Translation into English Markdown

Author | Wang Lingfang

Editor | Qiu Kaijun

Since last year, there has been a trend of Chinese battery supply chain companies being listed on the Swiss Stock Exchange.

Currently, Chinese lithium battery industry chains such as XAircraft (300207), Gotion High-Tech (002074), CATL (002240), Shanshan Shares (600884), Amperex Technology (002709), Huayou Cobalt (603799) and other related enterprises have all been listed on the Swiss Exchange by issuing GDRs.

In addition to the above-mentioned companies, according to IFR and Bloomberg reports, the leader in the lithium battery industry, Contemporary Amperex Technology Co. Ltd. (CATL), is also considering issuing Global Depository Receipts (GDRs) in Switzerland, with the possibility of raising $5 billion to $6 billion in funds.

How did Switzerland become the preferred choice for Chinese battery companies to raise funds through listing? What are the advantages of overseas listing compared to other financing methods in China? What impact will overseas listing have on enterprises and the Chinese lithium industry chain?

Overseas Listing: Obtaining Funds and Influence

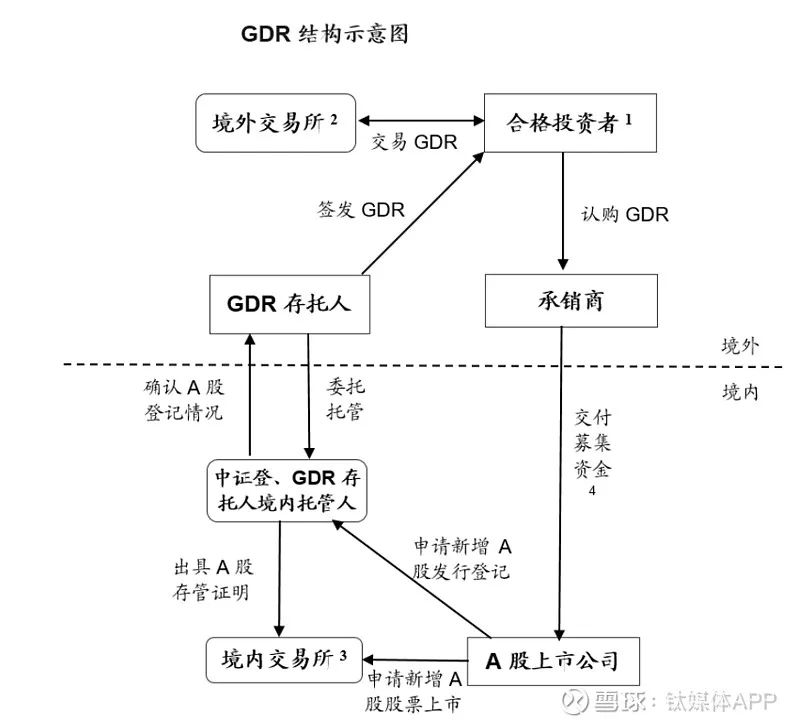

First, let’s talk about what GDRs are. Simply put, a GDR is a certificate that represents shares in a foreign company. This means that domestic listed companies do not need to issue stocks directly abroad. Through securities based on shares, overseas investors can enjoy the rights of “shareholders” in domestic listed companies, such as dividends, profits, and voting rights. The price of depositary receipts is linked to the A-share price and they both have an impact on each other.

According to Xian Yu, a consultant at the Gaopeng law firm, there are two main objectives of overseas listing for enterprises: firstly, to promote the company and improve its visibility; secondly, to help enterprises raise more funds and support their growth.

In Xian’s view, entering the international capital market is a form of promotion for companies within the international market. Overseas-listed enterprises recommend themselves to international investors through investment banks and securities firms, introducing high-quality global investors to the companies. Chinese enterprises can quickly access sufficient capital, experienced international investment institutions and investors, obtain substantial funds, and thus support the globalization of the company.

For example, XAircraft raised a total of approximately $440 million in funds through issuing GDRs, and Gotion High-Tech also successfully raised $685 million.

According to XAircraft’s announcement, the raised funds will be mainly used for global business development and international layout, research and development investment, and supplementary working capital.

Last year, XAircraft Holding’s subsidiary, XAircraft Automotive Battery, received a notification of appointment from Volkswagen concerning the HEV project battery pack system. XAircraft will provide power battery pack systems for Volkswagen’s HEV project as its mass production supplier.Country High-Tech Group stated in the announcement of GDR fundraising that it is to support the extensional growth of the company’s international business, further expand overseas business development, and optimize resource allocation.

According to Country High-Tech’s plan, they will increase the construction of power battery capacity and supporting industries in Europe, North America, and Asia. Last year, Country High-Tech announced that its first European battery production and operation base will be launched in Germany.

Of course, there are many domestic financing channels if it is only for financing, but the process will be very complicated if doing overseas investment. For example, it is necessary to go through the Overseas Direct Investment (ODI) process, which involves three departments including the Ministry of Commerce, the National Development and Reform Commission (NDRC), and the State Administration of Foreign Exchange (SAFE).

The Measures for the Administration of Overseas Investment of Enterprises (NDRC Order No.11) stipulates that for projects under record-filing management, if the investment subject is a centrally-administered enterprise (including a centrally-administered financial enterprise, or an enterprise directly managed by the State Council or its agencies), the filing authority is the NDRC; if the investment subject is a local enterprise and the investment amount by the Chinese side is USD 300 million or more, the filing authority is the NDRC; if the investment subject is a local enterprise and the investment amount by the Chinese side is less than USD 300 million, the filing authority is the development and reform department of the provincial government where the investment subject is registered.

As the head of the relevant department of a certain battery company said, “If the enterprise invests in building large-scale production capacity and completes this process, even the yellow flowers will have withered by the time the overseas plant is built.”

Shengxin Lithium Energy, which has no European business for the time being, also targeted the Swiss listing. Shengxin Lithium Energy stated in the announcement that they will use the raised funds for business development and strategic investments, enhance the company’s resource reserves, production capacity, and customer service capabilities, further deepen the company’s globalization layout, and supplement the company’s operation funds.

Shengxin Lithium Energy may be more interested in the endorsement function of overseas listing. In Xian Yu’s view, “with the rapid rise of China’s new energy industry, there may be some political frictions. If an enterprise has a certain international reputation and is recognized by overseas investors, it will bring greater space for the company’s layout and industrial chain development.”# Lithium batteries are in the stage of explosive growth. Competent battery companies hope to take this opportunity to grow into international giants. Overseas listing can effectively enhance the company’s visibility, raise ample funds, and simplify the investment process. There are many benefits.

Choosing Switzerland: Favorable policies, good industry matching

Actually, for Chinese companies, the United States is the best listing venue. The US stock market is the largest market in the world in terms of scale and liquidity, and listing in the US can have tremendous room for market cap growth, which is unmatched by any other stock market in the world.

However, in recent years, the US has become stricter on Chinese concept stocks, and the stock prices of some companies have been impacted. Some companies are even forced to delist.

Xian Yu believes that for Chinese companies, going public in Switzerland is a choice given the backdrop of increasing geopolitical tensions.

(1) Good industry matching

The average market value of the Swiss Exchange is the highest among the three major exchanges in Europe. Two-thirds of blue-chip companies in Europe are listed here, making Switzerland an attractive choice as a listing venue.

Xian Yu believes that when companies choose exchanges, they should first consider the matching of the industrial cluster effect. Switzerland is a relatively new GDR market, and “emerging industries and high-tech industries prefer to choose here, which is attractive to companies in the fields of new energy, equipment manufacturing, and healthcare,” for example.

The London Stock Exchange, on the other hand, is a mature GDR market, and London itself is an international financial center, so Chinese companies that have issued GDRs on the London Stock Exchange have mainly been in the financial and energy industries. Germany has advantages in enterprises related to Industry 4.0, and some companies that are more advanced in industrial manufacturing may focus on Germany for better matching”

“However, to issue GDRs in Frankfurt, there is currently a need for some infrastructure technology linking,” Xian Yu said. “It’s like buses currently waiting for stations.”

(2) Fast process, low cost

In terms of the approval process, the Swiss stock exchange is faster. Generally, it only takes 20 working days for the application materials to be reviewed by the exchange. Listed companies can complete overseas listing work between 3 and 4 months, reducing issuing costs.

In the London GDR project, “the UK Financial Conduct Authority conducts a relatively strict review of the prospectus, usually with three or four rounds of feedback, and it usually takes four to six months to complete a London GDR project.”

鲜瑜 gave an example – for instance, the Swiss Stock Exchange explicitly requires Chinese companies to issue GDRs, which can directly use Chinese accountants. If listed in the UK, the issuer’s auditor of GDRs must be registered with the Financial Reporting Council (FRC) before issuing the first annual report after GDRs being released on the market, and must comply with all kinds of requirements of FRC. The compliance obligations and costs of GDR issuers listed on the London Stock Exchange are higher than those of the Swiss Exchange.

(3) More relaxed than A-shares

Companies listed domestically can also raise funds by way of private placement and build factories overseas. Compared with domestic private placement financing, overseas listing regulations are more relaxed and financing is more convenient.

For this, Xian Yu cited”The size of arbitrage space depends on the price difference between GDR conversion price and A-share price, including factors such as exchange rate cost, conversion cost, fund cost, and subsequent stock price fluctuations,” said the analyst above. “If the price difference is large enough, and the exchange rate cost is suitable, the GDR conversion mechanism will cause some disturbances to the A-share prices of the company in the short-term, but in the long-term, the prices of both will tend to be the same.”

“In order to reduce the disturbance caused by concentrated GDR redemption on the stock market in the short term, the China Securities Regulatory Commission (CSRC) has formulated a series of restrictive measures, such as strict limitations on GDR prices, redemption time and quantity.”

Limiting price difference. According to Article 36 of the “Supervision Standards for the Business of Depositary Receipts Trading Connected with Domestic and Foreign Securities Exchanges,” the issue price of GDR should not be lower than 90% of the average closing price of the underlying stock of the last 20 trading days before the pricing date after being converted proportionally. That is, no less than 90% of the A-share market price.

It is worth noting that domestic price for additional issuance is limited to 80%. According to Article 36 of the “Management Measures for the Issuance of Securities by Listed Companies,” “the issuance price of non-publicly issued stocks by listed companies shall not be lower than 80% of the average price of the company’s stock price in the last 20 trading days before the pricing date.”

The CSRC is requiring stricter pricing rules to avoid any impact on domestic stock prices caused by discount issuance and expiration of GDR.

Limiting redemption period. The depositary receipts of listed companies issued overseas are not allowed to be converted into domestic basic stocks within 120 days from the date of listing. Depository receipts subscribed to by controlling shareholders, actual controllers, and enterprises they control of listed companies are not allowed to be transferred within 36 months from the date of listing. The time lag is used to absorb the price difference between GDR and A-share.

Limiting proportion. “The overall scale of GDR corresponds to a generally low percentage, around 10%, of the underlying A-share securities, so the pressure to sell is relatively limited.”

In the opinion of the above-mentioned analyst, the clear issuance limit and full consideration of time cost and uncertainty play an important role in stabilizing stock price fluctuations.

In addition to the short-term impact on domestic stock prices, GDR’s overseas listing is beneficial to a company’s development in the long-term, which would also force companies to improve in transparency and corporate governance.

The advantages of overseas listing for battery companies are numerous. It not only provides a convenient and efficient channel for obtaining funds, but also enhances their visibility and serves as endorsement for international development, thus improving their international competitiveness. The willingness of numerous battery industry chain companies to list overseas highlights their confidence and determination towards the internationalization of China’s lithium ion battery sector.It can be foreseen that more battery industry chain enterprises will enter the international financial market in the future, which will also demonstrate the international competitiveness of Chinese battery industry chain enterprises.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.