Author: Zhu Yulong

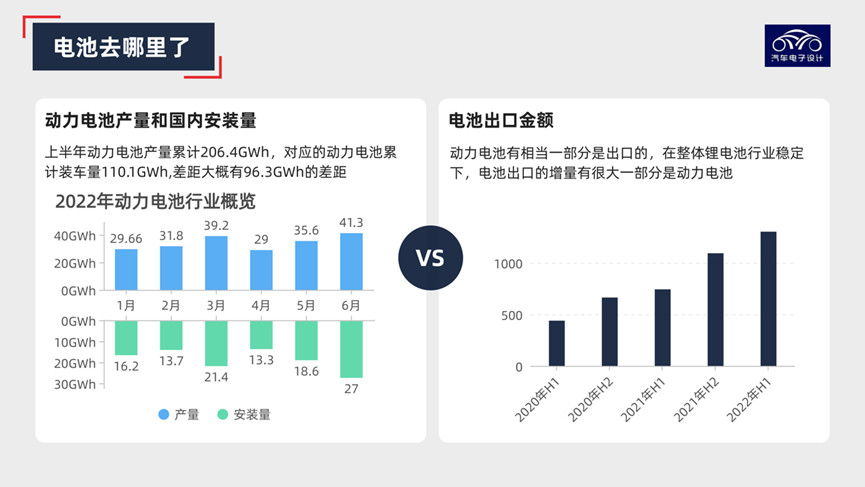

In the first half of the year, the cumulative output of power batteries reached 206.4 GWh, corresponding to a cumulative installation volume of 110.1 GWh, leaving a gap of approximately 96.3 GWh. I have been thinking about where these batteries are, but according to the data from the General Administration of Customs, I have found some answers:

-

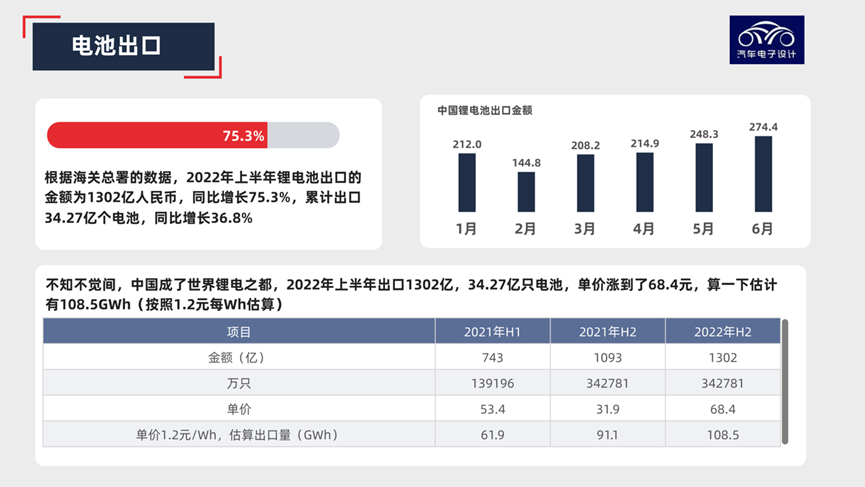

According to the data from the General Administration of Customs, the export value of lithium batteries in the first half of 2022 was RMB 130.2 billion, a year-on-year increase of 75.3%, with a cumulative export of 3.427 billion batteries, a year-on-year increase of 36.8%.

-

Unconsciously, China has become the capital of world lithium batteries. In the first half of 2022, it exported 130.2 billion RMB and 3.427 billion batteries, with a unit price of 68.4 yuan. By estimation, this is approximately 108.5 GWh (calculated based on 1.2 yuan per Wh).

This can also explain why the price of lithium cannot be lowered–lithium batteries are indeed being supplied globally in consumer electronics, small power, energy storage, and power batteries. This cannot be explained by only looking at whether the demand for power batteries is fluctuating.

Power Battery Exports

What started this train of thought was mainly the domestic production and installation volume of batteries, which we have analyzed many times before regarding the long-term gap.

Output = Installed volume with lag + Exports + Exported vehicles

In all the data, the most overlooked part is the export value of the entire lithium battery industry. By looking at the lithium battery classification in the General Administration of Customs database, if we examine the data for the past half year, starting from the first half of 2020, the growth curve looks impressive.

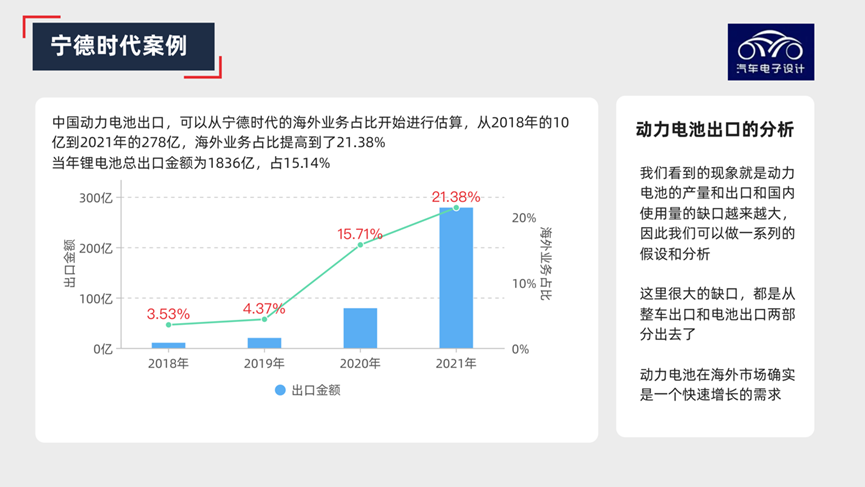

In analyzing the annual report of CATL, we can see from their data:

-

From 2018’s RMB 1 billion to RMB 27.8 billion in 2021, the proportion of their overseas business has risen to 21.38%.

-

The total export value of lithium batteries that year was RMB 183.6 billion, with CATL’s portion accounting for 15.14%.

Here, we will first look at the leading enterprises because the leading enterprises have the largest export business and the widest coverage.

Export of New Energy Vehicles

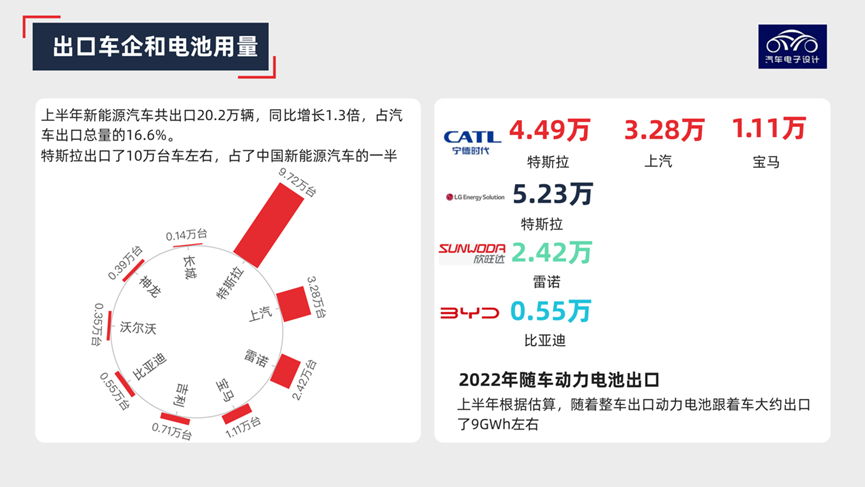

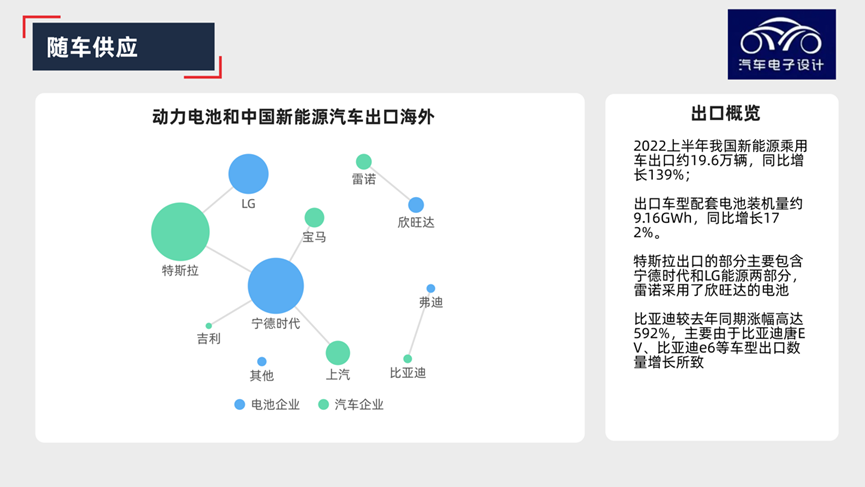

In the first half of the year, a total of 202,000 new energy vehicles were exported, an increase of 1.3 times year-on-year, accounting for 16.6% of the total vehicle exports. Tesla exported about 100,000 vehicles, accounting for half of China’s new energy vehicles. According to estimates, about 9GWh of power batteries were exported along with the vehicles.

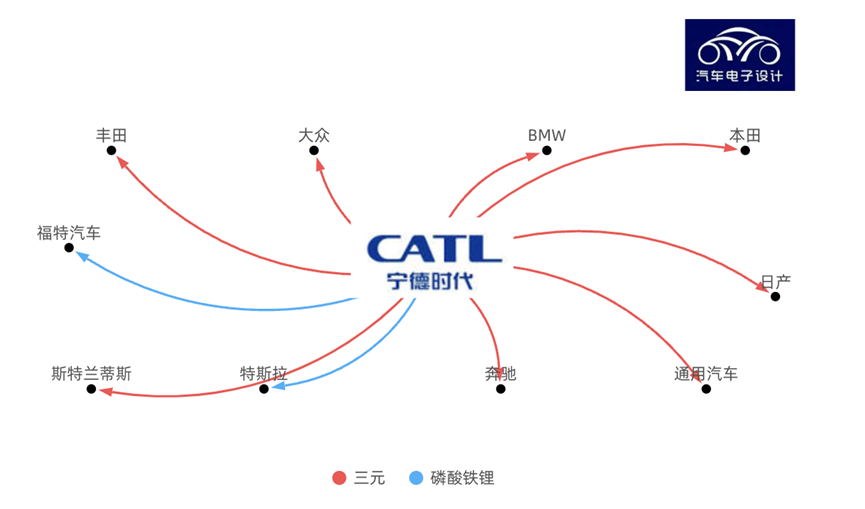

Breaking down the data further, NINGDE TIMES occupies the largest share, followed by LG and CATL.

Conclusion: Having examined the situation, it can be seen that this is indeed a necessary choice for Europe and the United States to produce power batteries and lithium batteries. Before the electrification begins, China has evolved into a city of lithium batteries with export earnings climbing continuously. If China’s power batteries are mostly used in the future, the effect will be very direct.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.