Thailand is swiftly becoming a hot destination for the overseas expansion of China’s new energy automobile industry.

On the one hand, in Thailand’s nascent pure-electric vehicle market, Chinese brands have taken a leading position, capturing the market through early entry and securing dominance in terms of total volume. On the other hand, at the industrial chain level, Chinese new energy vehicle manufacturers and power battery manufacturers have also started a wave of investments in local factories in Thailand.

So, the question arises, why Thailand?

Chinese New Energy Auto Enterprises Eye Thailand Market

Thailand’s current new energy vehicle market is still in its exploratory stage, and the growth potential is immense.

Electric Vehicles Stirring Up Thailand’s Auto Market

In recent years, the rapid growth of pure electric vehicles has brought new variables to Thailand’s car market.

As for the volume, the Thailand Automotive Institute reports that the total car sales in Thailand for 2022 stood at 840,000 units, a 12% year-on-year growth compared to 2021 – before the pandemic, in 2018 and 2019, the annual car sales in Thailand exceeded 1 million units. With the end of the pandemic, Thailand’s car market is expected to achieve a sales target of 950,000 units in 2023.

Looking at the distribution of vehicle types, two models sell best in the Thai market: firstly, pickup trucks, which dominate the Thai market as the mainstream choice, are popular among Thai workers, farmers, small traders, and small and medium enterprises; secondly, A0 class small passenger cars meet the Thai familial preference for each person owning a small car.

Against this backdrop, new energy vehicles represented by pure electric cars, though still a small share of the market, have shown strong growth momentum over the past two years.

Data from the Thailand Automobile Association show that in 2021, the sales of pure electric cars in Thailand were less than 2,000 units; in 2022, they reached 13,454 units, a year-on-year increase of 588.5%. Furthermore, the Krungsri Research Centre in Thailand predicts that in 2023, Thai pure electric car sales will exceed the 50,000 units mark – meaning that the market could see growth of 271.6% this year.

As can be seen, while the penetration rate of electric cars in Thailand remains very low, the market is currently in a critical period of explosive growth.

In fact, the growth trend in Thailand’s pure electric car market closely corresponds with the Thai government’s policy incentives.

Understood that the Thai government launched a car consumption stimulus policy in February 2022 – according to which, import tariffs on electric vehicles were reduced for the period 2022-2023. This policy aimed to encourage electric vehicle imports while reducing their market price.Moreover, from 2022 to 2025, the Thai government has reduced the VAT rate (from 8% to 2%) and provided a subsidy of up to 150,000 baht (about RMB 30,000) per electric vehicle that costs no more than 2 million baht.

Obviously, under such tariff and consumer stimulation policies, the enthusiasm of Thai consumers to buy pure electric vehicles has been mobilized, and a small-scale explosion in the Thai electric vehicle market is entirely foreseeable.

Why Chinese NEV Manufacturers?

It’s worth noting that Chinese brands dominate today’s pure electric vehicle market in Thailand.

According to the Thailand Autolife’s statistics of the electric vehicle sales list from January to June 2023, the market share of the top two models, BYD Atto 3 and HOZON V, is over 50%. Not only that, among the top ten in sales, except for Tesla’s Model Y and Model 3 (which are also imported from China and are Made in China), the rest are all from Chinese electric vehicle brands, accounting for about 80% of the market share.

Interestingly, according to the Thailand Open Thai Research Center, the Chinese brand’s share of the Thai pure electric vehicle market reached 78% in 2022, and this percentage could reach 85% in 2023.

So why can Chinese brands grab such a high market share?

One key reason is that these companies have already launched electric vehicle products suitable for the Thai market and have caught up with the policy dividend period. For example, MG launched its pure electric model MG ZS EV in Thailand as early as 2019, achieving localized production and sales, and the ORA Good Cat under the umbrella of Great Wall Automobile has also been on sale in Thailand for a long time; BYD and HOZON entered the Thai market through import channels, but can also benefit from the Thai government’s tax reduction and subsidy policies.

It is understood that following the introduction of Thailand’s electric vehicle subsidy policy, the Chinese electric vehicle companies that can currently receive the national supplement in Thailand are CCAG, GreatWall Automobile, BYD and HOZON.

On the one hand, this market share also owes much to these Chinese auto companies’ insight into local people’s needs.

Specifically, subject to income constraints (the average monthly income of Thai residents is 2,700 yuan), the most popular models in the Thai local market are low-cost, cost-effective entry-level small cars—targeting this characteristic, MG and HOZON have launched entry-level SUVs in Thailand, while Great Wall Automobile and BYD have adopted measures such as price cuts or the introduction of low-end versions after the launch of pure electric models, thereby enhancing their appeal to Thai consumers.

In addition, Chinese auto companies have also localized for the Thai market. For instance, MG has introduced a voice recognition and control solution for Thai language, which has been welcomed by Thai consumers; BYD has launched a new color scheme that locals like for the Thai market; HOZON has set up dozens of authorized dealers in Thailand, covering areas from Bangkok and its surroundings to major cities in Thailand……

It’s worth noting that, in the era of fuel vehicles, the Thai passenger car market has always been a primary battleground for Japanese brands. However, with the advent of the new energy era, the slow transition of Japanese automakers in the new energy domain, especially in electric vehicles, has prevented them from fully capitalizing on these policy benefits. Instead, Chinese automakers, who have made considerable arrangements in the new energy field, are starting to make a breakthrough in the Thai pure electric vehicle market.

According to Hajime Yamamoto, head of the Thai consulting department at Nomura Securities Research Institute, Chinese brands could take away at least 15 percentage points of Thai market share from Japanese hands in the next decade by introducing affordable electric vehicles.

Involvement in the Layout of Thailand’s Charging Infrastructure

As is known, in order to promote the development of the domestic electric vehicle industry and its acceptance by consumers, the Thai government has put a lot of effort into the construction of charging infrastructure.

In 2021, Thailand’s National Next Generation Automobile Committee approved investment incentives for EV charging and battery swapping businesses, aiming to install at least 12,000 charging stations and 1,450 battery swapping stations across Thailand by 2030.

As of the end of December 2022, according to data from the Thai Electric Vehicle Association, Thailand has a total of 3,739 public charging stations open to the outside world. Among them, there are 2,404 slow-charging (AC) stations and 1,342 rapid-charging (DC) stations. More than half of these charging stations are slow chargers, which greatly affect the efficiency of re-energizing. Additionally, Thailand’s fast chargers use either the Japanese standard DC CHAdeMO interface or the European standard DC CSS2 interface.

Currently, Thailand’s existing charging infrastructure undoubtedly provides good support for the existing market growth, but it is still insufficient to meet the rapidly growing demand for electric vehicles in Thailand.

At present, the car-to-station ratio in Thailand is approximately 20:1. That is, on average, 20 electric vehicles have to share one charging station. In contrast, the car-to-station ratio in China is 2.5:1. Thanks to rapid deployment over the past few years, the number has increased significantly. However, there is still a problem of uneven distribution across different regions. Charging stations are much more concentrated in the Yangtze River Delta region than in central and western regions—Thailand faces a similar problem, with the majority of charging stations concentrated in the capital, Bangkok.

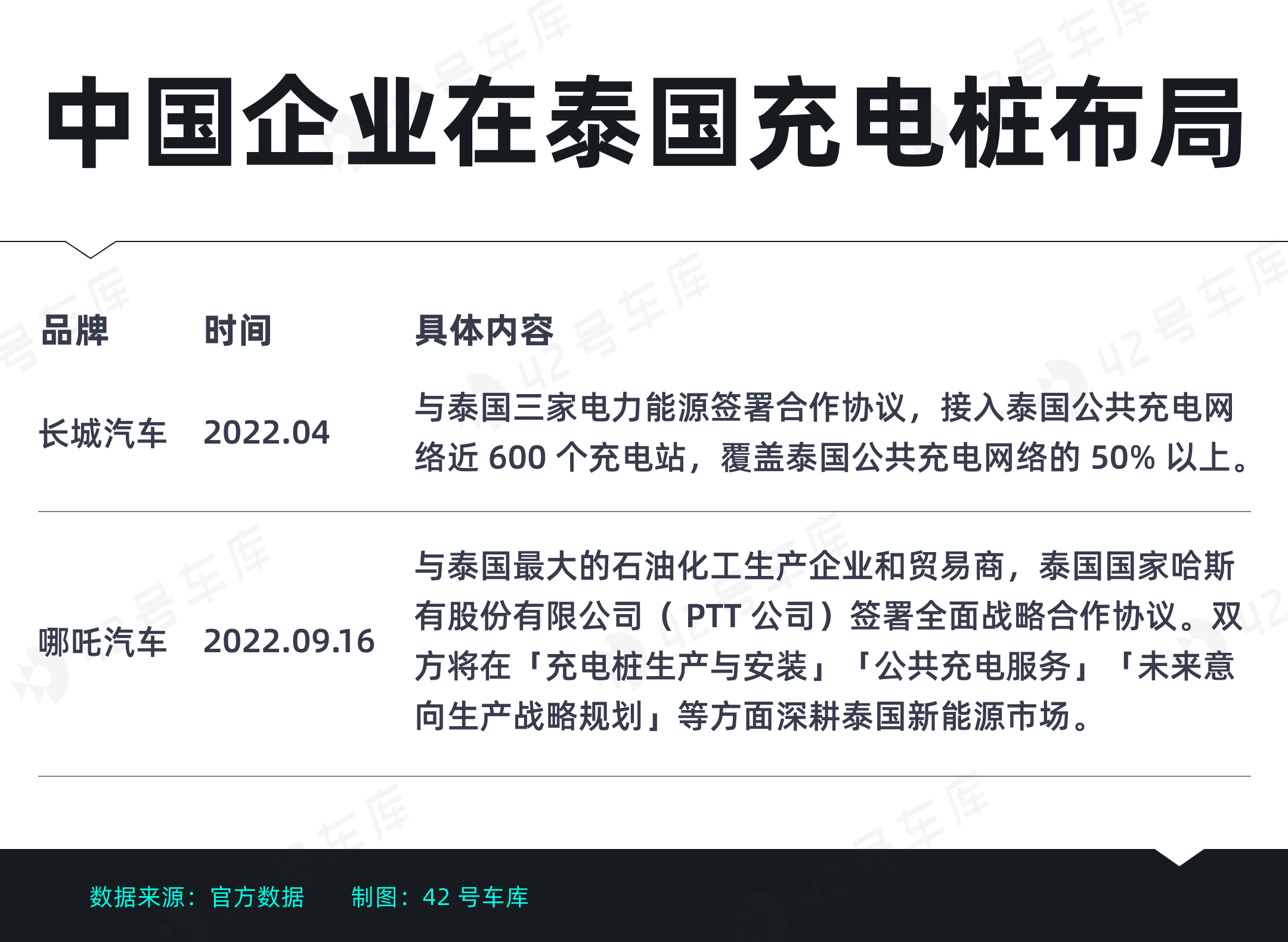

To address the shortage of charging stations, Chinese companies have already begun to deploy in Thailand.

Take for example, the Thai factory of Great Wall Automobile signed a cooperation agreement with three Thai power energy companies in 2022 to join the Thai public charging network. The first ‘photo-storage-charge integrated’ super charging station is now in operation in Thailand. The constructed charging stations can cover more than 50% of the Thai public charging network.

On another note, at the 19th China-ASEAN Expo, HOZON teamed up with Thailand’s largest petrochemical producer and trader, PTT Company, to sign a comprehensive strategic cooperation agreement. The two parties will delve into the Thai new energy market in terms of ‘charging station production and installation’, ‘public charging services’ and ‘future strategic production planning’.

As reported, according to the government’s plan announced by Thailand, it aims to accomplish the construction of 12,000 public fast-charging stations by 2030. Current circumstances suggest a massive growth potential within the sector.

Why has the Chinese New Energy Vehicle industry taken root in Thailand?

As Chinese automakers are quickly claiming the market share in Thailand’s Electric Vehicle (EV) industry, the Chinese New Energy Vehicle industry is also creating a trend of setting up its infrastructure in Thailand. It’s not just the automakers, but also the core suppliers such as power battery manufacturers.

Automakers are rushing to invest and set up plants in Thailand

Given the current state of affairs, Chinese New Energy Vehicle manufacturers have started a trend of building assembly plants in Thailand.

Among those who initiated the early setup are SAIC Motor and Great Wall Automobile, who already had presence in the Thai market.

In fact, a decade ago, SAIC had already laid out its strategy in Thailand by manufacturing MG vehicles in its Thai assembly plant and marketed them in other regions. In 2019, in alignment with SAIC’s transition to new energy, MG launched its first EV model, MG ZS EV, in Thailand, followed by the release of models like MG EP and MG 4 Electric.

Notably, at the end of April 2023, SAIC announced the launch of the SAIC CP New Energy Industrial Park project in Thailand. Spread over 120,000 square meters, the industrial park includes standard factory buildings, logistics warehouses, container yards, power station rooms, as well as roads, lighting, drainage, car parks, etc. It aims to initiate local production of key EV components, with the first phase of the park expected to be completed and put into use by October this year.

Next, let’s look at Great Wall Automobile.

Being one of the first EV manufacturers to enter the Thai market, Great Wall Automobile acquired General Motors’ Rayong plant in Thailand in 2020, invested THB22.6 billion (about CNY 4.72 billion) for refurbishment, and started production in June 2021. The new factory can produce hybrid, plug-in hybrid, and pure electric vehicles simultaneously with traditional fuel vehicles. It has an annual capacity of 80,000 vehicles, 60% of which are new vehicles sold locally in Thailand, and 40% are sold to other overseas areas.

Since 2022, a wave of Chinese automakers who had not previously set up factories in Thailand have begun to flock to Thai land to set up plants.

For instance, in September 2022, only a month after entering the Thai market, BYD announced that it had signed an agreement with Thailand’s WHA Industrial Park to fully invest in building its first overseas passenger vehicle factory in Thailand. With an annual capacity of about 150,000 vehicles and an investment reaching THB 17.9 billion (about CNY 3.74 billion), the vehicles produced will be sold to Thailand’s local market, as well as neighboring ASEAN countries and other regions. In March of the same year, the factory officially broke ground and is expected to start production in 2024.Thus, BYD becomes the third Chinese automotive brand to invest in factories in Thailand.

Besides BYD, a wave of Chinese auto companies have also announced their plans to set up factories in Thailand in 2023, specifically as follows:

- As the first newcomer to settle in Thailand, HOZON’s HOZON brand announced in March 2023 the foundation of its Thailand Eco-Smart Factory in Bangkok. This factory is HOZON’s first overseas factory, and also the first Thai factory of China’s new forces in car manufacturing, with a capacity of about 20,000 vehicles, and is expected to be put into operation at the end of January 2024. It is a significant manufacturing base for HOZON to make right-hand drive electric vehicles and export to ASEAN.

- At the end of March, AION submitted an investment intention letter to Thailand, planning to invest 6.4 billion baht (approximately 1.34 billion yuan) to build an electric vehicle factory. AION will also set up its Southeast Asia headquarters in Thailand this year, and actively prepare for localization production in Thailand, marking the start of its brand internationalization.

- In April this year, the Thailand Investment Promotion Committee confirmed that CCAG would invest 9.8 billion baht (approximately 2.05 billion yuan) to set up a factory in Thailand to create a global right-hand drive car production base. It plans to start production in 2024, with an initial capacity of 100,000 vehicles and doubling the capacity in the second phase.

Moreover, in July, at the China-ASEAN Emerging Industry Forum, Chery announced its plans to establish a factory in Thailand. Additionally, rumors abounded that Geely was in talks to enter the Thai electric vehicle market.

Overall, Chinese auto manufacturers are investing in factories in Thailand, not only to enter the local new energy consumer market, but also to radiate to Southeast Asia and other overseas markets, which complies with Thailand government’s plan to make Thailand a regional new energy vehicle manufacturing and export center.

Accumulation of Industry and Policy Support

So, why are Chinese automotive companies choosing to set up new energy layouts in Thailand?

On the one hand, it is closely related to the automotive industry environment in Thailand.

For a long time, Thailand has been known as the ‘Detroit of Asia’. From the 1960s to the early 21st century, through a series of industrial policy adjustments, the Thai government attracted many multinational automotive companies, gradually forming a more complete automotive supply chain and gradually developing into one of the automotive manufacturing centers of Southeast Asia. This has allowed Thailand to accumulate ample production technology and labor base in the automotive industry.

Meanwhile, as the largest automotive manufacturer in Southeast Asia, Thailand has more than 60 years of vehicle assembly and manufacturing capabilities, with an average annual vehicle production capacity of nearly 2 million vehicles, accounting for about half of the entire Southeast Asian automobile market.

It is worth noting that among all the production, Thailand’s domestic sales volume is as high as 849,000 vehicles, but it is still dominated by traditional fuel vehicles. Amongst them, pickups account for 54% of the share, a total of 455,000 vehicles, followed by passenger cars with a share of 41% and other commercial models of 5%. Pure electric vehicles hardly penetrate the Thai market, and its production capacity is still in preliminary demand stage.Hence, be it in terms of production or sales volume, to new energy automobile companies battling it out in China, Thailand undoubtedly represents a “blue ocean.”

On one hand, the Thai automotive industry has an extremely strong export radiating effect.

Indeed, Thailand is not only a country of automobile production and consumption, but also ASEAN’s largest automobile exporter, with exports making up over 50% of the country’s total automobile production, resonating with the entire Southeast Asian region and even a broader market. Besides the Thai market, there are right-hand vehicle markets among the ten ASEAN countries such as Singapore, Malaysia, Indonesia, and Brunei, as well as potential markets in Europe, America, and Australia.

In essence, Chinese car companies often choose Thailand as a key stronghold for advancing into Southeast Asia and other overseas markets.

In such an industrial and market context, support from the Thai government in terms of new energy automotive policy is indisputably a key allure for Chinese car companies.

Specifically, the Thai government aims to transform Thailand into ASEAN’s largest electric vehicle (EV) production base, launching the ’30@30′ policy to attain the goal of having 30% EVs in national automobile production by 2030. In line with this goal, the Thai government has initiated a series of favorable policies. For instance:

- Starting from September 2022, the Thai government has implemented an EV subsidy plan to foster its popularity. Firstly, each qualifying electric vehicle can receive a subsidy of 70,000 to 150,000 Thai baht, approximately RMB 14,000 to 30,000.

- Secondly, tax breaks are offered in areas like consumption tax, road tax, and import tariff reductions. For example, new energy vehicles can enjoy a 2% preferential tax rate, while traditional vehicles have an 8% consumption tax rate; from 2022 to 2023, new energy vehicles imported into Thailand can enjoy up to a 40% reduction in import tax.

- Lastly, companies that invest at least 5 billion Thai baht (about RMB 1.04 billion) in EV production can enjoy a 20% corporate tax exemption for 3 to 8 years. Pure electric vehicle manufacturers are exempted from corporate income tax for up to eight years, while plug-in hybrid projects can enjoy a three-year corporate income tax exemption. Until the end of 2025, import tariffs on key parts such as batteries and motors will be waived and subsidies for electricity costs paid by vehicle manufacturers are assured.

Of course, these incentives are not without prerequisites. To enjoy them, manufacturers must construct pure-electric factories in Thailand, and before the end of 2025, they must produce an equal number of pure-electric vehicles in Thailand as those imported.

Therefore, the entrance of Chinese new energy automobile enterprises into Thailand is indeed the result of mutual needs.

Not only vehicle factories, but also layout for power batteries

Besides vehicle factories, the Thai government is also pushing the upper stream supply chain of the new energy vehicle industry, especially power battery production, a central component of EVs – and this represents opportunities for Chinese power battery manufacturers as well.

Former Secretary-General of the Thai Board of Investment, Duangjai Asawachintachit, has previously stated:Over the past three years, measures taken by Thailand to promote investments in electric vehicles have yielded significant results. Through improved incentives for battery production, we hope to further strengthen the supply chain, a crucial factor in industry transformation.

According to the government’s newly revised incentive policy, existing and new projects that produce electric vehicle batteries (from cells to modules) using advanced technology, as well as those producing high-energy-density batteries, will enjoy a 90% reduction in import tariffs on raw materials and basic materials for 5 years if their products are sold domestically.

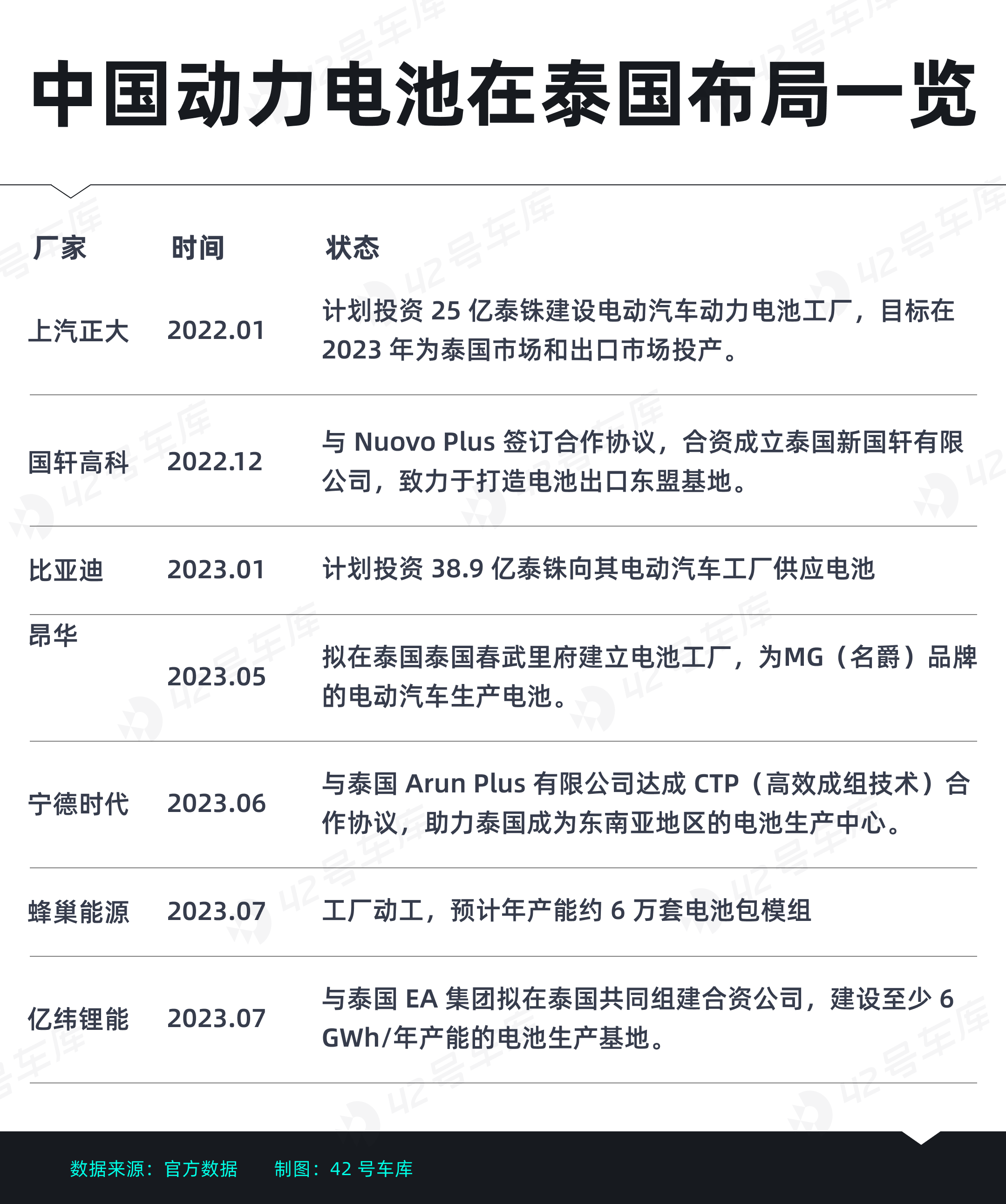

Guided by Thai policy, Chinese companies are beginning to establish their presence in Thailand’s new energy vehicle industry, particularly in the battery segment. In fact, companies such as CATL, BYD, Guoxuan Hi-Tech and Honeycomb Energy that are involved in batteries and raw materials all have relevant investments and collaborations in Thailand.

Here are some specific examples:

- In December 2022, Guoxuan Hi-tech signed a cooperation agreement with Nuovo Plus, an energy solutions company under the PTT Group of Thailand. The two parties jointly established a new Guoxuan company in Thailand to localize battery production and market development, while also actively exploring the new energy market in ASEAN, striving to become a hub for battery exports.

- In January 2023, BYD’s power battery factory project in Thailand was approved by the Thai Investment Committee. The company is planning an investment of THB 38.9 billion (approximately CNY 810 million) to supply batteries to its electric vehicle factory.

- Honeycomb Energy’s Thai factory, which covers 18,000 square meters, also began construction in July, and is expected to be operational by early 2024, with an annual capacity of approximately 60,000 battery pack modules, and an annual output value of about USD 140 million.

- EVE Energy recently announced its plans to form a joint venture with Thai EA Group to build a battery production base with an annual capacity of at least 6 GWh.

Notably, CATL, the world’s largest power battery manufacturer, had recently announced a collaboration with Arun Plus Co. Ltd., to meet local EV production demands and help Thailand become a hub in Southeast Asia for battery production. As per the agreement, CATL will provide a CTP (Cell-to-Pack) battery production line to Arun Plus, while also sharing the relevant technology.

Apart from addressing local market requirements in Thailand, CATL is also leveraging Thailand as a springboard to cover the broader Southeast Asian market with its battery technology and products.

Secretary-General of the Thai Board of Investment, Narit Therdsteerasukdi, also said:

We are in talks with many companies, not just CATL, but also many other companies in the battery sector. This is one of our goals, and we hope to attract battery manufacturers to establish factories in Thailand.## III. Conclusion

Nowadays, given the highly competitive and oversupplied atmosphere of the new energy vehicle industry in China, going global has become an important way for the industry to seek larger market and landing opportunities. The Southeast Asia, with a population of over 700 million, is considered as one of the crucial overseas markets.

Though this context, Thailand seems like a great choice.

After all, as a major automobile manufacturing center in Southeast Asia, Thailand is arguably the most proactive country in the region in pursuing electric vehicle transition. It not simply embraces new energy vehicles, represented by pure electric ones, at the domestic market level but also elevates the electrification transition to strategic importance across the upstream and downstream sectors of the industrial chain, aggressively driven by supportive government policies.

Meanwhile, under the “Belt and Road” Initiative and the advancement of the “China-ASEAN” comprehensive strategic partnership, economic and trade relations with Southeast Asia have grown even deeper. The ties between China and Thailand, in terms of trade interaction and cultural exchange, have been very positive.

Therefore, considering the manageable geopolitical risk, relatively favorable investment policies, the lack of strong local competitors in the new energy vehicle industry in Thailand, as well as the evident competitive advantages of Chinese new energy companies in product strength, manufacturing technology, and industry chains, there exists a mutual attraction for both parties who could easily form a win-win partnership.

At present, Thailand has made a strategic plan known as “30@30”, aiming to achieve 30% of its car production as zero-emission vehicles (mainly pure electric vehicles) by 2030, implying an annual production of 40 GWh batteries to power 725,000 pure electric vehicles.

The goal still seems afar — but it is certain that along the way to achieve this goal, the bustling figure of Chinese enterprises will be ubiquitous in Thailand’s new energy vehicle industry.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.