Author: TAO Yanyan

In the new year, we will start visualizing some information about Chinese power batteries from this annual summary report. By comparing and analyzing different data sources with specific quantity data information and combining some content made by the lithium dissolving team, we present better content to you.

Abstract:

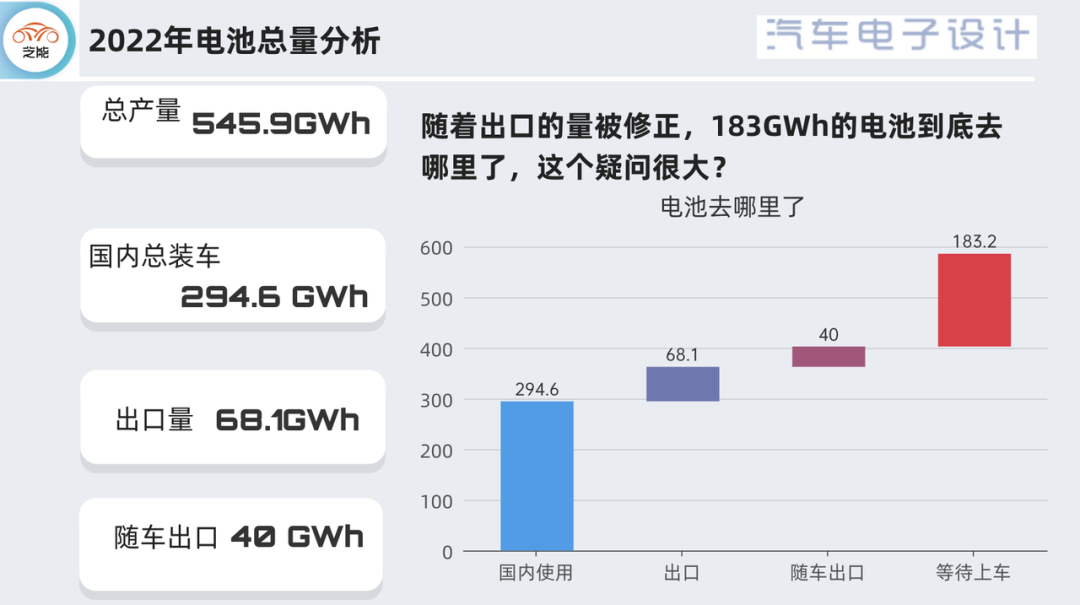

◎ Total output of power batteries: 545.9GWh

◎ Installed capacity of power batteries: 294.6GWh

◎ Export volume of power batteries: 68.1GWh

New energy vehicle exports 67.9 million units, estimated to be around 40GWh at 60kWh, and the final results are as follows:

Of course, our biggest question is: Where did the extra 183GWh of power batteries go?

According to the report of the Innovation Alliance in September: In the statistics from January to September, it was already 90GWh. However, in the report in December, the quantity from January to December returned to 68.1GWh. Regarding this data, we think that based on the difficulty of transportation and various data, the latter 68.1GWh seems more suspicious.

Analysis of Different Quantities

The biggest question here is the export data. I believe there are loopholes in the data, at least this data does not have credibility when viewed in this way. There were 22GWh in November alone, 10.7GWh in Q3 and 46.7GWh in Q4, resulting in only 10+GWh exports in the first half of the year.

### Production:

### Production:

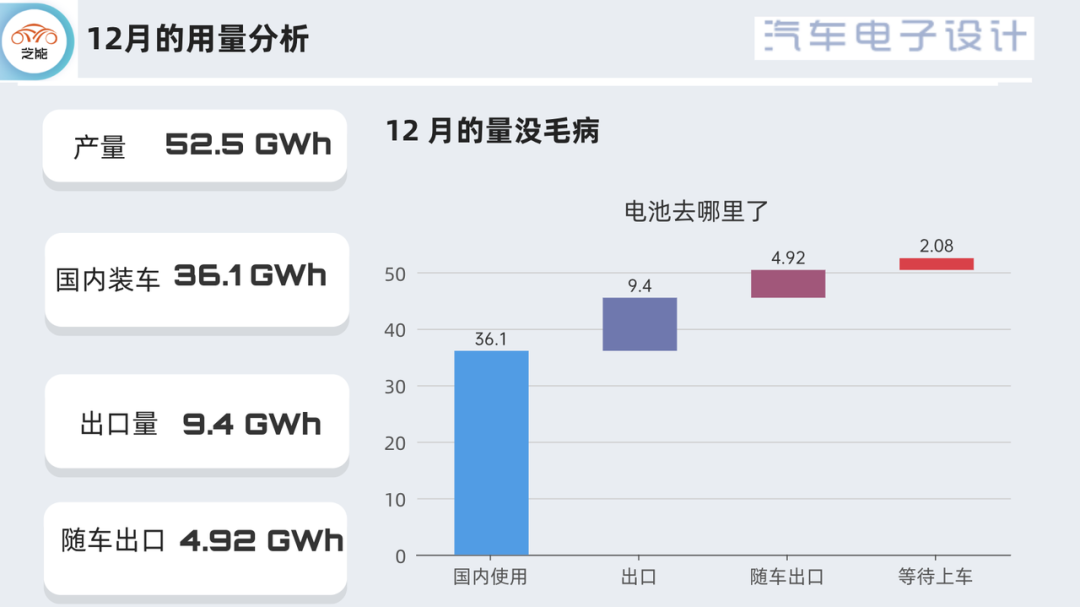

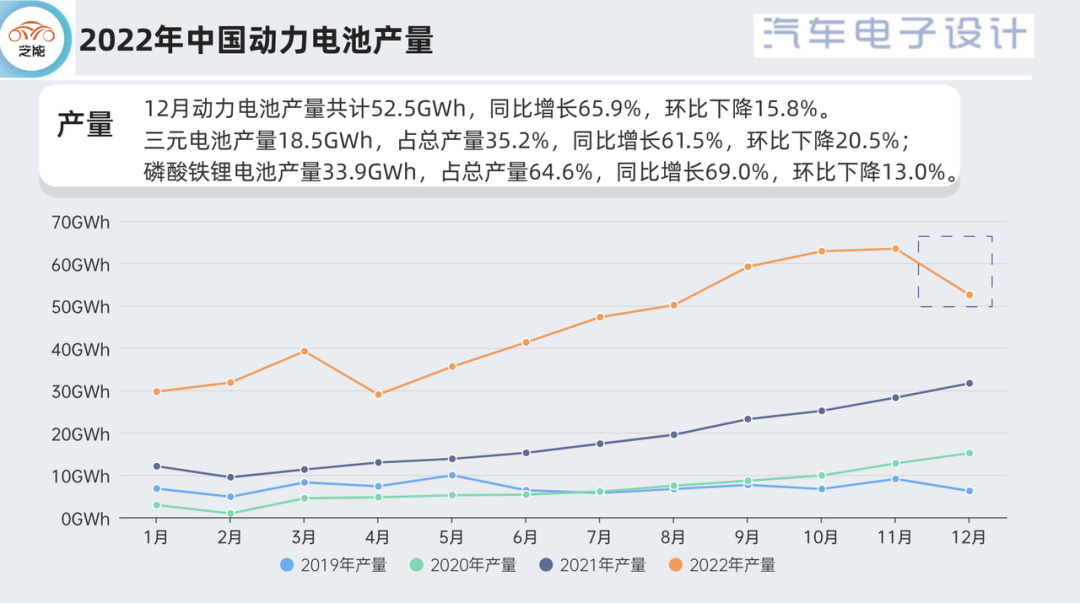

In December, the production of power batteries totaled 52.5 GWh, a decrease of 15.8% from the previous month, which was within expectations. The cumulative production of power batteries in 2022 was 545.9 GWh, which is indeed a high figure. President Zhu believes that the 60 GWh production increase since September was mainly for exports, and the end-of-year policy-driven demand surge to obtain subsidies contributed to the sudden increase in domestic battery production. The decline in December was mainly due to market anticipation for the coming year.

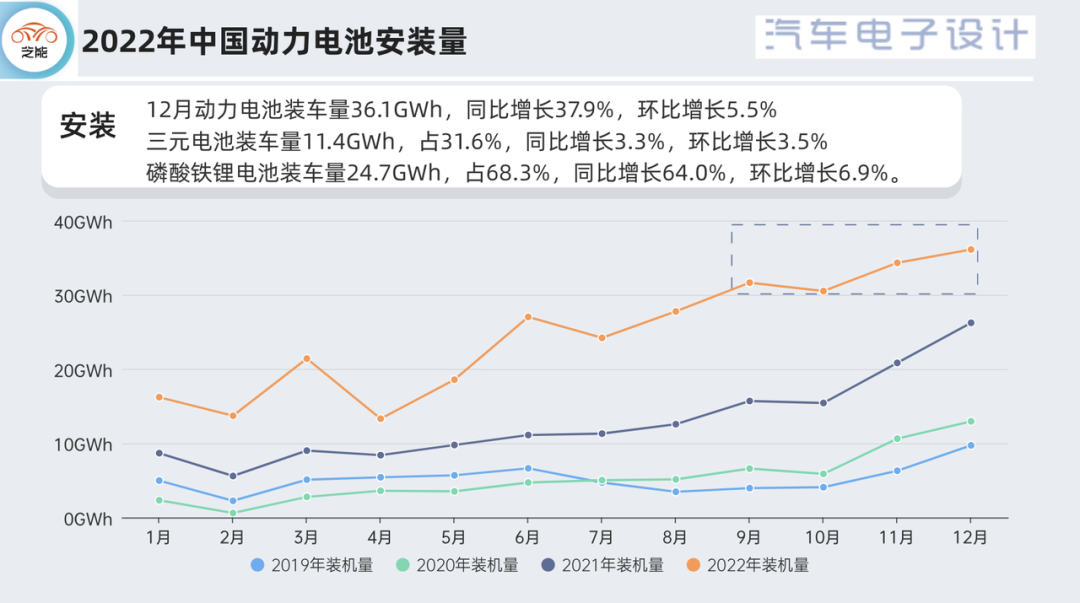

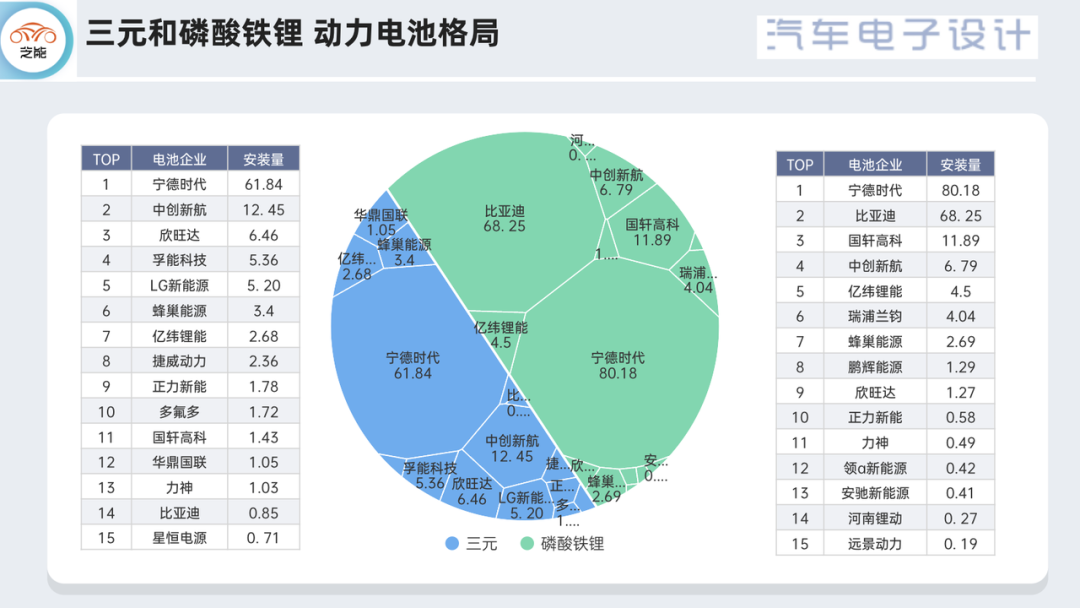

In December, the installed capacity of power batteries for electric vehicles was 36.1 GWh, which continued to increase. Ternary batteries had a capacity of 11.4 GWh, accounting for only 31.6%, with a year-on-year growth of 3.3%, indicating that there are almost no new applications for ternary batteries in China. On the other hand, lithium iron phosphate batteries had a capacity of 24.7 GWh, accounting for 68.3% (nearly 70%), with a year-on-year increase of 64.0% and a month-on-month increase of 6.9%. In China, electric cars consumed 294.6 GWh in total in 2022, of which ternary batteries accounted for 110.4 GWh, or 37.5%, an increase of 48.6% year-on-year, and lithium iron phosphate batteries had a cumulative capacity of 183.8 GWh, accounting for 62.4%, which had a cumulative year-on-year increase of 130.2%.

Regarding this matter, President Zhu believes that lithium iron phosphate batteries will definitely be close to 80% in 2023, and the decrease in the price of lithium carbonate will have a more direct impact on the iron-lithium batteries. Currently, cost-driven demand is the most dominant factor.

In the total consumption of 294 GWh, 261 GWh was used in passenger vehicles, while only 11 GWh was used in buses and 21.4 GWh in special-purpose vehicles.

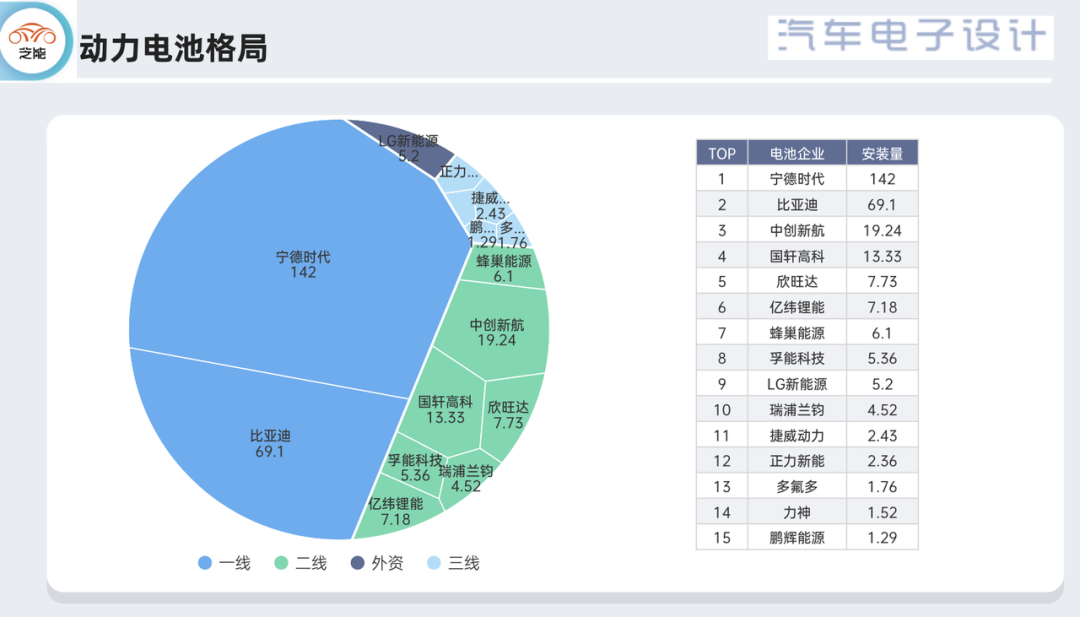

Changes in Supplier Data

From the supplier perspective, CATL’s production capacity is expanding rapidly with a total capacity of 142 GWh, while BYD has approximately 69.1 GWh. Two suppliers, Zhonghang and Guoxuan, still have a capacity of over 10 GWh. We believe that this is due to the supply and demand of the market.◎The high cost of raw materials has further squeezed the space for battery companies, limiting their bargaining power in the manufacturing process where value addition is limited by high raw material prices.

◎Some companies have begun to shift from power batteries, which are highly price-sensitive products, to energy storage, which has led some battery companies to voluntarily give up this market.

◎Due to cost pressure, second-tier battery companies are also engaging in strategic cooperation with several automakers for long-term contracts to ensure both price and quantity.

If we separate the above pattern into lithium iron phosphate and ternary, the gap between CATL and BYD in the field of lithium iron phosphate has begun to narrow. Currently, NINGDE is still invincible in the field of ternary. Therefore, looking forward to 2023, with more companies entering the field of lithium iron phosphate manufacturing, the battery pattern after 2023 is worth paying attention to.

Conclusion: This article mainly revolves around quantity, from the perspective of cost and price, the surge in demand for batteries in 2022 has resulted in structural shortages of lithium carbonate. With the slowing growth of batteries after 2023, there is hope for a decrease in lithium carbonate from recycling, salt lakes, and various channels. However, the opportunity for power batteries to grow as rapidly as in 2022 is unlikely to be repeated. We will track it from both quantity and price aspects and will make a retrospective from the price perspective in due course.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.