Author: Chang Yan

If it weren’t for someone reminding me, I would have forgotten about today’s conference call for XPeng Motors’ Q1 2022 earnings report.

I believe that all car companies have been struggling when announcing results and targets recently. Throughout the second quarter, from production to sales, everything was impacted by the epidemic. The two key phrases of price hikes and shortages also cast a layer of uncertainty over the development goals of the new car group, which have been delayed for release this year.

However, He XPeng is obviously a skilled player.

With XPeng’s revenue maintaining a year-on-year growth of over 150% for seven consecutive quarters and being at the top of the new forces delivery list for three consecutive quarters, he chose not to talk about accomplishments but instead to depict the future.

The Arrival of G9

Representing XPeng’s smart development, the two important works of P7 and P5 had both achieved excellent delivery results in Q1. In March, P7 achieved a monthly delivery volume of over 9,000 units for the first time, while P5 not only broke ten thousand in the same quarter, but also supported advanced driving assistance functions such as XPILOT 3.0 or XPILOT 3.5 for more than 50% of deliveries.

However, the product that can best represent XPeng’s smart development and overall level of car making in 2022 is the G9 that surprised everyone at last year’s Guangzhou Auto Show.

At today’s earnings call, He XPeng clearly stated that the G9 will officially launch and start production on a large scale in the third quarter, and will be delivered on a large scale in the fourth quarter.

These two “scalings” indicate that the G9 is not a showy flagship model, but a key product that continues to increase XPeng’s market share, capture customers’ minds, and put pressure on competitors.

“With the launch of G9, subsequent new platforms, and new models, we will structurally improve the gross profit margin of our models. Our medium- to long-term goal is to increase the company’s overall gross margin to over 25%.”

From the product perspective, He XPeng mentioned the decoupling of the vehicle body and intelligentization. Both P7 and P5 had some shortcomings in terms of the intelligent driving hardware and vehicle platform respectively. However, the two decoupled key experiences were seamlessly integrated into the G9.

Therefore, this also requires XPeng’s important intelligent technology and systematic capability to ensure the product experience of G9. At this earnings conference, XPeng also announced that it will begin large-scale deployment of the next-generation 480kW supercharging pile from the fourth quarter, which is a key indicator of the improved vehicle experience on the 800V architecture adopted by G9.

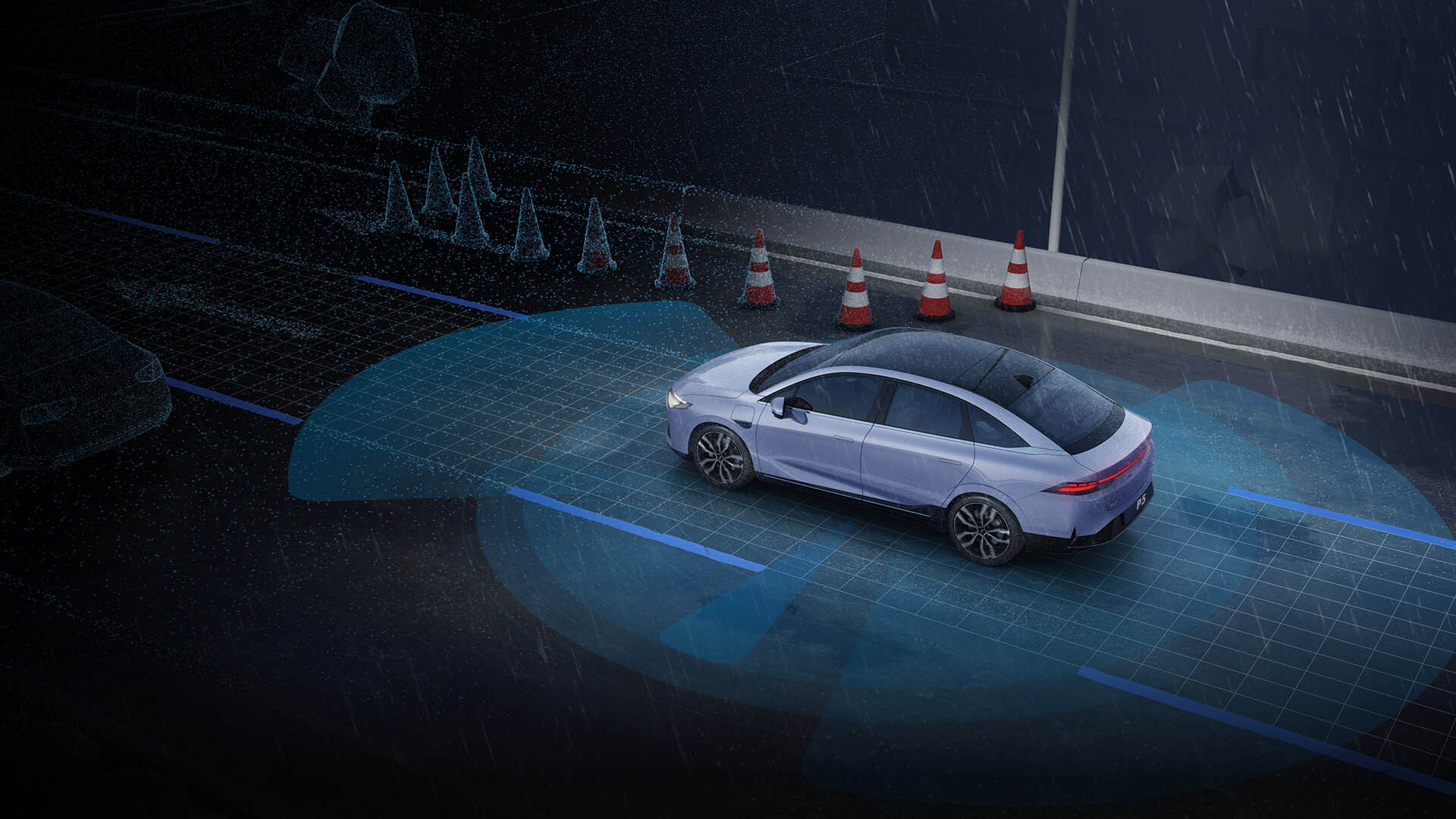

But more importantly, G9 is equipped with a stronger XPILOT 4.0.

L4 in 2026

Although it is said that intelligent driving has become a battleground for the new era, and although top players have begun to invest heavily in this area, XPeng still gave an extremely confident definition of G9’s advanced driving assistance capabilities:

“Starting from the G9 model, we will introduce the next generation of intelligent assisted driving system, which will significantly exceed all products currently available in the industry in terms of safety, performance, cost, and usage scenarios.”

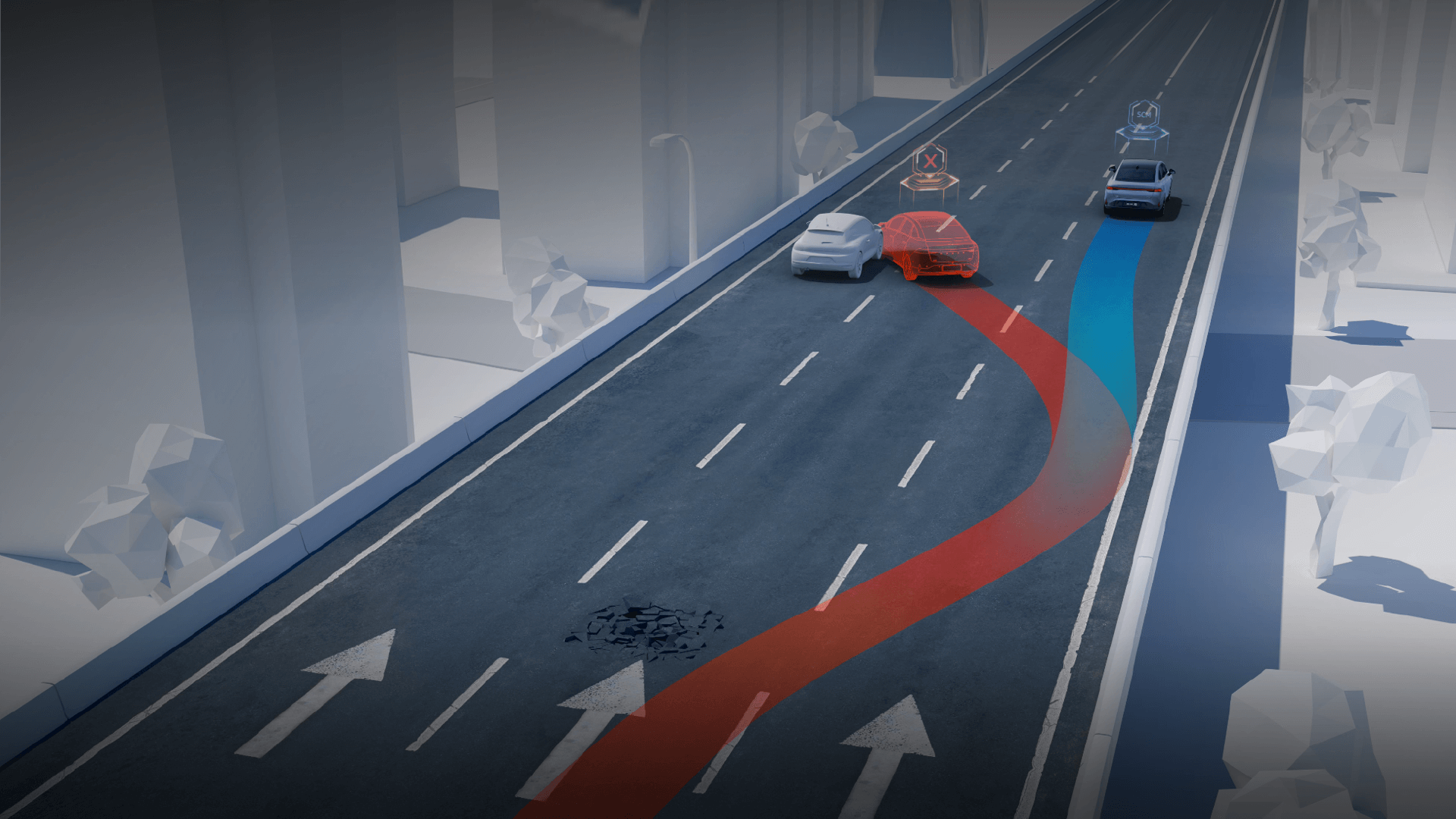

Among them, there is the NGP function within the city, which is viewed as a competitor to FSD. From the current situation in the industry, although related suppliers and host manufacturers have demonstrated exploration and reserves for the same level of assisted driving capabilities, it is unclear when they will be mass-produced and implemented.

However, XPeng stated that in mid-May, XPeng Motors had successfully tested the urban NGP project version in Guangzhou. Here, “testing” is defined as “entering a large-scale application from a local area, running smoothly overall, and exceeding expectations.” More importantly, the overall promotion has reached a critical approval stage. “After obtaining relevant approvals such as high-precision city maps, we will immediately release urban NGP and gradually increase the number of cities covered.”

In the previous iterations of advanced driving assistance, we have found that the more advantageous the first-mover advantage in each generation of competition, the more exaggerated the leading position of its technology and user reputation in the same generation of competition. The competition situation that XPeng G9 is about to face is another turning point in the way of human-vehicle co-driving, with a much higher value of opportunity than before.

# Translation

# Translation

XPeng He said, “We believe that only when the city’s NGP reaches a mature stage, forming an end-to-end closed loop of intelligent assisted driving capabilities, will it fundamentally change users’ experience and enter a real human-vehicle co-driving era.”

He even provided a very important timeline and target node: By 2026, XPeng will transition to L4 level autonomous driving technology.

However, from a more important and urgent perspective, XPeng needs to help users establish more cognitive abilities and make intelligent driving systems bring more real profits to XPeng. On May 9th, XPeng integrated the sales and intelligent assisted driving-related software, hardware, and operating services on the P5 and P7 through a series of adjustments. The industry once believed that this was a means adjustment caused by XPeng’s weak software sales.

However, at the financial report meeting, XPeng clearly stated that “XPeng is the first and best in the Chinese automotive brand to independently charge for software. We have also seen some changes. If hardware is charged once and software is charged again, the effect is not as good as combining hardware and software together. Moreover, packaging together can optimize the experience with intelligent cockpit, electronic electrical architecture, and other intelligent parts. One-time payment is more positive and direct for both enterprise gross profit and consumer experience.”

It is reported that after May, the software selection rate of related models has significantly increased, but XPeng also said that he is thinking about new software payment methods. G9, due to its stronger software capabilities, may introduce time-based and mileage-based payment methods or even consider charging based on scenarios.

Not afraid of chip shortage and price increase

“The industry trend is more favorable to leading companies.”

However, when XPeng mentioned this viewpoint, he did not emphasize the dominance of the big companies in the supply chain, but had already seen the next basic capability dividend brought about by XPeng’s long-term investment in intelligence.

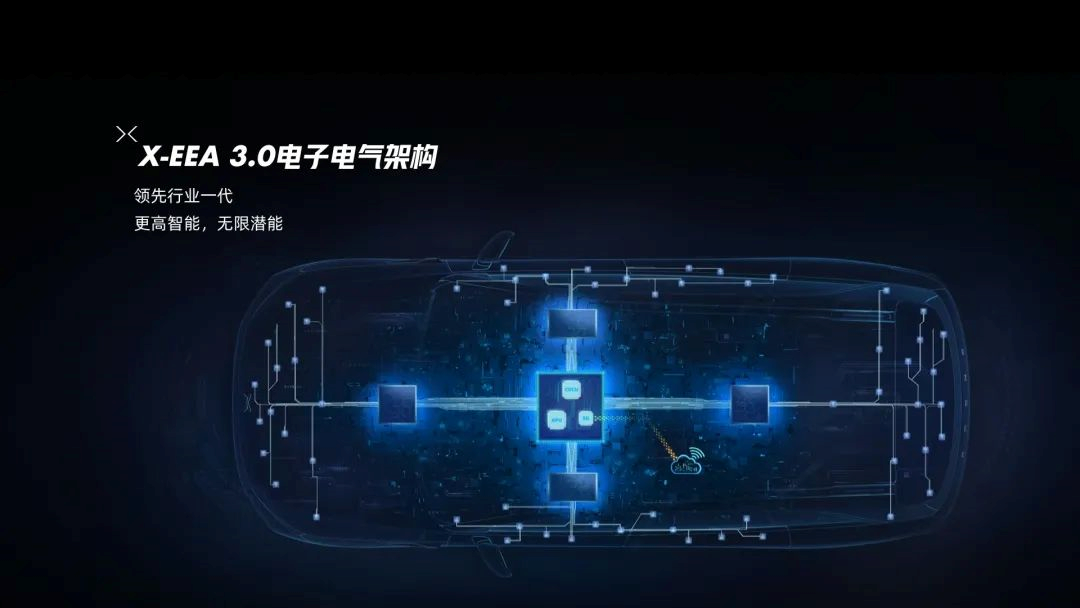

As previously mentioned, starting from G9, XPeng will deeply horizontally integrate its self-developed intelligent driving, intelligent cockpit, intelligent chassis, new-generation electronic electrical architecture, and whole-vehicle power systems.

This somewhat complicated description is playing a huge role in XPeng’s production state of resisting chip shortages.

XPeng Motors CEO He XPeng indicated that a smart vehicle now typically requires around 5000 chips, including several key chips, whose production capacity is not a problem. However, sometimes it is small and inexpensive chips that cause production delays, and sometimes it is difficult to predict whether such chips will be available next week.

However, for car makers with strong software and vehicle definition capabilities, they can make corresponding adjustments to the product structure within four months. This might enable them to find alternatives to certain chips, or to replace certain chips by software. This is why XPeng has made multiple mentions of its investment in embedded systems in recent earnings calls.

“Since 2015, we have been steadily developing the deep expertise of our embedded system hardware and underlying software capabilities that are tightly related to chip supply chain management, and will begin to see the economies of scale in 2022. This deep expertise enables us to respond quickly to chip safeguarding needs, to perform scarce chip verification, integration and switching more efficiently. This provides us with a highly flexible technology platform at the underlying level, which can better control costs and help us tackle the challenge of chip scarcity.”

This principle has in fact been proven in Tesla’s Model 3/Y when it avoided a global chip crisis before.

As for batteries, He believes that by the end of 2022 or the first half of 2023, the overall supply capacity of batteries will be significantly increased.

“We have seen some changes, with overseas lithium mines remaining at the same level as last year, and lithium mine prices declining moderately in Q2. Since the second half of last year, we have introduced more battery partners in order to solve the problem of being unable to sell cars due to insufficient battery supply, and this will completely reverse. We will have better prices than before in terms of cost. In the medium term, the price of batteries will decline compared to current highs.”

Order volume is no longer the main bottleneck for XPeng, and XPeng’s president, He Hongdi, commented that “we have already seen sales recovering in regions without travel restrictions, and May orders remain strong. If the supply chain returns to normal, we can catch up with production capacity in Q3, because we are already ramping up our capacity and can increase delivery volume.”“`

“We expect to deliver a total of approximately 31,000-34,000 vehicles, with an estimated revenue of RMB 6.8-7.5 billion in the second quarter of 2022.”

Throughout the financial report meeting, XPeng He successfully drew everyone’s interest towards the future. It is also clear that his thoughts were on the future.

There, we have a new car launched by XPeng on the newly developed B-class car platform and C-class car platform.

XPeng emphasized that these two new cars will achieve multiple global firsts in technological innovation and become the “face value representatives” in their respective vehicle categories.

“`

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.