Author: Zhu Yulong

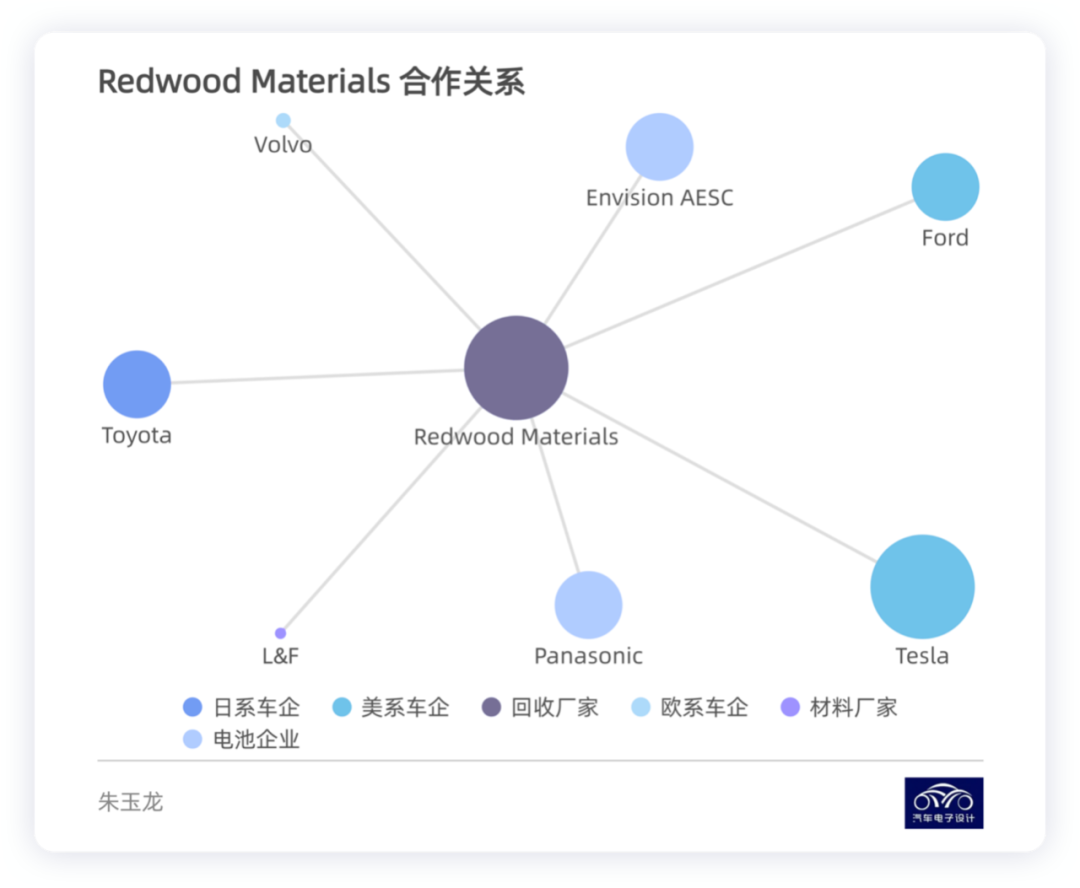

The global battery recycling industry is still in its infancy. JB Straubel, the former CTO of Tesla, founded a battery recycling enterprise and has established a wide-ranging cooperative network, currently recycling about 6 GWh of lithium-ion batteries (from consumer electronics) per year at the company’s factory in Nevada. Redwood also recycles materials from defective batteries at Tesla’s factory in Nevada that come from Panasonic. As far as we can see, Redwood not only covers Ford, Volvo, Toyota, and the Volkswagen Group in the USA (including Audi), but also has extremely strong imaginative space.

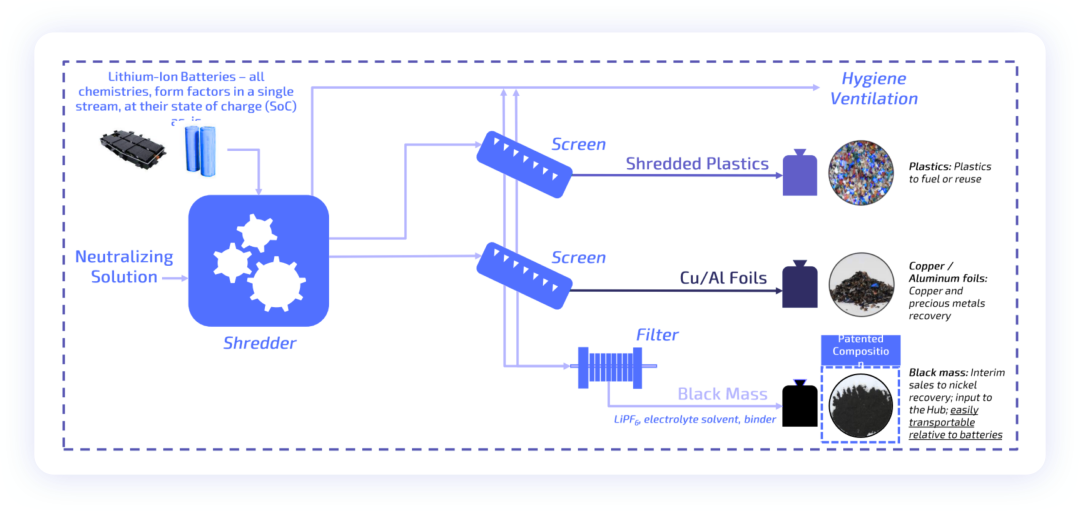

Currently, the recycling channels in the USA collect and package discarded batteries and materials through the dealer networks of automobile enterprises and transport them to Redwood’s factory in Nevada for recycling.

Investment and Prospects

I actually think that Redwood Materials is a bit suspicious (and it has nothing to do with Elon Musk, I just don’t believe it). This enterprise’s development curve is the most knowledgeable and clever capital cooperation in the United States.

Redwood Materials was founded in Nevada in 2017. In 2019, JB Straubel resigned from Tesla to focus on the operation of Redwood Materials.

The financing history is as follows:

-

Completed a seed round financing of $2 million in 2017.

-

In 2020, Redwood Materials completed a total of $40 million in its first financing round. The investors include Capricorn Investment Group and Breakthrough Energy Ventures.

-

In 2020, Redwood Materials conducted a second round of financing, totaling $200 million, with investors from Amazon, Capricorn, and Breakthrough Energy Ventures.- In July 2021, Redwood Materials announced the completion of a $700 million Series C funding, with investors including T. Rowe Price, Baillie Gifford, and Fidelity, valuing the company at $3.7 billion.

-

In 2021, Ford invested $50 million.

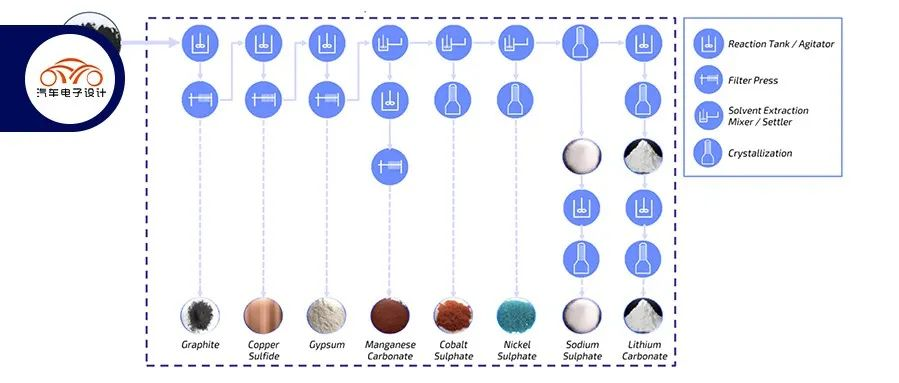

From a larger perspective, this company currently recycles 6 GWh of batteries and has established a foothold in the U.S. EV industry, which is early in development but has not yet taken shape. This means that most consumer electronics recycling in the U.S. comes from Amazon and Panasonic, by breaking down e-waste into powder, treating it with chemicals, and then sending it back as raw materials.

In August 2021, Redwood tripled the size of its 150,000 square-foot recycling facility in Carson City, Nevada, and purchased 100 acres of land near Tesla and Panasonic’s Gigafactory in Sparks, Nevada, for joint operations. In September 2021, the company signed a multi-year agreement with Korean battery material manufacturer L&F to use its design and manufacturing technology in a new factory to produce battery cathodes.

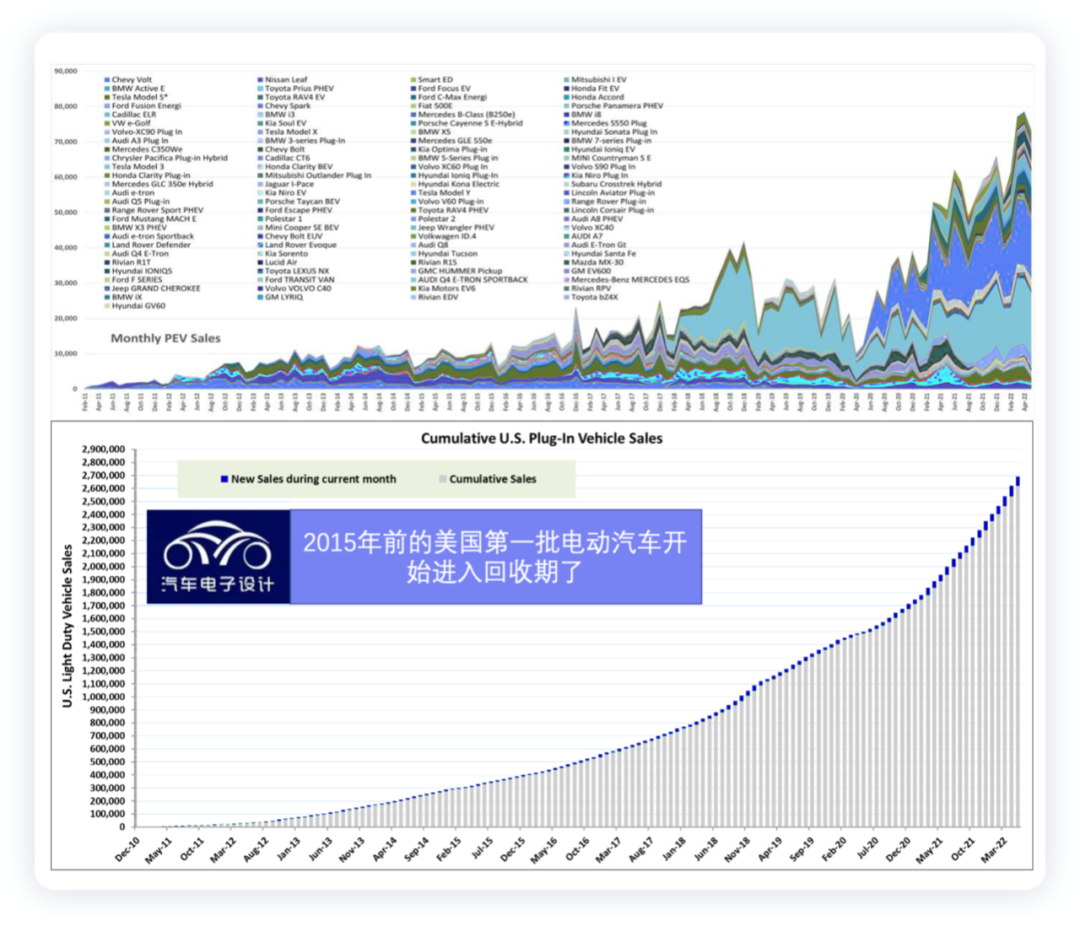

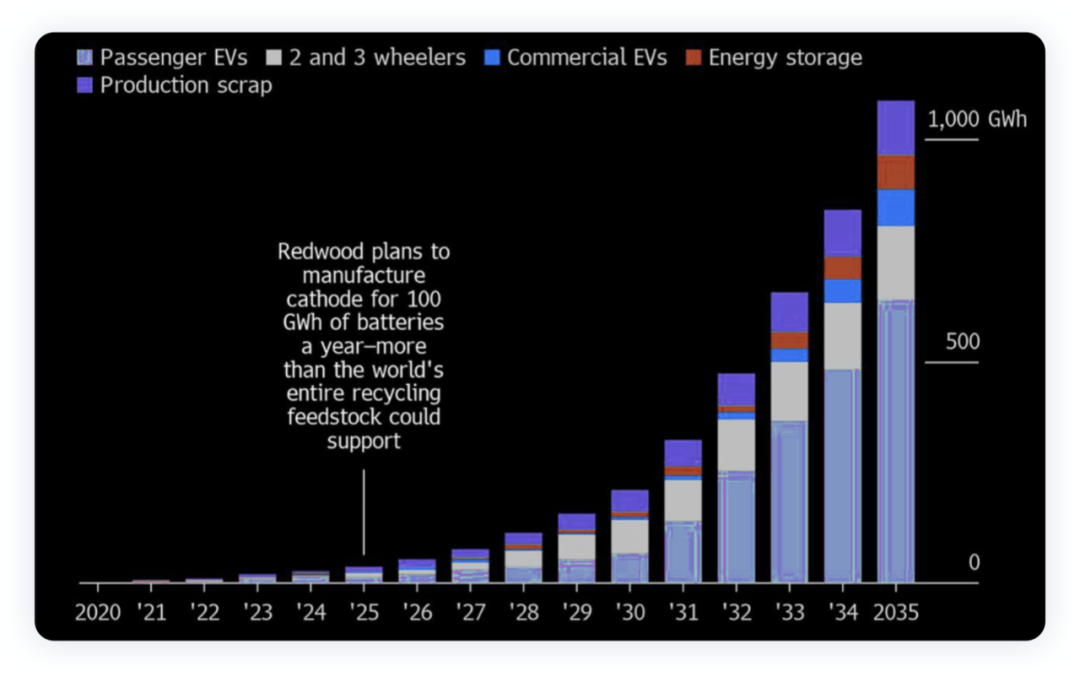

From a strategic perspective, Redwood initially planned to produce positive electrode materials, using accumulated lithium battery waste in the U.S. as resources to produce materials for 100 GWh by recycling in 2025, and gradually increasing production capacity as the U.S. EV market grows to reach 500 GWh by 2030. In other words, the U.S. wants to make power and consumer battery materials part of a sustainable cycle, building a complete system.

The subsequent collaborations with General Motors, LG Energy, and Li-Cycle also follow this logic, aiming to reclaim the inherent lithium batteries in the U.S. as part of the materials for power batteries.

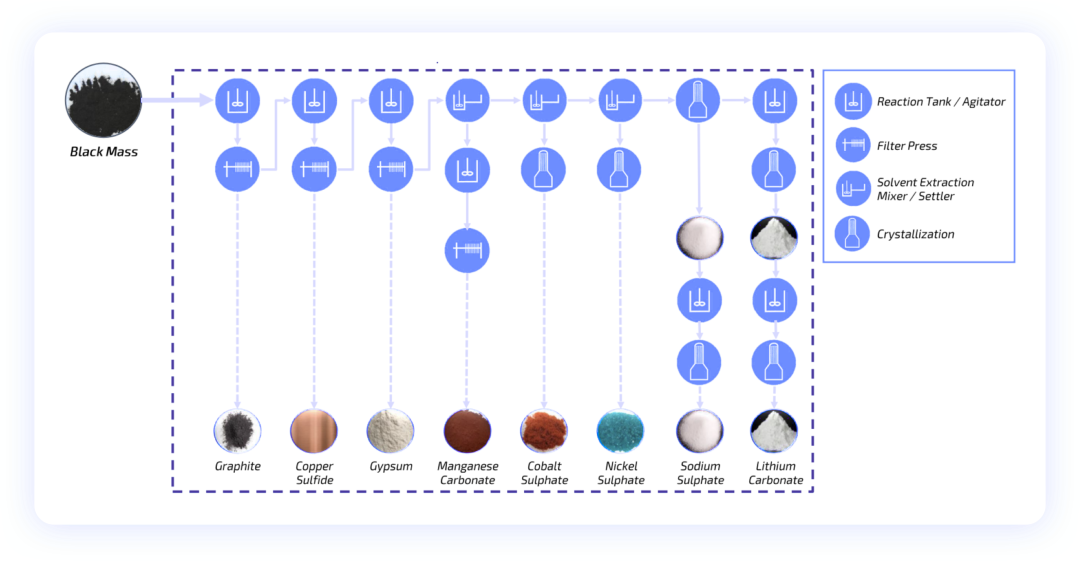

From the perspective of current recycling methods, there is a consensus that efficiency is improving, and the next generation battery material factories are indeed moving towards large-scale chemical production.

For the treatment of black powder, here is where the higher efficiency lies.

Discussion and Reflection

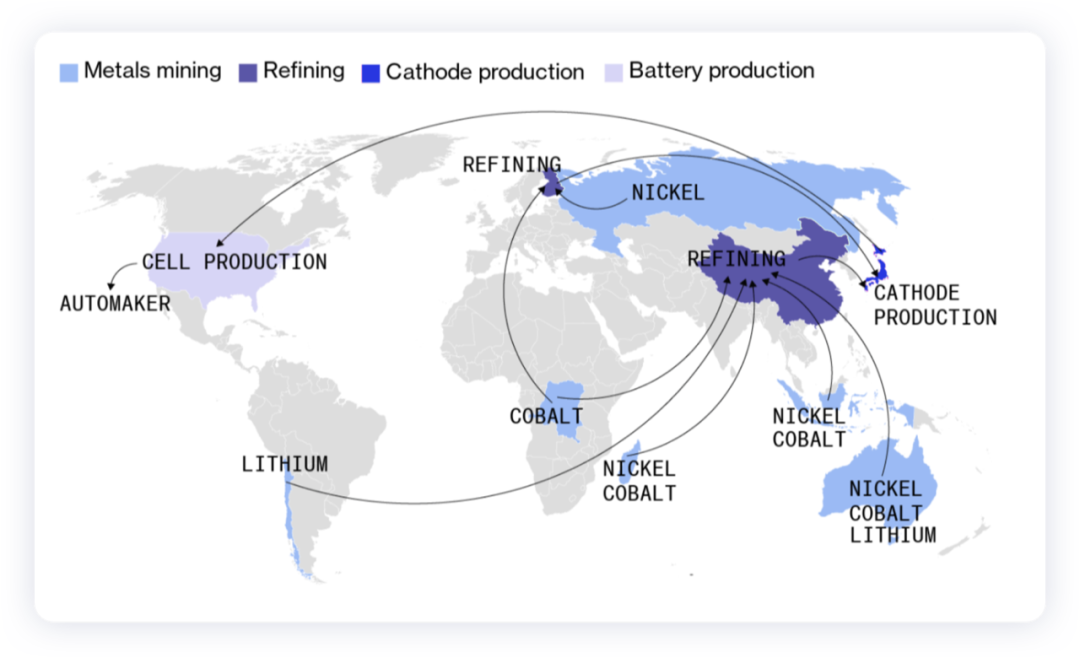

In my opinion, Europe and the United States have thought more about building their own battery industry. From the beginning, their logic was to build large enterprises.

-

There are relatively few companies capable of producing power batteries, so they purchase equipment from China, Japan, and Korea.

-

From the beginning, they established a complete recycling network and rules, and also developed the proportion of renewable materials. By 2030, power batteries may need to use 10-15% of recycled materials.

-

They have built battery material resource repositories overseas in South America, Southeast Asia, Australia, and Africa.

To sum up, from the current perspective, the entire battery production and material processing industry has homogenized, which means that there may be a certain degree of latecomer advantage. I can buy more efficient equipment, recruit battery scientists, battery designers, and process engineers from all over the world, and gradually increase production. From a technical perspective, Europe and the United States also have two paths:

-

Lithium iron phosphate: Unlike China’s considerations, due to the recycling situation, the comprehensive cost of iron-lithium may not be lower than that of high-nickel.

-

High nickel: This mainly relies on the previous existence of battery waste to support a part of it, forming a cycling system in the future.

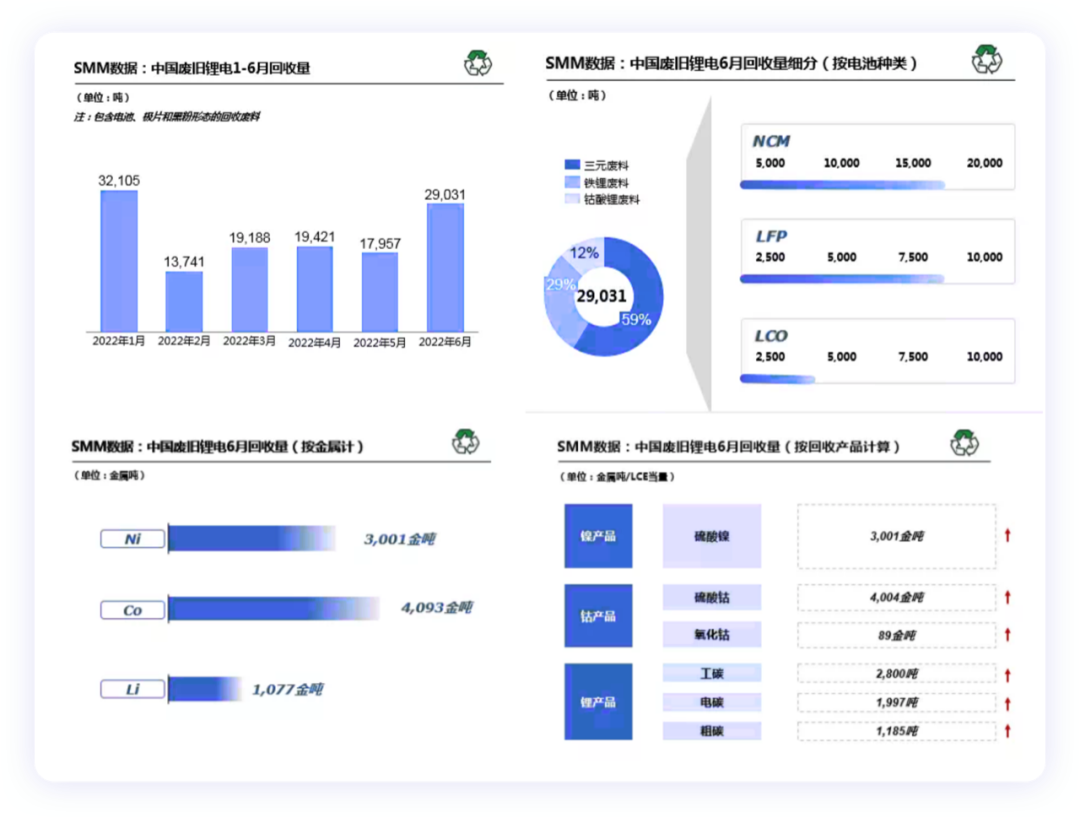

From the current data in China, a large amount of recycling has also been done, but there are many players, so everyone can collect it, and it has been a scattered situation from the beginning. In June, 17,032 tons of waste ternary were collected, 8,316 tons of waste lithium iron phosphate were collected, and 3,684 tons of waste lithium cobalt were collected. In June, 3,001 tons of nickel, 4,093 tons of cobalt, and 1,077 tons of lithium were recovered.

In June, 2,800 tons of industrial-grade lithium carbonate, 1,997 tons of battery-grade lithium carbonate, and 1,185 tons of crude lithium carbonate were recovered.

Summary: In the long term, recycling plays an important role in the battery materials and production. The development of power batteries is sustainable. It is worth considering how to build a controllable and efficient system in China.

Summary: In the long term, recycling plays an important role in the battery materials and production. The development of power batteries is sustainable. It is worth considering how to build a controllable and efficient system in China.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.