Author: Chen Nianhang

A number of foreign LiDAR companies have gone bankrupt, merged or faced sharp drops in stock prices and imminent delisting. Those with orders are also struggling to put them into production, facing a bleak future.

In contrast, domestic LiDAR companies in China have benefited greatly from the rise of the intelligent automotive industry, developing into a thriving supply chain for new automotive components.

These are two completely different scenes we see in this so-called “scale-up year for LiDAR” in 2022. In the domestic and international LiDAR confrontation, Chinese enterprises have won the first phase.

If LiDAR on a vehicle made little impact in the previous years, it is now the year when mass-produced vehicles carrying LiDAR are being sold in significant numbers. It is expected that soon, the shipment volume of domestic LiDAR companies will surpass that of the seasoned veteran, Valeo’s Scala.

According to public data, the number of LiDARs installed in vehicles in the domestic market from January to September this year has reached 57,000, and is expected to reach 120,000 for the whole year, an increase of more than ten times compared to 2021.

A research report from CITIC Securities also pointed out that 2022 is the year of scaling up LiDARs. 26 new LiDARs (automakers and models) have been established so far this year, surpassing the total from 2018 to 2021. This means that the industry’s investment window is here and LiDAR is expected to continue to grow as a basic component of the global automotive industry.

Do We Need Filling-in LiDARs?

At this time, several mainstream domestic LiDAR companies have withdrawn from the main LiDAR competition and opened up a new battlefield for filling-in LiDARs.

There is even an illusion: has the main LiDAR battlefield already settled? Do we need to start filling-in LiDARs?

In this new battlefield, the solid-state transformation of LiDAR has become the main theme, indicating that the competition for solid-state filling LiDAR will become increasingly fierce over the next two years.

Before discussing the second battlefield of filling-in LiDARs in detail, let’s take a look at the main LiDAR battlefield.

1. Has the main LiDAR battlefield settled?The Status Quo of the Overseas Market:

In most places around the globe, the majority of lidar companies have not yet progressed to the stage of mass-producing automotive-grade lidars. These companies are currently engaged mainly in some L4-level Robotaxi, unmanned delivery vehicle, unmanned truck-related fields, besides industrial robot scenarios. Although some automakers have placed orders for their products, they have not been able to expand their business rapidly due to various factors including the difficulty of obtaining automotive-grade verification, slow development progress of automakers, and high costs.

Analysts from the domestic lidar industry have pointed out that, taking Germany as an example, the accumulation of big German automakers – Volkswagen, Daimler, and BMW – in autonomous driving, the use of lidars and development of L3 functions began very early on. However, due to their stronger emphasis on safety, comfort, and more stringent certification standards, as well as cautious decision-making processes, the development cycle of a vehicle model can be very long, ranging from four to seven years in duration.

What’s more, Germany has a limited number of OEMs and long vehicle model development cycles. For overseas lidar companies, once they miss this generation of vehicle models, they will be faced with a long waiting period and will need to continue burning money for a period of time.

OEMs in the American, Japanese, and Korean markets are also facing similar problems, with little incentive to push for mass-produced lidar-included vehicles. Insufficient demand leads to weakened supply.

As a result, these overseas lidar companies either go bankrupt or are forced to implement mergers. Some listed lidar companies’ stock prices have plummeted and are now at risk of being delisted.

For example, the German pioneer of lidar Ibeo has filed for bankruptcy, Velodyne, an American lidar veteran, has announced a merger with Ouster, and Quanergy has announced its de-listing. The stock prices of many other listed lidar companies have been heavily impacted, with no significant revenue expectations in the short term, let alone earnings prospects.

Some overseas lidar companies have also chosen to try their luck in China, including Velodyne, Ouster, Luminar, etc., and they were able to sell some products with ease in the early days. However, when faced with fierce competition from emerging domestic lidar manufacturers, Velodyne and Ouster were unable to effectively compete, and as they were not able to offer local support and services, very few of China’s automaker customers accepted their wares. In any case, the situation is bleak. Luminar is among the few successful exceptions in this regard, as it has secured mass-production orders from SAIC, so the success of the vehicles largely depends on how they are sold in the future.

Domestic Situation:

In China, the situation is quite different.

Domestic automakers have an increasing demand for LiDAR, and domestic LiDAR production manufacturing is growing quickly. The era of monthly deliveries of over 10,000 units has arrived, and more demand means greater capital return. This is a healthy positive cycle for companies conducting technological breakthroughs.

In addition to Huawei, a “non-mainstream” player in the LiDAR market, the most active companies in the field of automotive LiDAR in China are Shenzhen’s Innovusion, Shanghai’s Hesai Technology, and Suzhou’s Robosense. Despite Robosense having only a few specified models, the intelligent electric car newcomer NIO has enabled it to enter the fast lane of mass production.

Currently Innovusion has received over 50 model orders for a variety of Chinese companies including BYD, GAC Aion, FAW Red Flag, Chery, Great Wall Motors, XPeng Motors, Jikke, WmAuto, Lotus Technology and Lucid. In 2021, 14 of the top 15 Chinese car sales groups were those that provided model orders for Speedtech, which is quite impressive. Especially winning the order from new energy sales champion BYD, received much attention and the sales volume is expected to be high later.

Hesai has also made significant progress. Its AT128 LiDAR has received orders for mass production from many automakers including Ideal, Changan, Jiedu, Gaohe, and Lotus. Particularly, depending on best-selling ideal car, Hesai has achieved great results.

Robosense’s “Falcon” LiDAR relies on the unique performance advantages of its 1550nm laser to form a binding effect with the capital and business sectors and the NIO car platform.

Other companies, such as One-Way Technology and Tianwei Technology, also have their own main LiDAR products. Currently, One-Way Technology has not announced any contracted automakers, and Tianwei Technology announced on September 30 that they received contracted orders for multiple models from Hechuang Auto. One of the models is the Concept-M mass production model created by Hechuang, and other specified model main LiDAR products will also use Tianwei’s car-grade solid-state LiDAR.Developing forward, more and more LiDAR companies will receive main LiDAR orders from automakers.

Many industry insiders may wonder, what happened to Livox, the company that achieved the fastest LiDAR mass production on XPeng P5 model? The reality is that there has been no update on production progress since the failure on the XPeng P5 project. He XPeng previously mentioned that Livox had not delivered a single mass-produced LiDAR in five to six months, implying that the LiDAR version of the P5 did not sell poorly, but rather the LiDAR production could not keep up. Therefore, on G9, Suteng Juchuang replaced Livox.

2. Are LiDAR companies opening the second battlefield?

Looking at it this way, it is true that the front players in the main LiDAR field have occupied most of the market share, and the rear players still have opportunities, but the cake is almost gone.

However, the players who have obtained a large share will certainly not be satisfied with this, so Suteng Juchuang and Hexagon Purus entered the field of supplementary scan LiDAR enthusiastically.

On November 2, Hexagon Purus launched the solid-state supplement scan LiDAR FT120, which is planned to be mass-produced and equipped by the second half of 2023. Currently, it has received orders for more than one million units. On November 7, Suteng Juchuang released the full solid-state supplement scan LiDAR RS-LiDAR-E1, which is scheduled for SOP in the second half of 2023 and has received orders and trials from dozens of automakers.

Both products have chip-based design, solid-state scanning, and small size to comply with vehicle regulations.

In terms of parameters, the FOV of Hexagon Purus FT120 is 100° x 75°, with a measurement distance of 30m@10% reflectivity and a maximum range of 100 meters, while the FOV of Suteng E1 is 120° x 90°, with a measurement distance of 30m@10% reflectivity and a farthest distance of 120 meters. It seems that Suteng E1 is more advantageous than Hexagon Purus FT120, but the pricing is still a suspense.Unlike the competition pattern in the main lidar field, the competition in the field of fill-flash lidar has just begun.

Here, RoboSense released LDSense Satellite, another solid-state fill-flash product, as early as May this year, and plans to start production verification in the first quarter of 2023. Moreover, the core component of the lidar recently passed the AEC-Q100 certification, which means it is one step closer to being installed in cars. In terms of capital, RoboSense has also recently completed a B1 round financing of over 100 million yuan.

Another player is OneWay Technology, which introduced the fill-flash lidar product ML-30s very early on, but this product is not pure solid-state, but based on MEMS technology, so it has some disadvantages compared to the previous players, but it can still be used for fill-flash, for example, it has been used on Mobileye’s Robotaxi before.

Recently, OneWay Technology announced that the upgraded version of ML-30s will be used in Baidu Apollo’s sixth-generation unmanned vehicle RT6. The upgraded version reportedly has a field of view of fill-flash lidar that exceeds the industry standard of 120°, and only 3 to 6 lidars are needed to achieve 360° coverage, while other lidar solutions on the market require at least 5 to 8 lidars to achieve the same degree of horizontal coverage.

This lidar is planned to be released at CES in January next year, and it is unknown whether a new solid-state solution will be introduced, or the MEMS technology route will continue.

In addition, OneWay Technology recently completed a C round financing of tens of millions of dollars, which is said to have been obtained a long time ago. XPeng Motors, SAIC, Dongfeng, and Intel are shareholders of OneWay Technology.

In the field of fill-flash lidar, companies such as RoboSense, Hesai, LeiShen, and OneWay are competing fiercely, and the show has already begun.

Seeing this, we can’t help but ask: Do we really need fill-flash lidar outside the main lidar market? How do we view this trend from a technical perspective?

3. Why do we need fill-flash lidar? Which scenarios require it?

Some automakers use lidars to improve safety during high-speed navigation assistance driving, some use them to achieve point-to-point driving assistance in the more complex environments of urban areas, and some use them for more precise automatic parking or higher-level automatic valet parking (AVP) in underground parking lots without GPS signals. Talking about the use of lidars without considering specific scenarios is just “cutting leeks”.Currently, the main application of primary lidar in the market is to take care of the car’s front vision in driving scenes and achieve more stable autonomous driving. Meanwhile, the fill-in lidar is used for monitoring blind zones in narrow city roads and parking lots to complete the auxiliary driving.

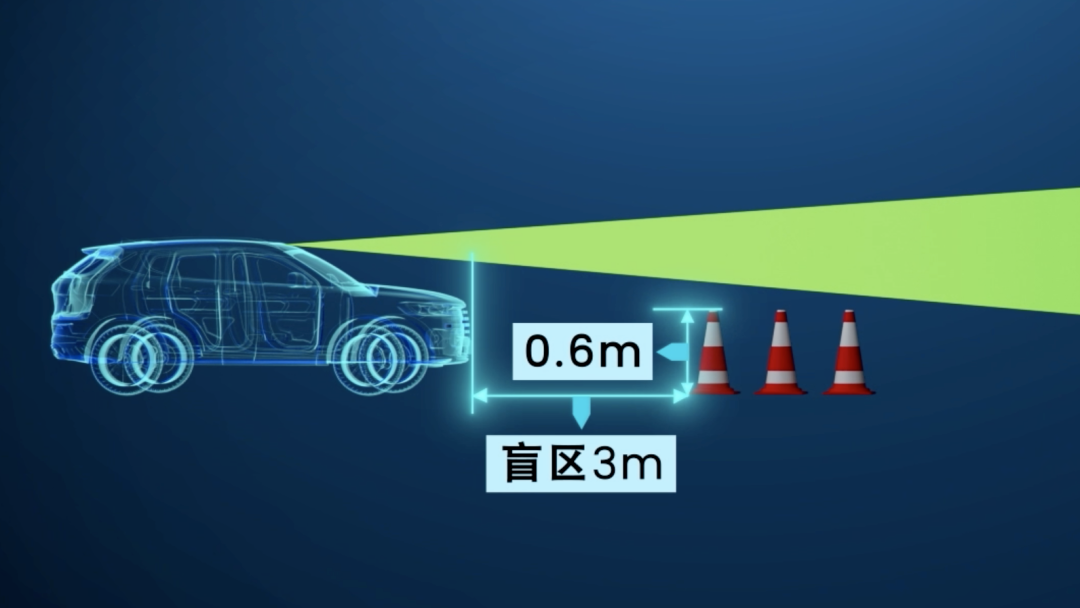

If there are blind spots around the vehicle, the auxiliary driving system is more likely to miss or mistake detection during operation, leading to wrong judgement and operation.

Technically, there is a strong demand for fill-in lidar.

In driving scenes, even with human drivers, there are still numerous traffic accidents caused by close-range perception blind spots. In some cities, more than 90% of the daily traffic accidents are minor collisions, rear-end collisions, and other similar accidents. Not to mention machine driving. If sensors for close-range perception and blind zone perception are not equipped, the auxiliary driving system is also likely to be “blind”.

Especially for the current primary lidar, its detection ability for distant targets is strong, but for close-range targets, it cannot be detected because its horizontal and vertical field of view naturally have some areas that cannot be covered.

Nowadays, most car manufacturers want to achieve high-speed navigation auxiliary driving, city navigation auxiliary driving, and point-to-point autonomous driving in all scenarios. However, they do not want to mount a primary lidar on the roof, so they will choose to use fill-in lidar as a redundant perception. In most cases, the system still relies on visual cameras and millimeter-wave radar for perception.

In some simple scenarios on highways, it is indeed possible to achieve the corresponding functions with visual cameras and millimeter-wave radar, but their stability, reliability, and usability cannot reach a very high level. Once entering the city, these two types of sensors are not sufficient, so equipping some side fill-in lidar will greatly enhance the experience.

Currently, it is still in the state of shared driving between human and machine. It is really necessary to let the system drive completely on its own in the future. Therefore, this kind of fill-in lidar will be indispensable. As a result, many robotaxis are equipped with numerous lidars of various sizes and types.

In the parking scenario, many parking lots may have various types of cars, pedestrians, shopping carts, etc. The parking spaces are also very narrow, and there are various piles, columns, pipes, and cabinets. In such scenes, in order to make automatic parking more usable, the close-range and blind-zone perception aspects need to be meticulously handled. Currently, the visual fusion parking in the Automatic Parking Assist (APA) can barely cope. If more advanced features such as Automatic Valet Parking (AVP) and Memory Parking are to be implemented, it is imperative to add fill-in lidar. For example, XPeng P5’s cross-floor memory parking function is more stable and reliable because of the addition of fill-in lidar.Summary:

- For driving scenarios where the function usage is not too complex, a combination of “camera + millimeter-wave radar + blind-spot lidar” is sufficient. Some car manufacturers now use the main lidar as a blind-spot lidar. If the functional usage scenario is complex, the perception solution that needs to be used must become “camera + millimeter-wave radar + main lidar + blind-spot lidar”.

- In parking scenarios, the APA function of vision and radar is sufficient, but for future higher-level functions, blind-spot lidar still needs to be introduced. Several blind-spot lidar companies have proposed several standards for product development to address this “both must have” issue, including being designed specifically for near-field detection, having an ultra-wide field of view, being compact and flexible in appearance, and having high performance at low cost.

- Some specific parameter indicators even exist, such as the horizontal field of view of lateral blind-spot lidar must be greater than 120°, the vertical field of view must be greater than 75°, and being able to detect a tennis ball with a diameter of 6 cm at a distance of 5m in front of the car.

From the perspective of consumers, if they want to buy such a car and the corresponding functions, installing more lidars means having to pay more money, and the subsequent maintenance costs may also increase accordingly.

How can car manufacturers satisfy performance requirements and function development needs while also reducing consumer sensitivity to the increased cost?

To address this “both must have” issue, some blind-spot lidar companies have proposed several standards for product development, including being designed specifically for near-field detection, having an ultra-wide field of view, being compact and flexible in appearance, and having high performance at low cost.

Some even have specific parameter indicators, such as the horizontal field of view of lateral blind-spot lidar must be greater than 120°, the vertical field of view must be greater than 75°, and being able to detect a tennis ball with a diameter of 6 cm at a distance of 5m in front of the car.

Domestic lidar companies seem to have come up with a solution based on Flash technology and chip-based pure solid-state blind-spot lidar. Since companies like Yijin Technology and Tuowei Technology have no plans to develop similar products, our main focus today is on how STJ Electronics, Hesai Technology, and Lidaray Intelligence are handling this.

Hesai, STJ, and Lidaray’s Close Battle

Interesting enough, STJ, Hesai, and Lidaray all set the mass production time for their blind-spot lidar product in the second half of 2023, which seems to indicate a wave of strong demand at that time.

1. Parameter-wise:The specification of three lidars are listed as below with the original Markdown format:

- LDsatellite of Liangdao Intelligence: Horizontal Field Of View (FOV) 120°, Vertical FOV 75°, range measurement capability of 30 meters with 10% resolution, external window size of 48mm×88mm, farthest measurement distance unknown.

The actual point cloud effect of this lidar is shown in the figure below:

- FT120 of Hesaitech: Horizontal FOV 100°, Vertical FOV 75°, range measurement capability of 30 meters with 10% resolution, external window size of 75mm×50mm, farthest measurement distance of 100 meters.

The right half of the figure below shows the actual point cloud effect of FT120, the whole figure shows the combined effect of the main lidar and the fill-in lidar:

- E1 of Robosense: Horizontal FOV 120°, Vertical FOV 90°, range measurement capability of 30 meters, farthest measurement distance of 120 meters with an external window size about half the size of iPhone 13.

From the parameters of the three lidars, all of them achieve the range measurement capability of 30 meters for objects with a reflectivity of 10%. However, there are some differences between them in FOV:

The Sagitar and Liangdao have the same horizontal field of view, while the Hesai and Liangdao have the same vertical field of view. Overall, the Sagitar has the advantage in terms of comprehensive parameters. Of course, when it comes to actual usage, we cannot just rely on these parameters, but also need to consider the comprehensive actual performance.

As can be seen, although the blind spot lidars’ ranging capability is not very far, their field of view has excellent performance. This is thanks to the fact that these lidars are all on the Flash technology path, which is incapable of “measuring far”, but excels at “measuring near”.

In the promotion of the three companies, Sagitar and Hesai suggest that the blind spot lidars should be installed on the side of the vehicle, because both of them have relatively powerful main lidar products and do not want to steal the limelight; while Liangdao’s rhetoric is that it can be installed on the side of the vehicle, as well as on the front bumper or headlight position.

With such a large field of view, what kind of perception effect will it have?

Sagitar Juchuang has provided two reference examples: one is the installation of two E1s on the side of the vehicle, together with a main lidar; the other is the installation of two E1s on the side of the vehicle, plus one E1 facing backwards, together with a main lidar.

The perceptual effect of the two solutions in the horizontal direction is as follows:

What needs to be noted here is that if the horizontal field of view of the blind spot lidar is insufficient, it can only be compensated by increasing the quantity (increasing the cost), or finding a tricky installation angle (difficult to implement in engineering). Obviously, a large field of view has a natural advantage, just like a tall person can dunk with ease, while a short person needs to jump hard to dunk.

Similarly, in the vertical direction, Sagitar believes that the FOV of the blind spot lidar needs to be above 81.5° in order to balance the perception of small objects on the ground and large obstacles. Otherwise, performance will be sacrificed. Therefore, the 90° of E1 is just right, while the 75° of FT120 and LDSatellite is slightly lacking.

Is this slight lack really that important? Only the algorithm engineers of the OEMs who have used it will know for sure.

The frame rate is a very important indicator for a LiDAR, as it directly affects the perception speed, especially for close-range recognition where a higher frame rate is needed to quickly detect and respond. Volkswagen believes that a frame rate of 20Hz or more is needed for its blind-spot LiDAR, while the other two companies either have not released this metric or have different ways of calculating it, so we need to wait and see before making comparisons.

The frame rate is a very important indicator for a LiDAR, as it directly affects the perception speed, especially for close-range recognition where a higher frame rate is needed to quickly detect and respond. Volkswagen believes that a frame rate of 20Hz or more is needed for its blind-spot LiDAR, while the other two companies either have not released this metric or have different ways of calculating it, so we need to wait and see before making comparisons.

Finally, if we compare the production speed and point quantity, it is known that Liangdao LDSatellite will start trial production in the first quarter of next year, while Hesa and Volkswagen will start mass production in the second half of 2023. However, Hesa is very confident that it can take the lead in production speed, as its previous AT128 was very efficient.

In terms of point quantity, Hesa FT120 has already received orders for millions of units, while Volkswagen E1 has received trial use from dozens of automotive companies. Liangdao LDSatellite is still undisclosed at this time.

After looking at the exterior of these three blind-spot LiDARs, let’s take a look at their internals.

2. Technological Progression: Flash, Chipification, Pure Solid-State

After years of development, LiDAR has evolved from mechanical rotary scanning to MEMS hybrid solid-state, and then to Flash pure solid-state, all of which are the result of continuous technological advancement and market demand.

Inside the LiDAR, there have been mechanical rotary scanning, single-axis gimbal scanning, dual-axis gimbal scanning, one-dimensional mirror scanning, mirror + gimbal hybrid scanning, and later pure solid-state chip electronic scanning.

In the second battlefield of the blind-spot LiDAR, the biggest revolution is complete solid-state. The LiDAR’s transmit and receive modules are chipified, making it smaller in size, more stable in performance, more suitable for automotive standards, cost-optimized, and easier to manufacture. This makes it possible for LiDAR to be mounted on a larger scale in the future.

When we dissect these three LiDARs, we can see the following:

Volkswagen JuChuang E1: Dual transmitter, single receiver

# HeSaitech FT120: Single Tx / Rx

# HeSaitech FT120: Single Tx / Rx

Lidar from Livox, LDSense Satellite: Single Tx / Rx

The “Moore’s Law” is affecting the development of lidars.

All three companies use compensated lidar systems with VCSEL chip (Vertical Cavity Surface Emitting Laser) in transmitter + SPAD chip (Single-Photon Avalanche Diode) in receiver + processing module chips. The specific process may differ, but all three claim to be in-house research products.

By chipization, the number of internal components in the lidar is reduced, and the moving components are cancelled, making it smaller in size and purely solid-state.

Taking the Fantech’s E1 plan as an example, the SPAD array and high-performance SoC are integrated into one chip with advanced 3D stacking technology for the receiver chip, which greatly simplifies the system link and reduces the cost, and can directly handle the generation of point clouds. However, the cost of applying 3D stacking technology will also increase accordingly, involving the cost of yield rate and the production of new technologies.

The SPAD array used in the E1 has more than 250,000 pixels (the smallest unit that makes up digital images), which is a leading level in the industry. This brings advantages of ultra-wide field of view and high angular resolution. Moreover, the photon detection efficiency (PDE) of the E1 receiver chip exceeds 20%, further achieving a performance breakthrough.

For the transmitter chip, E1 adopts two-dimensional addressable VCSEL array technology, supporting flexible scanning modes. Compared with one-dimensional scanning, the peak power of two-dimensional scanning is only one-tenth of the former, which is more friendly to power consumption and heat dissipation.

One-dimensional scanning here is to light up one column of VCSEL linear array at a time, with the same transmit power for the whole column, and cannot flexibly configure the energy ratio of different regions; while two-dimensional scanning can dynamically adjust the local transmit power according to different ranging scenes to achieve the optimal energy distribution ratio. It is like concentrating resources to accomplish major tasks and dynamically and scientifically allocating existing resources.“`

Heisse and Liangdao have not focused too much on the core technology of sending and receiving chips, so it can only be compared and analyzed after the subsequent technology is announced.

To sum up, the solid-state LiDAR with chip design: strong performance, lower cost, smaller size, fewer components, lower power consumption, more friendly heat dissipation, easy to manufacture, easier to achieve vehicle level, and so on.

So how much cheaper can pure solid-state LiDAR be?

According to Heisse CEO Li Yifan, even if the cost of pure solid-state LiDAR is much cheaper than AT128, it is still more expensive than cameras. The cost of LiDAR with filling the blind spot is about half the cost of MEMS LiDAR, whose price on the market is about 3000-9000 yuan.

Insiders expect that after large-scale production, solid-state LiDAR with filling the blind spot will have the opportunity to replace the current corner millimeter wave radar on the car.

Where is the industry headed after solid-state LiDAR with filling the blind spot?

From mechanical rotating LiDAR to semi-solid-state LiDAR to pure solid-state LiDAR with filling the blind spot, the competition in this industry has taken more than ten years to reach its current state. So where to go next?

Two aspects:

- Industry-side, by scaling up production to reduce the cost of LiDAR, including production costs, operating costs, and product material costs;

- Product side, through the development of new technologies, including FMCW, OPA and other cutting-edge technologies, to launch more advanced LiDAR products and make the main LiDAR pure solid-state.

Maybe one day when LiDAR can impress Tesla’s Elon Musk, this industry is a big success.

1. How to reduce costs?

Heisse CEO Li Yifan has a saying that scaling can lower costs, but it is also limited. The ability to improve the chip process through chip technology is the key. He believes that the barrier to entry for LiDAR is chipmaking, and the importance of chipmaking to LiDAR is analogous to the importance of engine technology to automobiles.

“`## So, reducing costs needs to start with two aspects: vehicle-level mass production and improving chip-based technology for transmitting and receiving modules.

Meeting vehicle standards is the only way to have the opportunity to carry out large-scale production and serve original equipment manufacturers (OEMs) well.

Therefore, based on this cognitive logic, several LiDAR companies have invested heavily in building their own LiDAR laboratories.

Currently, the largest scale is the in-vehicle laboratory of Suteng Juchuang, with a first-phase investment of RMB 50 million, covering an area of ??2,800 square meters, and nearly 50 professional engineers. Supported by more than 200 sets of testing equipment, this laboratory can independently carry out more than 120 tests, covering vehicle-level reliability testing items such as HALT (High Acceleration Life Test), HAST (High Acceleration Stress Test), high and low temperature operation, EMC (Electromagnetic Compatibility) testing, as well as high-altitude, salt spray, ice water impact, dust and water resistance, and temperature limit testing.

Production is part of research and development, which is particularly evident in the manufacture of high-precision instruments such as LiDAR, so most LiDAR companies would prefer to have their own production lines.

The above three LiDAR companies also have their own characteristics in production layout.

Hesai invested nearly USD 200 million to build the “Maxwell” Intelligent Manufacturing Center in Jiading, Shanghai, with an annual production capacity of more than one million units. The new factory is expected to be put into operation in 2023.

Suteng chose to build its own production line, joint venture factory as well as cooperation with contract factories in various forms. Multiple intelligent production lines are expected to be completed by the end of 2022 with an annual production capacity of one million units, including the manufacturing line jointly owned with Luxshare Precision.

Liangdao Intelligence has its own intelligent factory in Hangzhou, with a fully automated intelligent production line under construction. The first-phase production line is designed to have a production capacity of 500,000 units per year, and the first product is expected to be put into production verification in Q1 2023.

Of course, in order to reduce the cost of production and the difficulty of assembling LiDAR, the industry now proposes the concept of platform design and development. Just like making a car, a platform architecture is needed first, and then product variations can be achieved on the same platform.

For example, although the performance of the M-series LiDAR from Suteng has been upgraded, its size, shape, connectors, and communication protocols remain the same. Vehicle manufacturers do not need to carry out large-scale second-phase development, verification, nor do they need to redevelop, and the architecture is basically maintained, while the module is Pin-to-Pin upgraded. Moreover, the testing system and production line configuration are also platform-based.

Based on platform design, it can reduce costs, shorten R&D cycles, simplify production and design steps (just like the upgrade and iteration of iPhone), while improving product quality and stability. This model also provides a development reference for other enterprises.

Based on platform design, it can reduce costs, shorten R&D cycles, simplify production and design steps (just like the upgrade and iteration of iPhone), while improving product quality and stability. This model also provides a development reference for other enterprises.

2. All Solid-state?

There is a suitable technology and product for each stage. This also applies to the field of LiDAR.

In the matter of production to standards, cost, performance, producibility, stability, and other factors determine whether the LiDAR will be used by automakers. Therefore, automakers do not need the best, but the most suitable and worry-free product.

The mechanical rotating LiDAR of the past became the first choice for Robotaxi; the MEMS solid-state LiDAR and hybrid solid-state LiDAR have become the first choice for mass-produced intelligent vehicles, and later pure solid-state LiDAR may become the first choice for urban auxiliary driving and automatic parking functions (the world unified?). What will happen next when it comes to product development for LiDAR?

- Will 905nm turn to 1550nm with better performance on the laser?

- In terms of scanning technology, will FMCW and OPA technology be pursued on the basis of MEMS or will Flash technology breakthrough to promote pure solid-state LiDAR?

- Will there eventually be an industry standard for APD, SPAD, and ASIC chips on the receiver side?

- Will chip technology for LiDAR transceiver modules achieve a breakthrough and continue to evolve according to Moore’s Law?

These answers can be found in the secret R&D labs of various LiDAR companies, and we believe that the mystery will be unveiled soon.

Industry insiders predict that the large-scale industrialization of domestic LiDARs will occur after 2024, and better functionality will emerge in 2025.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.