Sun Rises Over Su-Tong Science and Technology Industrial Park

By Zheng Wen / Edited by Zhou Changxian

The sun has just risen.

Everything in the Su-Tong Science and Technology Industrial Park in Suzhou is slowly waking up, and the Taicang bases of automotive suppliers Schaeffler, BorgWarner, Magna, United Automotive Electronic Systems, as well as other manufacturers of automotive parts located here, are welcoming a new day’s work in the sunshine.

On September 16, the Director of Market and Product Management Department of United Automotive Electronics, Cheng Jie; General Manager of Electric Drive Business Unit, Bruno Ahrens; Taicang Plant Director, Pu Dongxing; Director of Human Resources, Ren Gang; and Director of Product Management, Xi Haobing, had a somewhat different day from their usual work.

Their main task today was to cooperate with external publicity, and comprehensively communicate the past phased achievements of the Taicang base to the outside world.

If not for this small-scale communication, automotive suppliers like United Automotive Electronics would be rarely seen in the limelight. In the industrial chain, the original equipment manufacturer (OEM) is the closest role to the consumer. Holding up the OEM are hundreds or even thousands of suppliers in the huge industrial chain.

They are hidden from the public eye, like a deep and bottomless darkness, holding up the OEM’s glimmers of light. But under the sweeping wave of the new four modernizations, their intense fervor is no less than that of the end market, and their importance is no less than that of the OEM.

Among these roles, there have even emerged many “hidden champions”. They may not be large in scale, but they certainly have the ability to excel or even be irreplaceable in their specific field. This darkness is worth seeing.

Here Comes the Dawn, Quietly

It is difficult for economists to quantitatively study how much impact the transformation to new energy will have on people’s economic life in the face of such rapid change nowadays.

However, a change that can be seen with one’s own eyes is that more and more people are participating in various nerve endings of the new energy industry chain, and more and more consumers are improving their acceptance of new energy vehicles.

Nearly one-third of the more than 450 college graduates who recently joined United Automotive Electronics this year will go to new energy-related positions.

To study consumers’ support for the discontinuation of gasoline vehicles in 2030, Polestar commissioned a survey by GlobeScan. This survey involved a large number of participants, including 18,000 consumers from 19 states in Europe, North America, Asia, Australia, and other regions. The survey results were unexpected, with 34% of respondents supporting the discontinuation of gasoline vehicles in 2030, and China’s support rate being 35%.Earlier, the sense of urgency for change was not prominent enough. Rewinding time back by five years, electric vehicle sales only accounted for 1% of global automotive sales. However, the threat is rapidly approaching.

According to the Chinese government’s plan, the penetration rate of new energy will reach 20% by 2025. However, this number has already exceeded 25% this year. The growth in passenger car sales of 14.7% is all contributed by new energy vehicles. The market’s health is also gradually improving from a dumbbell shape to a spindle shape with a thick middle and thin ends.

This spring, BYD’s sudden announcement to stop selling fossil fuel vehicles was like dropping a depth charge in the terminal market. In the first half of the year, BYD’s new energy vehicle sales reached 641,400 units, leading Tesla by nearly 80,000 units, becoming the global new energy vehicle sales champion. In July and August, new highs were created, raising the cumulative sales for this year to 978,800 units.

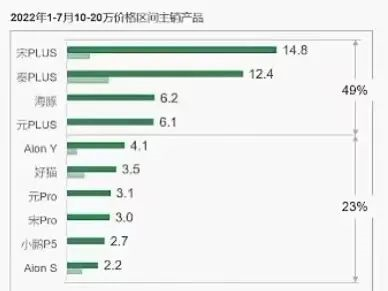

BYD has led the rapid growth of the 100,000 to 200,000 yuan market segment on its own. Among the top ten models in this price range, six of them were BYD, with a market share of over 50%.

The industry only has a choice to transform, and there is no option to “maintain the status quo.”

In 2018, Unigroup’s sixth base, the Taicang base, officially established.

This base is the main production base for new energy products, and an important proof of Unigroup’s transformation into large-scale development of its business. It mainly produces electric motors, bridges, power modules, and other products for new energy vehicles.

Today, five motor stator and rotor production lines, three bridge production lines, and one power module production line are put into production every day. On the right-hand side of the entrance to the Unigroup factory, there is also a large area of vacant land, and more new production lines are still under construction… According to the plan, the six new production lines will be put into full use by the middle of next year.

This component company was established in 1995 and is a joint venture between Zhonglian Automotive Electronics Co., Ltd. and Germany’s Robert Bosch GmbH in China. When the company was founded, it focused on engine management systems. Originally, the engine was a purely mechanical component, and the engine management system employed electronic control to make the combustion of fuel more environmentally friendly.

The time when Unimicron sensed the upcoming change was early. From 2008 to 2012, Unimicron, which was deeply involved in the automotive supply chain, realized that the automotive industry was in the early stages of transformation. Therefore, in 2009, the Electric Drive and Body Electronics Business Unit was established, and the business was subsequently improved to include four sectors: engine management systems, gearbox control, advanced networking, and electric drive.

The time when Unimicron sensed the upcoming change was early. From 2008 to 2012, Unimicron, which was deeply involved in the automotive supply chain, realized that the automotive industry was in the early stages of transformation. Therefore, in 2009, the Electric Drive and Body Electronics Business Unit was established, and the business was subsequently improved to include four sectors: engine management systems, gearbox control, advanced networking, and electric drive.

In 2020, Unimicron proposed the “Two Transformations, Two Innovations (Electric, Intelligent Networking, New Architecture, New Software)” strategy, and the pace of transformation has accelerated. In that year, Bosch’s global first electric bridge was mass produced at the Taicang base.

From the power module of the core components to the complete three-in-one electric bridge system, Unimicron’s delivery plan is complete and detailed. Cheng Jie said, “If they want the core components, we will sell them the core components. If they want the complete assembly, we will provide them with the complete assembly. This is where the OEMs highly recognize Unimicron.”

Unimicron’s parent company Bosch is the world’s number one automotive components supplier and the largest diesel engine system supplier globally. This enormous crocodile is still rooted in history while taking a leap forward into the future.

An obvious advantage is that, under the current background of unstable supply chains for many companies, due to Unimicron Electronics’ own production process modules and Bosch’s own chip production strategy, it has a more stable supply chain than its competitors.

“We may be a so-called invisible champion in the motor industry.” Cheng Jie said that he participated in the planning of many products produced in this factory. Every three motors produced at the Taicang factory will be sent to the vehicles of new power manufacturers.

Bruno Ahrens introduced that Unimicron’s electric drive business is developing rapidly, with more than 25 customers, and it should exceed 60 by 2028. By the end of this year, Unimicron’s electric drive business is expected to deliver more than 400,000 sets of electric bridges, over 1.5 million motors, and over 3 million controllers.

He revealed that various types of products produced on the line will be assembled into popular models such as ID.6X, IM L7, Mercedes-Benz C-Class, Ideal L9, and NIO EC6.

Cheng Jie said that although Unimicron already has nearly 10,000 employees, with explosive growth in business, the number of personnel is far from enough.

Taking the Taicang factory as an example, in 2019, the Taicang factory had 255 technical workers and engineers, but in future planning, the number is expected to reach 2,500 people by 2027. The scale of expansion suggests that the business prospects and blueprint are promising.

Cold or Warm in the Face of Winter?Unquestionably, the development of electric drive systems has become a key driving force for industrial evolution.

Quietly, however, many suppliers, like Schaeffler, famous for its transmissions, have also begun to transform one after another.

Schaeffler began hybridizing its transmission as early as 2009, but realized that hybrid transmissions and electric drive systems would be a complementary relationship.

Schaeffler’s strength in electric drive technology cannot be underestimated. It hopes to smoothly transition from hybrid transmissions to electric drive systems. In terms of the application of electrically driven passenger vehicles, Schaeffler can trace its roots back to the application of the hybrid motor in the 2008 Mercedes-Benz S-Class, which was the first mass-produced motor.

The pervasive change is ongoing in all corners. “Reducing orders for traditional fuel vehicle components” is the ultimate truth for all suppliers. The only uncertainty is the length of time.

The necessary strengths barriers appear to be diverging in an incomparably powerful manner, with pure electric, strong hybrid, weak hybrid, 800V electric drive, silicon carbide, oil cooling, water cooling, and others. Strong companies may be able to add weight to these factors, while those that are slightly weaker only have one chance to choose.

Electric drive system suppliers are a good example. There are four main types of companies in the market: those under automakers, such as BYD, Huayu Electric, Hive Drive, VIE, Weir, Volkswagon transmissions, Hyundai Mobis, and Denso; foreign top brands such as Japan’s Denso, Borg Warner, United Electronics, Faurecia, Siemens, Weipai Technology, and Schaeffler; independent brands such as China National Railway Times Electric, Huichuan Technology, Shanghai Electric, and Jingjin Electric; and new entrants, such as Huawei.

Is it heaven or hell? The iteration update of technology continues to test the resilience of participants’ strategic practices.

Like all technological changes, there are survivors and also losers. Those who hope to survive as suppliers need the ability to develop key components.

There is a clear trend that suppliers should reduce their R&D resources in the integration of electric drive systems. According to data from the NE era, in the first half of 2022, the top 10 mainstream electric passenger vehicle companies with sales of more than 10,000 units, only Changan, Hezhong, and Chery have not yet installed their own electric drive assemblies, with GAC supplying it through a joint venture with Denso.Bruno Ahrens told “AutocarMax” that the electric bridge (electric drive train) will not become an important investment direction for United Electronics. “For us, the investment in motors and power modules is more obvious. As customers can produce their own electric bridges, it will not be our important investment direction.”

In the second phase of the Taicang plant, there is only one electric bridge production line, with five others being motor and power module production lines. With more and more OEMs producing their own electric bridges, suppliers like Liandian will inevitably face more detailed (component and module) product supply solutions.

Li Changluo, director of the New Energy Development Center at Geek+ Intelligent Technology, said that the host company will definitely build its own system integration. “However, we have found that every supplier has its own core technological highlights, some in electronic control, some in electric drive, and some in reduction gears.”

Differentiated competition is a relatively friendly way for small and medium-sized enterprises. Taking power modules as an example, it is the core of the core for electric drives. If the human brain energy consumption accounts for 20% to 30% of the individual, then the power module accounts for about 70% of the energy consumption of the entire electric drive. Some suppliers are planning to achieve the performance and stability of this module to the extreme.

“In the NE era,” visited the top 10 players in the industrial supply chain over the past two or three years, and each one complained. The demand side has not had a large market scale in the past few years; recently, it has faced pressure from automakers to reduce costs, adding to the pressure of upstream raw material price increases and intensifying price competition; future R&D pressures are also not small, and both local and foreign companies are worried.

Reducing costs is an eternal theme for suppliers. Li Zhiwen, innovation director of Weipai Technology’s Asia-Pacific New Energy Technology Business Unit, said that the company has made a prediction that the cost of inverters must decrease by 40% to achieve profitability and competitiveness in five to eight years.

A coin has two sides. In the past, it was almost impossible to enter a mature system, but now, although the growing pains are painful, it is also a brand-new opportunity. The temptation is fascinating. These small and medium-sized enterprises can also ambitiously ask, “Is there anyone who is not from a noble family or high official, but can become a new international industrial giant in the face of opportunities?”

Supported by great determination, confidence, and ambition, short-term profitability issues have become tolerable troubles. Although the cost savings resulting from economies of scale have not yet been fully realized, the battery cost reduction example is effective, and electric drive suppliers have a firm confidence that in their opinion, there is still a large space for cost reduction in various dimensions.

Located in Yueqing, Zhejiang, far from the economic development zone, in a residential area, it is hard to believe that a seemingly warehouse-like 100-square-meter space can be a small supplier. This small workshop-style factory with only a few employees also faces transformation challenges.

In the training of the host factory Geely’s local supply chain system, they have produced small components that meet the quality requirements and have entered the supply chain through difficult efforts. However, the transformation brings with it new parts standards, and the cost of just reopening the mold is enough to break the small enterprise’s funding chain. Although the boss is helpless, he must bite the bullet and keep up with the pace.

What impressed the researcher from “NE Times” is the “resilience” demonstrated by the independent supply chain over the years. Even though there is a common problem of “not enough money, unable to attract people”, they strive to keep up with the pace, and many have their own technical highlights.

Duan Chengwu, the director of Power System Technology at the General Motors Technical Center, believes that enterprises with revolutionary technological advantages still have the opportunity to race on this track. The industry has not yet solidified, and the market has not yet stabilized, which means that even startups still have the opportunity to seek a place.

The NE Times White Paper supports this statement from the market level. The data shows that from 2017 to 2020, the CR10 (total market share of industry TOP10) of motors/electronics/control reducers has declined. Even though there was a slight rebound in 2021, there was no significant increase. The market clearly has not yet reached its peak.

Under intense competition, there are still companies that have entered, reflecting the optimistic expectations of the industry for the future.

Shaeffler’s Greater China electric drive axle business unit leader, Huang Chao, is very optimistic about the ongoing changes. In his opinion, the new four modernizations represent rapid iteration of all new technologies and all are opportunities. Moreover, there is a lot of capital available in China now.

“This is the best time with great opportunities. If you miss it, it may not be so easy to find such an opportunity again in the next 20 to 30 years.”

Closing Words

In 1986, Professor Theodore Levitt of Harvard Business School met Hermann Simon, the then director of the European Market Marketing Research Institute in Dusseldorf. Levitt questioned why Germany, whose economy is only a quarter of that of the United States, exports the most in the world. Which companies have contributed the most?

At that time, Simon could not answer this question, but he was determined to find the answer. Interestingly, the research object soon ruled out giants such as Siemens and Daimler-Benz.

After several years of researching hundreds of companies in depth, Simon discovered that the reason for Germany’s world-leading total export volume was because there are more than 2700 “hidden champions” among thousands of small and medium-sized enterprises. These hidden champions have an important position in niche markets, and it is these cornerstones that support Germany’s position as an “industrial power”.

In 1996, Hermann Simon published the book “Hidden Champions”, defining “Hidden Champions” as follows: they rank among the top three in niche markets; their annual sales do not exceed one billion German marks; and their B2B business leads to low public recognition.

Moreover, these companies share common traits, with a general emphasis on values such as technological worship, long-termism, and craftsmanship.

Initially, Simon thought that this phenomenon was unique to Germany, but as his research deepened, he found that Hidden Champions were prevalent in the United States, South Africa, New Zealand, and Asia. Currently, in China, the Hidden Champions phenomenon has started to take shape, with Zhou Fangsheng, who has been closely following the development of Hidden Champions at the front line for a long time, estimating that there are probably around 400 such companies.

People are curious as to how many Hidden Champions will emerge and break through the darkness on the value chain of the reshuffled automotive industry.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.