Author: Zhu Yulong

After receiving the latest retail data of passenger cars in March, I found there are many issues with the overall total number. With the detailed data from various car companies, I think I can make some judgments in the short term:

-

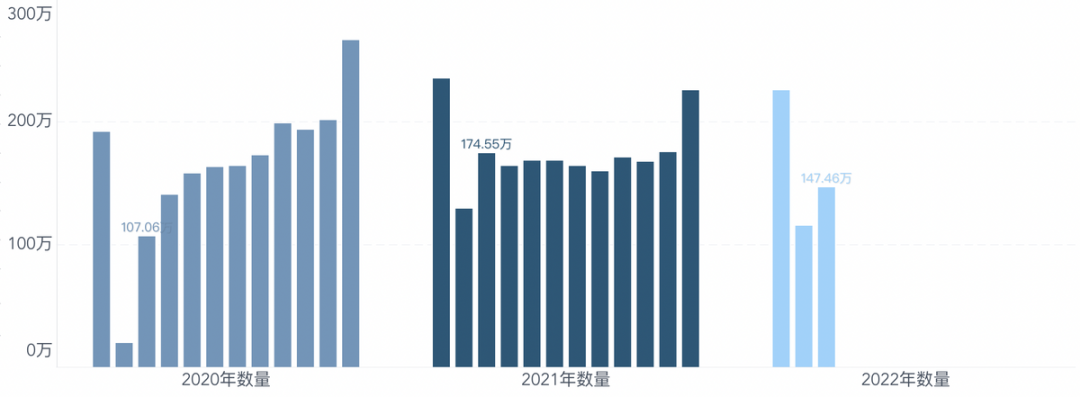

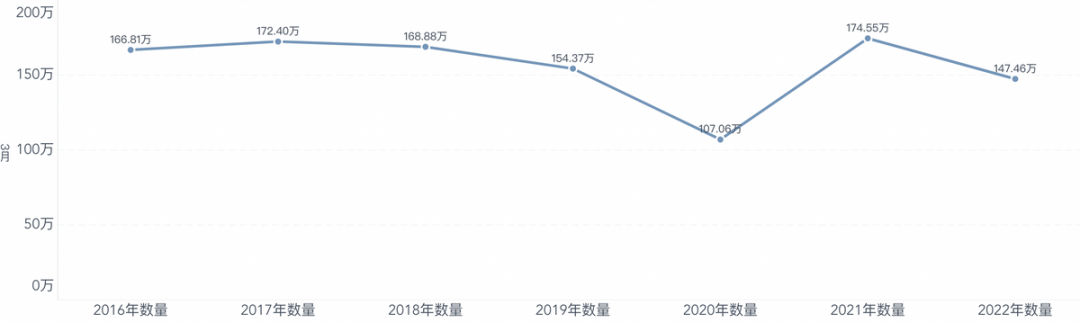

The 1.4746 million retail data in March is very fragile, with nearly 1.2 million in the first 27 days of March, and still underpowered. The reflected problem is that the entire gasoline car market is very weak. In other words, if taken independently, the total passenger car sales year-over-year declined by 15.5%, while electric cars increased by 123.4%, but the sales of gasoline cars decreased by 32.29%, which is a very concerning data point.

-

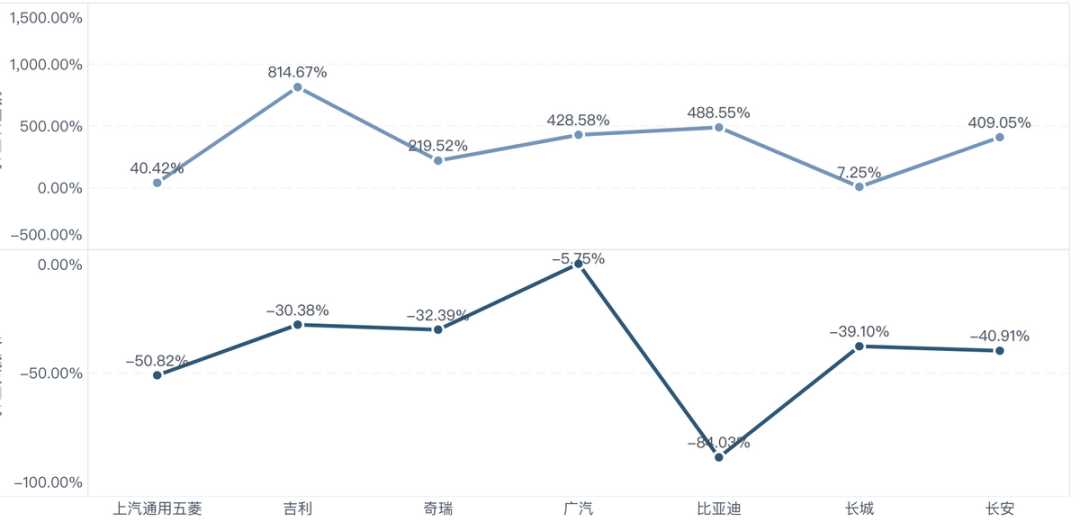

For specific key companies, SAIC-GM-Wuling and Chery have taken the lead in pure electric A00 terminal insurance data. SAIC-GM-Wuling has 47,400 pure electric A00 sales, accounting for 64.9% of the total, while Chery has 21,700 pure electric A00 sales, accounting for 51.66% of the total. Sales of gasoline cars for both companies year-over-year decreased by 50.8% and 32.39% respectively, which is really abnormal.

-

In March, both SAIC-GM and Great Wall showed significant decline in sales of their main gasoline models. SAIC-GM’s GL8 series retail sales dropped to 11,055 units, accounting for 26% of Buick, while Great Wall’s Ora sold 13,756 units, which is close to H6’s 14,050 units. Our previously best-selling sedans and SUVs are now unsellable in the high oil price and current market environment.

-

From the current perspective, consumer issues are a factor affecting terminals: the chip dilemma of 2022 has become very resistant, and with the weakening market demand, many car companies are now facing a chip shortage problem, which is different from the “chicken blood” state of 2021. Coupled with the actual situation of national logistics and supply chain, everyone should be prepared for April with certain expectations management.

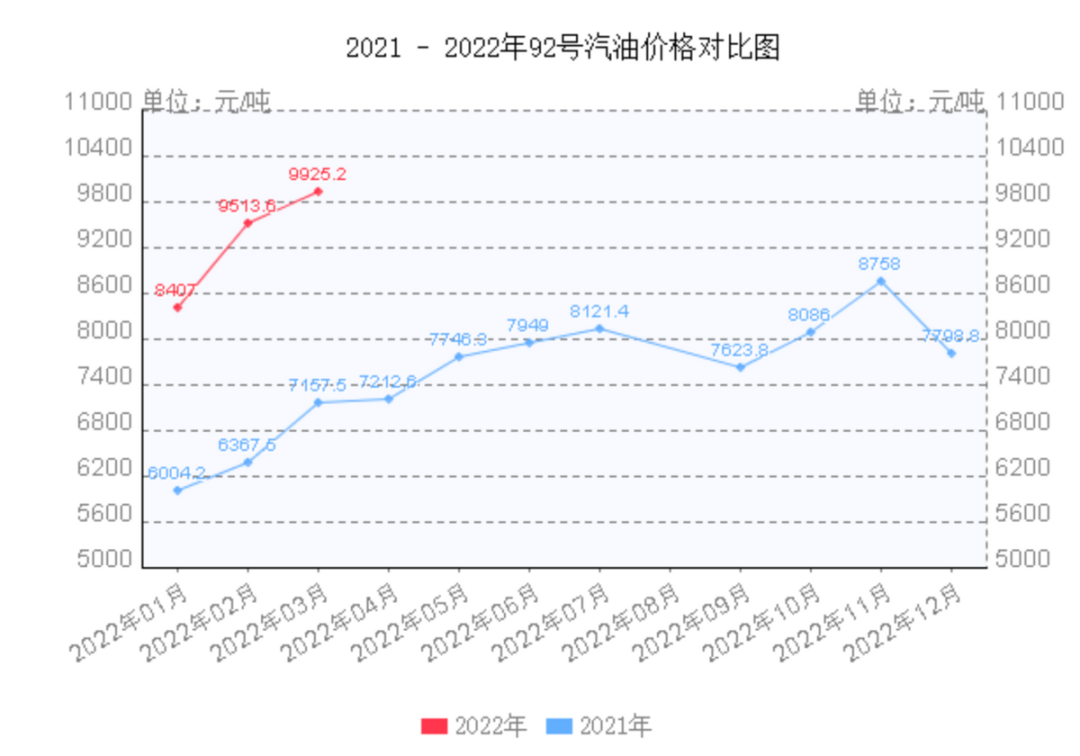

Of course, we applaud the sales of new energy vehicles, but if we look at the overall environment of the entire automobile industry, facing the rapidly rising oil price, the surge in the price of new energy vehicles, and the overall logic of automobile consumption, we need to make our own judgments on the short-term and medium-term trends.

The Struggle of Gasoline Cars

If we simply pull out the retail data of passenger cars in March, the result is not particularly bad. After experiencing the low point of 2020, the data in March 2021 is actually still good.

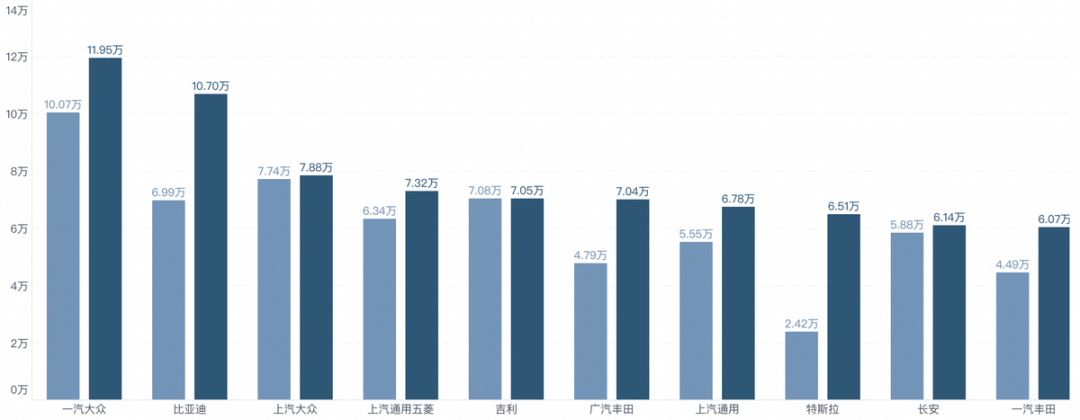

However, upon closer inspection of the problem, FAW-Volkswagen remains in the first place with retail sales of 119,500 units; BYD ranks second with 107,000 units, setting a historical record (could potentially top the list in April). Tesla’s 65,100 units are on par with SAIC Volkswagen, Geely, GAC Toyota, and SAIC-GM. However, as you can see, sales of traditional gasoline vehicles have been particularly sluggish, both for domestic and joint-venture automakers.

However, upon closer inspection of the problem, FAW-Volkswagen remains in the first place with retail sales of 119,500 units; BYD ranks second with 107,000 units, setting a historical record (could potentially top the list in April). Tesla’s 65,100 units are on par with SAIC Volkswagen, Geely, GAC Toyota, and SAIC-GM. However, as you can see, sales of traditional gasoline vehicles have been particularly sluggish, both for domestic and joint-venture automakers.

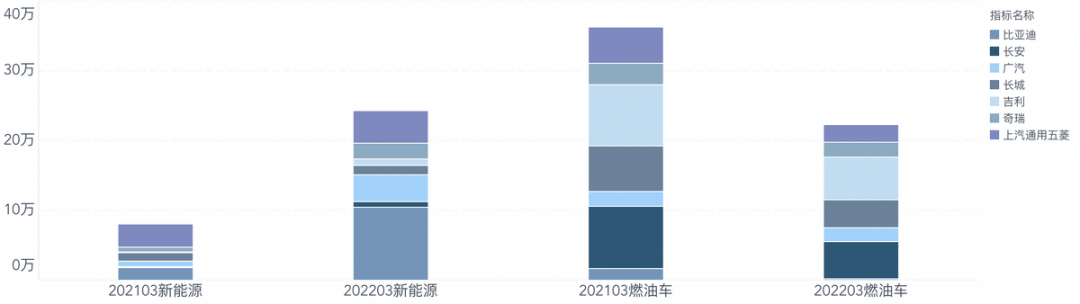

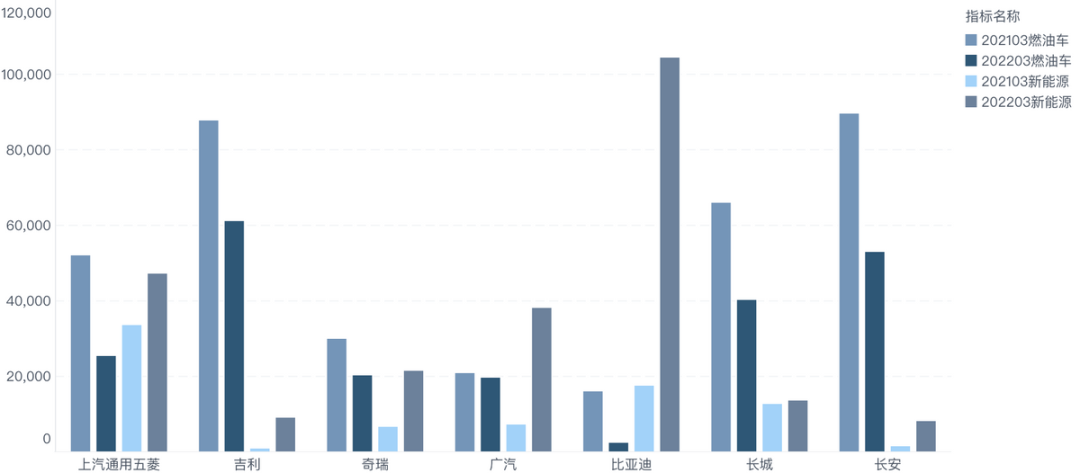

In other words, I have taken out SAIC-GM Wuling, BYD, Changan, GAC, Great Wall, Geely, and Chery, which are the major domestic brands, and their cumulative sales of new energy vehicles in March surpassed those of gasoline vehicles. While new energy vehicles are fast climbing, gasoline vehicles are rapidly declining.

Except for Guangzhou Automobile Group’s gasoline vehicle product lineup maintaining stability at 2C, gasoline vehicles based on the 2C market have all been hit hard by high oil prices, as shown more clearly in the following chart.

The rapid rise in oil prices from January to March, coupled with the recovery of gasoline vehicle discounts from the chip shortage last year, had a huge inhibitory effect on year-over-year sales growth of gasoline vehicles. Originally intended for entry-level transportation needs, the A00-level pure electric vehicles, especially the Wuling Mini and QQ Ice Cream, have become the new generation’s “magic wand” in terms of comprehensive cost.

With income growth affected and high oil prices having a significant inhibitory effect on the sales of gasoline vehicles, BYD’s surge is, in a sense, a replacement for gasoline vehicles of joint-venture brands. Buyers can purchase vehicles with similar prices but lower usage costs, making it the key driver of BYD’s recent high growth.

Status Quo of Electric Vehicles

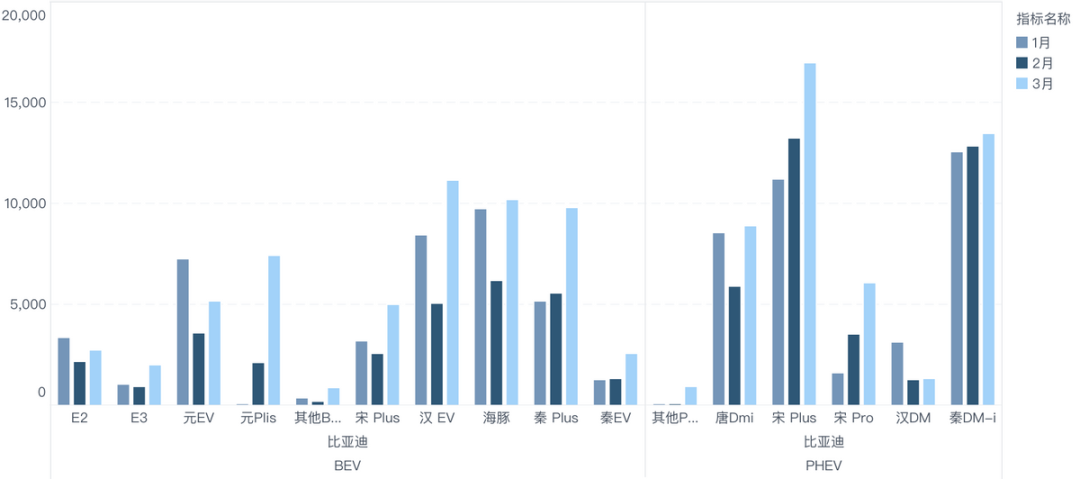

In competition, the changing environment can sometimes have a decisive effect. This is exemplified by the strategy employed by BYD, which has benefited the most in the Chinese market. The DM-i and the E3.0 architecture represented by the Dolphin are designed to replace joint venture brands with domestic technological thinking. Therefore, for BYD, the fact that its autonomous driving assistance and cabin are not as good does not actually affect this rapid replacement. Setting aside so many cars in the current lineup is to replace joint venture products layer by layer within the existing sales system.

Note: I believe that this sales model and product planning will be eliminated. After this wave of dividends is exhausted, we need to deeply explore our product matrix and customer needs.

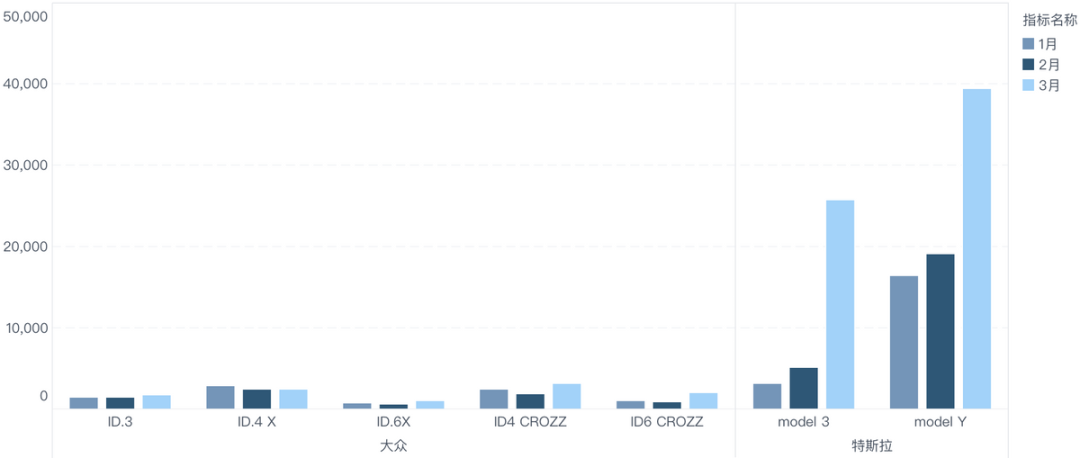

This is the comparison between Tesla and Volkswagen’s ID series this year. Due to the special situation in Shanghai, Tesla has to be quiet for a while, but luckily it will gain momentum in the Chinese market in the next two months, so the impact is not significant. Overseas, the Berlin and Texas plants may need to work harder.

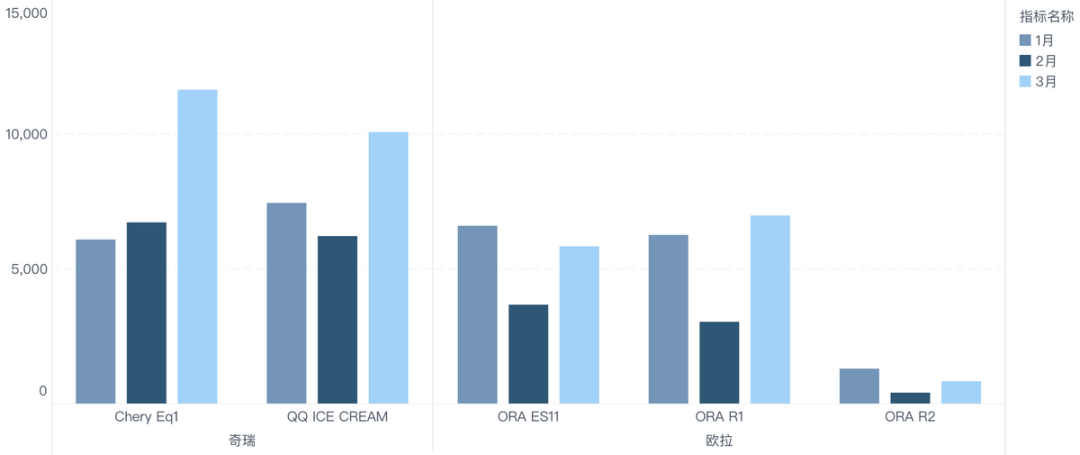

Currently, Chery’s 51.66% of its cars rely on Little Ants and QQ ice cream to support the market demand. Meanwhile, Euler needs some time to move upward after gradually discontinuing the Black Cat and White Cat.

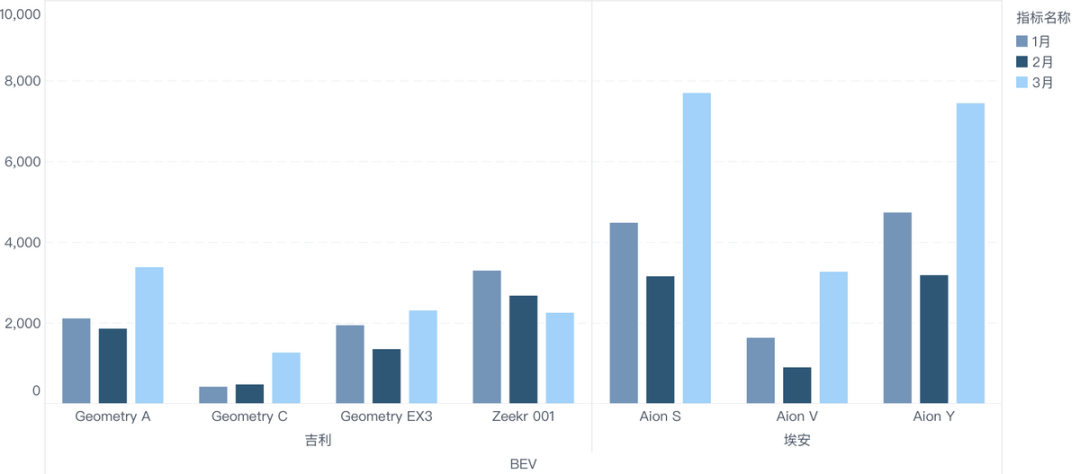

Aion S is in high demand due to the price of gasoline being too high, and this has resulted in a rapid increase for Geely. The key is that Aion V and Aion Y have achieved good results for Aion. However, given the significant increase in battery costs, we need to carefully consider future strategies.

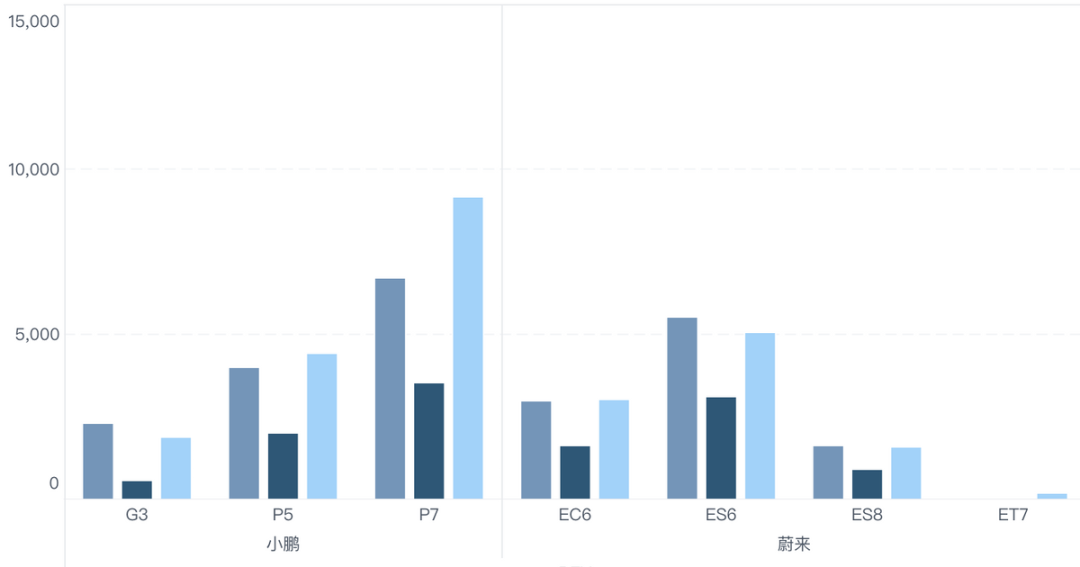

Two companies in the new forces are competing in the field of pure electric vehicles this year. However, the pressure on the new forces has increased after one stage. I think this time we can see that the speed at which they replace BBA’s low-cost and low-value models is accelerating.

In summary: I am not writing these to criticize the market. However, under this wave of high oil prices, it has indeed had a huge impact on the product system and enterprises of the existing fuel car. Once the Chinese consumer groups delay their purchase decisions, the long-tail value of your fuel car product matrix will be lost. In March, SAIC GM sold 12,219 Cadillac, 13,123 Chevy, and 31,382 Buick (excluding GL8). There are huge product combinations with thousands of units per share, and the original overlapping product matrix approach needs to be reset. I actually think that the methodology for automotive product planning and definition has been changing for a long time, but it is only today, when many factors have come together, that it gradually shows up in terminal consumption.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.