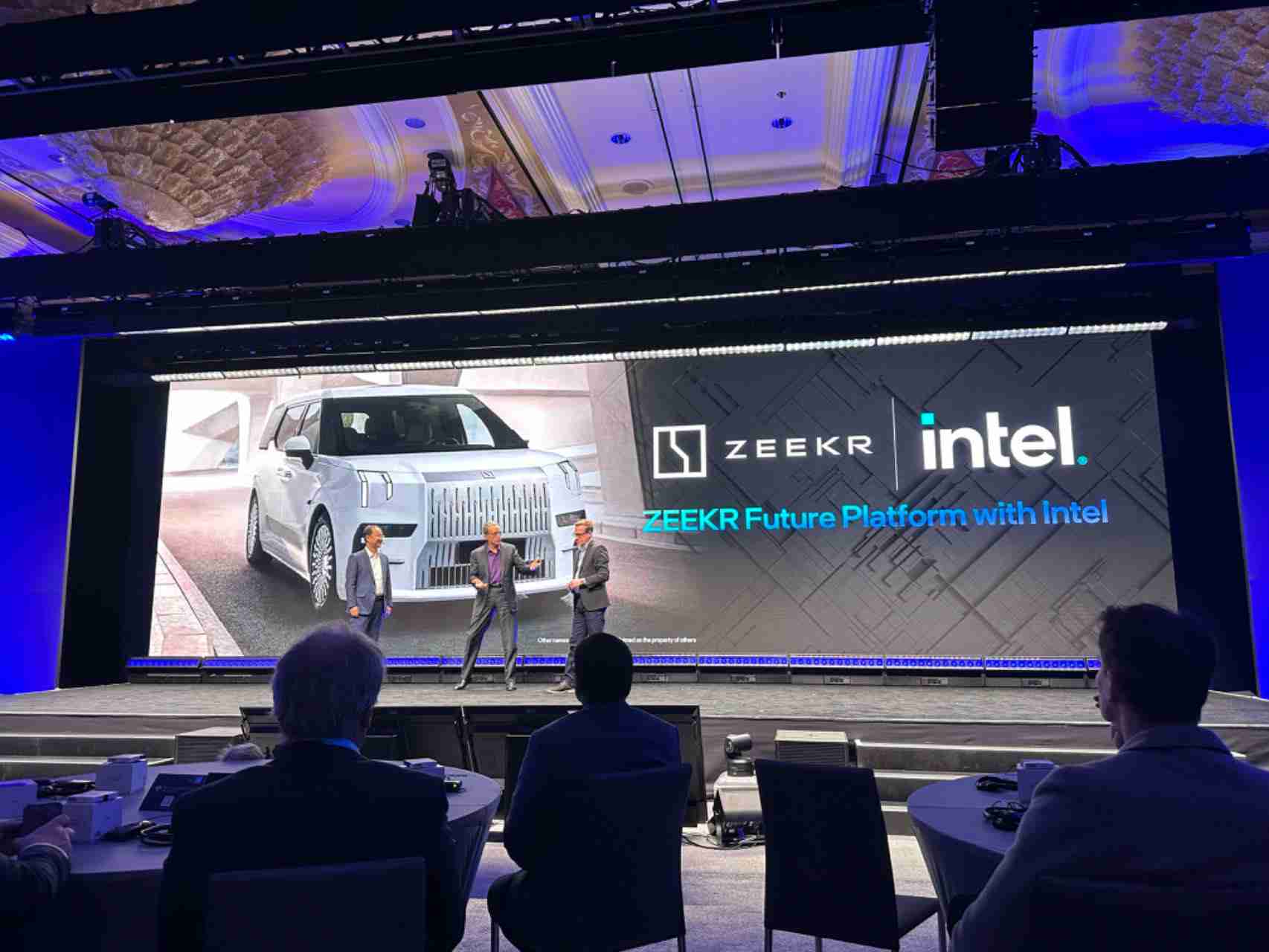

On the afternoon of January 9, 2024, at the Venetian Hotel in Las Vegas, USA, Intel CEO Pat Gelsinger, who has been in office for three years, stepped onto the CES event stage specifically set up to introduce the new Intel Automotive business. The moment he took the stage, there was a slogan with a declaratory implication on the big screen behind him:

The Geek is Back.

Through this slogan, and through this event itself, Intel merely wanted to announce one key message to the entire automotive industry: It wants to return to the automotive industry.

However, to be quite frank, during the entire CES 2024, the event held by Intel for the automotive industry, and the strategic cooperation it announced with ZEEKR, a Chinese smart electric car manufacturer, did not make much noise. The slogan did not cause much discussion either. Even in the crowded automotive industry, the role that Intel played this time was more like a newcomer who had “intruded”.

As a semiconductor giant, Intel’s role misplacement in the automotive industry today is baffling.

Because, Intel once stood at the key entrance of the wave of automotive intelligence and had enough presence and influence, but for a variety of unexpected reasons, it missed the key opportunity with the industry, and later almost withdrew, leaving only a mess – to the point where it has to start again today.

The twists and turns of Intel’s relationship with the automotive industry can be traced back to fifteen years ago.

Missing the starting point of autonomous driving development

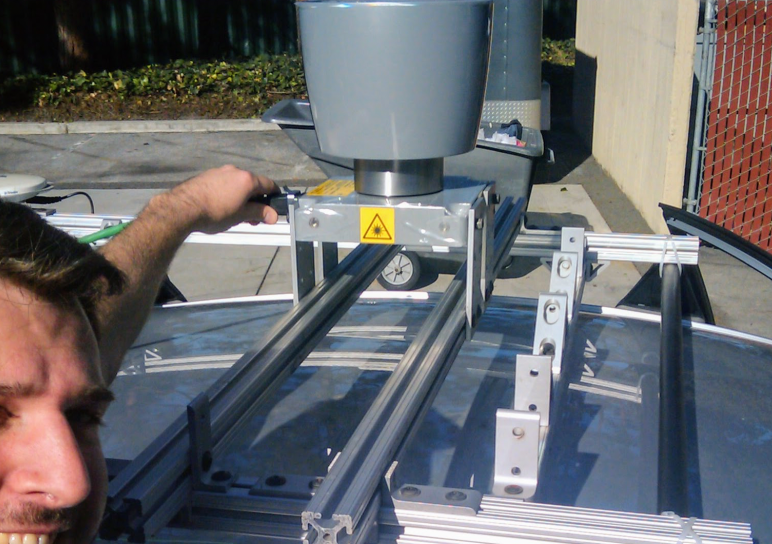

On January 20, 2009, a Google employee named Ryan Hickman purchased a metal rack from a store on Charleston Road near Google’s headquarters and used it to install a lidar from Velodyne on the roof of a Toyota Prius purchased by Google.

This car was the first one used in Google’s autonomous driving project.

At that time, few people knew that in addition to the bulky and expensive lidar, Google also deployed a similarly expensive and sizable computing device inside this Prius. The core of it was the Xeon server-grade CPU processor from Intel and the FPGA chip from Altera. Among them, the Xeon processor mainly provided computing power, and the FPGA chip ran algorithms specifically written by Google for the autonomous driving project.It can be said that from the perspective of this wave of autonomous driving development, Intel was originally the core provider of underlying computing power. It had ample opportunities to enter this race and get a head start.

Regretfully, Intel at that time was not very interested in this project.

The reason being that, for Google, this was an exploratory project aimed at new business. Although Google was willing to fund the progress of these types of projects, its initial stages did not require a large fleet of vehicles. It achieved its initial operations by refitting just 7 cars, thereby, the demand for Xeon CPU wasn’t significant.

Given this context, for Intel at the time, the actual commercial value brought by Google’s autonomous driving project was not high, and the commercial landing prospect was not clear. Hence, there was no need to focus too much on it.

It’s important to note another key context: Intel’s attention at the time was already occupied by the PC market and the mobile market.

On the one hand, Intel had long dominated the field of PC processors, benefiting greatly but also heavily burdened by antitrust allegations from its competitors, leaving Intel weary.

On the other hand, from the perspective of exploring new markets, the market that Intel was really eyeing was the mobile market represented by the iPhone and smartphones. Intel hoped to bring its specially developed Atom low-power processor into the smartphone industry and, of course, hoped to enter the iPhone’s supply system in some way, to become a supplier for the iPhone.

So, in front of these major opportunities that were closer to commercial landing, the cooperation with Google on the autonomous driving project seemed irrelevant to Intel.

In October 2010, Google first publicly announced its autonomous driving project, eliciting attention and reports from well-known media such as The New York Times. Sebastian Thrun, the father of Google’s driverless cars, also clearly stated that these cars mainly used cameras, radars, and LiDAR to perceive traffic and used maps for navigation, all based on Google’s data centers because they can handle massive amounts of information collected by the vehicles.

At that time, Sebastian Thrun did not disclose: the Google data centers he mentioned were actually Intel Inside. Of course, Intel may not particularly care about it.

Back then, Intel could never have foreseen: the Google autonomous driving project driven by its own chips as the foundation of computing power not only drove the start-up frenzy aimed at L4 level for the whole autonomous driving several years later but also stirred Elon Musk’s ambition to realize autonomous driving based on active safety in Tesla in 2013.

So, if the Google autonomous driving project can be described as an anonymous lamp that lit the raging fire of the automobile industry embracing autonomous driving, then Intel could be considered as the wick that fueled this lamp.Unfortunately, despite such a significant opportunity, Intel missed the inception of this industry.

Looking back, in fact, just two months before Google announced its self-driving project, in August 2010, Intel had completed three major acquisitions, one of which was the purchase of Infineon’s baseband chip business for $1.4 billion.

This acquisition was enough to thrill Intel as it meant that it finally had a ticket into the mobile market and became a supplier to Apple (after all, Apple had always used baseband chips from Infineon from the first iPhone to the iPhone 4). For this acquisition, then-Intel CEO Paul Otellini said that he hoped to integrate 3G and LTE technologies into the chips to secure the company’s economic and market status.

Unfortunately, Intel was not lucky. As time proved, what seemed to be a rare acquisition project turned into a burden in Intel’s vast business system (Intel kept funding and promoting this unprofitable business, making it a major technological layout for Intel in the 5G field until it was acquired by Apple in 2019). However, it did exert some influence on Intel’s subsequent development in car intelligence, especially intelligent driving — this is another story.

In fact, even before this acquisition, Intel’s business had already extended to the real car market, especially in China.

The Abandoned In-Vehicle Infotainment System

In late December 2010, at the Guangzhou Auto Show, Geely Auto and China Unicom jointly launched the in-car 3G network service system, G-NetLink.

This system mainly provides vehicles with communication, multimedia, information, security, travel, and convenient in-car systems based on 3G wireless communication. It is based on the Linux operating system in software, and is also built with an 8G solid-state drive and 512 MB of memory and can be connected to a large-capacity storage device. In fact, it’s more like an in-car computer that can go online.

And the underlying system is the Intel Atom low-power processor.

It’s worth noting that under the backdrop of the mobile internet, connected cars became the first wave of the entire auto industry embracing intelligence. For Geely, cooperation with Intel was a key move to embrace the tech industry and impact the high-end auto market. For Intel, this cooperation was a result of its multi-faceted layout in in-car computers and infotainment systems.Indeed, since the launch of the Atom low-power processor in 2008, Intel has been looking for a landing scenario; beyond the smartphone business, Intel has targeted the infotainment scene based on automotive services and has begun to layout in many ways.

As early as March 2009, Intel, along with BMW, Delphi, General Motors, Peugeot Citroen, Visteon, and Wind River Systems, established the GENIVI organization. The purpose of this organization was to create an open shared platform for the in-vehicle information system through collaborative efforts. As the only chip supplier at the outset of the organization, the Intel Atom processor was considered the computational base of this platform.

Clearly, in this way, Intel, as a chip giant of its generation, hopes to replicate its dominant computational base status from the PC era in the automotive field—for this, it even acquired, at a price of $884 million, Wind River Systems, a company that specializes in creating embedded software systems for cars, wireless routers, and in-vehicle entertainment devices.

Intel’s efforts were not in vain, as by May 2009 it had reached a collaboration with Volkswagen to create a new generation of car infotainment systems, with a landing time of three years later.

Meanwhile, Intel was actively laying out the Chinese market.

For instance, in August 2009, it held the “IVI (In-Vehicle Infotainment) Forum” in conjunction with China Telecom and Blue Star Technology. This was an event that focused on in-vehicle infotainment systems, during which Blue Star Technology even released products based on the Intel Atom platform and Telecom’s 3G network.

With this, Blue Star Technology became Intel Atom’s first Chinese partner for pre-installations—not only that but Intel also chose Shenzhen Hezheng Auto Electronics as a partner based on the Atom processor for after-installs.

On April 13, 2010, at the Intel Developer Forum (IDF), through collaboration with Blue Star Technology, Zotye Auto released the world’s first IVI car based on Intel’s platform and named Zotye B11. This vehicle was also officially unveiled at that year’s Beijing Auto Show (however, this high-end vehicle did not achieve good sales in the end).

Later, Intel continued to layout in China along this business line. For example, at the end of 2010, based on Intel’s Atom chipset, Geely launched the car-mounted 3G network service system G-NetLink; the same year, Intel announced a partnership with Beijing Yantec Technology, to create an infotainment system for GAC’s vehicle models.

In the second half of 2011, Dongfeng Nissan launched the Sylphy 2.0L 3G Leading Edition, which uses the Intel Atom Z510P processor, built-in Intel GMA500 graphics card, and offers satellite navigation, audio and video entertainment, 3D Internet, and other functions— this was an important landing project of Intel’s infotainment system in the Chinese automotive market.

By 2012, Intel’s investment department had established a $100 million fund specifically for the automotive industry, named “Intel Capital Connected Car Fund”. The fund mainly invests in in-car infotainment systems and applications, advanced driving assistance systems, voice and gesture recognition, and eyeball tracking functions.

However, it was also in 2012 that Intel found that its plans to bring the Atom chip into more in-car infotainment systems were beginning to face formidable challenges.

On the one hand, after initiating the establishment of the GENIVI organization, although Intel hoped that this project would be based on the Atom processor, global automotive giants such as BMW, General Motors, Peugeot Citroen did not wish to replicate the dominant position that Intel and Microsoft had in the PC industry. Consequently, other chip manufacturers were introduced into the organization, particularly a group based on the ARM chip architecture.

On the other hand, even in the field of infotainment systems where Intel has been deeply involved, Intel has to face competition from other camps. As a matter of fact, under the general trend of smartphones and mobile internet, the connection between in-vehicle devices and smartphones is getting closer. Automotive electronic suppliers like Desay Auto Electronics started to make strategic arrangements on infotainment systems based on the ARM architecture, and infotainment systems based on Intel’s Atom platform did not have a major advantage in terms of entertainment performance, product experience, power consumption, and cost.

Eventually, although Intel had won many customers for a while, there were few who ultimately followed through.

It is worth mentioning that in June 2012, Tesla officially launched Model S, and apart from its performance in electric driving, the biggest highlight of this car was the control of various functions of the vehicle through a center console (based on Nvidia Tegra processor) similar to an iPad, including controlling air conditioning, multimedia entertainment, lighting, phones, heated seats, sunroof switch, checking vehicle condition, battery power, suspension adjustments, etc.

It can be said that compared to previous in-vehicle infotainment systems, this car brought a revolutionary breakthrough and disruptive change – and all the efforts that Intel had made in the field of in-vehicle infotainment systems had become futile under this disruptive change.

Exiting the Mobile Market, Betting on the Automotive Industry

On November 19, 2012, Intel officially announced that its current CEO at the time, 62-year-old Paul Otellini, would retire in May 2013; this was his own decision.

Although this decision sparked debate outside, it was not surprising given Intel’s financial performance. After all, looking at Intel’s annual financial report in 2012, Intel’s total revenue had declined, and the decrease in net profit was as high as 15%.The reason for this is undoubtedly the overall decline of the PC industry. However, viewed from another angle, the decline in Intel’s profits is also due to the fact that Otellini did not lead Intel to open up any new businesses that could significantly contribute to revenue and profits – particularly Intel’s missed opportunity in the smartphone and mobile business, which is considered a major mistake in Otellini’s career.

In fact, Intel’s business layout in the field of car infotainment systems has not made much progress commercially.

It is worth mentioning that in 2012, Otellini once stated that Intel would build a new automotive product development center in Germany. This development center is the newest member of Intel’s European laboratories and is the first R&D center established by Intel in the automotive industry.

In Otellini’s vision, this R&D center would allow Intel to install and test newly developed products on-site. Other research areas of the R&D center include advanced tools, satellite antennas, television technology, digital video, and GPS. He indicated that by expanding the scope of research, increasing investment, and building new research and development centers, Intel would deepen its understanding of the interaction between humans and cars.

This R&D center became an important legacy that Otellini left to Krzanich in the automotive field.

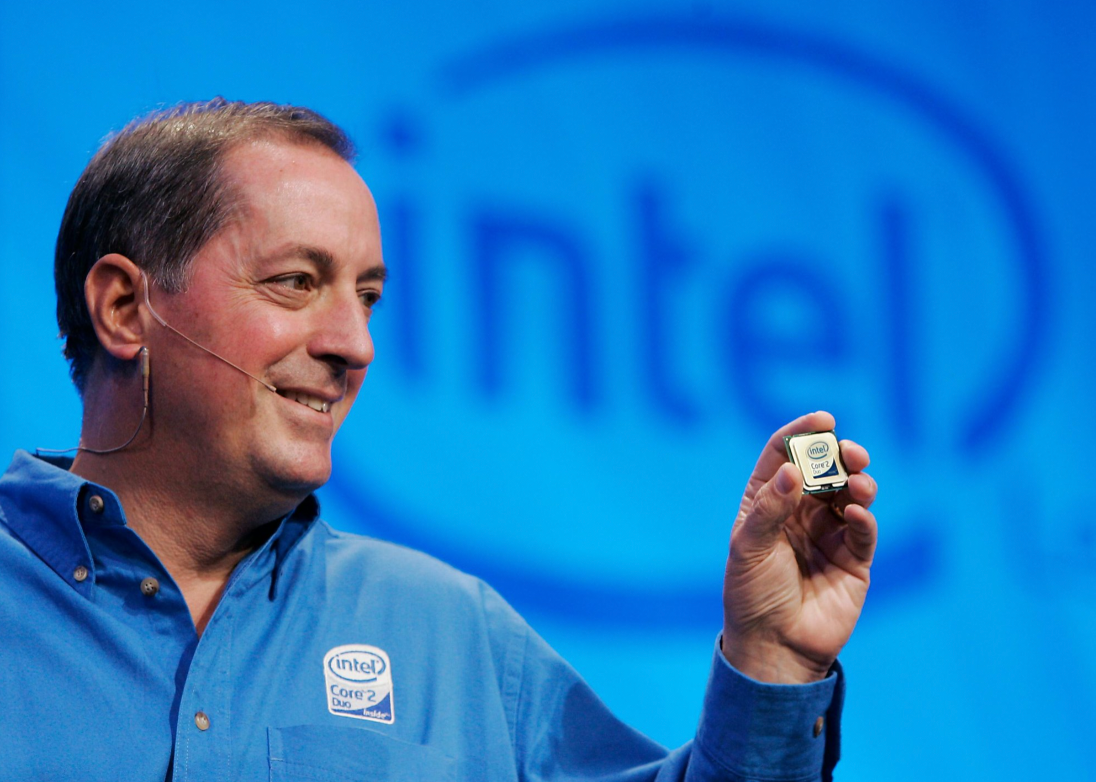

In May 2013, with Otellini’s official retirement, Intel welcomed a new CEO, Brain Krzanich.

Krzanich himself was a chip manufacturing engineer who had worked at Intel for several decades and later held management positions in the chip manufacturing department. Before being appointed as CEO of Intel, he was the COO of Intel, responsible for the company’s operations.

After taking office, Krzanich also focused on opening up new battlefields, only his focus remained on the mobile field, this time on the rapidly growing tablet market at the time.

From the second half of 2013, Intel began to break into the tablet market on a large scale through subsidies and low-cost strategies, and achieved the expected shipment target of more than 40 million units in 2014. However, this led to a huge loss for Intel’s mobile business department in 2014 – to the point where in 2015, Intel directly merged its mobile business with the PC department to cover up this financial figure.

So under these circumstances, Intel had already planned to exit the mobile market.

There is a big background here. Around 2015, with the explosion of artificial intelligence and Tesla’s foray into autonomous driving, the fields of artificial intelligence and autonomous driving also set off a wave of heat. Intelligence also sparked a wave of entrepreneurship in the automotive industry – under these circumstances, the automotive market, as one of the hot fields, re-entered Intel’s field of vision.

Interestingly, it was during the time Intel was aggressively laying out tablets that Intel also made some layouts in the field of automotive intelligence.For example, in May 2014, Intel’s Connected Car Fund invested in Japanese ZMP, a company specializing in autonomous driving technology. Intel tapped into the capabilities of ZMP, which included a smart automobile platform, assorted sensing systems, visualization and analysis, technical consulting, field testing, and connected car information systems.

Furthermore, since its establishment in Germany in 2012, Intel has chosen to collaborate with companies like Jaguar Land Rover and Toyota, jointly developing numerous new technologies including in-car infotainment systems, assisted driving, self-parking, and autonomous driving.

Through these partnerships, Intel has established a strong presence in the automobile industry. In a 2015 public event, the company stated that it had signed contracts with a number of car manufacturers. This includes renowned brands such as BMW, Daimler, Hyundai, Infiniti, Kia, Lexus, MINI, Rolls Royce, Toyota, and Tesla.

Notably, in May 2015, Intel announced the acquisition of programmable logic device manufacturer Altera for a staggering $16.7 billion, marking the largest acquisition in Intel’s history. The transaction was completed in December 2015.

The acquisition of Altera was significant for Intel in two ways: Altera’s FPGA chips were being used by many user data centers for acceleration, which offered a synergistic advantage for Intel’s data center business development. Plus, as part of Intel’s strategy, this acquisition led to the integration of Intel’s Atom processors with FPGA, producing chips that could be used in areas like car electronics systems. After purchasing these chips, customers can develop new features via programmable logic devices. This indicates that car-related business is a major consideration for Intel in this acquisition.

Interestingly, in its push to advance autonomous driving, Intel acquired a Russian computer vision company called Itseez which has developed software and services aimed towards driver-assist systems. Such technology is useful in alerting drivers of potential collisions, enhancing their ability to monitor their surroundings, and simplifying the driving process.

In April 2016, following the release of its first-quarter financial report, Intel announced layoffs for 12,000 employees globally. At this point, Intel formally withdrew from the mobile business, with autonomous driving emerging as the company’s new priority.

The $15.3 billion acquisition of Mobileye, taking a back seat.

On July 1, 2016, at the BMW headquarters in Munich, Germany, BMW, Intel, and Mobileye reached a collaboration agreement. The three parties planned to co-develop autonomous driving solutions and innovative systems, with the goal of mass-producing highly automated and fully autonomous vehicles by 2021.This time, CEO Krzanich personally attended the tripartite collaboration ceremony, emphasizing Intel’s steadfast commitment to autonomous driving.

Concerning this collaboration, Krzanich stressed the need for a robust and dependable electronic brain for autonomous vehicles and everything to which they connect – enabling the vehicle’s capacity for autonomous navigation and accident prevention. Intel can provide technologies encompassing in-vehicle computing, cloud-based systems, interconnectivity, security, and machine learning, thus manifesting a truly end-to-end solution.

In simpler terms, given Intel’s possession of Atom processors, 5G communication modules, software, machine learning, data centers, etc., these technologies can be instrumental in granting life to autonomous driving. As seen by Intel, everything is ready at hand – it just must be put to proper use.

To further showcase its commitment to autonomous driving, Intel has undergone a significant restructuring.

In November 2016, Intel established a dedicated division for autonomous driving, led by Doug Davis, who formerly managed Intel’s IoT branch and supervised its automobile-related projects.

Simultaneously, Intel recruited a seasoned executive from American automotive parts manufacturer Delphi, a concurrent collaborative partner in Intel’s autonomous driving research and development.

Furthermore, in the same month, CEO Krzanich made a special appearance at the Los Angeles Auto Show, revealing Intel’s plans to invest over $250 million in autonomous vehicles over the next two years. This investment will propel the technological advancements in interconnectivity, communication, content recognition, deep learning, and cybersecurity.

However, this $250 million investment may seem minute today.

In early January 2017, at the CES tradeshow, Intel took another significant leap in autonomous driving by announcing the Intel Go platform.

Specifically, the in-vehicle Intel Go autonomous driving platform is split into two variants, one powered by the Atom processor in conjunction with FPGA, the other by the high-performance Xeon processor paired with FPGA, executing autonomous functions such as perception, fusion, and decision-making.

Additionally, this solution includes the Intel Go Intelligent Driving 5G In-vehicle Communication Platform and Intel Go Intelligent Driving Software Development Kit. Consequently, in Intel’s perception, 5G is an integral component to achieving autonomous driving. At that time, Intel announced that hundreds of road-test autonomous vehicles were utilizing Intel’s technology.However, just two months after this plan was launched, Intel made a huge move: acquiring Mobileye for a whopping $15.3 billion.

At the time, although Mobileye was not small in terms of business scale, its revenue scale was not large, with total revenue in 2016 only reaching $350 million. But for Intel, which has a foundation in CPU, FPGA, 5G, and other businesses, the appeal of Mobileye was the fact that its products almost covered all mainstream car brands, with over 10 million cars equipped with Mobileye’s ADAS products. It also held a wealth of data and other quality assets.

The complementarity of the two businesses was indeed very high.

Regarding this acquisition, Yu Kai, founder of Horizon, stated: “This acquisition has provided Intel with a powerful computing platform and communication, composed of CPU + FPGA + EyeQ + 5G. It is a complete solution from perception to decision-making and communication, which has significantly improved Intel’s overall strength in autonomous driving. Intel effectively bought five years of time with this acquisition.”

Multiple industry insiders also stated: “For Intel, Mobileye is a rare ticket to enter the field of autonomous driving.”

It is important to note that according to a message released by Mobileye to its employees after being acquired by Intel, even though Intel wholly acquired Mobileye, in terms of actual business operations, it was Mobileye that integrated Intel’s autonomous driving department (including system engineers, vehicle R&D engineers, software engineers, simulators, map collection facilities, cloud computing and data centers), with Mobileye continuing to use Israel as its R&D headquarters.

At the same time, Mobileye’s business largely retained its independence, with Intel not intending to send people to participate in or interfere with Mobileye’s operations; during this acquisition, Intel acted more like a financial investor, spending 15.3 billion dollars and providing business resources.

Under these circumstances, Intel essentially gave up all its work in the field of autonomous driving and handed it over to Mobileye to handle—then sat back and waited for Mobileye to appreciate and yield returns.

Step by step, losing its presence in the automobile industry

To put it frankly, among Intel’s CEOs, Krai can be regarded as a very ambitious leader. He led Intel, a company nearly fifty-years old and heavily dependent on traditional PC business, continuously relying on its legacy, to strive towards the direction of AI, machine learning, and autonomous driving, and completed two significant acquisitions that caught the attention of the industry.

Among them, the acquisition of Mobileye was also a highlight of his career as Intel’s CEO.However, even with a certain strategic vision and business acumen, it’s challenging for Zaiqi Ke as a CEO to delve deeply into the autonomous driving industry which necessitates profound understanding, let alone considering issues of future business cooperation and product integration from a technical perspective after an acquisition.

In acquiring Mobileye, Intel, under his leadership, chose the most non-geeky, laid-back, and languid approach: giving money, giving people, then lounging.

In a sense, this is Intel’s disguised withdrawal from the automotive industry.

Another awkward point is, after acquiring Mobileye, Zaiqi Ke didn’t stay very long at Intel, and he was basically unable to effectively facilitate the integration of Mobileye business with Intel’s.

In June 2018, 10 months after Intel acquired Mobileye, Zaiqi Ke resigned from the company due to a scandal. Concurrently, Intel’s then CFO Bob Swan took over as Intel’s interim CEO, effective immediately.

In January 2019, seven months after serving as Intel’s interim CEO, Bob Swan officially assumed the position of Intel’s CEO. It is pertinent to mention that all Intel CEOs before Bob Swan had engineering experiences to varying degrees or technical backgrounds, while Bob Swan is the only Intel CEO with a financial background.

Being from a financial background implies that Bob Swan is more likely to view issues from a finance-oriented rather than tech-oriented perspective, which is a significant weak spot for a high-tech heavy company like Intel.

For instance, Marty Wolf, an analyst at Martinwolf, believes that though Bob Swan may be a good employee, what Intel needs is a strong technological leader; similarly, Wedbush tech industry analyst Joel Kulina also says that Intel has always needed individuals with a tech background who are good at execution.

Given this, Bob Swan has no motivation to promote the integration between Mobileye and Intel, and Mobileye remains an independent kingdom in terms of its business structure, other than being “An Intel Company”.

From assuming the role of Intel’s CEO in January 2019 to announcing a change in January 2021, Bob Swan has been notable for his ‘triple knives’ strategy during his tenure at Intel.The first blow came on April 16, 2019, the day Apple announced its settlement agreement with Qualcomm, Intel immediately declared its exit from the 5G smartphone modem business.

The second blow came in February 2020, where Intel announced its relinquishment of Nervana in favor of supporting its newly acquired Habana Labs products, causing quite a stir in the industry.

The third blow came in October 2020, Intel slashed its NAND flash business at a cost of 9 billion USD. Worth mentioning, in this deal, Intel also sold its NAND flash manufacturing plant located in Dalian, China, Intel’s only wafer factory in Asia.

Significantly, while Intel was ceaselessly cutting down businesses in search of a financial rebound, Tesla was vigorously driving the progress and breakthrough of intelligent driving technology, while NVIDIA was actively landing intelligent driving chip business in the Chinese market. Meanwhile, Mobileye remained focused on promoting its autonomous driving business at its own pace and modus operandi.

In just two short years, the competitive landscape of the industry had changed, with Intel’s ties to the automotive industry centralized under a relatively independent system led by its sub-company, Mobileye, leaving the parent company seemingly disconnected from the industry.

Thus, the Intel brand’s presence in the automobile industry gradually waned.

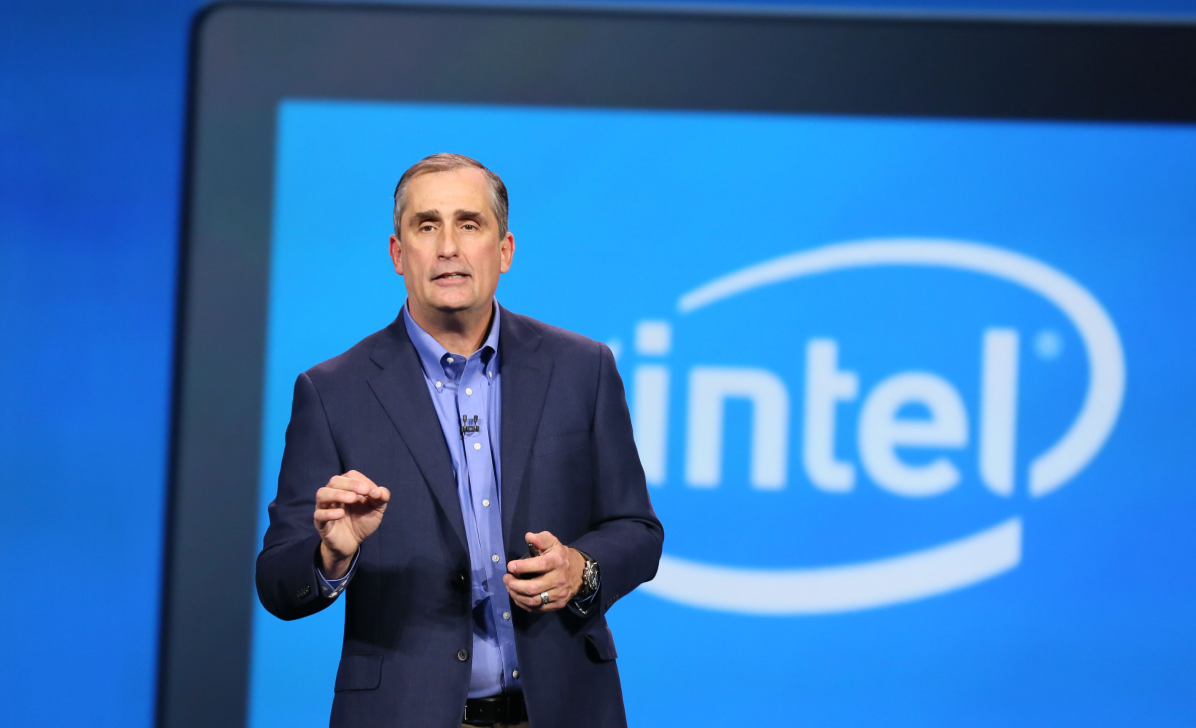

By February 2021, Intel welcomed its new CEO, Pat Gelsinger. He had a 30-year career at Intel and was the company’s first-ever CTO. With his technical abilities, leadership skills, and deep roots in Intel, Pat Gelsinger seemed to be a qualified candidate for CEO of Intel.

From Pat Gelsinger’s actions after assuming the role of Intel’s CEO, on one hand, he continued to encourage the relatively independent Mobileye to split from Intel’s financial system and gradually move towards going public. On the other hand, he began reconsidering leveraging the advantages of in-house chips to re-enter the automotive intelligence battlefield under the latest trend of AI technology development and industry competition.

Interestingly enough, just when Intel planned to revisit the automotive industry, the company collaborated with a recently established Chinese electric vehicle brand, ZEEKR.

In reality, the reason why Intel could establish contact with ZEEKR upon its re-entry into the automotive market was somewhat related to Mobileye.

As we learned from informed sources, after ZEEKR’s first model, ZEEKR 001, established a cooperation with Mobileye, Mobileye, impressed by the ZEEKR 001 and the ZEEKR brand, planned to invest in ZEEKR. For certain reasons, Intel Capital stepped in and invested in ZEEKR in August 2021.

In light of this investment relationship, in April 2023, Intel and ZEEKR announced a strategic partnership agreement. Both parties plan on exploring deep cooperation in areas like automotive hardware product development, smart in-car applications and solutions, as well as ecosystem construction. Currently, their collaboration in smart cockpit business has been further affirmed at CES 2024.

Returning to the automotive market, how long can it last this time?

Looking at Intel’s development in the automotive intelligence field over the past fifteen years, we find that before this comeback, Intel had great development opportunities and made some temporary achievements in this industry. They once held an undeniable industry position and committed significant investments in this field.

However, the ultimate impression left to the public is one of “constant change”.

On one hand, from a holistic strategic perspective, whether in the era of mobile or tablets or the domain of self-driving, Intel exhibits a severe path dependence. Instead of striving to take on an innovator role, it usually only mobilizes resources to follow up when a field becomes popular. This approach, while safe, often results in lost opportunities and inability to keep up with the pace of technological development.

On the other hand, in terms of specific business operations, Intel often exercises its capability to “print money”, constantly buying and buying major businesses available in the market. And some of these buys are indeed visionary. However, from the automotive industry’s perspective, after Intel acquires a new company, it often struggles to integrate their operations deeply, and it’s challenging to form new synergy.

Additionally, from an organizational standpoint, Intel, a tech giant established for decades, is no longer helmed by its founders but by professional managers. Top-level decisions are often made according to the board’s directions, rather than based on the leader’s business daring or gut feeling. Further, Intel changed its CEO four times in the past fifteen years. This change had a substantial negative impact on the continuity of Intel’s strategy and business.

Particularly within the automobile industry, a sector with longer cycles and inherently stable operations, such impact can be devastating.

Looking back at today’s leaders in the domain of smart automobiles, both NVIDIA and Tesla adhere to substantial long-term investments. They persistently cultivate their operations in a certain field, and don’t depend on their past businesses or standings, but trust their founders’ business instincts. They soldier on even while incurring losses, which enables them to persist and achieve today’s accomplishments.

In comparison, for Intel in the past 15 years, facing the turbulent development trend of the automotive intelligence industry, what they truly need is strategic perseverance.

It’s noteworthy that at the Intel’s automotive business launch event at CES 2024 on January 9, 2024, upon CEO Pat Gelsinger’s stage appearance, GM Jack Weast asked him the first question: How could the industry truly believe that Intel will persist in their commitment to the automobile business?In response to this, the gist of Pat Gelsinger’s reply was:

In actuality, upon my return to Intel in 2021, the company had already entered and exited the automotive market multiple times, so this is a question I had to answer. The automotive market is large enough, and by 2030, there will be several times more chip growth, Intel itself has the technical capabilities, as well as chip foundries… We indeed have ample opportunities and motivation to commit: we will invest in the automotive industry. Our customers can trust us, and we will be invested in this sector, not just today, but also for the coming decades.

At least from this content, it appears that Intel has already readied itself for long-term investment in the automotive market in the future.

However, Pat Gelsinger is now close to being 64 years old, which means that despite being an exceptional technical leader, it’s unlikely for him to helm the position of Intel CEO for a long period. If Intel wants to continuously accelerate its long-term strategy in the automotive industry over the coming decades, this chip giant must establish a strong consensus at the company culture and system level about this business’s long-term strategy.

Prior to this, a more pressing task for Intel in the automotive domain was to prove its technical capabilities, implementation capacity, and industry influence through its existing customer, ZEEKR’s mass-produced vehicle models – after all, time is running out for Intel.

This article is a translation by AI of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.