On April 12th, Honda briefly reported on its electrification business, which contained a significant amount of information about its “Ten-year Plan”:

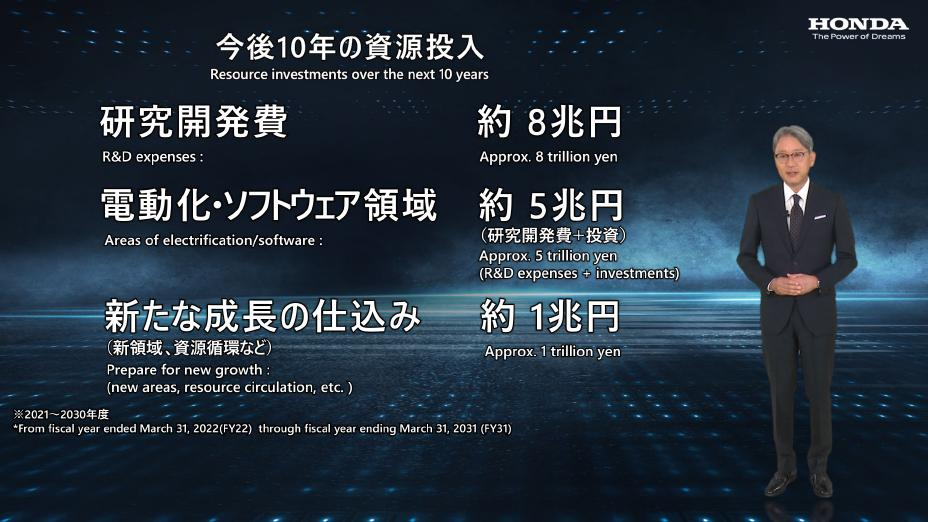

- R&D budget of JPY 8 trillion (approximately CNY 406.4 billion), with plans to invest approximately JPY 5 trillion in the fields of electrification and software (including JPY 3.5 trillion in R&D costs and JPY 1.5 trillion in investments);

- Launching 30 electric vehicle models globally by 2030, with an annual output of over 2 million vehicles;

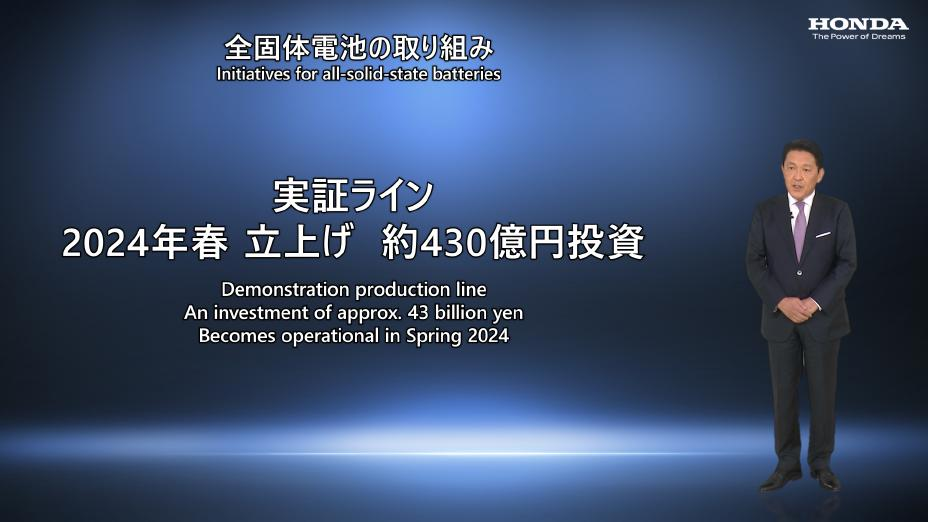

- Honda will invest about JPY 43 billion (about CNY 2.2 billion) to build a solid-state battery production demonstration line, with the goal of demonstrating production in the spring of 2024, and applying its next-generation battery products to vehicle models in the second half of the Ten-year Plan.

Money, vehicle models, and batteries – the plan is clear. Just when I thought Honda was going to go it alone in the all-electric space, I saw a news story from a few days ago: Honda and General Motors are going to jointly develop electric vehicles. And not just any electric vehicles, but a range of “million-unit” compact electric vehicles that will commence production in 2027. This signifies that the cooperative relationship between Honda and GM is further deepening.

In fact, Honda’s collaboration with GM dates back to 2013, when the two companies began joint development of the next-generation fuel cell system and hydrogen storage technology. In 2018, Honda joined GM’s EV battery module development work.

Even in 2020, GM and Honda announced plans to jointly develop two electric vehicles. The new vehicles will be launched in early 2024, with one being the Honda Prologue and the other being the first electric SUV under the Acura brand.

Earlier, Sony also announced the establishment of a joint venture with Honda to jointly develop electric vehicles. This has made it clear that Honda is keen to pursue multiple joint ventures with partners like Sony, in order to leverage their expertise.

However, Honda’s problem is not much different from Toyota’s. The new energy market in Japan itself is not “concentrated” enough, and talent, resources, and even funds are concentrated in China and the United States. Therefore, Honda’s electrification process still needs to be accelerated, which will ultimately test its leader, Toshihiro Mibe.🔗Source: Honda Newsroom 1; Honda Newsroom 2

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.