From its establishment to its listing, Xpeng took 6 years, LI took 5 years, NIO took 4 years, and ZEEKR took only 3 years.

The rapid development has become a signature feature of ZEEKR. While NIO, Xpeng and LI already had a certain share market, ZEEKR just entered the game. Although it started late, ZEEKR quickly won the favor of the market.

According to official data, from 2021 to 2023, the sales volume of ZEEKR were 5,808, 71,941, and 118,685 vehicles, respectively, and the revenue from car sales were CNY 1.54 billion, CNY 19.671 billion and CNY 33.912 billion, respectively.

Entering this year, ZEEKR 007 started deliveries, and the brand new ZEEKR 001 became a hot seller after its release, withstanding fierce competition and achieving a new high in quarterly sales, despite the all-round onslaught from rivals such as XiaoMi.

Yesterday, one month after ZEEKR’s listing on the US stock market, they handed in their first quarterly report. On the whole, this ‘debut’ showed ZEEKR’s potential and vitality but also revealed concerns of continuous losses.

Financial Data

Let’s look at the specific financial data:

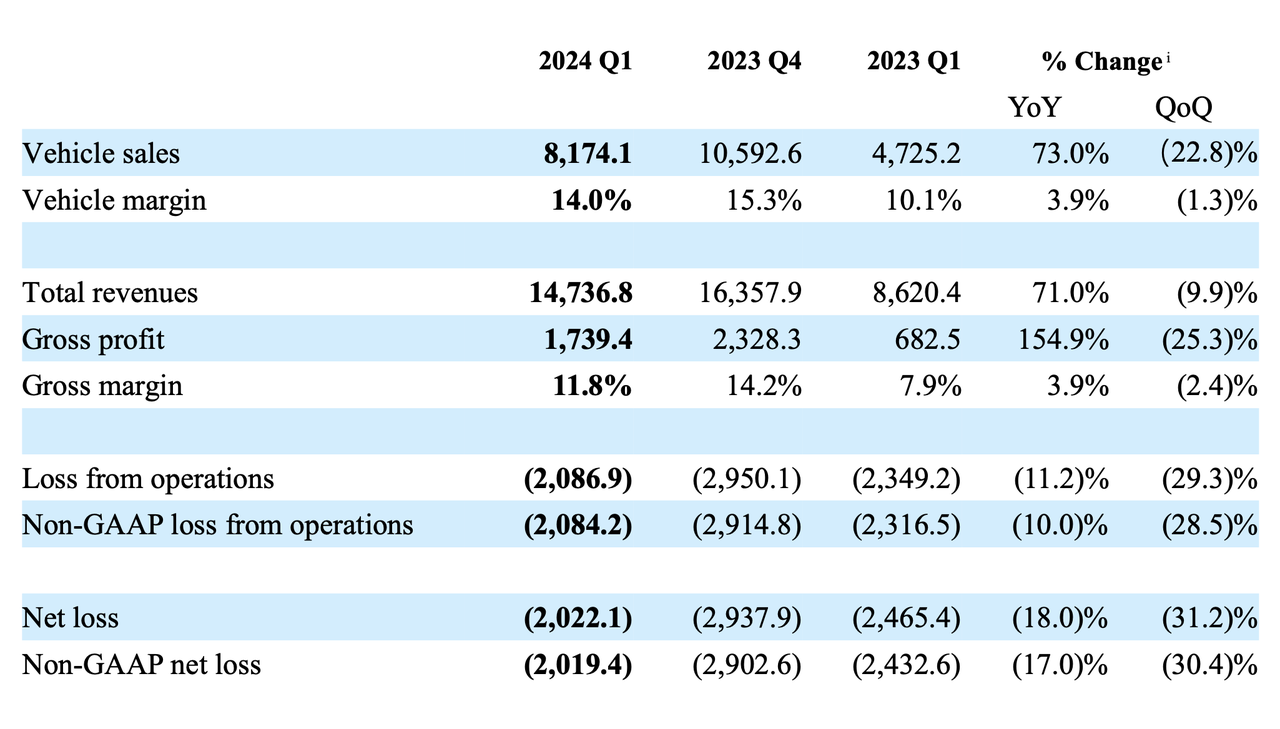

- Revenue in the first quarter was CNY 14.737 billion, up 71% year-on-year and down 9.9% quarter-on-quarters;

- The revenue from car sales was CNY 8.174 billion, up 73% year-on-year and down 22.8% quarter-on-quarters;

- The gross profit margin was 11.8%, compared to 7.9% in the same period last year and 14.2% in the fourth quarter of last year;

- The gross profit margin per vehicle was 14%, compared to 10.1% in the same period last year and 15.3% in the last quarter;

- The three power businesses, R&D and other services generated revenue of CNY 6.563 billion, up 68% year-on-year and up 13.8% quarter-on-quarters;

- R&D expenditure was CNY 1.925 billion, up 6.7% year-on-year and down 39.1% quarter-on-quarters with a cumulative R&D expenditure of CNY 18.9 billion;

- ZEEKR’s net loss in the first quarter of this year was CNY 2.0221 billion, a narrowing of 18.0% year-on-year and 31.2% quarter-on-quarters.

From this financial report, ZEEKR’s Q1 revenue and gross profit increased significantly year-on-year, but fell quarter-on-quarter. According to ZEEKR, the year-on-year growth in gross profit was mainly due to the improved car profit margin, and the quarter-on-quarter decline was mainly due to the fall in car profit margin and the increased percentage of revenue from sales of batteries and other parts with lower gross profit margins.

For the quarter-on-quarter decline in revenue, ZEEKR’s explanation is that seasonal factors affected delivery volumes, and the release of ZEEKR 007 also led to a decrease in average selling price.

Although revenue and car gross profit experienced a quarter-on-quarter decline, compared with LI’s 20.6%, Xpeng’s 12.9%, NIO’s 4.9%, and LEAPMOTOR’s -1.4%, ZEEKR’s single-car gross profit margin of 14% ranked second among the new forces listed.

Overall, with increased revenue, reduced losses, and growth in both sales and delivery volumes, ZEEKR – the fastest listed new automotive force – delivers commendable initial results.

ZEEKR CEO, Cong-Hui An, commented on the first quarter performance, “First quarter 2024 has shown excellent operational and financial results. With a new quarterly high in deliveries, we are advancing towards our annual target of 230,000 units. We will continue to push the boundaries of intelligence and autonomy, build our superfast charging ecosystem, and expand our service channels. Given these strengths and the strategic advantage and synergies we gain from our parent company, Geely, ZEEKR is advantageously positioned for sustainable global growth.”

Can the Annual Sales Target of 230,000 Units Be Realized?

This year, ZEEKR has consistently achieved over 10,000 units monthly sales, even amidst brutal price wars and the impact of strong competitors like XiaoMi’s SU7. This reinforces their step towards 20,000 units:

- For Q1 2024, ZEEKR’s volume doubled from the previous year to 33,059 units.

- From January to May, ZEEKR delivered a total of 67,764 units, a YoY growth of 112%. In May alone, ZEEKR delivered 18,616 units, a YoY increase of 115%, making a new record high in monthly delivery.

However, given the current sales volume, ZEEKR has to sell at least 23,000 units per month to achieve the target of “230,000 units by 2024”. Obviously, this is a daunting task for ZEEKR.

To accomplish this task, ZEEKR is making multi-pronged efforts.

Firstly, on products, The ZEEKR 001 and 007 have shown promising market performance, especially the ZEEKR 001. By the end of February this year, the all-new ZEEKR 001 was officially launched and received over 30,000 orders in its first month, making it the best-seller in ZEEKR’s product lineup with 11,729 units sold in April.

Of course, ZEEKR is not putting all its eggs in one basket.

This year, ZEEKR is continuously speeding up its product launch. From the ZEEKR 007 in January, to the all-new ZEEKR 001 in late February, to the MPV ZEEKR 009 launched in April, and the latest ZEEKR MIX developed based on the Massive-M technology.

Moreover, new products will be added. An Cong Hui stated during the earnings call that in the second half of the year, besides the newly launched ZEEKR MIX, ZEEKR will also launch a new mid-to-large size pure electric SUV, expanding its product lineup to 6 models.Beyond the product, sustaining a steady sales growth calls for advances in channel construction, energy replenishment ecosystem, and overseas expansion.

As of the end of May, ZEEKR has opened 392 stores worldwide, 380 of which are located in China. An Conghui stated that their channel focus this year is on “sinking”. ZEEKR will focus on the layout of ZEEKR Spaces in third and fourth-tier cities. It is anticipated that the number of stores will increase to over 520 by the end of the year, with a priority on enhancing the construction of ZEEKR Home and ZEEKR Space. ZEEKR CFO Yuan Jing also emphasized that channel sinking and overseas market expansion are highly advantageous strategies.

In terms of energy-replenishment ecosystem, ZEEKR produces the most 800V vehicles globally. By the end of May, ZEEKR has built 1076 charging stations (including dedicated ones) and has launched 487 extreme charging stations with 2615 extreme charging piles. Estimates predict that by the end of 2024, 1000 extreme charging stations will have been built, and by 2026, over 10,000 extreme charging piles.

In globalization expansion, as of the end of May, ZEEKR has entered over 20 countries and regions, including the Netherlands, Sweden, Thailand, UAE, and Saudi Arabia. ZEEKR 001 and ZEEKR X have started deliveries in Europe, and delivery of right-hand drive ZEEKR X will begin in the third quarter. It is anticipated that by the end of the year, ZEEKR will enter eight European markets, as well as more than 50 countries and regions around the globe, including Southeast Asia, Middle East, Latin America, and Oceania.

Profits Are Not Only From Vehicle Sales.

ZEEKR’s revenue exhibits clear diversification.

From the financial statement, besides the sales revenue from vehicles, ZEEKR also demonstrates a good income capability in battery, electricity, and electronic control business, research and development services as well as other fields – amounting to about 45% of the total income which is proportionally far higher than the extra-vehicle sales revenue of other EV companies.

This thriving income in battery, electricity, and electronic control industry and research and development services largely owes to the support of the “backer” Geely.

In July 2021, ZEEKR acquired CEVT from Geely. CEVT is Geely’s European Research and Development Center, one of the company’s four major global R&D centers. Post-acquisition, it continues to service multiple automotive brands under Geely, contributing to ZEEKR’s R&D income.

In the same year, Geely transferred a 51% share of Ningbo Weirui to ZEEKR, thereby contributing to ZEEKR’s income from battery and parts sales.

From this perspective, ZEEKR’s income from battery, electricity, and electronic control business and research and development services were crucial in its initial development stage. After ZEEKR began to sell vehicles in volume, these two businesses have become the company’s risk hedging chips.

Enabled by vehicle sales and battery, electricity, and electronic control business, and research and development, ZEEKR’s overall revenue performance is reasonably good. An unstinting concern is its deficit of 2 billion in the first quarter.

Although it’s progressively narrowing down and is significantly reduced both year-on-year and quarter-on-quarter, ZEEKR’s deficits are still undeniable. Geely’s unwavering support, on the other hand, remains indispensable.Backed by substantial support, yet ZEEKR suffered a net loss of 8.2 billion yuan last year, with accumulated losses over the past three years exceeding 20 billion yuan. As the product portfolio of ZEEKR continues to expand, along with continual growth in sales, ZEEKR is capable of producing more impressive financial reports.

This article is a translation by AI of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.