From Markdown Chinese Text to English Markdown Text

Author: Cold Ze Lin

Editor: Wang Pan

The history of China’s domestic automobile industry has gone through several decades, from import, manual, joint venture, plagiarism, reverse engineering, to independent research and development, and now to being a global leader in new energy vehicles. The industry has formed three generations of car companies: old, middle, and new.

The old generation of car companies, represented by First Auto Works (FAW), Dongfeng, and SAIC, witnessed the transformation of the domestic automobile market. The middle generation of car companies such as Geely, Great Wall, and BYD, transformed from the motorcycle, pickup, and battery industries, respectively. The new generation of car companies, represented by Nio, XPeng, and Ideal, are riding the new energy wave.

Although every era has different leading companies, BYD is an exception. As a domestic independent brand established around the turn of the millennium, BYD was always overshadowed by Geely and Great Wall in the era of traditional fuel cars, but is now impressive in the era of new energy vehicles.

In terms of absolute numbers, the “backup” companies of this era do not seem to be as impressive. According to the new energy vehicle sales data released by various car companies last year, BYD sold nearly 600,000 new energy vehicles throughout the year, surpassing the likes of Tesla’s China market sales of 480,000 vehicles and NIO’s 280,000 vehicles, as well as other established independent car companies with just over 100,000 vehicles.

In addition, BYD is not satisfied with just that. By modifying its logo, expanding its sales network, launching a younger-oriented product line, and planning a high-end brand, BYD is trying to establish a role that is loved by everyone, with its technological advantage. Will people buy it?

Technological Advantage is Adored

How much does BYD s technological advantage matter?

Looking at the sales data of new energy vehicles in recent years, BYD sold 248,000 vehicles in 2018, 219,000 vehicles in 2019, 190,000 vehicles in 2020, and this number soared to 593,000 vehicles in 2021, an increase of 231.6% year-on-year.

Since the launch of the DM-i hybrid system last year, BYD’s orders have skyrocketed. The Qin Plus DM-i and Song Plus DM-i have become hot products, with accumulated orders of up to 200,000 at the peak. The surge in orders has increased BYD’s production capacity pressure, and many car owners have been waiting for 3 to 5 months without receiving their cars.

This means that even in the case of severe production capacity constraints, BYD still sold nearly 600,000 new energy vehicles, accounting for 17.8% of domestic new energy vehicle sales (according to China Association of Automobile Manufacturers: 3.334 million new energy passenger vehicles were sold in 2021).

On the one hand, due to BYD’s battery background, when acquiring Qin Chuan Automobile, Wang Chuanfu set BYD’s future direction, saying “Xi’an Qin Chuan can be the entry point for the electric vehicle market.”Therefore, BYD has become one of the earliest automakers to lay out new energy vehicles globally. Its first hybrid vehicle with plug-in electric technology, the F3DM, can be traced back to as early as 2008. Meanwhile, during the same period, Musk, far across the ocean, was anxious about the delivery delay of the Roadster due to transmission system issues.

It is not difficult to find that the two new energy vehicle giants, BYD and Tesla, have left many companies behind on the starting line. They have been lying dormant for many years, waiting for an opportunity.

Last year, the rapid outbreak of new energy finally allowed the two companies to realize the dividend of many years of technological accumulation.

Tesla’s accumulated three-electric technology, autonomous driving technology, and Musk’s hard work in “selling” in Silicon Valley, have given the company a high-end, technological label, deeply loved by technology enthusiasts and young people.

On the other hand, BYD’s DM hybrid system, blade battery, and years of accumulated vertical integration and product experience in the automotive industry, have also reserved for it a seat as the king of new energy vehicles in China.

The DM-i system of BYD is different from previous hybrid systems, eliminating high-speed gears and adopting a single driving motor, which takes into account costs, fuel consumption, and prices. With policy guidance, DM-i models often have a strong competitive edge in the same level of fuel cars, such as the Qin Plus DM-i, which sold over 30,000 units in a single month, winning over many Corolla and Levin users.

The independently developed blade battery enables low-cost lithium iron phosphate to have the same endurance as ternary lithium batteries, and has also been improved in terms of safety.

However, on the other hand, Tesla and BYD have taken opposite paths.

We are more familiar with Tesla, from the Roadster, Model S, Model X, Model Y, Model 3, to the rumored Model Q, covering from sports cars to cars widely used by the public in all price ranges. Tesla has taken a path of branding that covers the full price range.

In contrast, BYD has relied on deep cultivation of a single product line to cover all vehicle types. Looking at the Wangchao series, with a price range of 80,000 to 300,000 yuan, it covers almost all models, with the Qin series focusing on A-class cars, the Han series focusing on mid-size cars, and the Yuan, Song, and Tang covering from compact SUVs to mid-size SUVs and MPVs.

At the same time, every model under each series of BYD is complex, making it difficult not only for users but also for many automotive reviewers to distinguish.

Single Song Series has 12 models on sale, with complex naming conventions distinguishing power types (DM, DM-i, EV) and models (Pro, Plus, MAX) using wordings like “new”, “upgraded”, “the xth generation”, and “xxxx edition”.

Single Song Series has 12 models on sale, with complex naming conventions distinguishing power types (DM, DM-i, EV) and models (Pro, Plus, MAX) using wordings like “new”, “upgraded”, “the xth generation”, and “xxxx edition”.

While the diverse models have advantages in satisfying consumers’ various needs and facilitating efficient cost reductions and sales growth through hybrid and pure electric versions, it can also make it difficult for consumers to find their desired model at first glance and lead to weak consumer perception.

As the saying goes, “fame brings gossip”. As BYD’s sales skyrocket, criticism follows. When searching BYD on Zhihu (a Chinese Q&A website), one can find many similar questions where family and friends of some car owners who bought BYD tend to give negative answers: “Buying BYD for more than ten to twenty thousand yuan? Better spend a few more yuan on XX.”

Though BYD has certain say in terms of product power, it lags far behind in brand building, especially in gaining favor from middle-aged consumers who experienced early BYD products.

For the domestic market, cars are mostly not personal items but family production tools. Thus, relying solely on product power and cost-effectiveness cannot satisfy all family members’ needs. As shown in Figure 1, the lower-priced Qin and Song series have grown rapidly in sales, while the higher-priced Han and Tang series lag behind.

In fact, this is also due to historical factors, exemplified by F3’s imitation of Toyota Corolla and certain insurance companies not providing theft and robbery insurance for F0.

Objectively speaking, although BYD’s start in the new energy field was even slightly ahead of Tesla’s, the gap in the auto industry between China and the United States at that time was not comparable.

Musk bought a General Motors assembly plant measuring 5.5 million square feet for 42 million dollars and could also gather various automotive and software talents in Silicon Valley, while Wang Chuanfu could only acquire the outmoded Qinchi brand and start exploring car manufacturing from scratch while cultivating talents and improving sales channels.

The past image and impression are hard to change, but for Z Generation, who will soon become the mainstream consumers, it may be a group that BYD cannot miss again. Drawing on a blank paper is easier than modifying an “unfinished product”.

Multiple reports show that younger generations are the main force behind new energy or pure electric vehicle models.

Overall, though BYD Dynasty series has invited former luxury brand designers from Mercedes-Benz, Audi, and other companies who have gradually changed the “dragon-face” design of their cars, the overall design is still relatively heavy, which is not very appealing to younger consumers’ aesthetics.As in Tesla’s minimalist interior, Lynk & Co’s factory customization of the 03+, XPeng P7’s low-lying appearance, and the Ideal ONE’s Baby Blue, youth marketing is one of the selling points.

BYD seems to have also realized this, and launched the Ocean series models at the end of last year and earlier this year to separate user groups. Although it is not a sub-brand model usually adopted by the main car manufacturers, the youth-designed design from storefronts to car models is emphasizing the difference between the Ocean series and the Dynasty series.

But it is easy to change superficially, and difficult to change fundamentally. Although BYD’s image has become more youthful, it cannot hide its true age in its actions, Just as makeup and thin faces can change appearance, only reading and thinking can change a person’s speech and behavior.

In fact, if we understand the history of BYD, we can easily find some traces of history in its current behavior.

As early as several years ago, in order to quickly open up the market, BYD had adopted online sales and set up four sales networks from A1 to A4. A1 sold F3 and F6, A2 sold low-end F3R, F0, and L3, A3 sold high-end G3 and F3R, A4 sold L3 and L6.

The problems were also obvious, with too few models and uneven distribution, which resulted in high inventory and difficult sales for some dealers. This led to a collective withdrawal from the network later, and BYD had to merge sales networks.

This time, BYD does not lack models, but also faces the choice of balancing the interests of dealers. Therefore, we can see that the Song Plus DM-i, which belongs to the Dynasty Network, can only be purchased on the Ocean Network. On the contrary, if the Ocean Network rises in the future and the Dynasty Network declines, will a few models need to be returned?

At the same time, the Ocean Network features pure electric models on the e3.0 platform and DM-i hybrid systems, which overlap with the positioning of the Dynasty Network, such as the Guided Missile 05, which can be seen as a younger version of the Qin Plus DM-i, and the Guided Missile 07, which targets the upcoming Han DM-i.

Not fully dividing the brand may bring BYD continuous “internal blending”.

On the other hand, the “DM-i Kunlun Campaign” that exploded last year can also be seen as an extension of BYD’s “precision marketing” (putting vehicles in each province and city).

You know, times have changed, and market logic has already changed. Some “outdated” ideas still seem to linger within BYD.

Who has taken over BBA?

Last year, Wang Qingfeng, deputy general manager of BYD Dynasty Network Sales Division, mentioned when introducing the sales volume of the Han that “we won a lot of BBA’s additional purchase customers.”

As for the composition of Han’s car owners, BYD stated that in addition to the additional purchase customers of joint venture brands, technology-based, high-knowledge-based, and business-type customers are also the main users of Han models, including many Huawei fans.### The Debate over Who Has Stolen the Customers of BBA

Ideally, the top three users of the Ideal ONE are all BBA car owners, as revealed by Ideal’s user profile. Meanwhile, NIO claims that those who purchase their products already have BBA cars within their households.

It seems there is a heated debate over who has stolen the customers of BBA.

Looking at the average prices, the BYD Han belongs to the ¥200,000 level, but the average prices of NIO and Ideal remain at ¥300,000+. Therefore, NIO and Ideal should have a higher probability of snatching BBA users than BYD.

Overall, BYD boasts highly competitive products, but lacks brand premium. When it comes to smart technology, after-sale services, and customer care, BYD falls behind its new counterparts.

Perhaps, at present, most consumers have not yet been impressed by the three smart technologies, but that does not mean they will not in the future. BYD’s multiple models have been criticized by owners for problems such as a lagging car machine system, slow updates, and untimely OTA, among others.

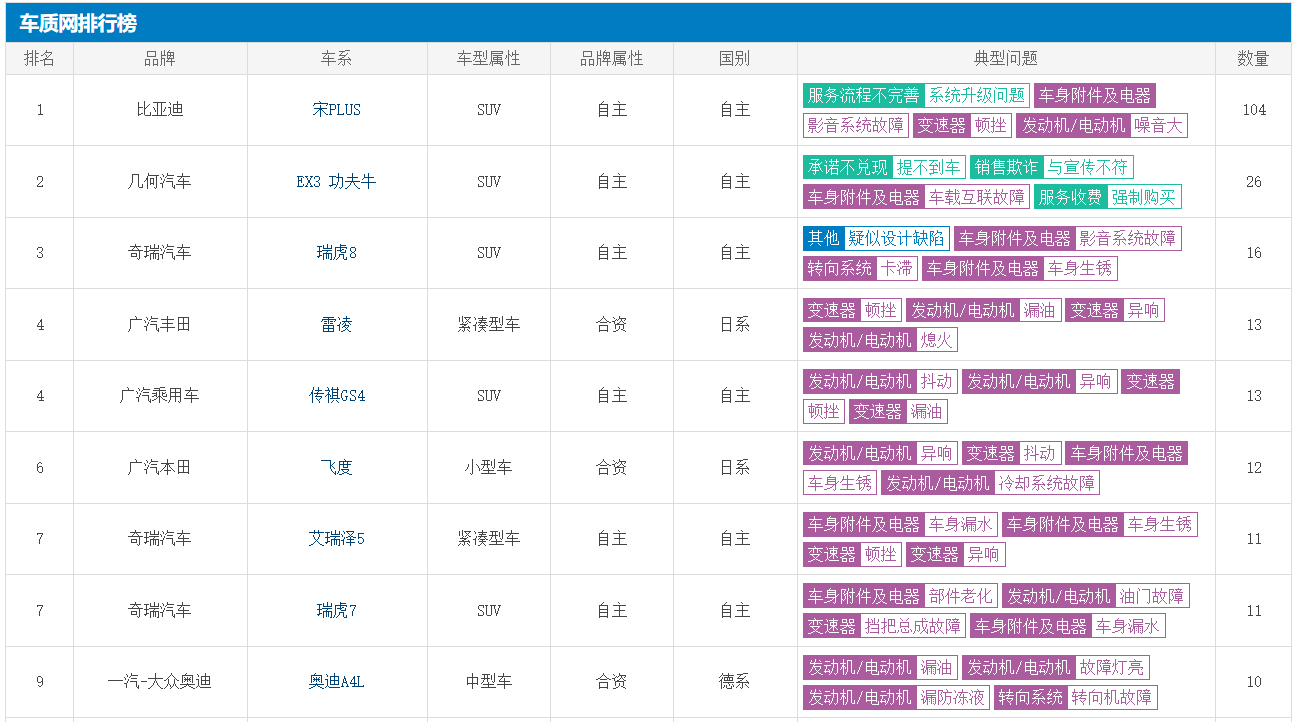

Recently, the BYD Song Plus fuel version topped the list of complaints due to issues with OTA.

While BYD is tapping into the market of educating young people, the new forces are also seizing the opportunity. When young people become the main consumers, and adopt a certain setting, there will no longer be any room left for industry practices that have lasted for however long.

Technology may improve product strength, but it does not necessarily enhance a brand’s power. If we consider pure electrification as the ultimate form of the automobile market in the long term, then BYD, which relies on the hybrid to account for half of its sales, cannot be guaranteed to stand on the final podium.

Before the technology dividend runs out, brand building must be one of the projects that BYD should tackle.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.