Jia Haonan, from the passenger temple

Reference for intelligent cars | WeChat Official Account AI4Auto

In 2021, Porsche is not ordinary. The just-released 2021 financial report shows that Porsche is still the most profitable car company in the world with a net profit of 5.3 billion euros (about 37.2 billion yuan) for the whole year and a significant increase. This is not surprising, with the biggest contribution coming from Chinese users who bought nearly 100,000 Porsches in a year, making it the largest single market. This seems unsurprising, but what is truly unusual is that in just one year, Porsche’s pure electric car model, Taycan, has surpassed the classic sports car 911 in sales volume.

Porsche has also announced that it will accelerate its new energy strategy and move towards a more aggressive de-fueling process in the era of intelligent automobiles and new energy. Porsche, a century-old shop, has abandoned tradition and emotions and is the most resolute.

The most important information in Porsche’s 2021 annual report can be described concisely: It’s all about money. This year, Porsche’s revenue climbed to 33.1 billion euros (232.7 billion yuan), up 15% year-on-year. Sales profits for the year were 5.3 billion euros, a 27% increase. Thus, Porsche achieved a sales return rate of 16.0% in the 2021 fiscal year, up from 14.6% in the previous fiscal year.

The sales return rate is the ratio of after-tax profit to revenue, which intuitively reflects a company’s profitability. So, how profitable is Porsche?

By comparison, according to its 2021 financial report, Toyota, the world’s largest producer and seller of automobiles, only had a sales return rate of 8.1%. This means that despite Toyota’s larger scale, its profitability is only half that of Porsche. In terms of numbers, Toyota can earn an average of 17,808 yuan (RMB) per car sold in 2021, while Porsche can earn an average of 124,000 yuan (RMB), a difference of seven times!The global sales of Porsche in 2021 were 301,915 units, just a small fraction of Toyota’s annual sales of 7.3 million units.

This has made Porsche the most profitable car company in the world.

Its outstanding profitability has brought Porsche abundant cash flow. The net cash flow grew by 67%, reaching €3.7 billion.

The second key point of Porsche’s financial report is cars. From it, one can discern the changing trends in Porsche’s business.

By region, China is the largest single market for Porsche, with 30,000 units sold, of which 95,671 were sold.

This is not surprising.

In terms of models, Macan, Cayenne, Taycan, 911, Panamera, and 718 are the top-selling models.

Do you notice anything different?

It turns out that the iconic and most popular model, the 911, sold fewer units than the pure electric Taycan.

Porsche: Gasoline cars? That’s history.

Although this is not what many car enthusiasts, fans, and nostalgia lovers want to see, the gasoline Porsche represented by the 911 is irreversibly heading towards the end.

Even Porsche itself has no regrets.

Taycan was only launched in March 2021 and sold a total of 41,000 units.

Moreover, according to Porsche, over 70% of Taycan owners are first-time Porsche buyers.

In addition, Porsche’s total sales increased by 11% YoY to 29,753 units.

This means that the pure electric Taycan not only contributed to Porsche’s entire growth source but also successfully compensated for the decline in sales of pure gasoline cars.

This also explains why Porsche announced its more aggressive and thorough transformation strategy at the same time as its 2021 financial report.

The latest plan is for pure electric and hybrid vehicles to account for half of Porsche’s total sales by 2025.

By 2030, 80% of Porsche’s total sales will be pure electric vehicles, and the entire company’s production and operations will achieve the goal of “carbon neutrality”.

The entry-level sports car 718 will be the first to be fully converted to a pure electric platform.

In fact, in the luxury car camp, Porsche is not only the fastest, but also the earliest and most determined to walk the road of electrification.

The earliest sign was in 2018. That year, Porsche announced the abandonment of diesel power system development and released the Taycan, which was still in the concept car state.

In terms of the automobile R&D cycle, the Taycan model is likely to have been proposed as early as 2015 or 2016.

Other existing models, Porsche also launched hybrid versions, such as in the Chinese market, Porsche introduced 16 new energy vehicle models that can be classified as green license plates.

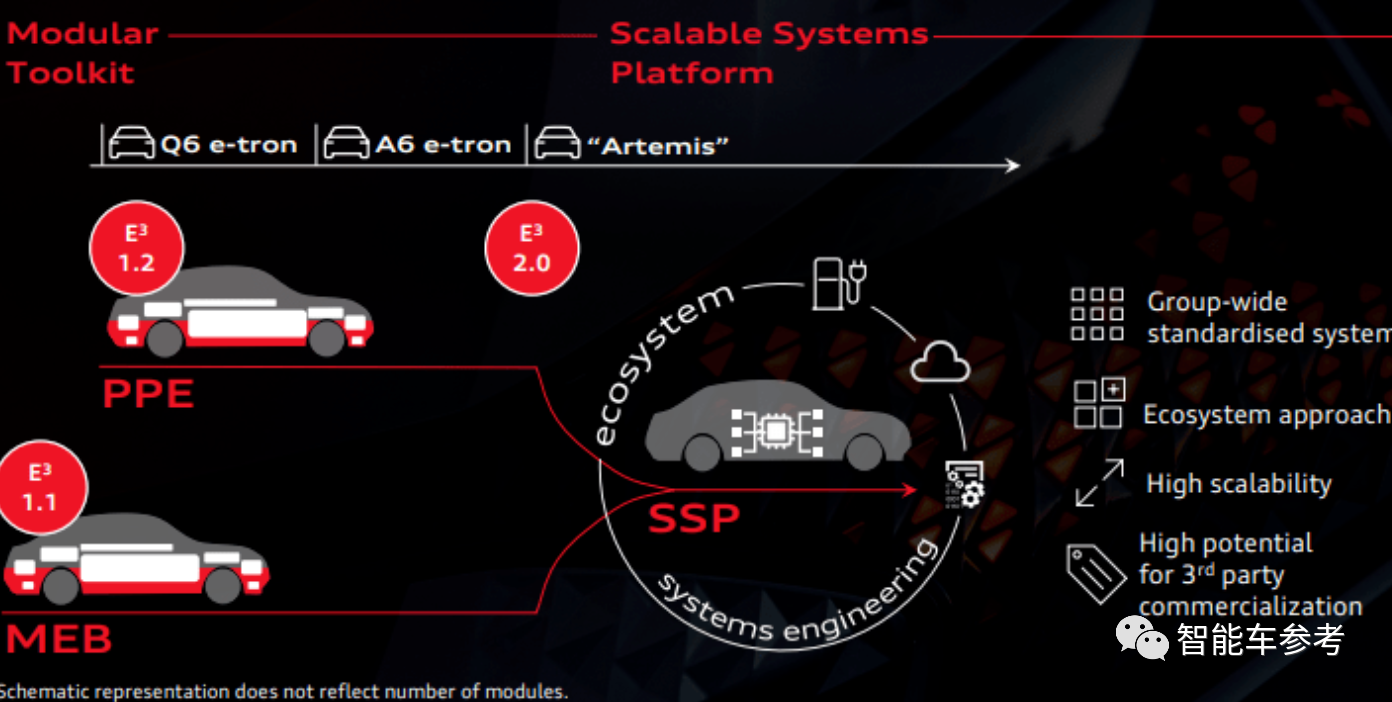

On the electric platform, Porsche cooperates with Audi to develop the PPE platform, which covers the B-D range of chassis wheelbases, has an 800V high-voltage system, and adopts a modular electric drive system.

The electronic and electrical architecture closely related to intelligent capabilities takes an open approach on the PPE platform.

In essence, the electronic and electrical architecture of the PPE platform is the E3 electronic and electrical architecture of Volkswagen Group, but with some improvements for the high-end luxury needs of Porsche and Audi.

Similar to the MEB architecture of the Volkswagen ID series, there is also a “Plus” version of the PPE architecture.

Like MEB, the core of PPE is actually a modular and scalable development platform, with software and hardware decoupling to provide the greatest development convenience to third-party suppliers.

Of course, Porsche can also develop software and hardware including autonomous driving and intelligent cockpits on its own, but the official has never disclosed any plans or intentions for self-research so far.

This also coincides with the current intelligentization and software development dilemma faced by Volkswagen Group.

As for the Taycan itself, only two optional features-proactive cruise control ($16,200) and lane change assist system ($7,200)-are available for intelligentization.

Based on information released by Volkswagen in 2018, these two auxiliary driving functions are likely to be supplied by Bosch.

Regarding the intelligent cockpit, it is based on Volkswagen Group’s MIB3 solution, which is identical to that used in Audi A3 and other models, with the core being the Qualcomm 820A chip.

As for how Audi’s infotainment and human-machine interaction are, I believe everyone can judge for themselves.

Therefore, the Taycan is actually a pure electric trial by Porsche that is “not yet mature.”

In terms of autonomous driving, it is far behind, even inferior to Volkswagen’s ID series. In terms of the intelligent cockpit, it is average and does not exceed Volkswagen’s average level.

The most critical underlying electronic and electrical architecture is actually an extension of the ID series MEB platform, and support for in-vehicle software development and operation is far behind that of Tesla and other new forces.

In other words, for the more than 1 million yuan spent on a Taycan, most of the money is spent on the brand, handling, power, and even faith.

The money spent on intelligence is very little. Taycan owners receive the same treatment in this regard as Volkswagen ID series owners who spend two or three hundred thousand yuan on a car.

Therefore, it is worth evaluating Porsche from the perspective of automobile electrification and intelligence:

The trend this year shows that Porsche’s future development and growth are unlikely to be driven by fuel-powered cars, and that electric and intelligent vehicles are the only way out.

Electrification has significant effects and leads the world’s luxury car brands.

Porsche’s product power in intelligence has fallen behind the definition of “luxury” due to the burden caused by Volkswagen.

The lack of emphasis on intelligence is not Porsche’s fault, and it still has opportunities.

For example, the next Porsche pure electric SUV, which replaces the Macan, is said to be based on the E3 2.0 version of the PPE architecture.

Of course, the biggest opportunity is for Porsche to go public independently without being restrained by Volkswagen Group. Can Porsche take off on the “intelligent luxury car” track?

Financial report link: https://www.porsche-se.com/fileadmin/downloads/investorrelations/mandatorypublications/interimreport-21/PSEQ32021_de.pdf

— End —

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.