Author: Zhu Yulong

According to weekly data, it can be estimated that the sales of traditional cars in April were about 760,000 and new energy vehicles 276,000, totaling around 1.03 million.

From the overall data, April’s data is similar to that of February (one week less due to the Chinese New Year). In most years, April is a climbing period with a small delivery climax before the weather heats up. This year’s April data has many things that are worth considering. Since the end of 2020, the impact of chips and raw materials on the entire automotive industry chain has been very significant. Optimistically, from weekly data, many automakers began to recover gradually from the bottom in April, beginning with the last week of April.

We may see such changes:

- From a global perspective

The automotive industry cluster still revolves around whole vehicle manufacturing, but parts production will continue to be localized. Previously, as long as the quantity was large, it was not easy to transport from a logistics point of view. But the current trend is that several major automotive countries have hopes of upstream critical chips and materials realizing deep-level traceability and control. The first thing we see is the localization process of domestically produced automotive chips.

- From a regional perspective

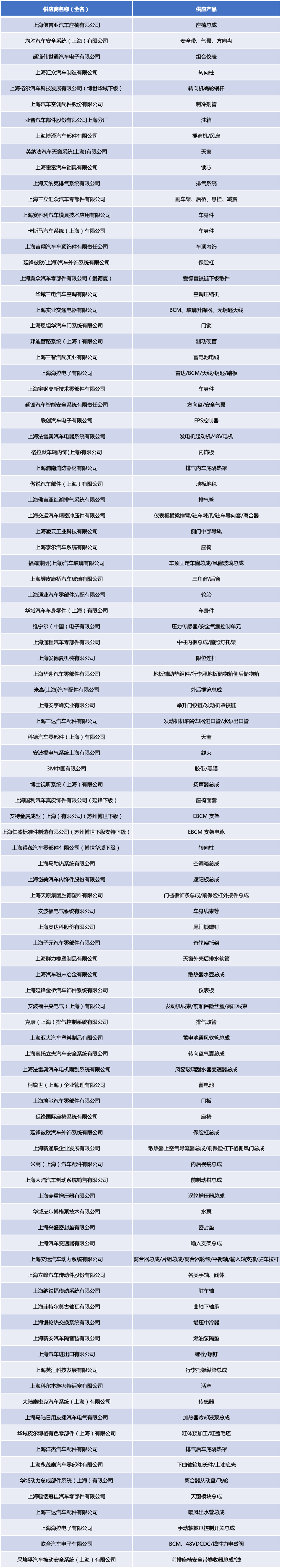

In terms of fuel vehicles, due to the order of development, the Yangtze River Delta automotive industry cluster has shown strong combat effectiveness in some aspects, such as high output of engine control units produced on a single line, achieving strong concentration under limited logistics costs. With the transition to new energy vehicles and the simplification of many parts systems, how to layout and differentiate supply chain risks, from Tier1 to Tier2 and above, and how to adjust will be on the agenda.

The epidemic can change many things, not only from a domestic perspective but also from a foreign perspective.

Analysis of weekly data in April

As previously mentioned, April encountered significant difficulties in terminal sales, so we can see a not-so-good data.

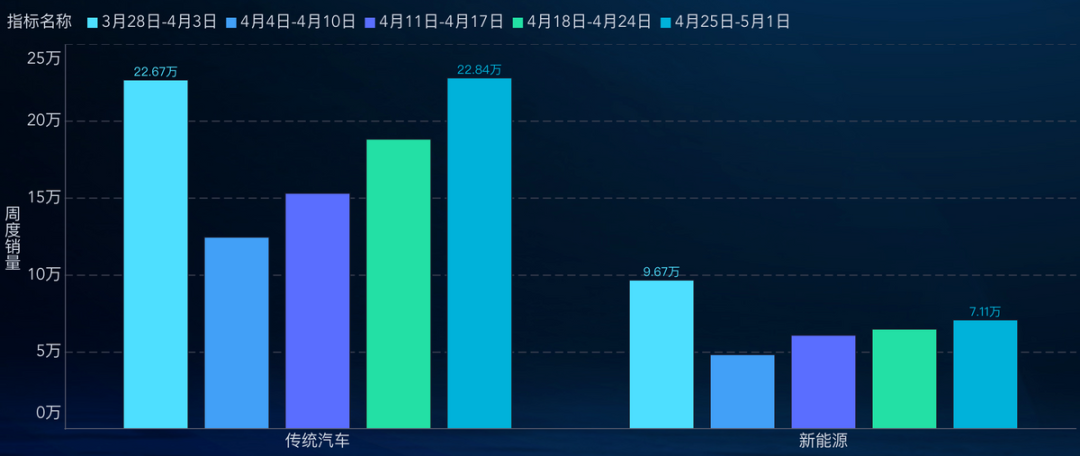

Sales of new energy vehicles are estimated to be 276,000, and traditional cars are 759,000, totaling approximately 1.03 million. The penetration rate of new energy vehicles in April was 26.6% on a monthly basis. In the beginning of April, the 14th week (March 28 to April 3), the sales of fuel vehicles were 226,700. Due to supply and demand factors, passenger car demand declined, and the comparison of data in two weeks showed a drop of 60%. At the end of April, in the 18th week (April 25 to May 1), it recovered slightly, with a year-on-year decrease of 32%.The process for electric vehicles is similar, with 96,700 units in Week 14 and 71,100 units in Week 18, and a yearly growth rate of 20% to 120%. Throughout this process, the penetration rate of new energy vehicles has declined steadily from a peak of 30% to 23.74%.

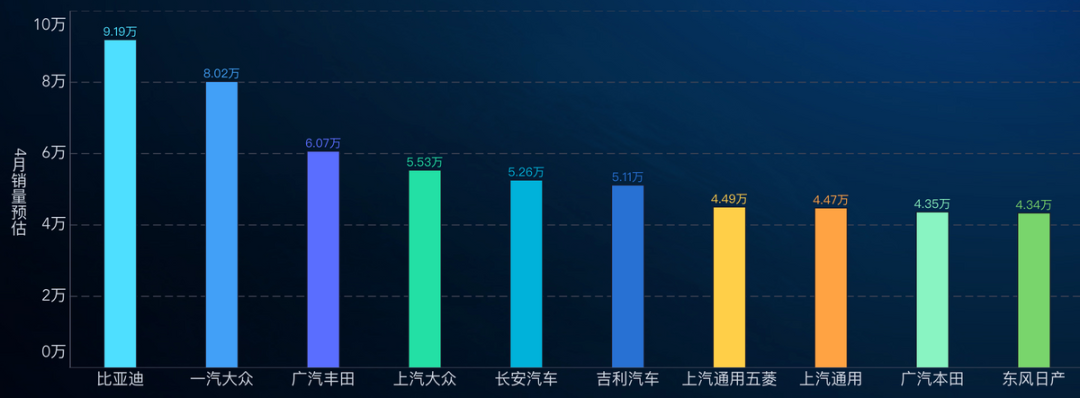

In terms of overall sales, no car company sold more than 100,000 units in April, with BYD leading the way with over 90,000 units sold.

Note: The calculation method weights Weeks 14 and 18 together, so there may be some errors in monthly data.

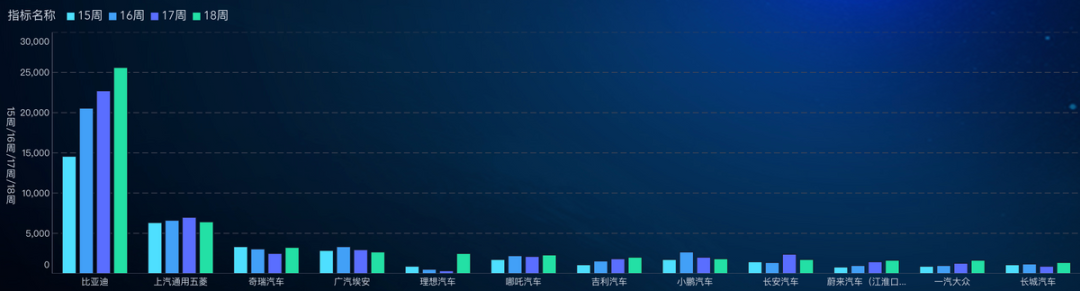

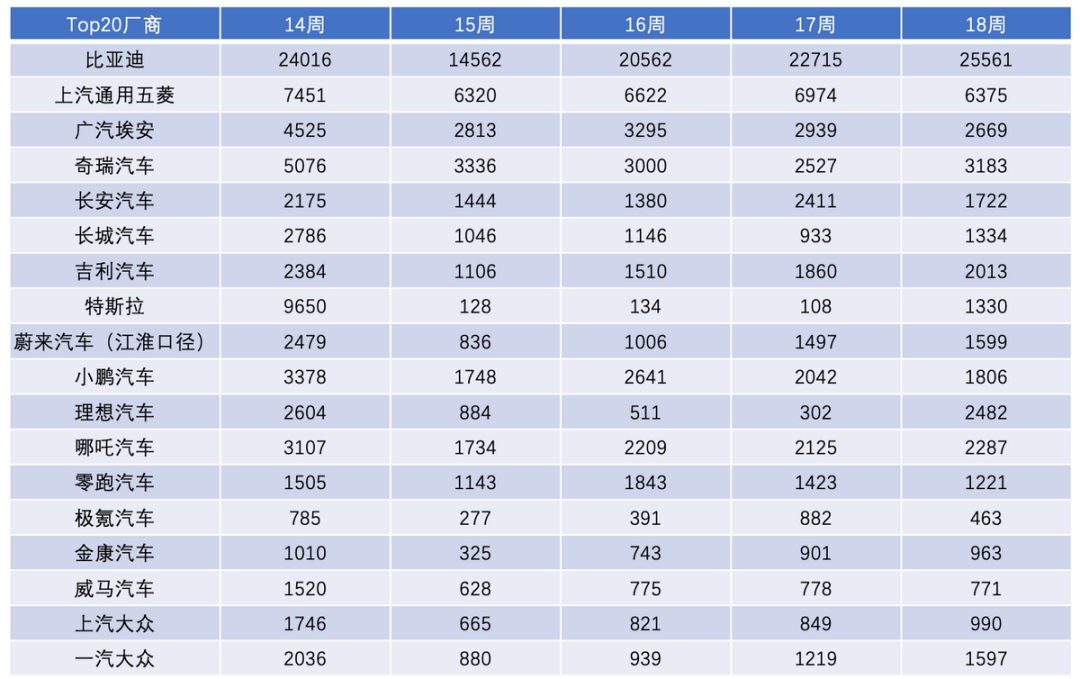

Looking at each company separately, lows were seen in Weeks 15-16, followed by a rebound in Weeks 17-18. The low baseline made it possible for BYD, which only sells new energy vehicles, to top the weekly data charts.

When looking at new energy vehicles separately, BYD outperformed other companies in weekly sales of new energy cars in April, due in part to Tesla’s temporary production shutdown. The majority of vehicles currently being delivered are from Wuling.

- BYD: Weekly sales of between 14,000 and 25,500 units

- Wuling: Weekly sales of 6,300-7,400 units

- GAC Aion: Weekly sales of 2,700-2,800 units

- Chery: Weekly sales of over 3,000 units

Tesla delivered 1,330 units in Week 18 as it gradually resumes production. According to official data, Tesla produced 10,000 cars between April 19 and April 30. Li Auto also saw weekly deliveries increase significantly, with 2,482 vehicles delivered in Week 18.

## The Supply Chain of Fuel Vehicles and the Subsequent Automotive Industry Cluster in Shanghai

## The Supply Chain of Fuel Vehicles and the Subsequent Automotive Industry Cluster in Shanghai

From 2016 to 2020, the sum of the total output value of the six key industrial sectors in Shanghai has all exceeded 2 trillion yuan, reaching 23,784.22 billion yuan in 2020. The electronic information product manufacturing industry and automobile manufacturing industry are the two sub-industries that contributed the largest amount to the total value of the six key industrial sectors, both exceeding a total output value of 1 trillion yuan. In China’s expansion of the component system, Shanghai and the Yangtze River Delta have occupied a significant portion of the rapid growth, on one hand with foreign-funded component systems and on the other hand with private-owned component systems, resulting in a low-cost system with competitive pricing and providing the necessary support for the early stage of growth of independent brands.

Currently, the problem at hand is that as the production of automobiles has been hindered by chip shortages, the current pandemic may also change the supply and selection strategies of components:

-

On the one hand, it is proximity: Being close to the factory has become a rigid requirement. The logistics cost of component transportation is a major consideration, but with the efficiency revolution brought about by integrated casting, companies like Tesla require the aggregation of the industrial chain nearby in order to improve their attractiveness and increase the production capacity of a single factory to coordinate with the changes in the factory’s layout.

-

On the other hand, it is diversification: In the supply of key products such as chips and battery cells, we have seen the necessity of diversification.

In summary, from the current situation, April is a very pessimistic month, but with the recovery of the industry, the data and operational conditions of enterprises will soon improve.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.