Translate the following Chinese Markdown text into English Markdown text in a professional manner. Retain the HTML tags within the Markdown and only output the result.

Author: Tao Yanyan

Editor’s note: Based on 2022 data, we have selected ten power battery companies to look forward to future development. Foreign: LG, SK on, Samsung SDI, Panasonic; Domestic: CATL, FARADY Battery, Domestic Second-tier Battery Companies (Overview).

In the power battery circle, Chongqing CALB is a unique company that has endured the longest patent battle with Ningde Times. The patents are also the reason for Chongqing CALB’s success in the Hong Kong stock market. Looking at the financial reports:

◎ In 2022, Chongqing CALB achieved a revenue of 20.375 billion RMB, a YoY increase of 198.9%; net profit of 694 million RMB, a YoY increase of 521.8%.

◎ The power battery sector is the company’s main business, with sales revenue growing from 6.065 billion RMB in 2021 to 18.324 billion RMB in 2022, a YoY increase of 202.1%.

◎ Revenue from energy storage system products and others grew from 752 million RMB in 2021 to 2.051 billion RMB in 2022, a YoY increase of 172.8%.

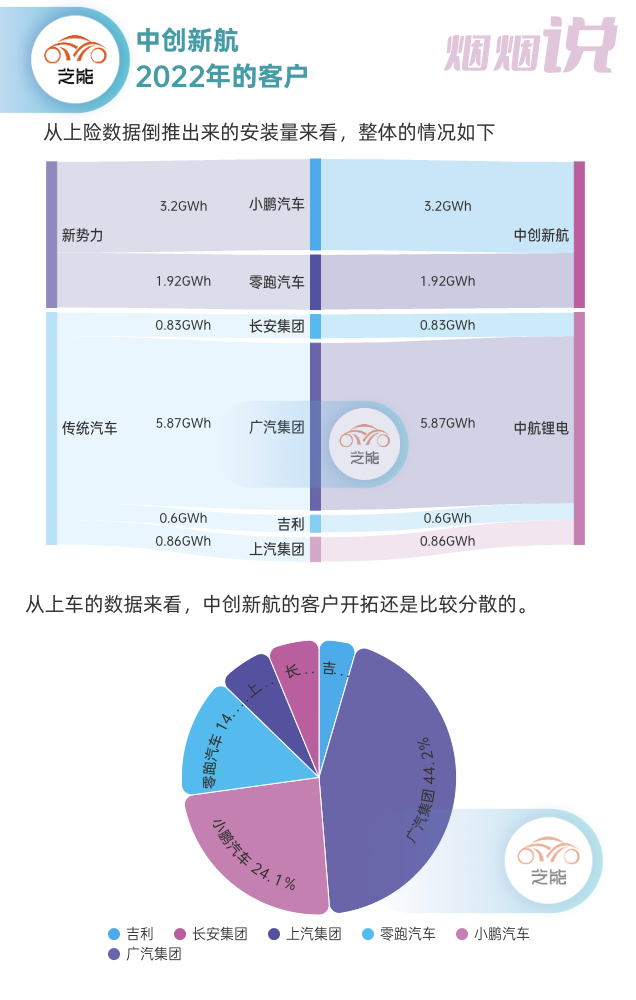

Chongqing CALB’s Clients

From 2019 to 2022, Chongqing CALB’s sales revenue has been growing along with the increasing demand for power batteries in China, which has also led to the rise in the company’s gross margin and gross profit. In terms of product-based revenue, the rapid growth in the passenger vehicle and commercial vehicle sectors has allowed the company to successfully position itself in the PHEV/REEV market, treating the hybrid market as a fast-growing segment.

Domestically, the company continues to maintain in-depth strategic cooperation with automakers such as GAC, Xpeng, Changan, Geely, and Leap Motor, and has added new fixed partnerships with NIO, Dongfeng, FAW, and other automakers. They have also begun mass production and delivery to clients such as Smart and Honda.Judging from the data, in 2022 GAC accounts for about 40%, XPeng for about 20%, and the overall customer base for expansion is relatively reliable.

In terms of energy storage system products, the revenue increased from CNY 752 million in 2021 to CNY 2,051 million in 2022, a year-on-year increase of 172.8%. Important plans have been made in industrial and commercial energy storage and residential energy storage sub-markets. Currently, the product introduction includes long-life lithium iron phosphate energy storage batteries, designed for energy storage applications, featuring long life, high efficiency, and high safety, applicable for various energy storage products and solutions, and the competition in energy storage is quite intense.

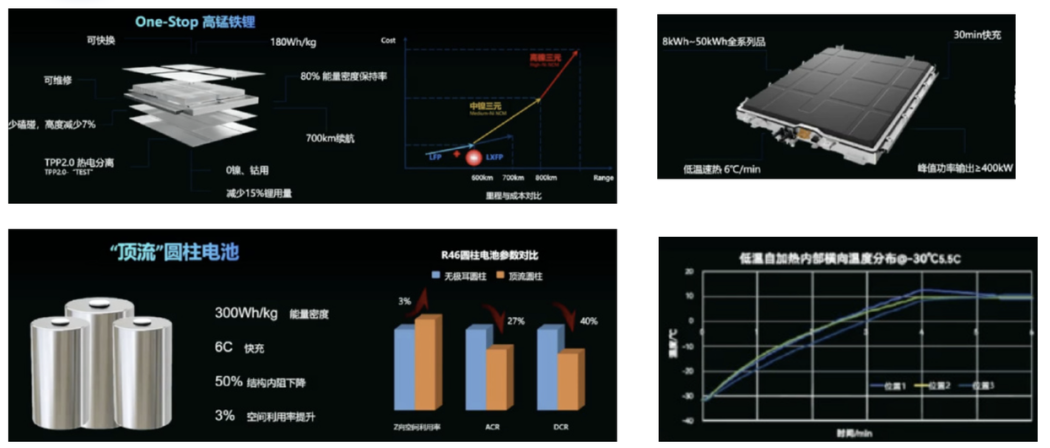

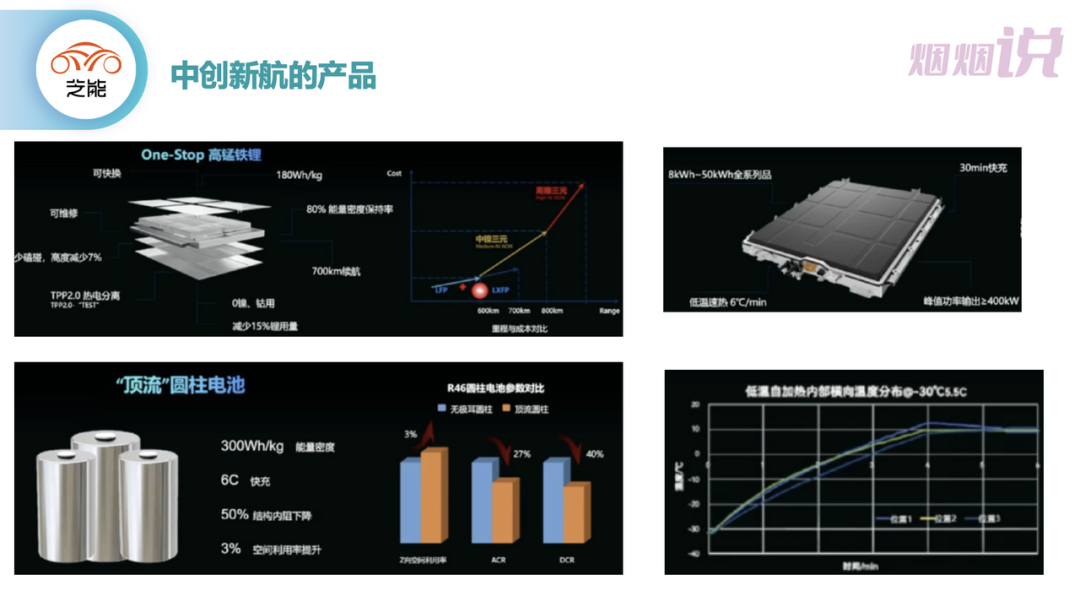

Product Portfolio of Innovusion

As for products, currently, the ternary batteries mainly include:

◎400V 2C Medium Nickel Battery: 100kWh version, 20%-80% charging time of 18 minutes, 50% shorter charging time than the previous generation;

◎800V 4C Medium Nickel Battery: 20%-80% charging time of just 10 minutes, this product may also be developed around a prismatic cell.

These two products are still centered around the existing prismatic cell system.

◎800V 6C High Nickel Battery: This is the top-tier large cylindrical battery later promoted, with an energy density of up to 300Wh/kg, supporting charging to 80% in 8 minutes; through structural innovation, the internal resistance drops by 50%, and the space utilization rate increases by 3%; of course, with integrated cell terminals connected to the top busbar structure, further assessment is needed.

There’s also a more specialized high-nickel multi-element battery with an energy density of up to 350Wh/kg, although it is unclear how practical it is.

Lithium iron phosphate batteries include:◎High-Power Lithium Iron Phosphate Battery: This battery features high power output and all-weather adaptability, providing reliable performance in low-temperature environments. It was developed for the passenger vehicle hybrid market and has been adopted by several automakers for their hybrid models, although it is uncertain whether it is used in HEVs or PHEVs. The probability of being utilized in PHEVs is quite high based on current information. There is considerable demand for this type of battery in the automotive industry.

There are two types of short-blade batteries in this category, which are achieved through lithium iron phosphate and lithium manganese iron supply. At this point, many companies have taken a completely different route from Ning Wang.

◎One-Stop Lithium Iron Phosphate Battery: Similar to short-blade batteries, this battery combines high energy, high strength, and high power. It offers an energy density of 152Wh/kg, supports a driving range of over 600 kilometers, and is suitable for various vehicle types, including sedans, SUVs, and trucks.

◎One-Stop High-Manganese Lithium Iron Battery: This battery uses a 0-nickel and 0-cobalt formula, reducing lithium usage by 15%, providing an energy density of 180Wh/kg, and supporting a driving range of over 700 kilometers.

Summary: In my understanding, if this wave of second-tier battery companies holds their ground, it will have a significant impact on China’s power battery landscape. China cannot return to a monopolistic structure, and second-tier battery companies are working hard to expand their customer channels. Battery innovation requires the collective effort of many entities, so do not underestimate the potential of young startups.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.