On March 2, LEAPMOTOR held a new product launch in Hangzhou for the C10 and a full range of models. After the conference, Zhu Jiangming, founder and CEO of LEAPMOTOR, and Cao Li, senior vice president of LEAPMOTOR, were interviewed by the media.

Question: Mr. Zhu and Mr. Cao, my question is simple, and I only ever ask one question. Speaking of today’s race, the last time we referred to the “king of the race” was during our previous full-range launch. So far this year, everyone has seen that BYD started the race after the Spring Festival. Moreover, their focus models, which are not overly expensive, still overlap significantly with ours. These include top-selling models in the market, such as the Song PLUS. Today, from start to finish of our race, I only want to ask one question: How will we outperform BYD, especially when we’re faced with BYD’s strong performance? We won’t mention other competitors for now. We’re only concerned with the “king of the race” we’ve seen at the start of this embarking year. How can we beat them at their own game?

Zhu Jiangming: Today, I want to mention two vital aspects: innovation and dedication.

In fact, regarding the question, BYD’s models are not really on the same track as ours. They are not the same type of product. Our LEAPMOTOR C11 targets at least the role of BYD “Tang”. In reality, even our LEAPMOTOR C10 is much higher than their Song PLUS, whether in terms of intelligence or other aspects. Moreover, we firmly believe that sincerity has greater advantages. From a user’s perspective, the cost of use and the driving experience, plug-in hybrids with low endurance are neither economical nor enjoyable. Not to mention introducing more intelligence, these are different products in different tracks.

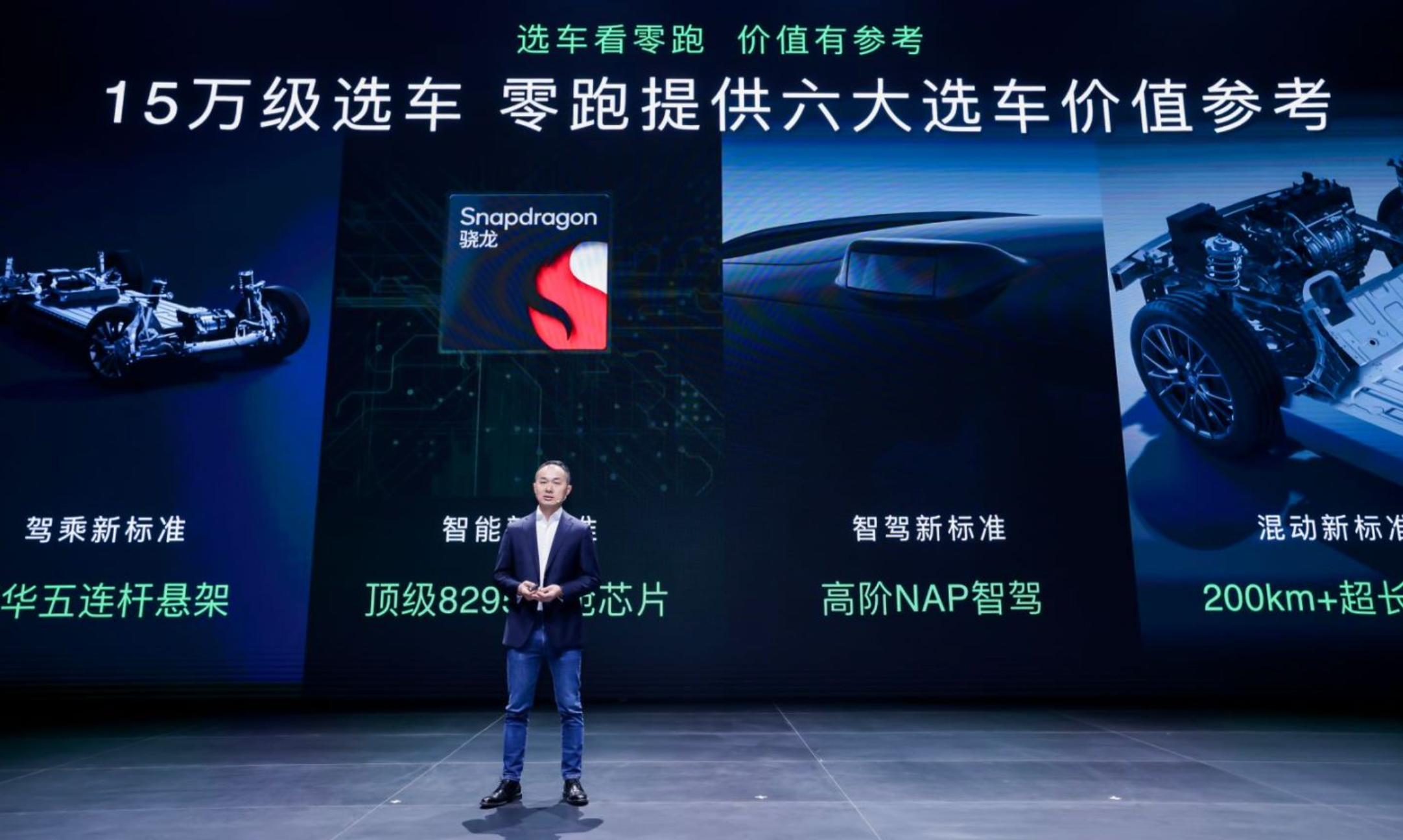

What matters for us is how to create greater value for our users through our innovation. I also repeatedly emphasize that our 8295 chip has done many things that others have achieved. That’s the value of LEAPMOTOR. We can provide users with better, more advanced products. Moreover, our suppliers for the C10 are absolutely top-notch and on par with BBA or better. At least in terms of intelligence, we are on par with leading NEV companies in configuration. For regular interior and body materials, we use suppliers from BBA. We aim to offer products that will meet customer satisfaction at a reasonable price. This is how we use innovation to demonstrate our value.

At the same time, we benchmark every detail. We learn from LI L7. In some areas, in addition to learning, we have to go one step further and learn even better to demonstrate value. This is our approach and thought process in vehicle manufacturing and fully reflected in our C10. This has led to a large number of users and pre-orders, and everyone thinks our C10 has exceeded their expectations in every way.

On the other hand, we can switch all products to LEAP 3.0 at the earliest opportunity. This is difficult for many companies to achieve. Whether it’s new or old forces, it’s hard to adopt 8295 in all products, all new electronic and electrical architecture, and equip all products overnight. Only when you have genuine full-domain self-research and truly develop our underlying architecture and entire system, can you achieve the current state.

Question: Greetings, President Zhu and President Cao. I noticed that none of the electric vehicles we released today exceed a 700km range, which is somewhat different from last year. I’d like to know LEAPMOTOR’s thought process in choosing electric vehicles for under 200,000 RMB with a range. Thank you.

Cao Li: Considering the consumer market as a whole, none of the electric car models with a range exceeding 700km have top-notch sales. That indicates that customers are slowly evolving from range anxiety to realizing that a 400 or 500km range serves all their daily commuting needs just right. Thus, our central focus is on defining the range within 500 to 600 km, including small cars operating at around 400km. With current trends like fast-charging speeds and the increasing-utilization of high-voltage platforms, range anxiety isn’t a bottleneck anymore. Thus, we’ve optimized our product definition by eliminating the 700km range option.

Zhu Jiangming: To add on a bit, we’ve made adjustments to our product definitions; the LEAPMOTOR C11 that we mainly promote has a 580km range. We’ve sought to minimize range anxiety while providing a more satisfying experience at a slightly higher cost. Resolving the previous 500km range by an additional seventy or eighty kilometers was a primary goal; locating the 580km range was so the user could enjoy the experience more. Of course, that comes with the added cost. As Cao Li has just mentioned, the 500km range is definitely a mainstream demand in the future.

Question: Hello President Zhu, I’ve been looking at price differences. The C10’s pure electric version is slightly cheaper than the extended version. However, the pricing strategy for C11 and C01 is the opposite; their pure electric versions are slightly more expensive than the extended versions. Why are the C10’s electric versions cheaper than the extended ones, whereas the opposite is true for the others? Will the extended and pure electric versions be priced the same in the future?

Zhu Jiangming: Firstly, our pure electric C10 starts at 400 kilometers, its battery capacity is slightly smaller than the C11’s, hence the lower starting cost. That’s primarily the reason. Also, we take into account the varying needs of different users. For instance, if they are county town residents who daily commute around 50 kilometers within the local vicinity, then a 400km range is perfect.

Question: President Zhu, you have mentioned that our products are equivalent to BYD TANG’s level. Given our competitive pricing, are we formally launching a “war” on companies like BYD with a chance to undersell BYD TANG series?Zhu Jiangming: Firstly, we focus on being the best we can be, not declaring war or making comparisons with others, as different manufacturers have their own positioning. We want to make products that are within the 150,000-200,000 RMB price range. We have chosen six standards by which to choose our cars, as Cao Li just introduced. We hope to offer products priced under 200,000 RMB, featuring the Orin-X, laser radar, and 8295, which are not yet available in the market. We just want to offer more in our class. We strive to provide the best user experience and price our products based on our capabilities. Our pricing strategy for LEAPMOTOR, as we always say, is cost-based, it’s about what we can afford. We don’t compare ourselves to the competition. LEAPMOTOR is about our own capabilities, what price we can set, what we can afford, and what can satisfy the customer. We hope LEAPMOTOR can always surpass customer expectations, that’s our goal.

Zhou Ying: The general idea from General Manager Zhu is that we focus on improving ourselves. This not only involves pricing, but also meeting the standard, the technical standard, and the product standard.

Question: Two things remain unchanged: one is our leadership in technology in the industry; the other is the cost-effectiveness for consumers.

Clarify two points: One is about internationalization. We heard that we are about to export our first model, LEAPMOTOR T03. Can you tell us about the countries and areas we will export to, as well as our product selection strategy and rhythm strategy? I noticed that the choice of this model is also based on market research in our target countries. We found that there is a big market for compact cars and there is a relationship with local policy subsidies, so I am curious about the choices behind this. Can you reveal something about our collaboration with Stellantis in local channels? Because our export in this field is not just about taking the cars out, but also about exploring the overall model and paradigm. On another point, we have been discussing the CTC technology for a long time and we talked about many Fortune 500 suppliers today. One of them that I am familiar with is Zhongxin Deka. They just released their integrated die-casting technology. I’m curious, who’s our existing supplier in this technology, and could we cooperate with Deka in the future? As they said this year, the integrated die-casting technology will take off, and this technology will continue to be transferred down. I’m curious about the trends in technology and industry.

One is about the international market and the other is about the technology changes in integrated die-casting technology products. Thank you both.

Zhu Jiangming : Regarding the products for export you mentioned, I also mentioned that we will start large-scale sales abroad in the third quarter, and the first product is LEAPMOTOR C10, our flagship model overseas. Of course, as everyone knows, Europeans like compact cars, so the volume of T03 might surpass C10. However, in terms of LEAPMOTOR’s overseas flagship brand, it’s the C10. We’ve made rapid progress in our internationalization process. Today, all 10 executives from LEAPMOTOR International have attended the launch event. We didn’t make a public announcement, they are here to see how China does it and to further understand LEAPMOTOR. In the last few months, we have set up a LEAPMOTOR international team in Europe and globally. We will continue to expand rapidly into the world’s four major regions, in addition to Europe, including South America, Asia Pacific, and the Middle East and Africa.Our model is akin to the domestic one, wherein we are not trade-focused but emphasize on establishing marketing networks locally and promoting our brand. We also strive to establish a comprehensive service system and an integrated system of finance and insurance – an approach that mirrors our domestic strategy completely. While initial growth may be slow, once expansion starts, the pace accelerates.

Speaking of LEAPMOTOR, in terms of internationalization, amongst the new generation of automakers, I believe we’ll be quicker and more concrete. This includes planning all future products, where a significant portion of our efforts will focus on stockpiling for overseas markets. Given the fact that these markets have requirements that differ from ours, it’s essential for us to comprehend local demands. Our partnership with Stellantis allows us to access more high-quality channels swiftly, including spare part distribution systems, service systems, and of course, markets. One step ahead of others, we perform better in terms of efficiency and cost.

Regarding integration casting, LEAPMOTOR always prioritizes value for money. Every chip, car body, and interior decoration related detail is considered from that perspective, with emphasis on innovation based on cost and performance comparison. Take integrated pressing and casting, for instance. We consider what parts can be made, what parts can reduce weight and balance costs or slightly increase the cost; these factors determine our positioning. It doesn’t mean using all-car aluminum die-casting or stacking more continuation batteries simply because it’s advanced. Indeed, the customer’s needs are our priority, and we work on achieving a balance between technology and cost. We are indeed discussing opportunities for cooperation in aluminum die-casting with Daika and also Wei Qiao.

Question: Good day to the leaders. I have two questions.

First, when watching LEAPMOTOR press conferences, I always wonder how you manage to not make losses. You vaguely mentioned ways of innovation or full-stack self-research. Could you be more specific – how much savings in terms of scale for manufacturing costs of the entire new energy vehicle does self-research offer? I saw that we turned a profit last year, barely so; what is this year’s gross margin target?

Also, I was wondering if the products exported will be identical to the ones made in China in terms of manufacturing and configuration, or will there be any differences due to export?

Cao Li: Let me talk about export products. As Zhu mentioned, our planning and definition of our products abroad are based on the domestic ones. Our five-year product plan for overseas is ready. Therefore, the definition of domestic and overseas products certainly comes from market user needs. Consumers in Europe have different demands from domestic customers, so we need to satisfy local customer needs. There are certainly distinctions between domestic and overseas products. On the premise, with the view from the research and development technology perspective, the maximum use of platform scale to reduce costs, so the bottom platform planning and architecture, we’re looking to globalize it. On this basis, we work towards different regions and product differentiation.Zhu Jiangming: Regarding the issue of gross profit, as a publicly-listed company, we can’t disclose details, but I can assure that we’re making steady upward progress and are striving to do better, rather than declining.

The question about whether our in-house full-domain research and development will reduce costs, I’ve already provided a good example in my first speech. For instance, the 8295, which everyone knows is now the flagship cockpit chip. To date, Leapmotor is the only one that has announced that a single 8295 chip can be used for intelligent cockpit plus intelligent driving, and can also be utilized for amplification, audio, and 360-degree panoramic view. Other auto companies need another chip for smart driving even if they’ve used 8295 chip for cockpit, and additionally, they would need to buy a third-party amplifier for audio tuning. Our implementation illustrates our accumulated technical know-how and capability for innovation.

Moreover, as I mentioned, the under-chassis integrated technology CTC, which we have implemented as CTC 2.0 on our C10 models, is lighter than most others, even those made from aluminum. The price difference between steel and aluminum is substantial, forty versus ten dollars per kilogram. Our CTC is completely non-modular, without many complex parts such as end plates and tie straps. With our approach, the cost of our CTC saves us 1500-2000 dollars. This is just the scheme, but our self-development in all realms means we manufacture all of our battery packs, providing us with stronger bargaining power over the battery cells. Hence, the idea behind Leapmotor is selling the entire vehicle and not just making profit from parts.

Question: Mr. Zhu, you mentioned self-development earlier. I remember Leapmotor emphasizing this right from the start. Today, there were two slides that stood out, expressing collaboration with top international suppliers. I feel like there’s a contradiction here. While the company stresses self-research and the vertical integration of supply chain – the current direction for Chinese auto companies – it’s opting to use parts from global enterprises. Does this contradict with cost and corresponding price? That’s the first question.

Second, everyone is fighting for market share, and publicly listed companies undoubtedly eye profits. So, what are your expectations for market sales after listing? Could you also elaborate on the sales network strategy for this year, especially considering some changings have occurred? Thank you.

Zhu Jiangming: Firstly, when it comes to our suppliers, we’ve always only focused on electric-related parts. We use top-tier suppliers, the ones who supply to BBA for interior accessories, instrument panels, seals, etc., or set up joint ventures with them to deliver our products. We aim for our products to be equivalent to those of BBA, so we must resort to similar suppliers. So-called “full-domain self-research” refers to electric-related parts only, which we’ll deal with ourselves. Every electronic part has its second-tier suppliers, and we choose the best among them. Examples include Qualcomm, NVIDIA, MXP, etc. We opt for nothing but the best.For our online channel strategy in 2024, one of our key objectives as a company is to greatly enhance our service offerings. This entails improving our service outlets and employing a “1+N” channel strategy, where a single 4S store serves as the hub for our service, delivery and multi-product demonstration in a certain area. This is supplemented by various supermarkets and urban showrooms in the vicinity. Our existing network can be quite convoluted and overlapping and we are working on streamlining it and implementing regional segregation to minimize price conflicts. Looking forward to 2024, our primary goal is to optimize our network, establish more 4S service centers and delivery points. As for supermarkets, we will continue to pick those that have shown stellar performance while we might phase out some poor performing nodes. Therefore, “optimization” is the underlying tune for LEAPMOTOR’s network development in 2024.

**Question: A familiar question about sales. I saw some media coverage that overseas production has already begun. What is the estimated sales volume overseas in 2024? Mr. Zhu also mentioned the sales network. In these past few years, it doesn’t seem like there are any big dealer groups and traditional investors backing LEAPMOTOR. Are you hoping to attract larger dealer groups for expanding your sales network, or is it going to be an in-house effort?

Zhu Jiangming: For 2024, all our EU certifications will be completed only by the third quarter, so the fourth quarter will carry the weight for sales. We aim to have over 200 sales outlets established this year, starting sales in September. As for sales volume, we hope to achieve 6000 to 10000 units, but the focus will mainly rest on next year, since establishing a network requires considerable time and is a long-term investment.

As for domestic investors, rather than specifically targeting the biggest dealer groups, we strive to appeal to leading regional investors. Our approach is to select investors based on regions, using each city as a focal point. We are prioritizing finding the top three candidates within each city to undertake the regional network resources.

Question: I have a simple question. What’s the volume of orders we have up till today, and what are the proportions of the different models chosen, the extended-range and pure electric versions? The price revealed today is indeed a pleasant surprise. For the user group within this price range, Mr. Zhu, do you think they would really pay attention to the 8295 and laser radar configuration? Because not only are these options expensive, but their future maintenance costs will also increase.

Cao Li: As mentioned during our launch event, we have received over 45,000 orders as of yesterday, and this number continues to increase. We are confident of our performance. For users in this price range, the middle to high-end configurations account for over 80% of the orders, with pure electric and extended-range selections split around 6:4, leaning slightly towards the former. Based on the options selected by our customers so far, users are very interested in the C10’s intelligent and autonomous driving features. Our surveys indicate that the average age of our users matches our original expectations, skewing towards a younger demographic. This group shows great appetite for technologically advanced and novel features.In terms of intelligent costs, the highest-specification smart driving version is just over 160,000, which includes all hardware and subsequent software costs for intelligent driving, making it very cost-effective from a usage cost perspective.

Zhu Jiangming: The use of lidar in smart driving is beyond our imagination. There is also the smart share version with 8295, which many have flocked to!

Question: Leaders, I have a question. Recently, including Ouyang Mingga, has been reflecting on the risk warnings of China’s new energy vehicles, including technology, business, and policy lag. We all know that Leaper’s lead, or the entire China’s new energy automotive industry’s lead lies in the fact that it has leading positioning in parts including the whole industrial system. As General Manager Zhu mentioned earlier, you can negotiate with parts suppliers on price. Regarding the sustainability of our lead, at the current state of either breaking even or minimal profit, will there be risks for the continuous lead of the entire industrial chain, I would like to ask, thank you.

Zhu Jiangming: First of all, from a market demand perspective, new energy vehicles are indeed a new thing. But judging by the rate of growth from last year and the year before, new energy vehicles have received most user’s acknowledgment. Without such acknowledgment, such a swift switch could not have been possible, since users would worry about various issues. Right now, this is no longer a big concern. The core reason, which I always attribute to, lies in the extremely low cost of usage. That’s a priority for the users. Secondly, an excellent control system and highly intelligent capabilities. Even those who bought BBA cars still use mobile navigation, however, with a leap, these issues have been eliminated. With a Leaper T03, you can get to where you want without needing mobile navigation, this is a significant advancement. With only 1/10 of the cost, there is no reason to choose a petrol car, this is a fundamental aspect, and hence the general direction will not change.

Secondly, many are still hesitant, including Benz who was hesitating, wavering back and forth. Benz is uncertain about whether to go all in on electric cars, and whether the combustion technology still needs to be developed. This, however, gives us the opportunity. We have only one path “forward in darkness”. We must push forward quickly, which should be more beneficial to us.

I have always been researching the “oil-electricity ratio”. The ratio in the US and China is about 10:1, comparing the costs of refueling and charging. The price of electricity and petrol are similar in the Asia-Pacific region, close to China’s pricing. In Europe, electricity is a little more expensive, making the cost of electricity approximately 25% of the cost of petrol. Elsewhere is closer to China’s level, at 15%-10%. This is an offer that no one can refuse. Even if they’re not highly conscious about working for environmental protection, they’ll strive for a better life, to reduce transportation costs. No one would reject that, it’s my opinion.

As it stands today, our sales are comparable to Toyota’s. I’m not sure if electric cars can surpass Toyota in 2024, or perhaps exceed them just a little. If we are still comparable each year, by a certain volume, it will be difficult for them to catch up even after three to five years.Every industry is fiercely competitive, be it for household appliances or photovoltaics. As media professionals, you would know the ups and downs of the photovoltaic industry. But Chinese photovoltaic technology undoubtedly leads the globe. Such primacy is only possible with industry support. You might argue that innovation doesn’t usually come from the laboratories of universities, but from the practical pressures faced in real scenarios. It is these pressures that push for cost reduction, scalability, and growth. If electric cars are the future direction, one would naturally have great chances of success if they commit to this course fully, compared to those who don’t.

Question: Greetings to both leaders. I wish to ask:

1. LEAPMOTOR’s flagship models are all priced within the 100k-200k range, which is a benchmark of value. But, with the growing number of contenders in this price bracket, how does LEAPMOTOR view this market competition?

2. Currently, Europe and America have placed certain barriers on Chinese automakers trying to venture into international markets. How does LEAPMOTOR view this situation and what impact do they think it will have on the global progress of Chinese automakers?

3. What unique advantage does LEAPMOTOR hold in its overseas exploration?

Mr. Cao Li: Regarding internationalisation, I can comment first before Mr. Zhu adds further insight.

In the 100k-200k competition, everyone can see that what we’ve been caught up in isn’t a price war, but improving the overall driving experience and configuration despite maintaining a competitive price. From this point of view, even though models like BYD’s Han and Tang fall within the 100k-200k range, they haven’t hit the floor price yet, so they aren’t yet the most affordable. Competition shouldn’t be insensitively about price, but about providing the best value within a specific range.

In addition, our current collaboration with Stellantis offers us a strong advantage for global expansion. We hold a significant edge in our understanding of foreign markets, including local knowledge and the sales network. Plus, we can learn from their successful experiences. As for different rules or restrictions in various regions, we are well-prepared to understand and tackle them.

Regarding the international political aspects, it really comes down to the needs of consumers. More regulations or barriers only highlight our advantages and cannot resist the trend in the long run. Think about it this way: why should the consumer choose a product with a usage cost that is ten times higher than its electric equivalent? If the product offers a better experience, why should it be hindered? With a long-term outlook, we remain confident about our global expansion journey!

Question: Greetings to both leaders. Mr. Zhu, you mentioned that the C10 took some cues from LI’s L7. Could you share which aspects of LI’s product research and development were borrowed or referred to? Furthermore, not only is the price being controversial now but also the intelligent driving systems. A peer mentioned earlier on that those who do not implement full-range NoA in urban areas this year may fall behind. You also mentioned that we would begin using urban NoA in the second half of this year. Also, just because a technology is more advanced does not mean it is necessarily better. What are your views on smart urban driving and our plans for it? Thank you.

Zhu Jiangming: Cao Li mentioned that our C10 should learn from LI L7. What it did well was to understand the needs of the users better. Its comfortability is something we should learn from. Its comfort in operation and Human-Machine Interfacing (HMI) was indeed well-done, including noise reduction and control. Even the display of information and methods on some vehicle machines, I think in this respect it was more finely crafted. This is something we should learn from. Our C10 has also put a lot of hard work into these areas, including seats. We have a blind test with Benz S seats, you will know which is better once you sit on it.

Even the height of the glove compartment, we have indeed adjusted many times until everyone finds it comfortable. If there is no place to rest your hand, it gets tiring, or even if it’s placed too low it’s not comfortable, let alone placing it even higher, it’s uncomfortable. Even a little improvement in comfortability can earn you many plus points. We have spent a lot of time on these details for the C10. First of all, because it has a good foundation, our height is even higher than Rolls-Royce. The stiffness of over 40,000 Nm determines the stillness of the car body whether it’s noise reduction or the little deformation when driving over bumps. After this foundation is set, we then work on the delicate HMI experience engineering. Including the optimization of throttle, brakes, steering and other aspects, hence we hope the media teachers can experience our C10, it will definitely exceed your expectations; and also our sound system, I don’t know if it’s because I have more confidence in our own products, I have not heard a sound system better than this, this is an honest fact!

You can go and try, it might not necessarily be right, at least that is what I think now. Of course, there are also many customers, I went to the store, one customer came and listened to it, and thought it was better than his GLC. Because the sound system, rendering is like whether a mobile phone takes good photos. Some say they are very good, they take really beautiful pictures, but they aren’t real. Some music sounds really good, it renders a lot, which is increased, which is decreased, all the settings have been changed. Some completely restored, using the kinds from the electronic tube era, I just guarantee its fidelity, it really is difficult to appraise. Photos are the same, whether beauty pictures are good, whether beautiful pictures or real pictures are good. Music is also confusing, there will be this problem. At least that kind of high fidelity music is put in, it can truly restore, I think this is good. Of course, we also need beautified pictures, beautified ones, the freedom to choose that would be best!

Zhou Ying: Our sound system particularly excels in playing good songs, because the resonance is particularly good. City intelligent drive was also mentioned earlier.

Zhu Jiangming: City intelligent drive, everyone has driven in the city, after driving you can sleep from point A to point B, but I think this will take some time. Have any media teachers tried intelligent drive? You can express whether it’s good or not, dare you sleep after setting it from A to B? When you’re using this function, you’ll feel frightened, you’ll feel really tired, you don’t feel secure until you’ve tried this function. We’ve also seen a lot of disastrous accidents, there are many exposures online. I don’t think it’s time yet, if it really enhances your auxiliary driving a bit, it can make your drive a bit more relaxed, such a function can get on the car first. Whether you’re driving in 100 cities, or 10,000 cities, it’s useless no matter how many cities you’ve driven in. I also say LEAPMOTOR can start driving in the city tomorrow, open to all. We are still solid on how to enhance the user’s auxiliary driving experience, be more realistic, further solve the user’s pain points, alleviate the user’s driving fatigue, this is what we have to do.Zhou Ying: Regarding the learning from LI L7, here’s an addition. Mr. Zhu mainly talked about product refinement earlier. We turn to L7 for references and inspiration as well. For us, the product C10 is in a pretty good state. The same goes for marketing, we need to take a leaf out of L7’s book. We watched LI’s online product launch yesterday, their explanation and smart tactics for product promotion were impressive. So, our assignment is to learn from L7 not only about the product but also about the marketing, as our product is doing pretty well. Our quest is huge, we hope for more support from the teachers present here.

Cao Li: Additionally, learning from LI L7 does not mean we replicate their moves, we don’t just copy them. What we need is to understand their attitudes toward the product, the users’ needs, and the specific positioning of their product. Our C10 users and L7 users are not the same, so we can’t simply adopt their definition, I need to have my own thoughts. Young users can also see, there are many unique features in our C10, such as zero formaldehyde fabrics, made for babies and mothers. These are all customized for the younger family users, catering to their real needs. This same approach, we learn from the excellent product managers and enterprises.

Question: I wanted to ask, recently a lot of automakers have been announcing super models or GPT in their cars, not only related to intelligent driving, including smart cockpits also. How does LEAPMOTOR perceive this technology, is there a timeline for its integration? Since January, the competitions have started, some rivals have temporarily halted. Mr. Zhu also shared some insights about the future last year, have there been any changes to these predictions, or is there something new that you can share? Also, what are LEAPMOTOR’s objectives this year, what is your main focus?

Cao Li: Firstly, let me clarify, there is no issue on the technical front, we are also working on planning and discussing product definitions. We aim to cater to the real use scenarios, making it really user-friendly. Everyone can check out, we have significantly optimized our intelligent voice system since the last version. Our plan is to truly understand what you are saying, easing your operations, and eliminating detours. We have also looked at the use of AI on cars, it seems more like, it’s there just for the sake of it. Sometimes AI in cars can kind of become AI ghastly, in a sense that it doesn’t really understand what you actually want to do. It might seem interesting, with some gags to crack, but what we really need to tackle is how to make your operations and usage more convenient.

Zhu Jiangming: I would also like to comment on the topic of artificial intelligence, everyone seems excited, considering that China is falling behind America, with supermodels taking over. Actually, in August and September last year, I also attended an advanced course at Tsinghua. Tsinghua’s AI Lab is also one of the leading ones in the country, of course, a couple of startups have been working on supermodel companies, including the president of SenseTime, who also happens to be my schoolmate. We spent half a day discussing, in actuality, it’s not so simple to bring some things to reality, it’s a long journey. It might be used as an auxiliary tool, but it cannot completely replace the current jobs, or designing cars, and including creating music, or writing articles, which are relatively better, because it’s not qualitative. For intelligent driving, or solving complex math problems, it can’t solve the problem, it’s not a statistical law factor, it’s computational. While it’s not all-powerful, we should embrace and employ this tool perfectly to improve our products, efficiency. That’s the direction we need to work towards.The overall process is indeed harsh, like an elimination game, one after another is eliminated. Yet this is quite normal, be it in businesses or game shows. It’s similar to sports competitions; one must stay humble in victory and gracious in defeat. In the end, we must face the fact of the outcome and find ways to remain in the field. Broadly speaking, LEAPMOTOR owes its development to a solid technological foundation, steady progress, improvements day by day, year by year. Our goal this year is to advance at least one place in the ranking of new automotive forces. I believe we can achieve this ambitious goal, or at least that is what we strive for. Surviving till the end equals success; dropping out equates to failure. Therefore, the key is to stay determined and stick to our direction.

With fortunate circumstances, our joint venture with Stellantis has provided substantial endorsement, support, and sped up our exploration in overseas markets. By 2023, we will have settled several core components, such as the battery, electric drive, and headlights. As the year 2024 approaches, I believe there will be more and more in the pipeline. The entire core components sector will harvest more in 2024 as we take multiple routes to cut down overall consumption. Given the long designation period for many cars, which typically lasts 1-2 years, an accumulation of components, in conjunction with LEAPMOTOR’s growth in scale, should not be overlooked. Needless to say, Stellantis will also undoubtedly be using LEAPMOTOR’s components, and I believe we’ll see a lot of implementation in 2024.

Question: Mr Zhu, I would like to ask you a question. We noticed significant changes in LEAPMOTOR over the past few years, including the launch of C10, the collaboration with Stellantis, and many more. The release meeting also shed light upon the features and innovative ideas of our products. As the founder, chairman, and CEO of LEAPMOTOR, what unique characteristics of the company have contributed to its current position?

Zhu Jiangming: The uniqueness of LEAPMOTOR lies in our pragmatic approach and a steadfast adherence to reality. We, coming from technological backgrounds, shun empty and grandiose talks. Although we may seem conservative, we are actually quite daring and aggressive in various fields. Ever since we established the research team for key components in 2015, we have been dedicated to laying a solid foundation for all elements involved, such as electric drive, battery, controls, and electrical architecture. To win, we believe in the significance of being practical, down-to-earth, and truth-seeking. This is the most critical factor behind our success today!

Question: Hello, leaders. I would like to ask about the specific upgrades made to both C01 and C11 during this product upgrade, and what unique values these enhancements will bring to consumers. In addition, as we’ve only just entered March, it’s likely just the onset of the first round of competition; rivals will continue to launch new products in the coming quarters. Mr. Cao mentioned earlier that BYD’s pricing is not the lowest yet, there’s potential to go lower. How do you perceive this, and have you noticed any changes in domestic consumer demand that may have triggered this trend? Thank you.Cao Li: The greatest upgrades in C01 and C11 first come from product enhancements. We have upgraded the fundamental electronic architecture to LEAP 3.0, utilizing a centralized supercomputing structure. This advancement will pave the path for future smart functions and customization abilities aligning on a level with C10. Additionally, we have rectified areas of dissatisfaction among users for the C01 and C11, like the issue of the rear seat of the C01 being excessively exposed to the sun mentioned in the press conference was resolved. The luxurious features that were initially optional have now become standard. As you can see, with the reduced price, we have also enhanced the configurations of our C01 and C11. That’s the most significant change in our products.

Moreover, we are constantly reducing prices to capture market share. The market competition intensifies every year. As long as there are players and demands in this race, the competition will certainly continue. The result of this continuation is a test of overall strength – some sectors have deep pockets to plunge the bottom line without considering profit. In the end, the competition will come down to technical strength and product competitiveness of the company, which are the strongest cards in the overall battle. We have prepared ourselves for this, whether the competition accelerates in the second half of the year or next year. We are well positioned to leverage our comprehensive in-house research capabilities and cost-control abilities. This is the core logic that underlines our approach.

Question: Good day, Mr. Zhu and Mr. Cao, I have two questions. Firstly, the C-series models have been fully upgraded to the LEAP 3.0 architecture, supporting an 800V platform. When will LEAPMOTOR incorporate the 800V/5C fast-charging technology into its models? Secondly, regarding product upgrades, there’s been quite a buzz in February and March with many new model upgrades, including new models of ZEEKR 001, LI L7, among others. LEAPMOTOR rolled out comprehensive upgrades today. The upgrade directions such as 8295, laser radar, suspension, etc., seem relatively consistent across the industry. What was the rationale behind LEAPMOTOR’s comprehensive upgrade? Could you evaluate the changes made compared to the previous generation of C11 and C01? Thank you.

Cao Li: In terms of fast-charging at 800V, we previously hinted that the mid-year model of C16 will debut as the first model with 800V fast-charging and will be directly delivered to buyers. Concerning the logic behind upgrades, our simplest concept is to initiate technical iteration and product upgrades consistently across all our models every year. Regulatory constraints or otherwise should not restrict upgrade one model whilst another one has waited for six to twelve months. Since we mentioned an upgrade in technology structure to LEAP 3.0, we have to unanimously upgrade our entire series of models to this technology structure. We will continue to maintain our advantage in self-development, involving basic three and intelligence. So the new …With regards to these, we are advantageous in certain areas such as the speed of chip iteration, lidar, advanced intelligent driving, and follow-up algorithms. We strive to provide the best experience to our users, which is why we will continue to maintain a leading position.

This article is a translation by AI of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.