Is NIO showing signs of breaking free from its long-standing value-centric financial performance?

Recently, NIO’s 500,000th mass-produced vehicle rolled off the assembly line, ONVO’s L60 orders have far exceeded expectations, the battery swap alliance continues to expand, and NIO Energy has secured another 1.5 billion in strategic investment.

However, what really rekindled NIO’s market momentum was its sales performance. According to official data, NIO achieved a record high of 20,544 vehicles sold in May this year, breaking the 20,000-mark for the second time since July last year.

Given this backdrop, the long-term value proposition that NIO has built and steadfastly adheres to is demonstrating increasing monetization potential.

Therefore, despite the less-than-stellar Q1 financial results released by NIO today, and the passively tinged messages inferred from these financial data, NIO still warrants an optimistic outlook given its current situation.

Less-than-expected financial results

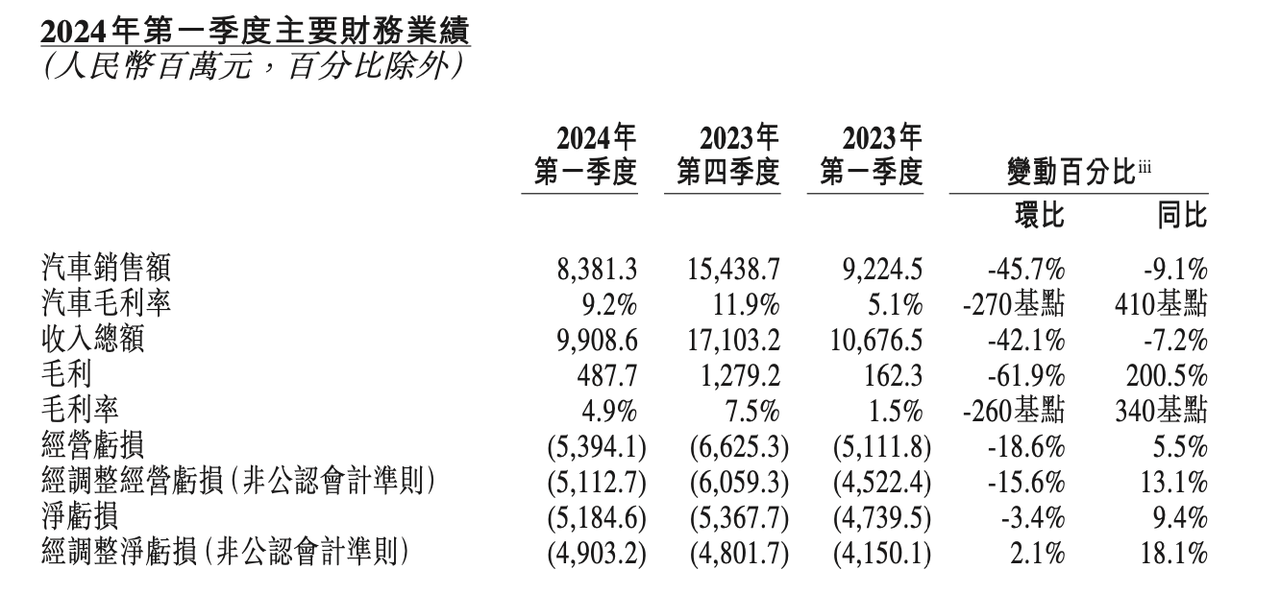

Let’s have a look at some key financial data from NIO for the first quarter of this year:

- Auto sales revenue at 8.38 billion yuan, down by 9.1% YoY and 45.7% QoQ,

- Auto gross margin at 9.2%, compared with 5.1% of the same period last year and 11.9% of the fourth quarter last year,

- Total revenue at 9.91 billion yuan, down 7.2% YoY and 42.1% QoQ,

- Gross profit of 490 million yuan, up 200.5% YoY and down 61.9% QoQ,

- Gross profit margin at 4.9%, compared with 1.5% of the same period last year and 7.5% of the fourth quarter last year,

- Net loss of 5.18 billion yuan, up 9.4% YoY and down 3.4% QoQ,

- Cash reserves of 45.3 billion yuan as of March 31, 2024.

Judging by these financial results, NIO’s current financial situation remains somewhat unstable — marked by significant losses and persistent lack of improvement in gross profit.

The company attributed the quarter-on-quarter decrease in gross profit to factors such as upgrades to vehicle models, delivery of lower-priced models like the ET5, reduced overall average selling price due to discounts, and seasonal fluctuations.

At NIO’s media event in December last year, NIO Chairman Li Bin unusually expressed NIO’s pursuit of short-termism and efficiency. However, at least until the first quarter of this year, NIO’s pursuit of short-termism and efficiency has yet to deliver practical results.

Regarding NIO’s financial performance for the first quarter, Li Bin remains optimistic, stating:

Despite intensifying market competition, NIO’s high-end brand positioning, industry-leading technology, and innovative “rechargeable, swappable, upgradable” energy replenishment experience have gained market recognition, demonstrating distinguished competitiveness. The steady growth in vehicle deliveries in recent months … With the addition of ONVO to our brand portfolio, we are ready to enter a broader mainstream market and kick-start the next phase of high-quality growth.## Increased Sales Success

We believe sales will get better and better, and we can reach a monthly level of 20,000 once again.

Li Bin shared this sentiment during the Q4 and annual financial report conference call for 2023 in early March. Unsurprisingly, NIO’s monthly sales have traced a beautiful growth curve from Q1 to the present.

During Q1, official data shows NIO delivered 30,053 vehicles, the sales tally for each month was as follows:

- January: 10,055 units;

- February: 8,132 units;

- March: 11,866 units.

Obvious to see, compared to the stable monthly sales performance of over 15,000 in the second half of 2023, NIO’s sales in Q1 this year did not meet expectations. Therefore, on March 27th, as the end of Q1 approached, NIO lowered its quarterly delivery forecast from the original 31,000 – 33,000 units to an even 30,000 units just managing to fulfill the forecast.

However, upon entering Q2, NIO saw a quick rebound in sales. According to official data, NIO’s monthly sales for April and May were 15,620 units and 20,544 units, respectively.

From the sales performance in April and May, NIO’s Q2 sales performance has significantly improved compared to Q1. Based on the strong sales performance in the first two months, NIO has set the following expectations for Q2 business performance:

- Vehicle deliveries: 54,000 – 56,000 units;

- Revenue: 165.9 – 171.4 billion yuan.

That is to say, to meet the Q2 business expectations, NIO needs to achieve at least 17,836 sales in June. For NIO today, the pressure to meet this target is not considerable.

The exploration into why NIO could rapidly increase its monthly sales will show that everything seems to be favoring NIO at the moment.

Pragmatic Approach

From NIO’s perspective, the strategy that long-term brand, technology, battery swaps and other aspects underlay, along with becoming more pragmatic in market tactics, are contributing to NIO’s victories.

In terms of sales, Li Bin said that NIO became cognizant of its sales deficiencies in the second half of last year, and now those are ascendant.

Of course, the significance of the BaaS policy is considerable. NIO launched a new BaaS policy in March, substantially lowering the barrier-to-entry price of its products. Li Bin stated that now the proportion of orders using battery leasing has exceeded 80%.

Regarding intelligentization, starting in March of this year, products equipped with the 8295 chip from the 2024 model have been successively launched. Simultaneously, the globally leading assistant NOP+ system, based on swarm intelligence and covering over 1.2 million kilometers across 726 cities, was formally launched on April 30th.

This further enhanced NIO’s product competitiveness in intelligence. Worth mentioning is that NIO recently obtained L3 autonomous driving permission, providing a fresh boost to the development of intelligent driving for NIO.In the field of battery swap, NIO has spent nearly a decade introducing this method to the market. At this point, the battery swap model has become a significant force in attracting users to purchase NIO’s vehicles.

In terms of numbers, according to the latest official data, NIO has deployed 2,429 battery swap stations nationwide. Industry-wise, NIO has formed partnerships with seven major domestic car companies including CCAG and Geely for battery swap.

This implies that, on the one hand, the cost of explaining what battery swap is has been reduced due to the increased brand recognition of NIO and the constant expansion of battery swap stations, leading to a constant increase in user acceptance and recognition. On the other hand, the mainstream industry has recognized the battery swap method, boosting the confidence the market and consumers place in NIO’s battery swap model.

In addition to charging, NIO has introduced a new story that’s closely related to the user’s interests— battery life.

Li Bin indicated at the Chinese Electric Vehicle Conference in March of this year that resolving the calendar life problem of the battery cannot be delayed. This is because the earliest batch of private new energy vehicles’ batteries are about to expire their warranties, and the post-sale costs of batteries are exorbitant. Moreover, as batteries deteriorate, their safety could also be jeopardized. These issues, according to Li Bin, can be effectively addressed by NIO’s battery swap model.

Timely Rebound

From a market fundamentals perspective, the resurgence in NIO’s monthly sales is highly correlated to the current trends.

The penetration rate of the new energy vehicle market is persistently increasing. According to data from the Passenger Car Association, the penetration rate of new energy vehicles exceeded 50% for the first time in the first two weeks of April, while the total penetration rate for April was 43.7%.

This indicates that new energy vehicles are becoming the choice for most people purchasing cars. As a high-end brand that has been dedicated to the new energy market for a decade and has significant market influence, NIO naturally benefits from this upswing in market fundamentals.

At the same time, an influx of customers from competitors also brought a wave of orders for NIO.

On March 28, Xiaomi’s SU7 officially hit the market and quickly became a phenomenal hot seller in the 200,000-300,000 yuan market. Backed by the Xiaomi brand, the Xiaomi SU7 not only excelled on its own but also piqued more interest in new energy vehicles. Moreover, due to the overcrowding at physical stores and long delivery lead times, there was a spillover effect that stimulated the sales growth of other brands.

On the first weekend after the launch of Xiaomi’s SU7, Lei Jun tweeted, “I heard that all new energy vehicles have increased in sales this weekend, which is great.” NIO is one of the beneficiaries of this wave of popular interest triggered by Xiaomi’s SU7.

Will ONVO Be NIO’s Revenue Generator?

After monthly sales once again surpassed 20,000 units, NIO faces the challenge of realizing even higher sales breakthroughs and profit growth. In the short term, this will of course still rely on NIO. In the long run, it will eventually depend on ONVO, targeted at the mainstream consumer market.On the 15th of May, the long-anticipated and much-debated second brand of NIO, alpine, finally made its debut as ONVO. Concomitantly, the first car model of ONVO, the L60, was officially released with a pre-sale price of 219,900 yuan.

ONVO and the L60 have gained a strong response following the official launch. Despite the fact that NIO, following their usual policy of not disclosing order data, has not announced the number of pre-orders, according to Li Bin, the amount of L60 orders taken has greatly exceeded expectations.

Indeed, the L60 surpassing expectations in pre-orders merely denotes the solid start for ONVO, with the ultimate litmus test coming down to delivery volume. In reality, it’s crucial for NIO to steadily accomplish mass distribution tasks via ONVO.

After all, NIO had already started planning for the ONVO brand as far back as 2020. As mentioned by Li Bin, NIO has invested substantially in ONVO and its third brand over the past few years, and it is now time to monetize those investments. Li Bin specified that ONVO is targeting a gross profit margin of over 15% and would not exchange lower profit margins for higher sales volume.

Regardless of whether it’s ONVO or NIO, it is time to monetize as soon as possible.

For one, since its establishment, NIO has invested a considerable amount in areas such as technical research and development, battery swapping layout, and engineering manufacturing. According to the Q1 financial report, NIO has invested an additional 2.86 billion yuan in R&D in Q1 this year. This figure, although lower than in the past, remains quite prominent compared to other competitors.

At the recently concluded 2024 Future Car Conference, Li Bin emphasized that technology is at the heart of NIO and that they remain firmly committed to their absolute amount of R&D expenditure. Consequently, it is likely that NIO will continue with its policy of substantial quarterly R&D investment.

Hence, it is only through the fast-paced mass distribution of ONVO that NIO’s technological capability can be converged into commercial returns on a grand scale. This shift would consistently dilute the vast R&D expenditure, injecting robust energy into the financial performance.

Simultaneously, the mass distribution of ONVO can expand the fleet size of the NIO system, driving the development of NIO’s intelligent driving. This growth allows NIO to enhance its competitive advantage in smart driving by leveraging a vast amount of data.

On the other hand, the new energy vehicle market in the 200,000 – 300,000 yuan price range is crowded and fiercely competitive. For ONVO, a completely new brand, if they cannot timely harness the initial momentum, establish a strong product, and attract users, they will likely be outpaced by competitors. If this happens, it will be challenging for ONVO to be a consideration for consumers, which will further burden NIO’s financial performance.

Therefore, for NIO, ONVO’s operations around promotion, sales, production, and delivery, before and after the September release event, will once again face the challenge of efficiency. This challenge leaves little room for error.

Apart from ONVO, Li Bin also revealed some information about NIO’s third brand, Firefly, in the earnings call. He mentioned he had driven it a few months ago and was very impressed with its performance. Firefly is a premium compact car in the hundred thousand price range; it has a very high development standard and will share a sales network with NIO. It will be delivered in the first half of next year, but the release date is yet to be fixed.## In Conclusion

NIO is currently at a developmental stage characterized by self-improvements. Thus, given NIO’s history of high financial risks, each step must be securely and firmly taken.

Should NIO’s monthly sales sustain at a level of 20K units, it’s foreseeable that its financial risks will be greatly mitigated. However, considering the relentless market competition and the unpredictable market feedback from ONVO’s initial public offering, the future path of NIO remains quite uncertain.

Looking back at NIO’s journey over the last decade, it’s evident that while NIO has been progressing forward, setbacks often occur. For instance, production constraints are still limiting NIO’s deliveries, as admitted by Li Bin during the earnings call — NIO’s orders in May have exceeded production capacity, resulting in May delivery serving as its current maximum output.

Therefore, although NIO has gathered momentum once again, complacency must be avoided at all cost. Amidst the unfavourable economic conditions and market environment, it is paramount to remain vigilant against financial risks, enhance organizational efficiency, and consistently produce high-quality products. On this note, Li Bin also emphasized:

In maintaining stable sales, improving the gross margin is our most important task in the next phase.

Below are the main points from the earnings call, edited without changing the original meaning:

Q: What are NIO Power’s funding plans?

After a fresh round of funding, NIO still holds 90% of NIO Power’s shares. With the initiation of separate financing for NIO Power, it will continually accept investments.

We are extremely confident in NIO Power’s long-term sustainability, despite upfront investments, the profitability is crystal clear, as NIO Power generates income not only from energy storage but also flexible upgrades, hence, we have no doubts about its profitability.

Q: What are ONVO’s channel distribution plans?

ONVO plans to have about 100 stores by the time of its delivery in September. ONVO won’t require NIO House hence minimizing investment, each ONVO store requires an investment between 1 million to 2 million RMB.

ONVO will launch a medium-to-large SUV next year, although ONVO won’t have many product offerings, it’s hoped that every ONVO product will be well-received in their respective market segments.

Q: What’s the status of JAC?

I’ve been using it for several months and it works well. JAC makes boutique compact cars priced at ten-thousands, it has high R&D standards, will share the sales network with NIO, deliveries start in the first half of next year, launch date is undecided.

Q: What are NIO’s plans for its third-generation platform?

NIO’s products will transition to the third generation from next year, we hope this will significantly improve the gross margin, for example through our proprietary chips.

Our target average gross margin for the third-generation platform products is above 20%, we’re confident that the NIO brand can achieve monthly sales volume of 30K units.Furthermore, ONVO will not exchange volume for low gross margin, maintaining a gross margin above 15% is ONVO’s goal, and ONVO can break even by achieving sales of 20-30 thousand per month.

Q: What is the plan for NIO’s next generation of swap stations?

NIO will start deploying the formal fourth-generation station from next week, and it will be compatible with ONVO and NIO. The layout will depend on the specific situation, and it is expected that by the end of the year, ONVO will be able to use more than 1,000 swap stations.

We have notably observed the significance of the swap station numbers in a particular region for sales growth. For example, the number of swap stations in the Yangtze River Delta exceeds 800, and the users in this region account for more than 50% of NIO’s total users.

Currently, NIO’s nationwide swap network has taken shape, and the forthcoming deployment will pay special attention to ROI and the support provided for sales acceleration.

Q: How is NIO developing L3 autonomous driving?

We have just obtained the L3 access, which is a rather essential matter. On the one hand, it is an endorsement of our technology from the authorities, and on the other hand, we will have further discussions from the access point with government departments.

Q: What does the BaaS strategy mean for NIO’s recent sales growth?

We believe that the sales growth in recent two months is composite, of course, the BaaS strategy is supremely important, now the proportion of battery renting surpasses 80%.

Additionally, the sales growth is also due to our sales capacity’s enhancement. We started realizing last year that our sales were not sufficient, and now the sales capability has improved. Simultaneously, as the number of swap stations increases, user’s approval of battery swap is also increasing; the preservation rate of our products has increased too, many of our models are top-ranking in electric vehicle value preservation.

Next, we will persistently improve our gross margin, escalate high-margin product sales, like ET7. Maintaining stable sales and enhancing the gross margin rate is our most crucial task for the next phase.

Q: What are NIO’s sales plans for Europe and the Middle East?

We believe that the EU’s increase in tariffs is in the wrong direction, contradictory to sustainable development. Nevertheless, as a company, we will make appropriate modifications according to this strategy. At present, NIO’s sales ratio in Europe is still relatively low, it has no substantial impact. In the long term, we will formulate a reasonable strategy based on tariff changes.

NIO will start sales in the Middle Eastern market later this year.

Q: What is the relationship between NIO’s three brands?

NIO is positioned in the high-end market, catering to both commercial and family users, ONVO targets the mainstream family market, and Firefly aims to serve as the second vehicle requirement in a family with its excellent compact car. Their common characteristics are battery swappable, highly intelligentized, and the extent of whole vehicle engineering reusability is remarkably high.

Q: Please estimate the changes in NIO’s delivery volume.

Our orders in May surpass our capacity, actually, May’s delivery volume is NIO’s maximum capacity. NIO…The delivery volume is experiencing steady and continuous growth, wherein we hold substantial confidence in the forthcoming sales numbers. Additionally, we are already in the process of training workers to enhance capacity by operating in two shifts.

This article is a translation by AI of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.