8.

But NIO has several high-cost items, including:

A 70 kWh high-capacity battery, which we estimate will cost NIO about 80,000 yuan more than the Volkswagen 2.0T+DSG system.

B special technology

Automatic driving system/all-aluminum body/air suspension

Overall, looking at the cost of materials alone, NIO’s price is slightly higher than Touareg, but its material cost is expected to be significantly higher than Touareg’s, and its sales volume is far lower than Touareg’s. Its product gross margin is bound to be much lower than the latter.

- Cost control ability of start-up companies

As a start-up company, when you don’t have the scale, your purchasing manager cannot have a very high bargaining power-at least cannot compare with mature large companies such as SAIC Volkswagen, Geely, and BYD. The scale of ES8 is completely incomparable with Touareg, and Volkswagen has a lot of common parts among multiple models.

This means you will pay more for the same parts.NIO’s team is brand new, with all-new technology platforms and products. In this “everything is new” situation, it is difficult for a startup company to achieve the optimal balance of “performance – cost – time” control, as traditional car companies do. Secondly, due to the lack of economies of scale, startups face great pressure in the first few years of investment distribution.

In many industries, startups’ cost control is better than that of traditional players – because they are more serious, hardworking, and economical. However, this rule doesn’t quite apply to the automotive manufacturing industry, as long as OEM relies on Tier 1 component companies and follows relatively conventional product development processes, everyone is dancing under the same rules.

Looking at two excellent representatives of state-owned enterprises: SAIC Passenger Car (Roewe, MG brands) was established in 2007 and turned a profit for the first time in 2017; GAC Trumpchi was established in 2008 and became profitable in 2013 – this is one of the fastest recent cases of domestic brands turning losses into gains.

After our analysis, we estimate that the gross profit margin of NIO ES8 may be around 20-23% in the early stages and may approach the current gross margin level of Tesla and BYD (about 25%) by 2021.

However, in terms of the more important operating profit indicator, due to the huge R&D investment (NIO manufactures the whole vehicle, develops the driving system, develops the vehicle networking and autonomous driving), and the heavy asset model (direct sales stores and service systems are self-operated), NIO is unlikely to present a great magical answer to the outside world within five years.

In a relatively optimistic and smooth situation, NIO can only achieve an operating profit margin of about 2% in 2021. Under normal circumstances, its operating profit margin is likely to be lower than -10%, similar to the situation of Tesla in 2016/2017.

He XPeng, Chairman of XPeng Motors, publicly stated at the Electric Vehicle Hundred People Summit that electric vehicle startups don’t have to consider profits within five years.

Among the many romantic PR slogans of emerging carmakers, this is one of the few big truths.

In conclusion, let’s review the core viewpoints of this article:

-

The automotive industry is a capital-intensive industry that is highly dependent on investment.

-

NIO’s first model, the ES8, is more competitive than the 300,000-550,000 yuan range of pure electric vehicles currently on the market, but the potential of this segment of the market is not that great.3. By 2021, NIO is predicted to achieve an annual sales volume of around 50,000 (fluctuating between 30,000 to 100,000) with three vehicle models, and the pace of launching new cars and the speed of mainland China’s sales growth will be significantly faster than that of Tesla.

-

Similar to Tesla’s heavy asset model (self-operated retail, after-sales, and derived services like battery swapping), NIO’s service revenue will account for a higher proportion than traditional car companies. By 2021, its revenue is expected to break through RMB 20 billion (under general market conditions), with service revenue accounting for 16%.

-

Profitability will be a major challenge for startup car companies and NIO is no exception. Emerging startup car companies are unlikely to rival traditional companies in terms of cost control, such as BYD, Geely, and SAIC. According to our calculations under ideal circumstances, NIO’s operating profit margin can barely reach around 2% by 2021. A more likely scenario is similar to Tesla’s performance in 2016/2017, with operating profit margin lower than -10%, requiring continuous financing and large amount of capital burn.

The Highway Flying research team has contacted many executives, teams and capitals in the field of startup car making, and we are very optimistic about the general direction of the automotive industry revolution. The next decade is indeed the time for transformation in the fields of transportation and automotive manufacturing, and a rare window of time for entrepreneurship is opening up to talents and capitals.

At the same time, we found that many outsiders and investors, although already aware of the huge difficulty of starting a car-making business, may still greatly underestimate the difficulty of this matter.

When Uber and DiDi changed the taxi industry with an internet software system, Shanghai Yongda taxi company and traditional taxi license owners in New York were actually powerless. When they discovered that the weather was not favorable, a new overlord had already emerged.

But the story of startup car-making is bound to be different from the logic of Uber, Airbnb, Ctrip, Dianping, Taobao, and JD.com. When all entrepreneurs with capital rush in, they will find that the power of traditional companies is incredibly strong, and the pace of this industry is extremely slow. You can hardly change anything overnight, or even within a year. All your actions are almost transparent, and the big brothers of traditional companies are silently watching you.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.