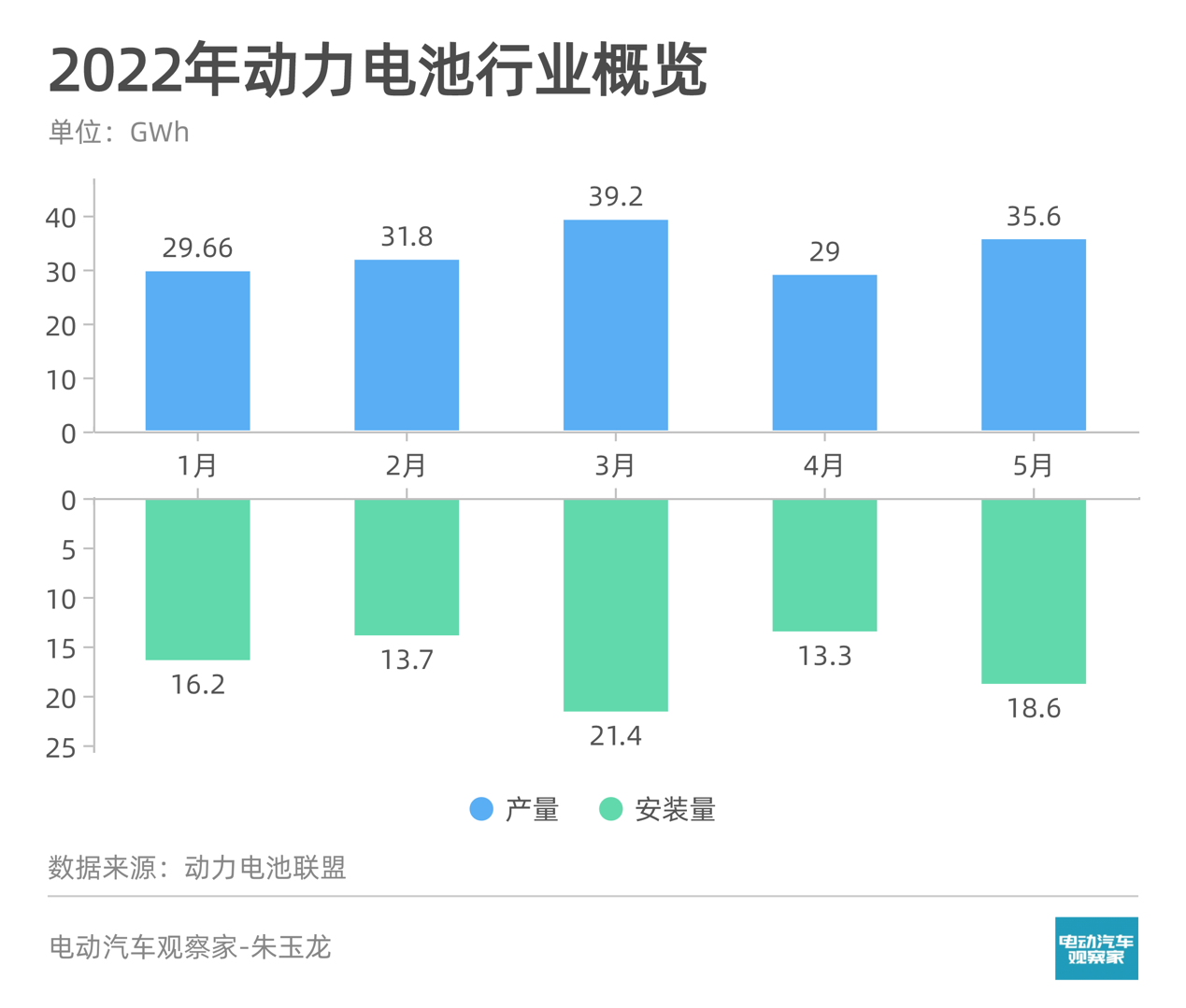

May’s power battery industry recovered relatively quickly from the pandemic.

The total production of power batteries in May was 35.6GWh, an increase of 22.8% compared to the previous month, indicating a return to growth.

The installed capacity of power batteries was 18.6GWh, up 39.9% from the previous month. The impact of the tax reduction policy for traditional cars on new energy vehicles is relatively small. In addition, as oil prices continue to rise, consumers are increasingly considering pure electric and plug-in hybrid vehicles as they watch the price of gasoline per gallon.

The main industry trends observed include:

1) Ternary batteries are recovering: In May, the production of ternary batteries reached 16.3GWh, an increase of 58.2% compared to the previous month; the installed capacity of ternary batteries was 8.3GWh, an increase of 90.3%, especially with Ningde recovering relatively quickly. This is mainly due to the popularity of foreign brands both domestically and internationally, which indicates that these enterprises will accelerate their efforts in the second half of the year.

2) The growth of lithium iron phosphate has slowed down: Due to the high price of lithium carbonate, the cost advantage of lithium iron phosphate is not significant. In May, the production of lithium iron phosphate batteries was 19.2GWh, an increase of 3.3% compared to the previous month; the installed capacity of lithium iron phosphate batteries was 10.2GWh, an increase of 15.1%, mainly driven by domestic growth, which is not particularly significant at present. As Tesla gradually recovers to 50-60,000 units per month and new forces gradually increase their shipments, the situation will improve.

3) Price adjustment mechanism: According to information disclosed by NIO, a new agreement between battery suppliers and auto companies is that battery costs are linked to the price of raw materials (battery material index) and fluctuate accordingly. The cost of the battery is determined based on the previous month’s battery material prices.

4) The strategic positioning of China’s entire vehicle industry is clear. At the Q1 communication conference, NIO explicitly stated its battery strategy of self-development and external procurement, and SAIC Group’s new joint venture, Ruipusaicke, has also officially launched, representing both new forces and traditional car companies preparing for the large-scale penetration of electric vehicles. The pattern of China’s power battery industry is entering a new stage.

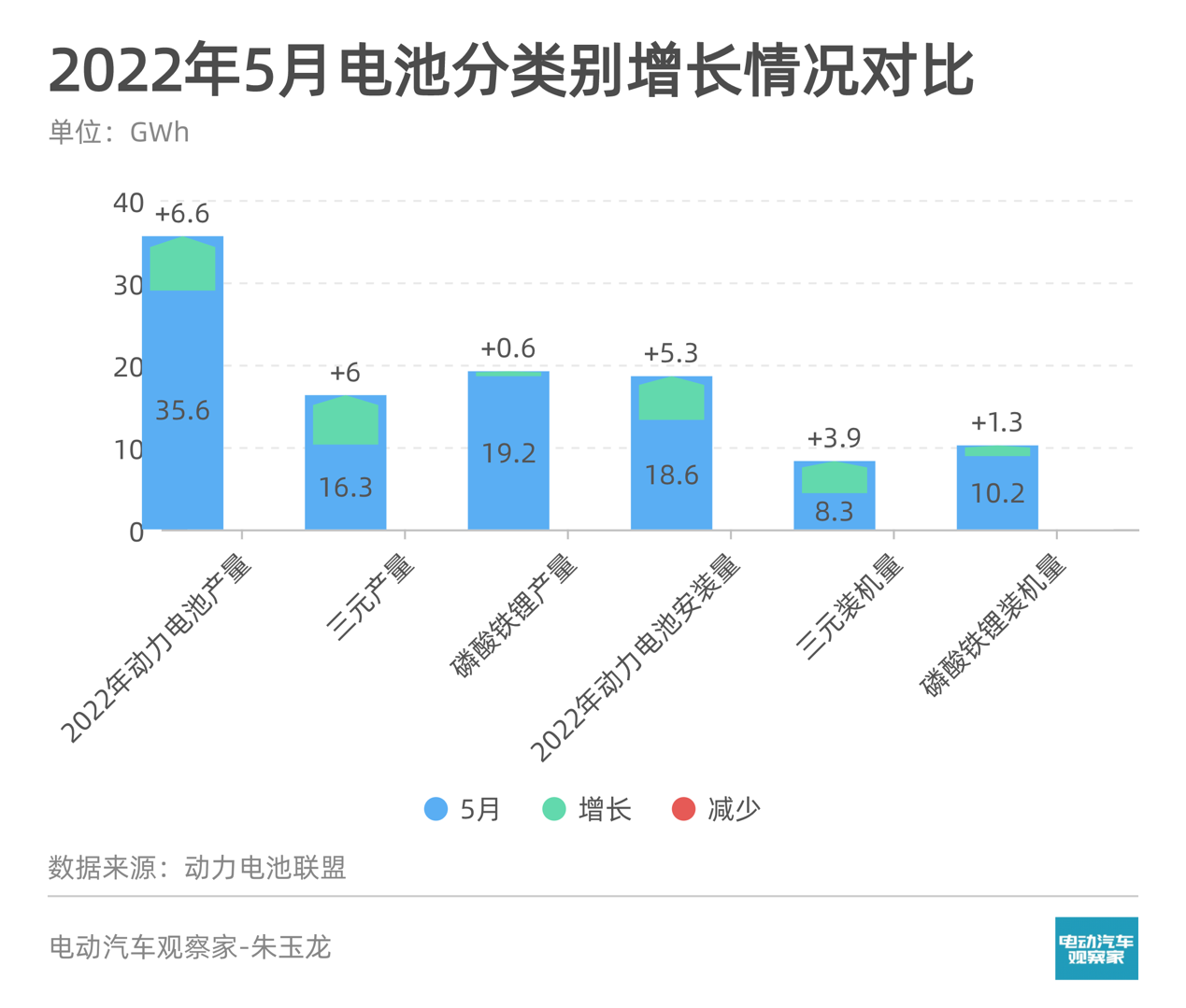

Ternary recovery and lithium iron phosphate stagnation

In May, the total production of power batteries was 35.6GWh, a year-on-year increase of 157.9% and a 22.8% increase compared to the previous month.

This is a very good data point. May’s production volume of 35.6GWh was only 4.2GWh lower than March’s 39.2GWh. In addition, it should be noted that production volume includes domestic and international demand.

We can draw many conclusions from the month-over-month data:

- China’s total production of power batteries was 35.6GWh, up 22.8% from the previous month.

- The production of ternary batteries was 16.3GWh, an increase of 58.2% compared to the previous month.- Lithium iron phosphate battery output reaches 19.2GWh, up 3.3% compared with the previous month.

- Domestic power battery shipment is 18.6GWh, up 39.9% compared with the previous month.

- Ternary battery shipment is 8.3GWh, up 90.3% compared with the previous month.

- Lithium iron phosphate battery shipment is 10.2GWh, up 15.1% compared with the previous month.

May is the month of ternary battery recovery, and the demand and actual shipment of major power battery companies on the ternary battery side have seen a substantial month-on-month recovery.

Compared with ternary batteries, the growth of lithium iron phosphate batteries was relatively stagnant in May.

My understanding is that this represents the gradual recovery of the demand from foreign brands that use a large amount of ternary batteries, which in turn drives China’s ternary battery production. The significant increase in actual shipment volume is also due to their recovery and that of new energy companies.

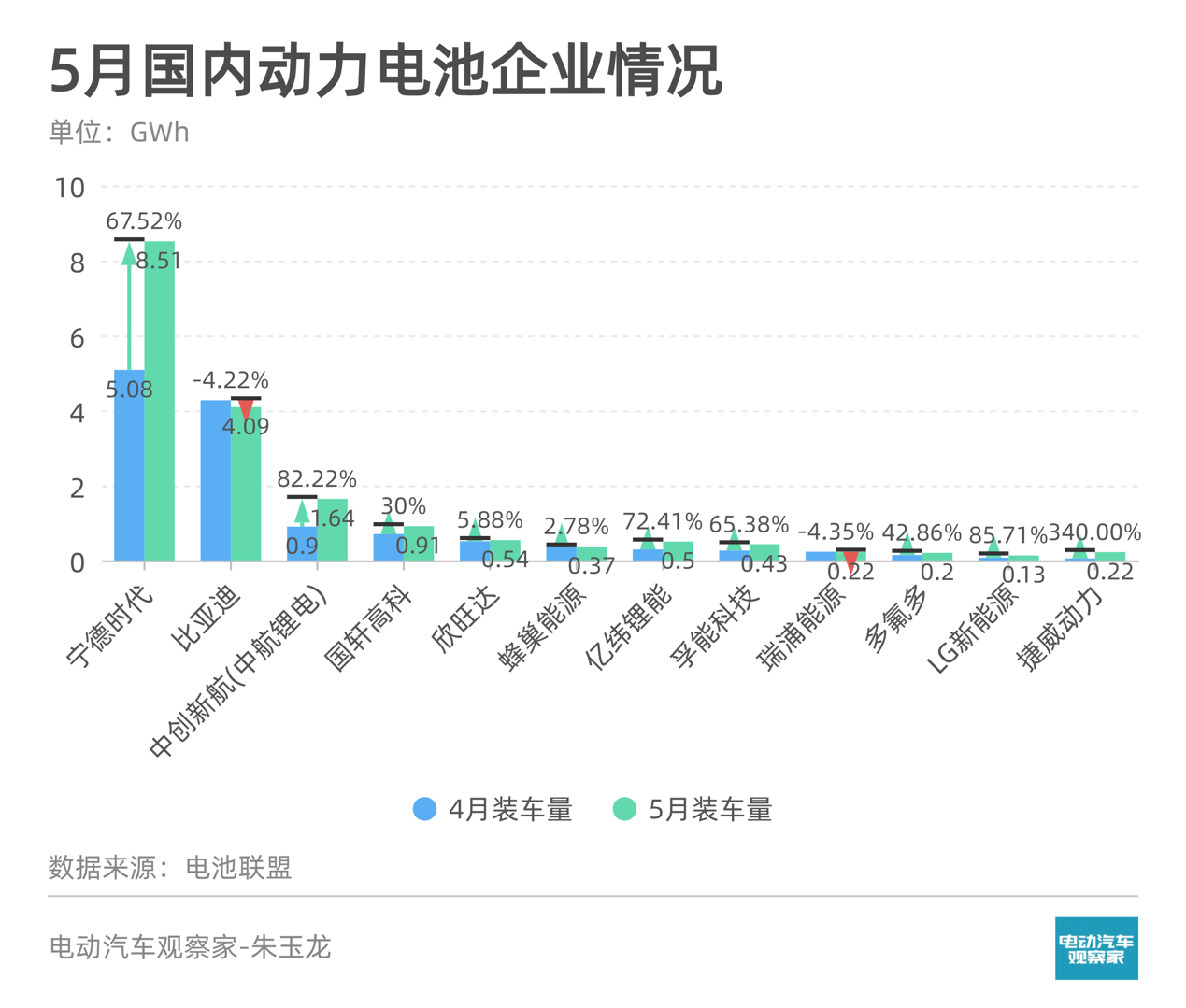

Competitive Landscape: CATL Achieves the Highest Month-on-Month Growth in Installed Capacity

In May, a total of 37 power battery companies in the new energy vehicle market achieved vehicle matching (a decrease of 4 companies compared with 2021). The top three, top five, and top ten power battery companies in terms of power battery shipment volume were 14.2 GWh, 15.7 GWh, and 17.4 GWh, respectively, accounting for 76.7%, 84.5%, and 93.9% of the total shipment volume.

Compared with April, CATL achieved the highest month-on-month growth in installed capacity, up to 67.52%, while BYD decreased slightly; CEA increased by 82.22%, reaching 1.64GWh.

If we distinguish between ternary and lithium iron phosphate batteries, the situation is as follows:

- CATL: Both ternary and lithium iron phosphate batteries have shipped more than 4.2GWh, and the increase in the ternary battery is very noticeable.

- BYD: The large sales of DM-i also objectively offset the demand for BEV. From the perspective of comprehensive cost, it has a competitive advantage in the current period of high battery material prices. DM-i only requires 8-24KWh of electricity.

- CEA: 1.37GWh of ternary, 0.27GWh of lithium iron phosphate, and the shipment of lithium iron phosphate is slowly increasing.

- SVOLT: The shipment volume of lithium iron phosphate and ternary is relatively balanced.

- Xinwanda: The shipment volume of ternary is higher.

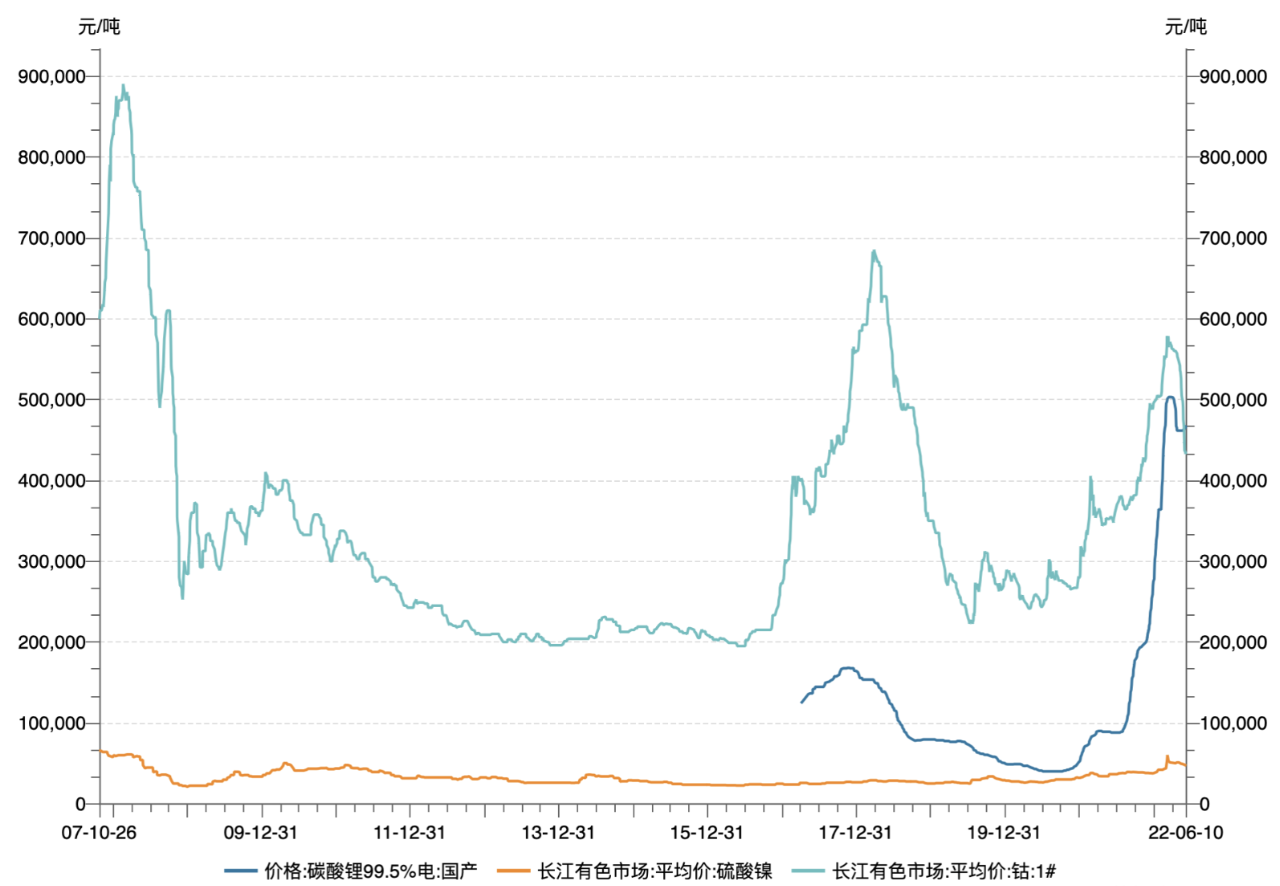

Pricing Mechanism: Linked to Material PricesBefore March 2022, the price of batteries was relatively unaffected by fluctuations in material prices. However, with the continuous increase in the price of lithium carbonate and lithium hydroxide, midstream battery companies want to emulate Korean battery companies and pass on the impact of material fluctuations through a fully market-driven mechanism to adjust prices.

The objective effect of this move is to force weakly competitive car companies to exit the battery purchase market.

The cost of batteries will be linked to raw materials and will fluctuate with the price index of battery materials. Currently, we do not know the specific composition of the material price index, but the general principle is to determine the cost of batteries based on the previous month’s battery material prices.

Car Company Battery Production Strategy

In NIO’s Q1 2022 earnings communication, NIO mentioned its battery strategy.

NIO’s second brand will be delivered in the second half of 2024, with main products in the 200,000 to 300,000 RMB range, and will use its own produced batteries.

For car companies such as NIO, self-produced batteries will be a significant challenge in terms of cost. NIO’s battery cell route is worth paying attention to whether it goes in the direction of square shell iron-lithium or 4680.

Currently, we hear many voices. NIO currently has a battery-related team of over 400 people, deeply involved in battery material, cell and pack design, battery management system, manufacturing process, and other R&D work, establishing and enhancing battery systematized R&D and industrialization capabilities. In public information, NIO has already started building a cell pilot line, cell testing and R&D laboratory. Pack line is more exploration or will cover 400V/800V systems in the future for charge and discharge.

Personally, relying solely on these 400 people to build a cell company may not be enough for NIO. However, through these people, NIO can have deeper cooperation with second and third-tier companies, making it more likely.

Summary: The pattern of power battery companies is actually gradually changing, and some things have already determined the direction, and the flow of talent can objectively reflect the changes in the entire industry. Around low cost and high-efficiency manufacturing, the vertical integration of cell supply is a long-term effective organizational model.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.