Introduction

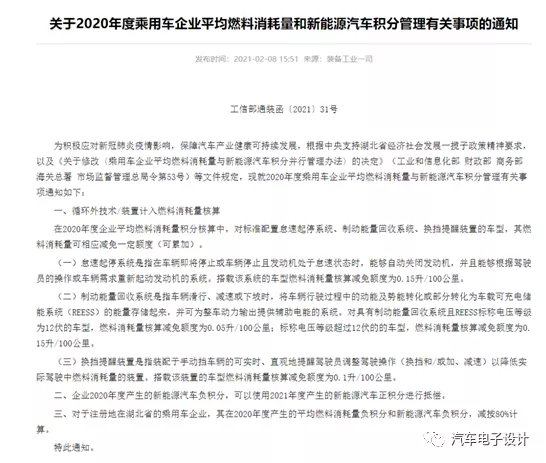

On February 9th, China Association of Automobile Manufacturers (CAAM) and China Passenger Car Association (CPCA) released their January data for new energy vehicles. According to CAAM, the production and sales of new energy vehicles were 194,000 and 179,000 respectively (with 186,000 and 172,000 being new energy passenger cars), making it the best January in history. In addition, there will be some rebalancing for 2021, due to the changes in fuel consumption management by the Ministry of Industry and Information Technology (MIIT) for passenger cars in 2020.

Data from CAAM and CPCA

First, let’s take a detailed look at the data. Generally, CAAM’s data is similar to CPCA’s wholesale data.

1) CAAM’s data is as follows: the production and sales of pure electric passenger cars were 158,000 and 143,000 respectively, while the production and sales of plug-in hybrid passenger cars were 28,000 and 29,000 respectively.

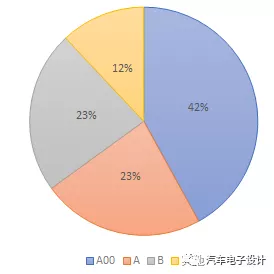

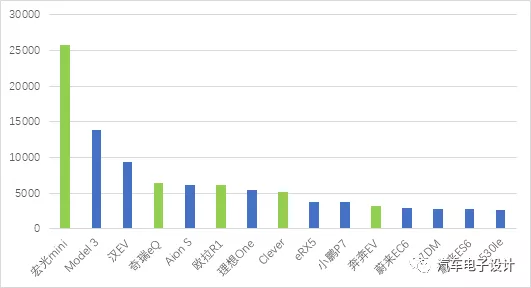

2) CPCA’s January data showed that wholesale sales of new energy passenger cars were 168,000 (with 141,000 pure electric and 27,000 plug-in hybrid), while retail sales were 158,000 (with 130,000 pure electric and 28,000 plug-in hybrid). Looking at the detailed sales by category, there are some interesting points. A00-level car models sold 60,000 units, which returned to the center of the market and accounted for a 42% share of the pure electric market. Among them, SAIC-GM Wuling sold 38,496 units, accounting for nearly 60% of the market. Sales of A-level car models were 33,000 units (which accounted for 23% of the BEV market) and returned to the situation before the subsidy in 2017. Sales of B-level car models reached 33,000 units, accounting for 23% of the pure electric market. This part is particularly obvious for replacing A-level electric cars in the private market.

From the top 15 ranking, mini EV, Chery eQ, Ora R 1, Clever, and Benben EV, five car models reached 46,600 units.

Among the top 15, the A-level pure electric cars we are familiar with were swept out, and this structure is to oppress the support car models in the middle. We tend to think that these car models are based on fuel consumption points and produced by independent brand companies. On one hand, they lower fuel consumption, and on the other hand, they also gain new energy points.## Pre-holiday Hybrid Policy Gift Pack

In terms of accounting methods, due to the large subsidies for new energy vehicles, based on compliant vehicles (which can receive subsidies or not), taking the outstanding example of Wuling, the company has made efforts since 2020 due to the compliance pressure of fuel consumption points. The wording of the hybrid technology in the automotive roadmap last year, I think, is a correction for this, because in essence, it is impossible for all car companies to continually expand the base of this field by fighting price wars in the category A00. This overdraws the accounting benefits for overall new energy.

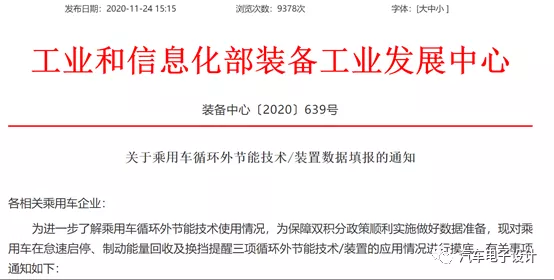

In fact, there were some clues about technical incentives outside the cycle before. The National Recommended Standard for Energy Efficiency of Automobiles developed by the Energy Saving and Consuming Reduction Standards Committee had been published in September, including “Evaluation Method for Energy Saving Driving Indication Devices of Passenger Cars outside the Cycle Technology/device for Evaluating Energy-Saving Effect in Part 1” and “Evaluation Method for Energy Saving Driving Indication Devices of Passenger Cars outside the Cycle Technology/device for Evaluating Energy-Saving Effect in Part 2: Idling Stop-Start System”, followed by research in November.

Overall, according to international management, out-of-cycle technology refers to technology whose energy saving effect cannot be fully reflected in the measurement of cycle tests. Its preferential treatment in policy compliance is referenced by international practices, in addition to other components that cannot be measured during testing, such as air conditioning and high-efficiency headlights.

“Automobile air conditioning” and “Brake Energy Recovery System” in “Evaluation Method for Energy Saving Driving Indication Devices/Equipment of Passenger Cars outside the Cycle Technology” are huge incentives for out-of-cycle technology in 2020. Idle stop-start systems are given 0.15 L, 48 V and HEV are further given 0.15 L.

In 2020, the sales of domestic 48 V passenger cars were 331 thousand, an increase of 39% year-on-year; the sales of HEV passenger cars were 414 thousand, an increase of 40% year-on-year. A total of 744,000 vehicles can receive a discount of 0.3 L. Moreover, many companies that face heavy fuel consumption pressure have already fitted idle stop-start systems as standard, which can relieve them from great pressure. From the perspective of car companies, it is the companies facing heavy fuel consumption pressure that need to use 48 V and HEV. Thus, the use of these technologies can help car companies save a lot of money on balancing fuel consumption in 2020.According to this document, we can speculate that the favorable policies for 48V and HEV will be implemented for a long time after 2021. Once the roadmap for hybrid electric vehicles is established, there won’t be much impetus for progress without actual policy guidance. This policy relaxation will make the companies that previously laid out their strategies for hybrid vehicles or 48V systems become the biggest winners. Under the dual credit policy, the major pressure for high-producing automobile companies is fuel consumption, and with the upgrading of consumer preferences from new purchases to replacement purchases, the pressure of fuel consumption persists. The playing field of this policy gives a meaningful development incentive for the joint ventures and independent automobile companies on hybrid and 48V systems. In this sense, the previously-existing internal combustion engine models need to be continually upgraded and rapidly transformed to hybrid models, whether it is 48V or strong hybrids.

Conclusion

Considering the layout of battery production capacity and electric vehicle production capacity based on the year 2025, I don’t think there will be a sudden rise in demand for battery electric vehicles (BEVs) in 2022-2023. As the prices of battery materials increase, battery manufacturers may consider negotiating with automobile companies in 2021. This will have a negative impact on the new energy vehicle market after the subsidy reduction in 2021. The development of 48V+HEV will accelerate the direction towards electrification in the entire automobile industry.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.