Tesla is increasingly moving away from dependence on the automotive business and is boldly advancing into the AI industry with an All-in persona.

On July 24th, Tesla released its Q2 financial report for this year. Despite the current pressure of increasing sales, Tesla still delivered a respectable Q2 report card.

Behind the scenes, Tesla’s revenue growth depends not merely on car sales, and increasingly, it relies on energy storage business and businesses centered on AI, particularly the latter, which is extremely important.

In terms of AI business, Tesla has devoted considerable resources to autonomous driving, Robotaxi, and humanoid robots. However, so far, Tesla has not produced particularly remarkable results that are widely recognized by the market.

Nevertheless, though Tesla is in a potent state in AI, it could cause significant changes with its powerful force when it explodes. Because of the heavy investment in AI, Tesla’s future seems foggy and fascinating.

Tesla’s massive investment in AI

Autonomous driving and Optimus are Tesla’s core products in AI. Musk stated in the earnings call that Tesla currently focuses on the development of these two aspects.

Currently, Tesla has made substantial investments around autonomous driving and Optimus, where the core of the investment is computing power.

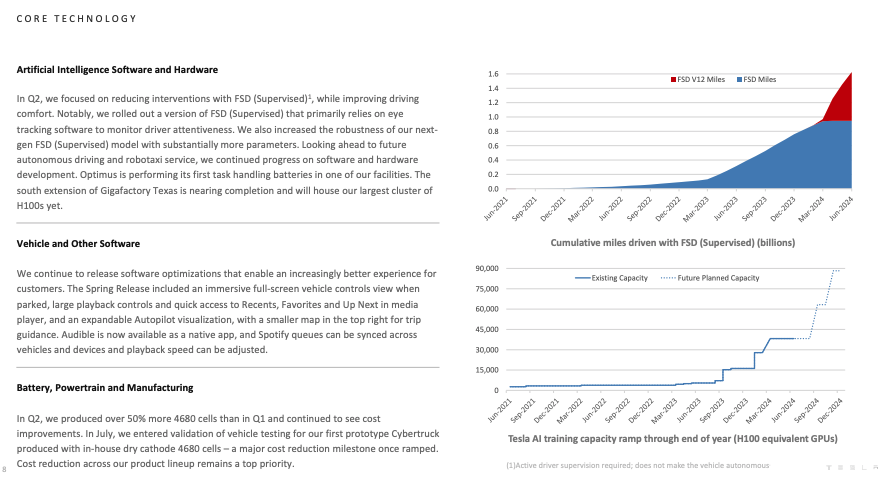

It is reported that Tesla has bought approximately 35,000 NVIDIA H100 chips and will add another 90,000 by the end of this year. In this financial statement, Tesla also pointed out that the expansion of the Texas factory will be completed soon and house the largest H100 cluster to date.

According to Musk in June, the data center and cooling facility for this H100 cluster will hit 130 megawatts this year and reach 500 megawatts in the next 18 months.

Besides buying computing power from NVIDIA, Tesla is also advancing the evolution of Dojo.

Dojo is a crucial tool developed by Tesla to process video data. According to Musk, by the end of this year, Dojo 1 or the first-generation version of Dojo, will have computation power equivalent to the total power of 8,000 H100 chips.

Because of the heavy investment in computing power, Tesla’s operating expenses are skyrocketing. The financial report shows that Tesla’s Q2 operating expenses were $2.973 billion, a year-on-year increase of 39%, and a sequential increase of approximately 18%.

However, for the improvement of computing power, Tesla will continue to invest. Tesla will not blindly invest. Under Musk’s impetus, Tesla might cooperate with Musk’s AI side project that was established last July. In the earnings call, Musk also stated that he would consider how to form a better synergy between the AI project and Tesla.xAI’s current computational power layout is monstrous. Recently, the supercomputing cluster xAI deployed in Memphis, Tennessee, has officially commenced operations. This supercomputer cluster contains 100,000 H100 chips, showcasing a colossal capacity for large-scale training.

Musk initiated a poll on X site, querying whether the public is in favor of Tesla investing 5 billion dollars into xAI. The results elucidated that 72.5% of respondents were in support of this investment strategy. Primarily, this was Musk probing public sentiment. The final decision to invest in xAI should emerge from the board of directors. Yet, Musk’s strong aspiration to integrate Tesla and xAI becomes visible from this action.

In fact, it is not just xAI and Tesla that could be integrative. An intercommunication exists between xAI, Tesla, and SpaceX. If these three entities successfully amalgamate, Musk’s AI empire may display an especially potent domination.

Thanks to considerable investment, Tesla has achieved phased successes in autonomous driving and Optimus.

In terms of autonomous driving, the financial report revealed that Tesla’s FSD total mileage has breached 1.6 billion miles and continues to burgeon rapidly.

Concurrently, Tesla pointed out that in Q2, attention would focus on reducing user takeovers for FSD, augmenting the mileage between two FSD takeovers, and improving driving comfort.

In the financial report, Tesla stressed that FSD has introduced a function to track the driver’s attention through their eye movements. However, sunlight glasses were denounced for impairing this function’s utility on X site. In response, Musk announced that this function would be amended in version FSD 12.5.

Regarding FSD 12.5, Musk stated in the financial earnings call that the volume of parameters in FSD 12.5 is five times that in 12.4, and the software stack for high-speed and other driving scenarios has been merged.

At present, FSD 12.5 has commenced rollouts. According to Musk, FSD 12.5 will, to start, only be pushed to Model Y with HW 4.0. Following confirmation of satisfactory performance, the rollout will expand further. Also, HW 3.0 will run an identical parameters model, this version will solely require additional code optimization.

Tesla has dedicated heavily to autonomous driving. As stated by Tesla’s CFO, after FSD’s price adjustments, market penetration is on the rise. Yet, Musk felt that many have not fully appreciated Tesla’s systems’ grandiosity.

From this angle, the key product to demonstrate Tesla FSD’s capability, Robotaxi, will play a highly significant role.

Currently, Robotaxi’s release has been postponed from August to October. Musk stated that continual improvements to Robotaxi were underway, with high hopes to provide an impressive user experience. It could potentially be possible for Robotaxi to hit the roads by next year.Meanwhile, Musk also announced that by the end of this year, FSD might acquire approval to enter the Chinese and European markets. Viewing from the Chinese market, scenarios for the application of intelligent driving are increasingly expanding. Sundar demands and attentiveness towards intelligent driving, especially the recent triggered wide-ranging societal discussions about the influence from automatic driving on industry and employment.

If Musk’s prediction holds true and FSD enters the Chinese market by the end of this year, it could pose a formidable challenge to car companies that emphasize intelligent driving and Robotaxi companies like “Fast Carrot Run”.

As for FSD’s capacity to handle the complex environment of the Chinese market, many people are relatively skeptical. In the earnings conference, Musk indicated that the FSD trained by Tesla in the US possesses general driving capabilities, which are applicable in markets outside the US.

As for Optimus, currently, Optimus has conducted simple battery production tasks. According to Tesla’s plan, by the end of next year, Tesla will mass-produce approximately 1,000 Optimus to handle a greater portion of the production tasks. Furthermore, it will commence providing services to the customers in 2026.

Regarding the future of humanoid robot business represented by Optimus, Musk suggested that there would be over 20 billion humanoid robots capable of executing general jobs. This would not only drastically ameliorate production efficiency but also construct a massive distributed computing network.

Modest Return to Expected Financial Performance

Let’s take a look at Tesla Q2 financial information:

Total revenue 25.5 billion dollars, YoY growth approximately 2%, sequential growth around 20%;

Gross profit 4.578 billion dollars, YoY growth around 1%, sequential growth around 19%;

Gross margin 18%, same period last year 18.2%, Q1 this year 17.4%;

Auto business total revenue 19.878 billion dollars, YoY drop approximately 7%, sequential growth around 14%;

Operating income 1.605 billion dollars, YoY drop approximately 33%, sequential growth around 37%;

Operating profit margin 6.3%, same period last year 9.6%, Q1 this year 5.5%;

Free cash flow 1.342 billion dollars by the second quarter.

From these data, compared to the same period last year, Tesla’s performance in Q2 this year is not quite strong. The total revenue and gross profit remain basically flat as last year, while the revenue and operating profit margin of the auto business have experienced noticeable declines.Compared to Q1 this year, Tesla has achieved significant growth in all aspects, returning to its expected performance level.

Worth noting is that Tesla saw particularly strong development in its non-automotive businesses in Q2, especially in energy storage.

According to official information, Tesla’s energy storage business generated $3.014 billion in revenue in Q2, a year-over-year increase of 100% and a quarterly increase of 84%. In addition, revenue from services and other businesses was $2.608 billion, a year-over-year increase of 21%, with a quarterly growth of approximately 14%.

Thanks to the growth of the energy storage business as well as services and other revenues, Tesla saw a noticeable increase in revenue in Q2. Tesla also projected in its financial statements that the growth rate of its energy storage business might exceed that of its car business this year. Tesla also stated that it inked excellent contracts in Q2, with a backlog of orders to be handled through 2025 and 2026.

Meanwhile, the growth in Cybertruck deliveries was a significant driver of revenue growth in Q2. Tesla stated in its financial report that Cybertruck’s production in Q2 increased threefold compared to the previous quarter, with the full project expected to be profitable by the end of this year.

Looking ahead, Tesla stated in its Q2 financial report that the current focus remains on reducing the overall costs of the company and accelerating the development of AI-empowered products. Tesla is managing its product portfolio with a longer-term orientation to boost sales and generate adequate cash flow for future growth investments.

Continued Emphasis on Expanding Sales

Tesla’s operating income in Q2 was $1.605 billion, a year-over-year decrease of about 33% and a quarterly increase of around 37%. Looking back at Tesla’s quarterly operating income since Q2 last year, $1.605 billion is evidently a lower number. This change is closely related to the sales of Tesla’s S3XY product lineup.

According to official data, the total production of Tesla’s S3XY in Q2 was 410,831 units, down 14% year-on-year and 5% quarter-on-quarter. Total deliveries were 443,956 units, down 5% year-on-year and up 15% quarter-on-quarter.

Among these, Model 3/Y, being Tesla’s main products, saw a Q2 production of 386,576 units, down 16% year-on-year and 6% quarter-on-quarter; deliveries stood at 422,405 units, down 5% year-on-year and up 14% quarter-on-quarter.

Tesla didn’t provide a clear explanation for the production decline in its financial report and conference call, but it anticipates quarter-on-quarter production growth in Q3 following the decline in Q2. Specifically, Tesla plans to greatly increase the production of Cybertruck and Model 3 in the second half of this year.

Regarding the increase in Q2 deliveries, Tesla’s frequent use of price reductions was an important factor. However, this also affected the average selling price of the entire S3XY product lineup, eventually impacting Tesla’s revenue growth.On how to continue stimulating sales growth, in Tesla’s financial report, the proposed strategies pivot around its products.

In the report, Tesla stated it would continue to update its global vehicle lineup, including launching new Model 3/Y interiors, providing new car paint choices for the whole S3XY series.

In the earnings call, Musk also revealed that Tesla will introduce and produce new models by the first half of next year; production of the Roadster might possibly be expedited to next year too.

Meanwhile, Tesla’s increasing market reach assists in boosting delivery figures. According to official info, the Tesla Berlin factory has initiated the production for the Right-Hand Drive market, and the first batch of vehicles has been delivered to the UK. Moreover, deliveries have begun for Qatar, with increasing deliveries in Israel and Taiwan.

Interestingly, during the earnings call, Musk also stated that, to increase sales, Tesla will dynamically adjust its advertising strategies, conducting some proportionate advertisements in due course.

In addition, considering the Chinese market, Tesla is facing a substantial competitive pressure. As mentioned in the report, the car market in China is among the fiercest in the world, but Tesla will secure favourable positioning for long-term development, beyond its focus on autonomous driving, cost structure also serves a crucial drive.

In terms of cost structure, Tesla remains committed to cost reduction. In this earnings report, the focus on cost reduction was highlighted.

According to official intel, excluding the Cybertruck, the average cost of Tesla vehicles is continually declining. This is observable from Tesla’s performance in maintaining good profit margins even amidst frequent price reductions.

Conclusion

The current Tesla hasn’t presented something truly exhilarating for a while now.

According to Tesla’s perspective, it is because Tesla is currently between two waves of growth — the first wave initiated with the globalization of Model 3/Y; the next wave is the development of autonomous driving and related new product rollouts.

When positioned between these two gargantuan growth waves, Tesla naturally finds itself in a more subdued stage of development. However, given the tremendous impact of the first wave, it raised the market’s expectations, corroborating Tesla’s might, although currently seeming somewhat lacking.

Looking at the attention, investment, and progress Tesla has allocated to AI, it appears that completely autonomous driving, Robotaxi, humanoid robots, and other product applications are on the cusp of being realized. Many changes that will eventually affect our lives may have quietly begun, unbeknown to us.

Regarding these transformations, of course, we can just wait and see.However, for enterprises such as Huawei, XiaoMi, NIO, LI, and Xpeng, preparing for the battle in advance is still essential. With the entry of FSD into China, perhaps as early as the end of this year, another fierce battle for autonomous driving will commence.

This article is a translation by AI of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.