Author: Tao Yanyan

Editor’s note: Zhineng Monthly Report officially launched, mainly divided into five chapters: Whole Vehicle, Battery (Domestic, Overseas, Energy Storage), Charging, Electric Drive, and Intelligence.

The whole vehicle report is divided into two parts, Part 1 is to comb the entire industry, including tracking of key companies; today is Part 2 to make judgments on the situation of each model.

From another perspective, analyzing the data of January 2023 mainly looks at the models — we have selected the top 20 sales models for specific analysis. The threshold for entering the TOP20 in January was 3,664 units. With the information in the table above, we can further analyze the dimensions. We will focus on several aspects:

-

Analysis of the relationship between price range and model: This mainly analyzes the positioning of different models from a quantitative perspective. In essence, the logic of consumer selection is very simple and clear — which products can be chosen in their own intention range (same price range). Therefore, dividing by price range is actually to analyze the demand for SUVs, cars and other products that can be selected from the perspective of the user.

-

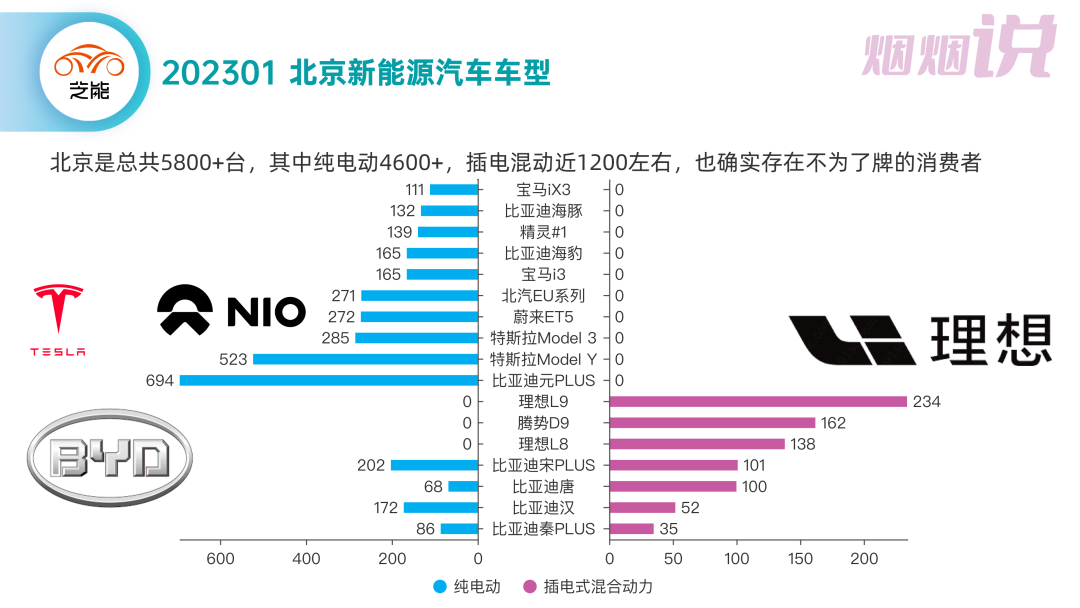

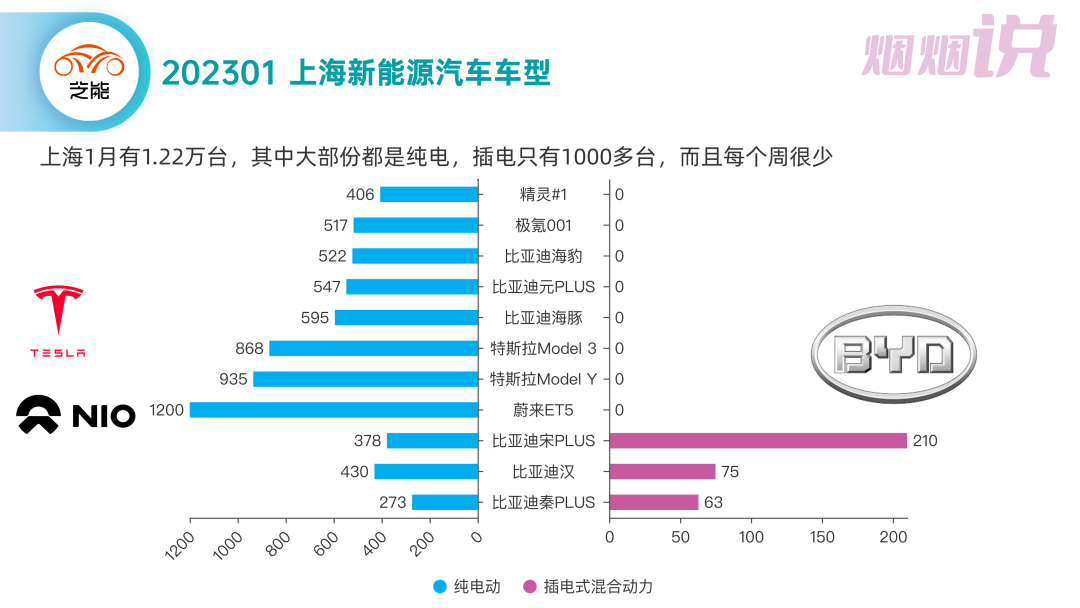

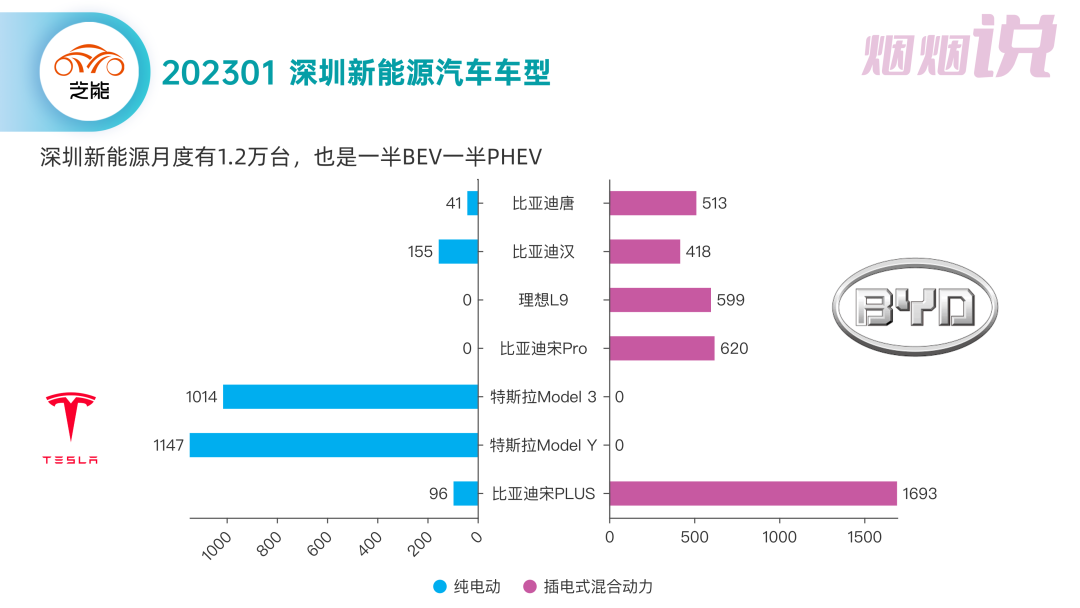

Analysis of the preferred models in different cities: This mainly analyzes from the perspective of consumer choice.

China’s TOP5 models in 2023 are:

◎ Song Plus: Pure electric less than 5,000, plug-in 26,400

◎ Hongguang Mini: 18,000 — Sales of this car have been stable since its release in 2020

◎ Dolphin: 17,300 — The leader in the A0 level, very stable

◎ Model Y: 14,400 — This sales volume is the result of price reductions and incentives

◎ Yuan Plus: 13,000 — This car has become the preferred SUV model for entry-level buyers

The table below is ranked by the sales of models, and BYD has occupied 7 places among the TOP10 models, which is indeed a reflection of its market share.

## Penetration Rate of Different Price Segments

## Penetration Rate of Different Price Segments

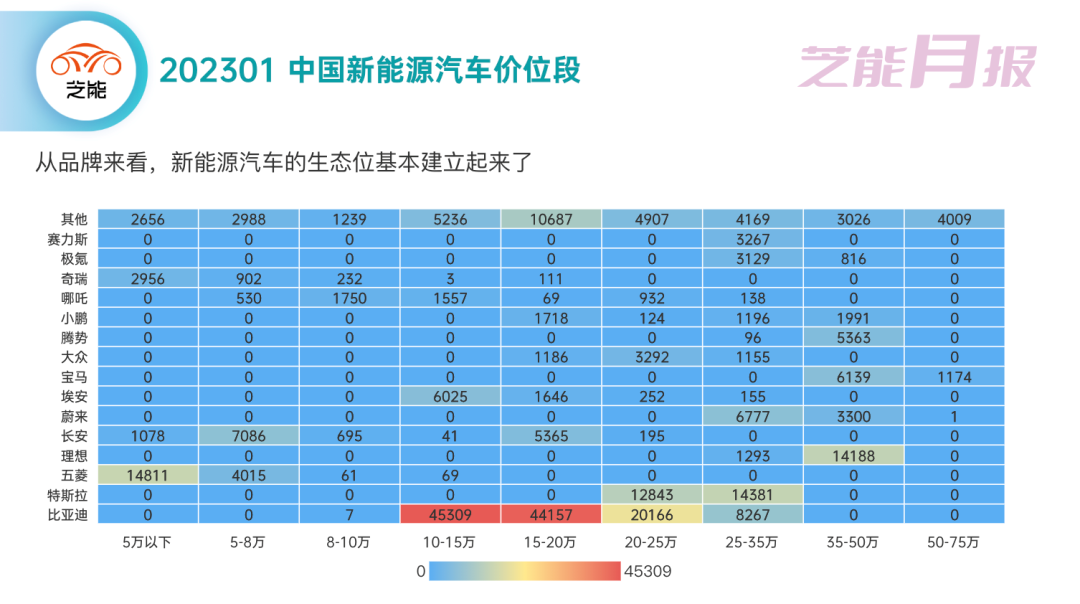

Price Segments of Brands and Models

When it comes to the penetration rate of different price segments, we can look at this table from an ecological perspective. Specifically, we will examine the price segments of brands and models. If we categorize them into four different types — budget, family, improvement, and luxury — based on four price segments, 100,000 RMB and below, 100,000–200,000 RMB, 200,000–350,000 RMB, and above 350,000 RMB, respectively, it will look like this:

◎ Budget: Wuling, Changan, and Chery are the three brands that have been constantly improving in this field.

◎ Family: BYD has the largest market share, relying on models such as Song and Dolphin. The next brands with substantial market share are EA and Changan. I believe that in this market, Great Wall, Changan, and Geely will fiercely compete with each other. This is the essential survival requirement for their internal combustion engine vehicles.

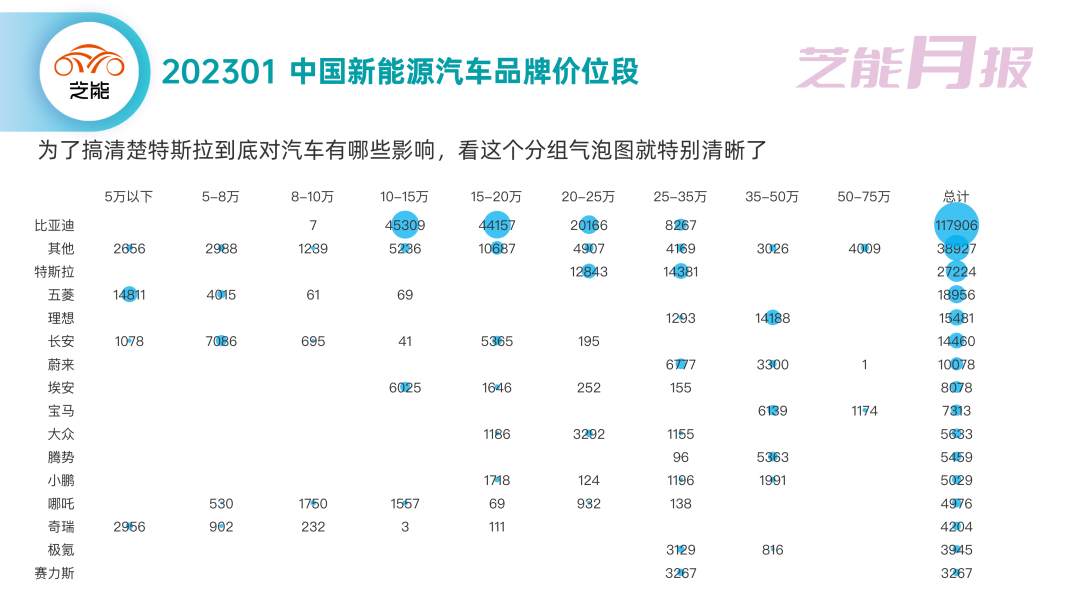

◎ Improvement: Tesla is the leader in this area, followed by BYD and Volkswagen.

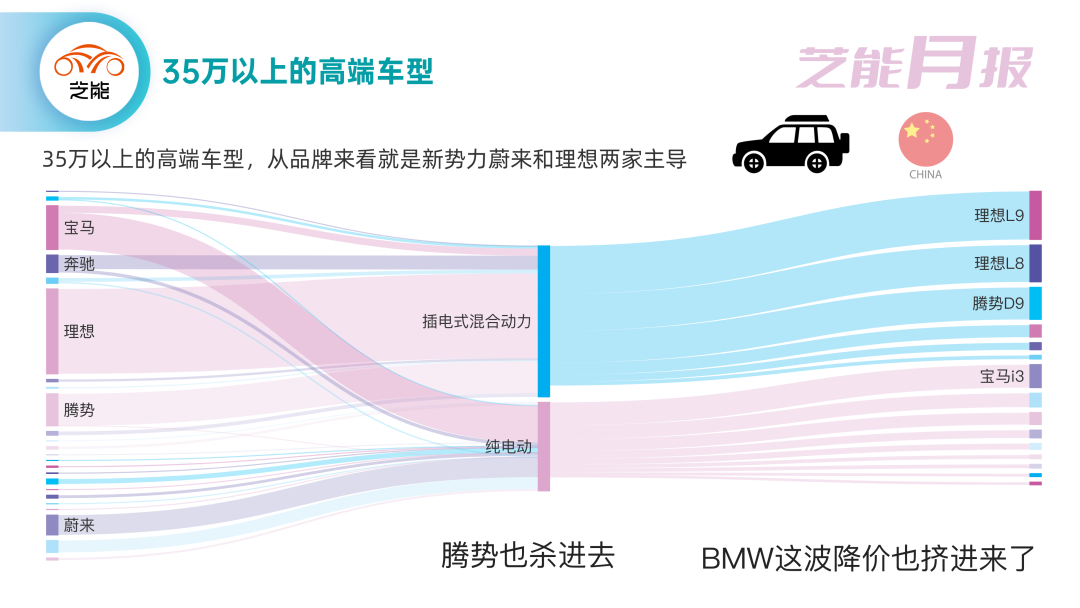

◎ Luxury: This area belongs to Ideal, NIO, and the German Big Three, with sales also fluctuating due to economic factors.

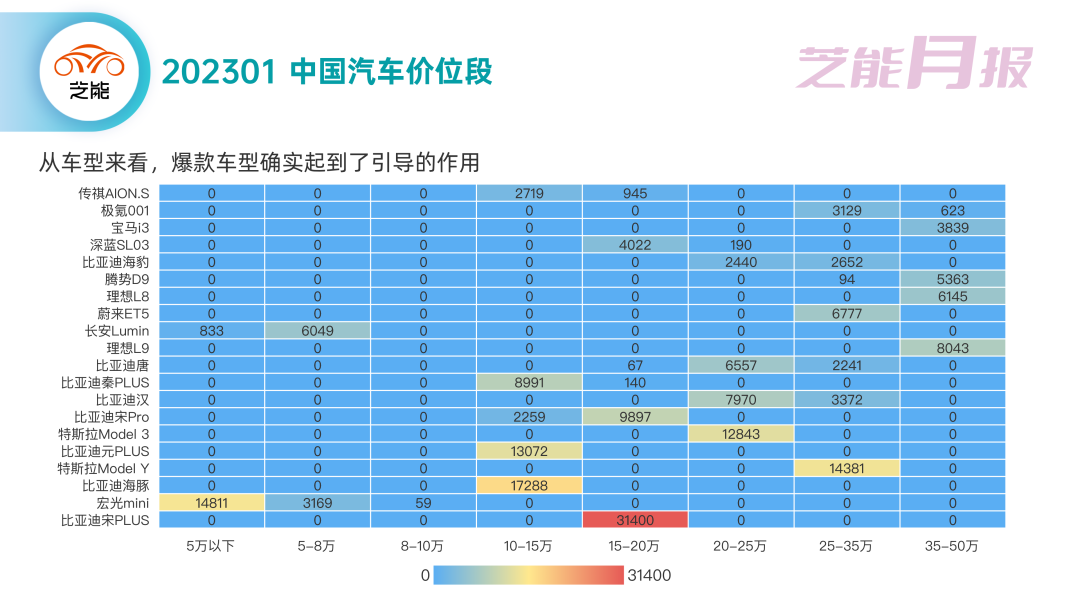

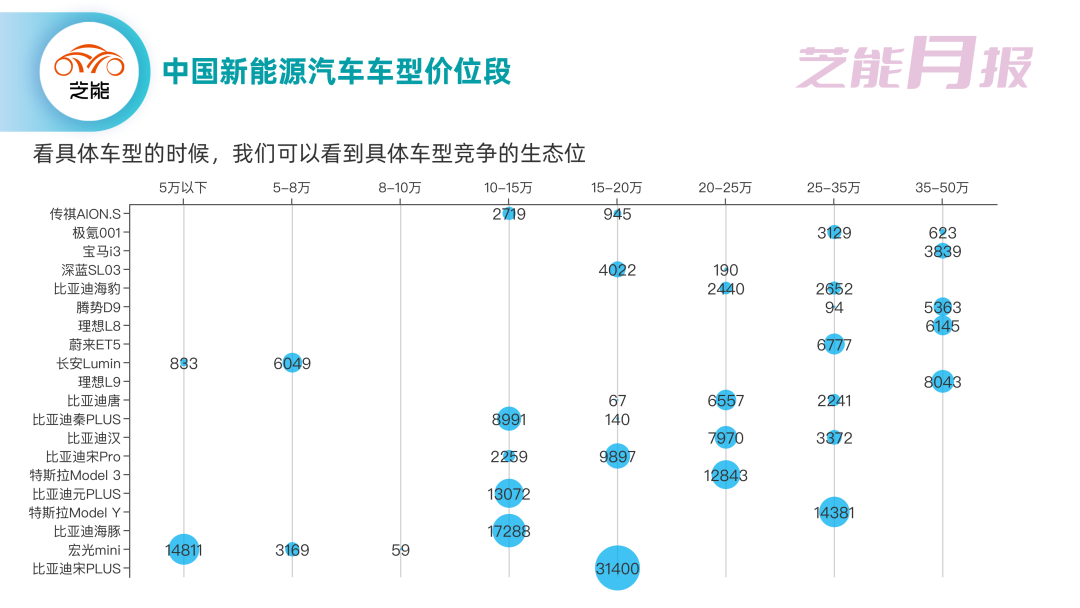

Looking at it from different price segments (see the figure below), we can describe each segment in the following way:

◎ Below 50,000 RMB: Hongguang Mini is on top with 14,800 sales. Additionally, there are more than 3,000 sales in the 50,000–80,000 RMB segment, showing that consumers still value the affordability of Hongguang.

◎ 50,000–80,000 RMB: Changan Lumin is close behind with nearly 6,000 sales, showing the difference in brand positioning.

◎ 80,000–100,000 RMB: None.

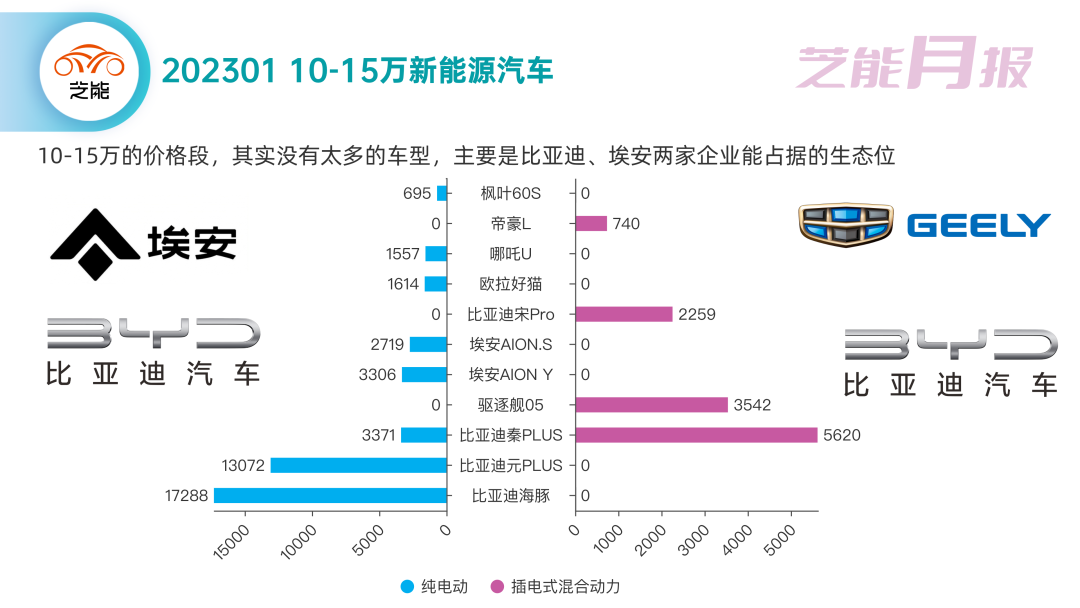

◎ 100,000–150,000 RMB: Dolphin has 17,200 sales, Yuan Plus has 13,000 sales. These two cars are strategic products for BYD, covering both urban and town entry-level models. Qin Plus is aimed at a more extensive consumer market.

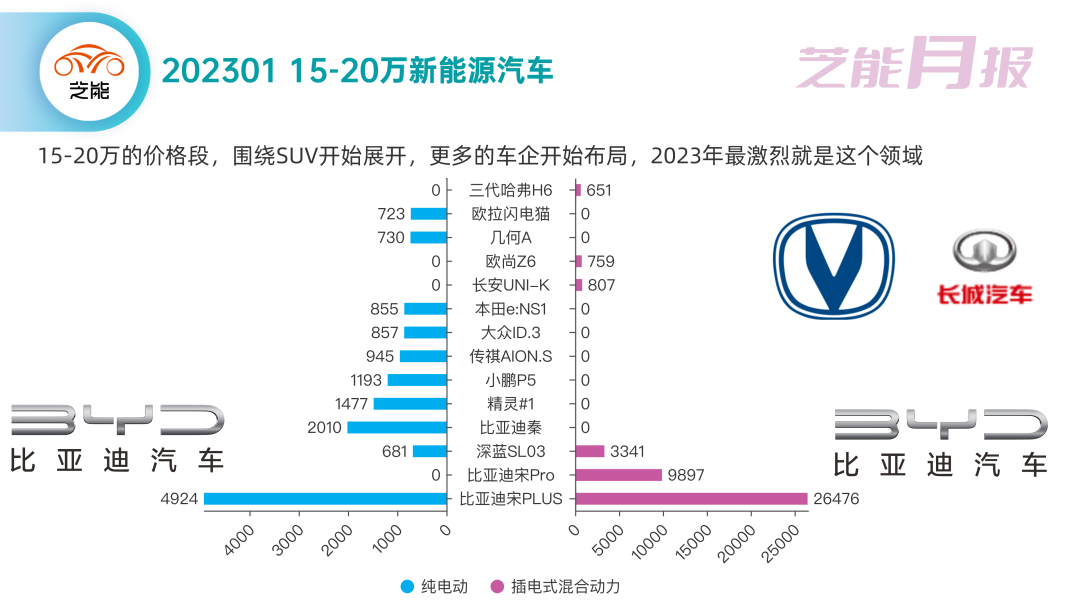

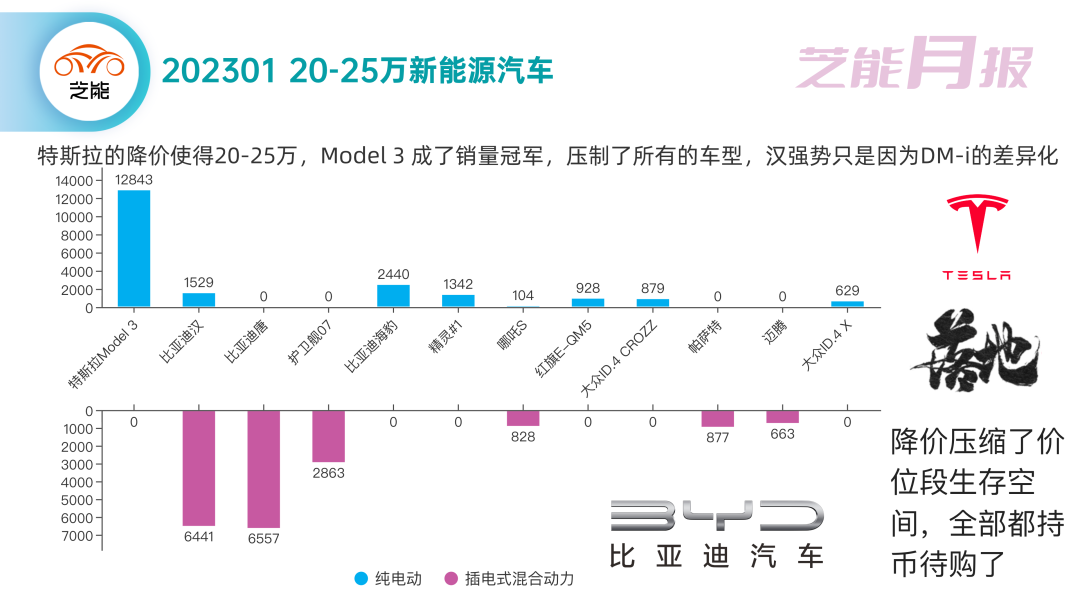

◎ 150,000–200,000 RMB: Song Plus has 31,400 sales, Han has nearly 10,000 sales, and there are 4,000 sales of Shenlan SL03. These are the current models in this price range.◎ 200,000-250,000 RMB: Model 3 sold 12,800 units, HAN Sold 8,000 units, and Tang sold 6,550 units. We will further analyze the competition relationship between these three models later.

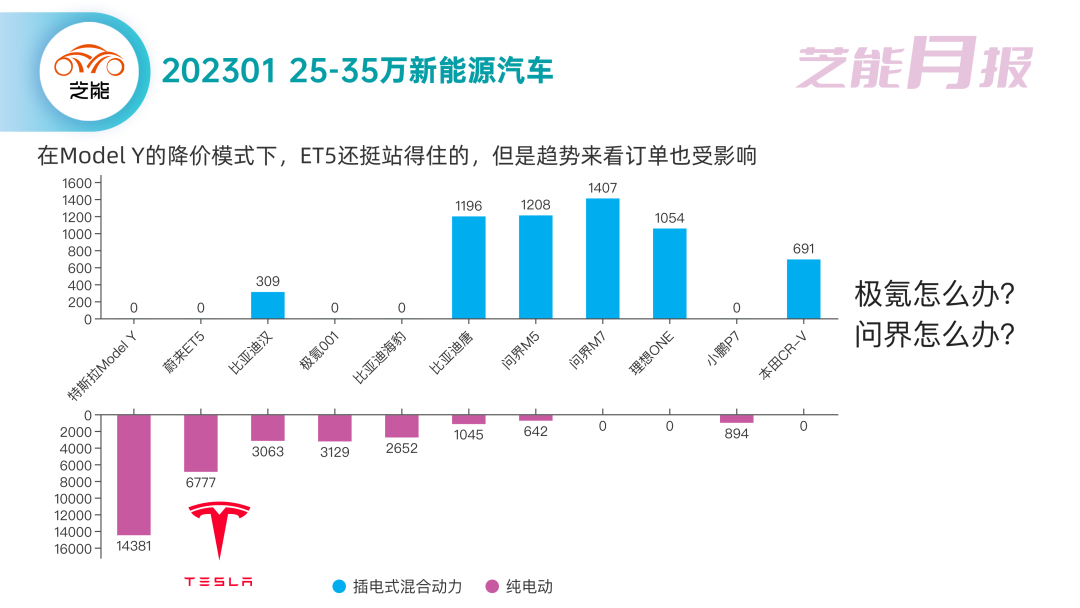

◎ 250,000-350,000 RMB: Model Y’s price reduction puts a lot of pressure on this price range, and the only competitors that can stand out are ET5 and JiKe. Sea lions are also affected to some extent.

◎ 350,000 RMB and above: Ideal two models and the DENZA D9.

The bubble chart below, classified by brand and price, shows the models that have been directly affected by Tesla’s influence.

The following charts provide a more detailed comparison by price range:

Analyzing Brand Preferences by City

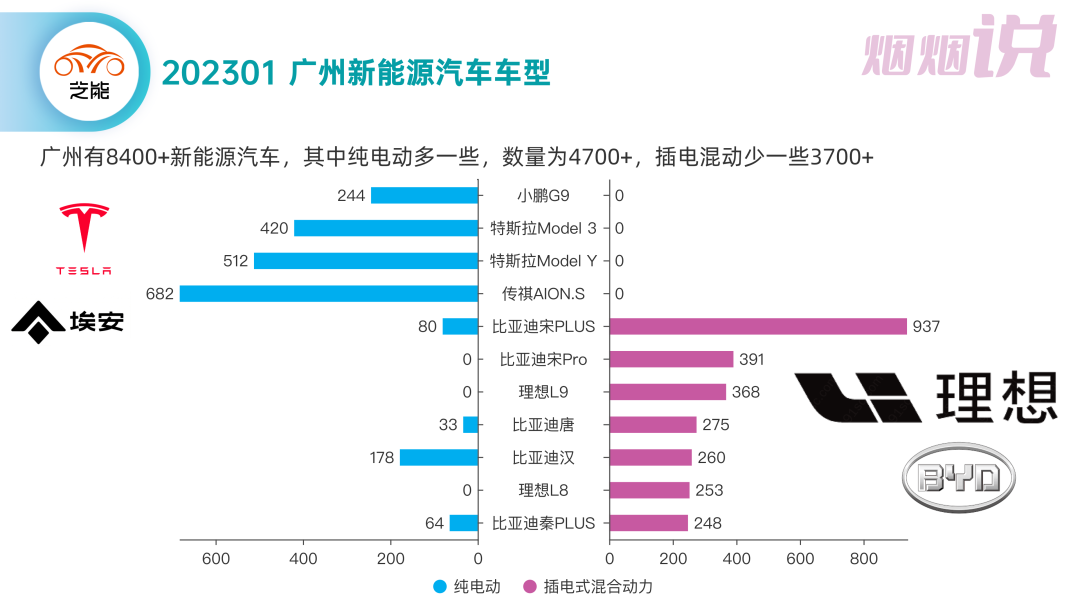

After exploring sales data by price, we can also look at the geographical distribution of sales by city. Here are the brand preferences in each major city:

-

BYD: ranked first in all major cities, impressive!

-

Tesla: facing the problem of only being able to thrive in large cities

-

Li Xiang: doing well in all areas except Shanghai

-

NIO: focusing on the Yangtze River Delta region, plus Chengdu, Shenzhen and Guangzhou

For other car companies, sales are not good due to the overall sluggish market. We need to wait until sales recover before conducting further in-depth analysis.

In the four major cities of Beijing, Shanghai, Guangzhou, and Shenzhen, the main players are still BYD, Tesla, and NIO. Due to policy reasons in Shanghai (hybrid models can no longer be eligible for green license plates), Li Xiang did not make it into the list.

In Shenzhen, due to the high number of BYD pure electric models used for taxis and ride-hailing, individual consumers are more likely to choose plug-in hybrids or Tesla. The large number of public vehicles has resulted in a clear crowding-out effect on individual consumers.

Summary: The second part of the monthly report on the overall vehicle market analyzes changes in consumer preferences from the perspectives of price segments and major cities, which is the focus of our report. We hope you will enjoy it.

Summary: The second part of the monthly report on the overall vehicle market analyzes changes in consumer preferences from the perspectives of price segments and major cities, which is the focus of our report. We hope you will enjoy it.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.