Author: Zhuyulong

Let me summarize the content of automotive companies in this year’s Hundred People’s Conference: on the one hand, the viewpoints of the automotive industry on technology and strategy, and on the other hand, given the attention and opportunities from senior leaders, we can also discuss what these companies can do in the next three years.

The forums involved in this part of the major enterprises (see below) include: the Double Intelligence Forum for promoting the coordinated development of intelligent connected vehicles and smart cities on the 25th, the International Forum on Automotive, Transportation, and Energy Transformation in the Carbon Neutrality Process on the 26th, the high-level forum on ushering in a new stage of the market-oriented development of new energy vehicles on the 26th, and the New Generation Automotive Market and Consumer Forum on the 27th.

- Foreign Automotive Companies

Volkswagen, BMW, General Motors, and Volvo

- Domestic Automotive Companies

BYD, Changan, EAIC, Dongfeng Voyah, and BAIC

- New Energy Automotive Companies

XPENG Motors, Ideal Motors, Slacio, NIO (energy)

New Energy Automotive Companies

- XPENG Motors

The main price range of intelligent vehicles is 200,000-400,000 RMB, and in 2021, 98,000 intelligent vehicles were delivered (the number one in the new Chinese-made automotive companies), and the user penetration rate of intelligent driving assistance XPILOT 3.0 reached 96.2%.

Regarding the NGP (Navigation Guided Pilot) for high-speed driving, 62 out of every 100 kilometers on highways are driven automatically by NGP smart driving. The goal is to achieve more than 90%. Based on XPILOT 3.0, XPILOT 3.5 for scenarios from high speed to the city will be launched in 2022, opening up the second half of intelligent driving assistance, including the addition of laser radar and new planning algorithms.

In 2022, the urban NGP function will gradually be opened in major Chinese cities, such as Guangzhou, Shenzhen, Beijing, Shanghai, Hangzhou, etc., and will enhance support for multi-floor parking lot memory parking. In the first half of 2023, XPILOT 4.0 software and services will be launched, hoping to achieve intelligent driving assistance in all scenarios and cover more than 100 cities.

The foundation of intelligence is that the proportion of R&D personnel exceeds 40%, and the cumulative R&D investment exceeds 9 billion yuan.

- Ideal Motors

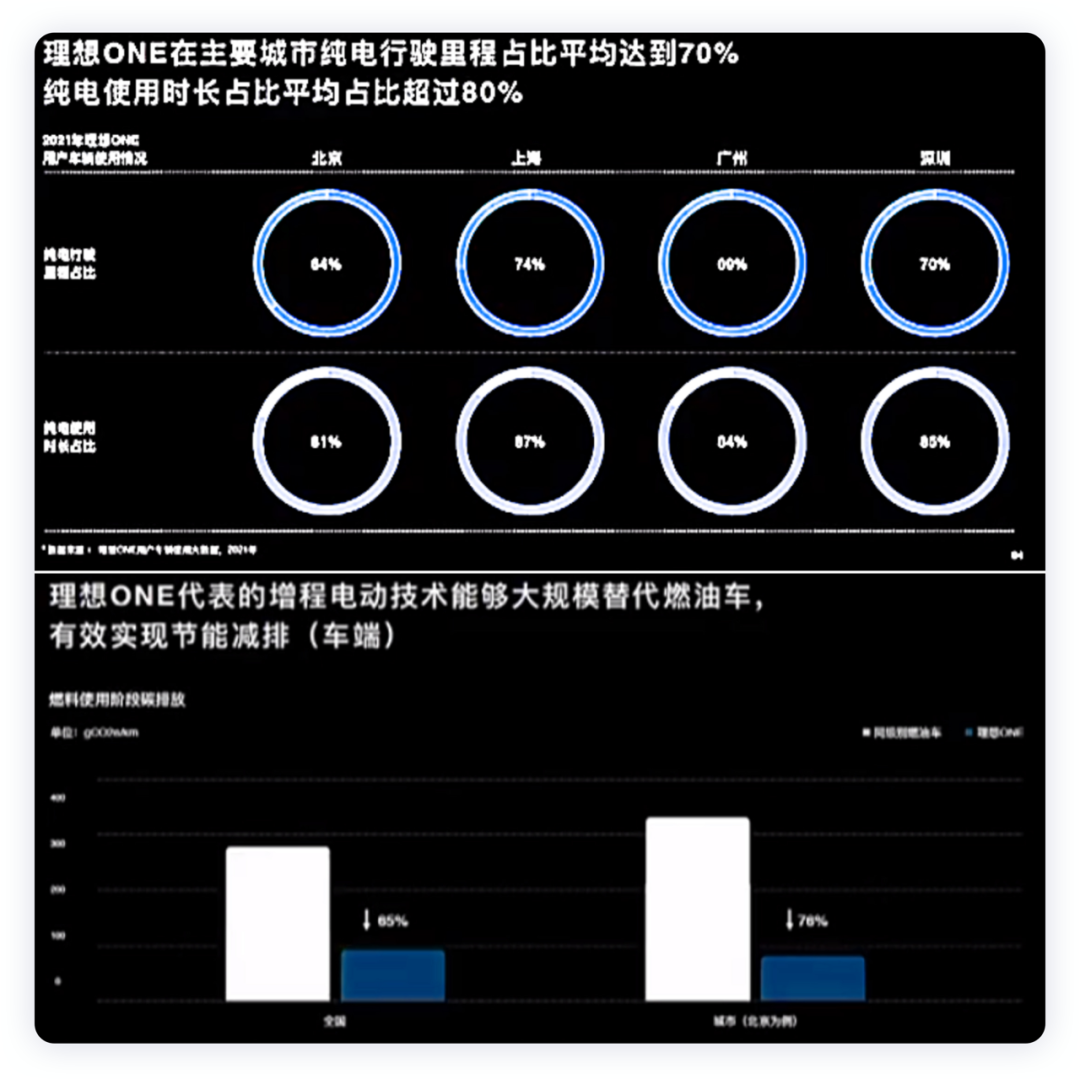

New energy vehicles need to meet the convenience and cost of energy acquisition, as well as environmental protection.The main topic of Ideal Automobile this time is the rationality of urban range extension. “Electricity for city driving, power generation for long-distance driving, adhering to pure electric drive”- fully electric driving is used in the core urban areas, and the range extender is not allowed to start. Through intelligent regulation, the core urban areas can truly achieve 100% zero emissions.

By 2022, the new product’s battery range can surpass 200km, with a 15% increase in thermal efficiency, and a reduction of over 90% in carbon emissions in urban areas.

Regarding battery costs, the cost of lithium carbonate was previously between 30,000 to 50,000, but it has now switched to a new source of petroleum.

- Celerity

The platform range-extender hybrid, fully electric in city conditions, with driving performance comparable to that of EVs. The range extender is not used much in city driving, which is mostly pure electric. On long-distance journeys, the range is guaranteed, which can effectively solve the current worries of EV users such as range anxiety, charging anxiety, battery life anxiety, and battery safety.

In the current industry’s “shortage of chips and electricity” situation, the quantity of installed range-extender batteries is only 30-35% of that of EVs, due to the rising prices of basic battery materials such as lithium mines, positive and negative electrode materials, etc.

- NIO Power

From the perspective of energy and power, each electric vehicle is a carrier of energy with the feature of spatiotemporal transposition (it is both a load and a power source). The cycle life of power batteries can reach thousands of times. The average number of charging times for private cars is only about 100 times per year. Only about 1,000 of those cycles are actually used by vehicles, so the remaining 3-5 thousand cycles can be utilized in the power grid.

Battery swap stations, including V2G charging piles, can be virtually aggregated into a frequency modulation unit, and other charging loads can be aggregated into peak regulation units to participate in the adjustment of the power grid. In the future, NIO will continue to promote the coordinated development of electric vehicle charging and swapping infrastructure and new types of electric power systems.

Traditional Chinese automobile industry

- BYD

With the hot sales of DM-i, the talk of hybrid vehicles still being the mainstream of private car development gives confidence. Plug-in hybrids effectively solve more needs for first-time buyers and upgrades, and form an obvious substitution effect in the large stock of the gasoline vehicle market.

At the same time, BYD continues to stand by lithium iron phosphate batteries. When the driving range of an electric vehicle reaches 500 kilometers, battery energy density is no longer the most important factor. The most important indicators may be safety, cost, cycle life, etc., matching social resource carrying capacity more accurately.

There was not much discussion of technology during the entire conference, with the 35% penetration rate being repeatedly emphasized. It is suggested to clarify the preferential policies for new energy vehicles during the subsidy era.

- Changan

Stated specific goals, with a target of selling 1.05 million Changan new energy vehicles, accounting for 35% of total sales by 2025, and a target of selling 2.7 million new energy vehicles, accounting for 60% of total sales by 2030. It also mentioned that China’s fuel vehicle market competition will become more intense with the acceleration of new energy vehicles. Currently, there are 85 traditional fuel vehicle brands in the Chinese market, 34 of which have monthly sales of less than 1,000 vehicles, and 9 have disappeared. In the next 3-5 years, 80% of Chinese fuel vehicle brands will shut down and transform.

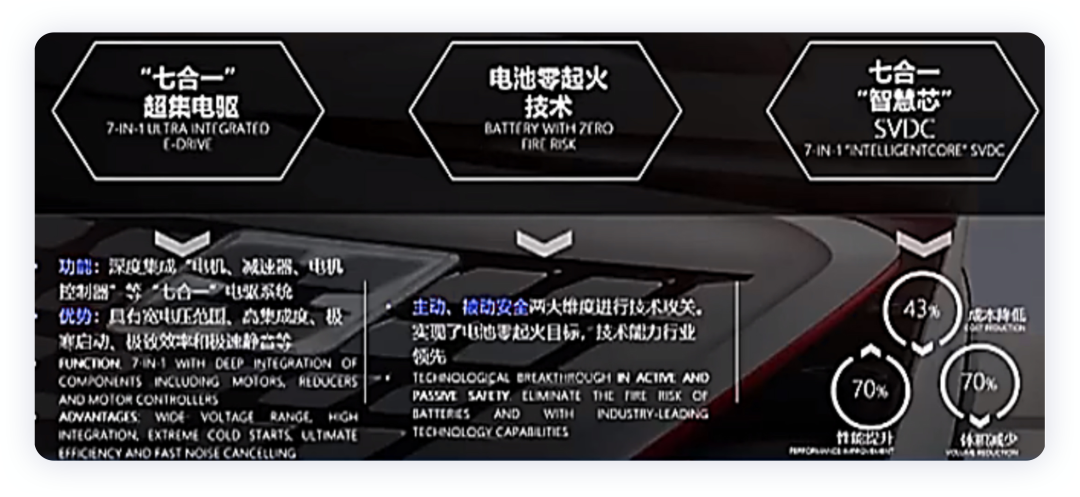

On the technical level, it discussed the entry of China’s automotive industry into a multi-power coexistence mode (the five power sources: ICE, HEV, PHEV, REEV, EV). Changan has built a research and development team with 3,500 members in various fields such as new energy, autonomous driving, and intelligent interaction. In terms of technology, the key focuses are the “seven-in-one” intelligent vehicle domain controller, the “smart core” SVDC zero-fire technology for batteries, the super-ensemble electric drive system, high-frequency pulse heating technology, and the integrated “motor, reducer, and motor controller” seven-in-one electric drive system.

- EAZI

Guangzhou Automobile Group always releases exciting new technologies (regardless of whether people recognize them). This time it introduced a brand-new electric vehicle platform called AEP3.0, which is super-chargeable, upgradable, and quick-changeable. In the future, it plans to layout brand-based ultra-fast charging networks and establish energy ecological companies to layout sustainable energy supply systems. Under the “Star Spiritual Electronic and Electrical Architecture”, it will comprehensively enhance its ICV tech innovation strength and will launch the first infrared sensing technology case in the future.

The suggested aspect is that it hopes the government can regulate and control the prices of upstream raw material resources for electric vehicles, prevent upstream resources from being monopolized, prioritize the supply of power batteries, and introduce new energy subsidy policies for 2023 and beyond in advance.

- Voyah

Voyah mainly focuses on users, and it will launch a new platform where users can participate in co-creation and open it to ecology partners. It will explore more customization and personalization. Voyah aims to change the traditional relationship with users, create a seamless online and offline user experience, and establish a more lasting and deeper connection with users. By constantly converging the values and habits from various industries and companies with sincere interactions with users, Voyah and the user’s ecology will become better and better.

Note: This part is somewhat similar to the content discussed by new forces in the past and does not involve technology.

- BAIC Group## Global Automotive Companies

Foreign car companies mainly talk about their viewpoints and do not have much special content.

- BMW

By 2030, BMW plans to deliver approximately 10 million pure electric vehicles worldwide, and 15 pure electric vehicle models will be put into mass production by 2022, covering about 90% of the subdivision markets. By the end of 2025, BMW plans to ship 2 million pure electric vehicles and 10 million by 2030.

- Volvo

By 2030, Volvo aims to become a pure electric luxury car company and is working with its Chinese technology partners to test autonomous driving functions and services.

- General Motors

By 2025, General Motors will introduce more than 30 electric vehicle models globally, with over 20 of them to be launched in China. The ultimate goal is to achieve the electrification of all new car models by 2035 and realize 100% renewable energy supply worldwide. By 2040, General Motors is aiming for carbon neutrality.

- Volkswagen

Volkswagen is promoting intelligent logistics applications in its factories nationwide. The first phase involves a connected electric truck fleet, autonomous driving buses, and data platform construction, followed by upgrades and scale expansion.

Summary: This is roughly what the automotive-related content of the Hundred People’s Meeting was about. If I have time, I will also sort out the content of the battery-related reports.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.