On February 16th, the second to last day of the Chinese lunar new year, a blank check company named Churchill Capital Corp IV on the other side of the Pacific Ocean surged 31% overnight. Yes, it is the shell company rumored to merge with Lucid Motors. The reason for the surge is the news that the shell company has been in talks with investors to raise funds through PIPE mode, and the two sides have reached an agreement on key terms.

In addition, this morning, CCIV, the shell company, closed up 8.37%, and after-hours, Lucid announced a merger agreement with CCIV. The estimated valuation after the merger will be around 24 billion US dollars, and the equity value of the company’s trading shares is about 11.8 billion US dollars. The investment is led by PIF, BlackRock, Fidelity Management, Franklin Templeton, and other companies. Later, CCIV plunged 30.26% after hours.

Unfortunately, I don’t understand stocks, so this article is not a recommendation. But maybe I still know a little bit about Lucid. After all, many foreign media have crowned it the “Tesla Killer” or “Avenger of Cars.”

In my opinion, Lucid does indeed have Tesla’s blood flowing inside, but they are not “twins,” not “brothers and sisters,” and certainly not clones of each other. They are more like “cousins” with a certain degree of blood relationship.

So today, I plan to talk about Lucid Motors from three aspects: the founder, financing, and electric vehicle products.

The story begins with Lucid’s predecessor, Atieva. Atieva is a company founded in 2007 that specializes in the development of electric vehicle powertrain systems. Its headquarters is located in Newark, California, USA. Its main customers are vehicle manufacturers. It wasn’t until 2014 that the company shifted its focus to electric vehicles and changed its name to Lucid. Simply put, Lucid was originally an auto parts supplier and had also supplied power batteries for domestic coaches.

The company was founded by two Chinese-Americans, Bernard Tes and Sam Weng. The current CEO, Peter Rawlinson, also has Chinese ancestry, but that’s another story. Let’s first take a look at the backgrounds of these two founders.Let’s talk about Atieva’s co-founder, Shi-Ming Wen, who served as Senior Director of Marketing at Oracle Corporation from 1996 to 2000 and Vice President of Sales at Redback Networks from 2000 to 2002. Fluent in Chinese, Japanese, and English, he mainly managed the business in the Asia-Pacific region, established sales alliances, and collaborated with enterprises such as Nokia, ZTE, NED, NTT, China Telecom, and Korea Telecom, among others. After that, Wen also served as Co-Founder, Vice President of Sales and Marketing at Astorin Networks. The two companies mainly helped operators provide broadband, telephone, television, and mobile services on the Internet-based infrastructure.

Now let’s talk about Jia-Peng Xie, who is a true scholar. He graduated from the University of Illinois at Urbana-Champaign with a Bachelor’s, Master’s, and Ph.D. degrees in Electrical Engineering. He founded a display and computer manufacturing company called Wyse Technology in 1981, with $600,000 from David Jackson of Altos Computers, and $1 million from Kleiner, Perkins, and Caufield & Byers, and led Wyse to its initial public offering on NASDAQ in 1984.

In 2003, the year Tesla was founded, Xie was invited by Martin Eberhard to join Tesla as a founding member of the board of directors, and also served as Executive Vice President and Chief Battery Engineer, overseeing the design, development, and manufacture of battery systems for Tesla Roadster and other car manufacturers.

By the way, Martin Eberhard, the founder and first CEO of Tesla, was actually a graduate of the University of Illinois at Urbana-Champaign, and his career began at Wyse Technology. At that time, he was an electrical engineer, where he developed his first product: the WY-30 ASCII computer terminal. Interestingly, after Ma Yi-long was invited by Martin Eberhard to invest 6.3 million US dollars in Tesla in 2004, Ma became the Chairman of Tesla while exploring space at SpaceX.Don’t forget, Shai Jia Peng is the founder and CEO of Wyse. What’s more dramatic is that later, Martin Eberhard left Tesla to become a technical advisor to Lucid after some disagreements with Ma Yilong. It’s also because of Shai Jia Peng, Peter Rawlinson, and Martin Eberhard’s background at Tesla that it’s not too difficult for Lucid to poach some people away from Tesla. This is also why the “blood relationship” between Lucid and Tesla has become closer.

For Lucid, after discussing the people, let’s talk about the money aspect. Almost no new car-making company is not short of money. Tesla and NIO have both worried about money during the car-making process, except for Apple, which is the most likely exception.

In the early development history of Lucid, many Asian investment institutions participated. In 2013, in the A round and B round financing of Lucid Motors, the participants included the Silicon Valley venture capital company Venrock, Mitsui & Co., Ltd. of Japan, and Qing Cloud Ventures. In January 2014, BAIC invested $100 million in the C round of financing of Lucid Motors, with a shareholding ratio of 25.02%. And in July of the same year, Jia Yueting, who was then in his prime, also invested about 70 million yuan.

By 2015, due to BAIC’s hope that Lucid would prioritize the Chinese market, and Shai Jia Peng’s hope to open up the US market first, the differences in opinions doomed the cooperation to be short-lived. Afterwards, BAIC sold all of its holdings to Jia Yueting, making Jia Yueting the largest shareholder of Lucid with a shareholding ratio of about 40%. However, because of the financial situation of LeTV’s investment in FF, Jia Yueting has also sold these Lucid shares, showing that for the sake of his dreams, Jia Yueting can not only suffocate himself, but also empty out his own wealth.

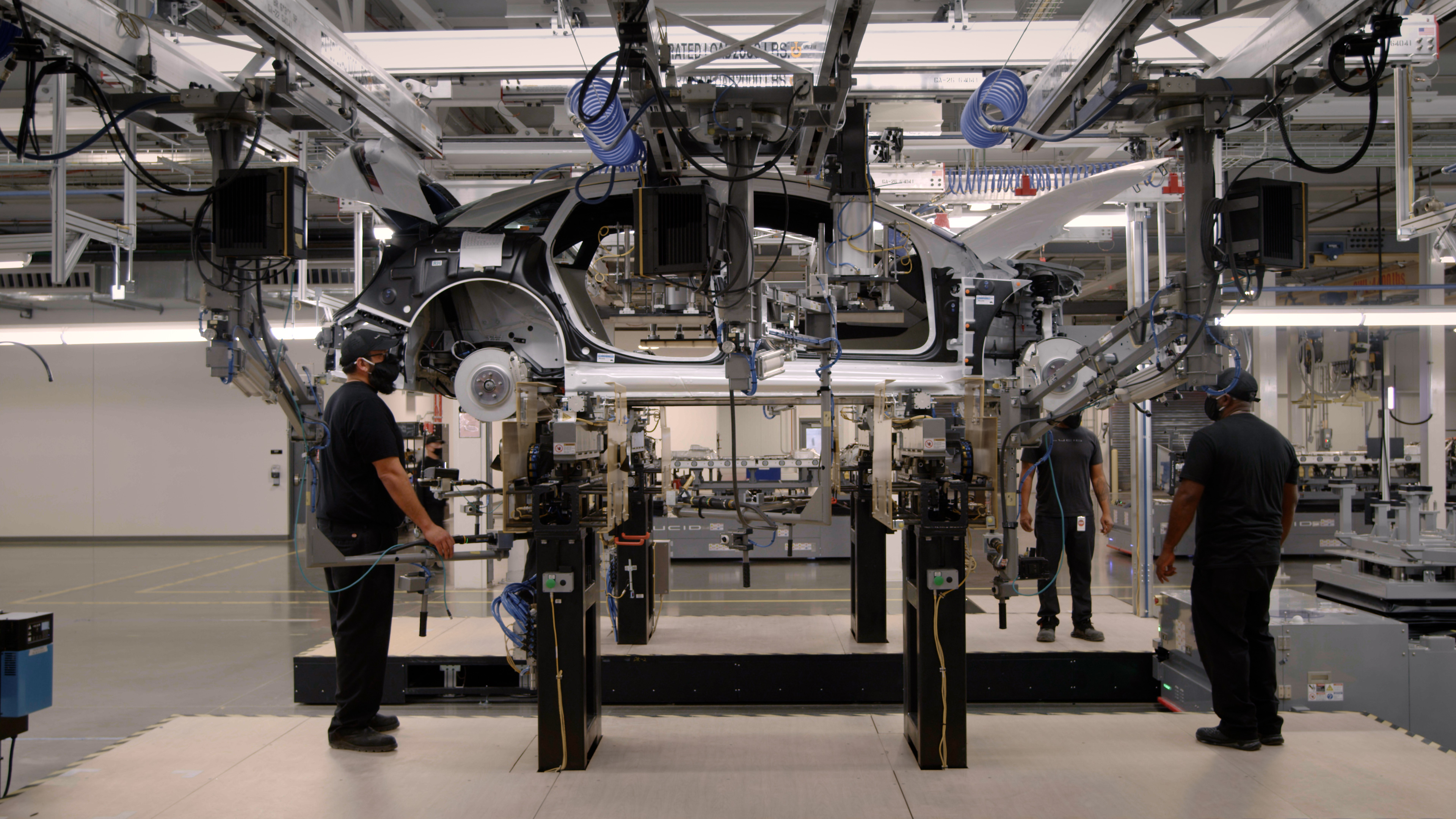

Of course, for Lucid, the most important thing is the “life-saving money” from Saudi Arabia. In 2016, Lucid released the new car Lucid Air, and announced at the end of the year a total planned investment of $700 million to build a factory in Arizona. The problem of where the money comes from is obvious for both car-making and factory-building.The delivery schedule of Lucid Air has been delayed due to a lack of funds. In order to solve this problem, Lucid began its Series D financing in 2017, even considering selling itself to Ford. However, Ford did not seem to be interested in it.

In June of the same year, in the far eastern hemisphere, a young and wealthy prince, Mohammed bin Salman, successfully ousted his cousin and became the Crown Prince. This young prince has a lofty dream: he leads the “Saudi Vision 2030” plan, which aims to change the current situation where nearly 80% of Saudi Arabia’s fiscal revenue relies on oil and hopes to vigorously develop other industries.

Usually, what we need to do is “attract investment,” but don’t forget, it is Saudi Arabia, so it only needs to “attract” and “invest.” This is where we need to mention one of the richest sovereign wealth funds in the world, the Public Investment Fund of Saudi Arabia (PIF), whose regulator is the young prince.

In early 2018, PIF first invested $2 billion in Tesla, holding about 5% of its shares. In September of the same year, Lucid also announced that they had received a $1 billion investment from PIF. This investment not only meant that Lucid had found solutions for its cars and factories, but also thwarted its “cousin”.

Therefore, Peter Rawlinson, who was the CTO of Lucid at that time, excitedly said about PIF’s investment, “PIF is not only our financial partner, but also our strategic partner.”

I don’t think this is just superficial politeness, because for Lucid, they gave up 67% of their equity to secure the $1 billion. For Lucid, which was facing a lack of funds and was in the midst of mass production, it had no choice.

For PIF, they missed the opportunity to add to Tesla in 2018, but PIF had no choice either. When Musk suddenly tweeted in August 2018 about taking Tesla private and faced an inquiry by the US SEC and Tesla’s skyrocketing share price, the Saudi prince, who was savvy, obviously did not want to be a “sucker.”

But for Lucid, with the people and the money in place and the factory successfully built, the next step is to see how the product turns out.

Before talking about the product, let me mention Peter Rawlinson. He was born in South Wales, UK, and joined Lucid as CTO in 2013. On April 23, 2019, he was appointed CEO and CTO after the successful merger, and he will continue to hold both positions.

Before talking about the product, let me mention Peter Rawlinson. He was born in South Wales, UK, and joined Lucid as CTO in 2013. On April 23, 2019, he was appointed CEO and CTO after the successful merger, and he will continue to hold both positions.

If his work experience as chief engineer of Jaguar and Lotus cannot prove his expertise in electric vehicles, then his identity as the chief engineer of Tesla Model S is sufficient to show that this guy knows his stuff.

Lucid Air left the deepest impression on me not because of its 0.21 Cd drag coefficient, nor the rear seats that can tilt up to 55 degrees, nor the Dream Edition’s $169,000 price tag. What impressed me the most was the 900 V high-voltage battery that can replenish up to 32 kilometers of range in one minute, the 202-liter spacious front trunk, and the laser radar.

Let’s talk about the 900 V high-voltage battery. Lucid Air uses 21700 cylindrical batteries from LG Chemical, and unlike Tesla’s approach of inserting thermal pipes between the battery cells for temperature management, Lucid’s temperature control involves adding thermal pipes to the two layers above and below the cells. This design allows more batteries to be packed into the same volume, which is why Lucid has managed to achieve a maximum battery capacity of 113 kWh. As a result, the Grand Touring version has an NEDC range of up to 832 kilometers.

In addition, by adopting a 900 V high-voltage battery, Lucid can require less current to output the same power compared to a 400 V battery. This means that thinner cables and wires can be used, which can further reduce the volume of the three-electric system. However, Lucid’s focus is on the fact that less current passing through the wires means lower resistance, which reduces losses and allows Lucid Air to have better power and range performance. In terms of data, Lucid Air has a range of 7.4 kilometers per kWh, which is about 6.6 kilometers per kWh for Tesla’s Model S, indicating Lucid’s superior efficiency.Talking about the 202-liter front trunk, I like this design not only because it can accommodate more handbags, but also because it indicates that Lucid has achieved good integration. For this purpose, Lucid has integrated the motor, gearbox, differential, inverter, control unit, and other components into a single assembly, which can save a lot of interior space.

As a result, Lucid’s single motor, weighing only 73 kilograms, can output 670 horsepower, which is 56% higher than the output of the motor of Tesla Model S Performance version, despite being only 54% of its weight. All of this is achieved by a permanent magnet synchronous motor, because Lucid believes that the efficiency of permanent magnet synchronous motor is higher.

However, high integration also brings an important problem – the cooling problem of the motor. Because electric vehicles usually do not use clutch, and the number of gears in the gearbox is decreasing, almost only one or two gears are left. This will cause the current flowing through the wire to increase and the resistance to increase, leading to an increase in the temperature inside the motor when the motor is running at high power during vehicle start-up, acceleration, and high-speed driving. This will not only lead to a decrease in the stability of the magnetic materials inside the motor, resulting in a lower energy transfer efficiency, but also easily damage the motor if the temperature is too high.

Here I would like to say a few more words. The most traditional cooling method is “air cooling”. The general method is to increase the cooling area of the motor surface by using a cooling grid, and some will also add a cooling fan to increase the cooling effect. In other words, it is just poking a few holes and adding an electric fan. The advantage of this method is that it is cheap, so the volume and quality of air-cooled motors are difficult to reduce due to their physical characteristics.

Nowadays, the most common cooling method is “liquid cooling”, which mainly arranges cooling water channels on the outer shell of the motor to take away heat by flowing water. This cooling method is relatively luxurious. Because it is necessary to add additional electric water pumps and radiators, etc., this invisibly increases the additional costs and power consumption, and the structure becomes more complex, and the manufacturing difficulty increases.

However, for Lucid, neither of these two methods is what they want. They developed the “axial jet cooling manifold”, which can let water flow through the heated wires to achieve cooling effect. Compared with the first two methods, Lucid’s method is more direct and efficient. At this moment, I just want to say that this version of the “PPT” is really amazing!

Finally, let me talk about the laser radar that I am most concerned about. Actually, it is a bit unexpected that Lucid Air is equipped with laser radar, as it is Tesla’s “cousin”. Obviously, Elon Musk’s contemptuous attitude towards laser radar has not affected those resigned employees.According to the laser radar information disclosed by Lucid, the first is an equivalent of 125 lines, and the second is the field of view, which is horizontal 120 degrees and vertical 25 degrees. Combining these two pieces of information, the company that is locked in is Suteng Juchuang. In addition, according to insiders, the original point cloud animation of Suteng Juchuang was used in the laser radar promotional video shown by Lucid at the press conference.

Furthermore, according to the official statement of Suteng Juchuang, its M1 laser radar has obtained fixed cooperation orders for multiple mass-produced car models since July 2020. The mass production delivery of laser radars will be started in Q2 2021. And the first fixed-point cooperation order received is from a North American car company, which not only confirms that everything about the laser radar is ready, waiting for the official announcement, but also implies that Lucid Air is confirmed to start delivery in Q2, Isn’t it?

Putting aside doubts and just looking at the Suteng Juchuang M1 laser radar, I think that from the enterprise positioning, Lucid and Suteng Juchuang have many similarities. For example, both parties emphasize efficiency and are pursuing “small and exquisite”. Suteng Juchuang pays more attention to the size and power consumption of the M1 laser radar.

Regarding the size, as a laser radar embedded in a mass-produced car, the thickness of the M1 laser radar is 45 mm, the depth is 108 mm, and the width is 110 mm. Compared with the previous M1 B2 version, the depth is reduced by 12 mm and the thickness is reduced by 5 mm, and the overall volume is reduced by 19%, which brings obvious benefits.

Here, I quote the official statement of Suteng Juchuang as an example of roof-mounted installation. After installing the M1, the NEDC mileage loss is reduced by no more than 3% compared to the vehicle without a laser radar. Small size can bring smaller wind resistance, better endurance performance, and also prevent vehicle exterior designers from going crazy. Of course, the last sentence is just my personal opinion.

In addition, power consumption not only affects the driving range, but more importantly, it affects the service life of the laser radar. As a “self-luminous body”, the process of emitting laser pulses also requires electricity to support. The rated power consumption of M1 is controlled within 15 W, that is, one degree of electricity can run for 66.7 hours, which is quite friendly for our “electric father” who has limited endurance at the current stage.And more importantly, the rated power consumption within 15 W also controls the temperature rise of M1 to less than 15 degrees Celsius. By the way, high temperature will degrade the insulation performance of electronic products, aging the components and materials, and prolonged high temperature will also reduce the resistance of the machine, increase the current, which will further raise the temperature inside the machine and ultimately cause damage to the machine. It’s like using a cheap hair dryer to blow on the hottest setting for a long time, it will produce a burnt smell and is prone to damage.

For the products used in the automotive industry, stable and durable performance is a higher priority than absolute technological leadership, which is perfectly reasonable. Moreover, low power consumption is usually accompanied by simpler machine internal structures, which can further reduce the product’s cost and weight. Reasonable cost is an important foundation for mass production.

In addition, let’s talk about the detection distance. M1 can detect up to 200 meters, 150 meters under 10% reflectivity, with an average resolution of 0.2°x0.2°. This enables M1 to obtain 4 lines and 13 points when detecting a black sedan more than 150 meters away, which is higher than the perception threshold of 2 lines and 3 points of perception algorithms. There is no problem with the detection perception.

Now let’s look at the distance. Let’s take the extreme case, excluding millimeter wave and visual perception, relying solely on LiDAR perception. Assuming a vehicle is traveling at a speed of 120 kilometers per hour, the distance traveled per second is 33.3 meters. Assuming there is a stationary obstacle ahead, the known stopping distance must be within 150 meters. Assuming the vehicle’s braking G value is constant and unchanged, the collision event can be completely avoided by stopping within 9 seconds, or 8.5 seconds if you want to reserve some distance between vehicles. The ratio of “speed/time” is approximately 3.92, which is then divided by the known gravitational acceleration, taken as 9.8, resulting in an average deceleration G value of approximately 0.4 G.

If you have no concept of this number, it’s okay, I can reverse it for you. Assuming a car with an average deceleration G value of around 0.4 G, the average 0-100 km/h acceleration time is approximately 7 seconds, which is the acceleration performance of an original factory Golf VI GTI around 2011. As an inappropriate analogy, imagine driving a Golf GTI in reverse gear and stepping on the accelerator pedal to simulate a deceleration G value of 0.4 G. I can imagine that feeling, and for my body, it’s still a bit “stimulating.”

Finally, let me mention the wavelength. I am not advocating “worshiping futures”. In the age when 1550 nm cannot be mass-produced, 905 nm still has market value. But with the development of autonomous driving, the imaginable space for 905 nm is still relatively limited, and I believe that if 1550 nm is widely popularized, according to the current propaganda methods of the entire vehicle manufacturers, the slogan shouted will no longer be “autonomous assisted driving”.However, as a translator in the automotive industry, my responsibility is to provide English translations, proofread for spelling errors, and modify phrasing to ensure that the meaning remains unchanged. In extreme scenarios, as I’ve mentioned earlier, achieving a detection range of 150 meters at 10% reflectivity with a 905nm wavelength is not an easy feat, but I believe that the comprehensive performance of the M1 lidar system can provide an impressive driving assistance experience for the Lucid Air.

Although the official statement from Lucid only claims that the Lucid Air is equipped with a Level 2 driving assistance system, in addition to one lidar system, there are 14 cameras, 12 ultrasonic sensors, and 5 millimeter-wave radar sensors, totaling 32 sensors. This hardware combination is difficult to describe as merely “sufficient.” If Lucid could offer even more “detection range,” that would be beneficial.

This also indicates that Lucid does not have a particularly clear direction or technological roadmap for autonomous driving and therefore can only prepare for the future by having ample redundancy.

In conclusion, Lucid Motors had plans to mass-produce Lucid Air in 2018 and execute this version of the PPT. However, due to funding and utilization of a 400V electrical architecture, the production plan was postponed several times as Lucid felt that the car was not prestigious enough as a luxury electric vehicle.

It is possible that Lucid Motors have seen the success of the Tesla Model 3 and Peter Rawlinson has repeatedly mentioned in public that they are not developing models targeted solely at wealthy consumers. They want to develop and sell vehicles that cost around $40,000 for the market.

Nonetheless, they may be more focused on vehicle engineering itself and will collaborate with suppliers to complete software algorithms. In my opinion, this is due to a lack of funds.

Regarding the “Tesla killer” title and similar names, Peter Rawlinson admitted that “our gap with Tesla is increasing” and from what he said, I infer that he was referring to the development process of autonomous driving.

Therefore, for Lucid, going public and mass-producing cars are just the beginning of this battle.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.