Facing the market between 200,000 to 300,000, Li Bin finally made his move.

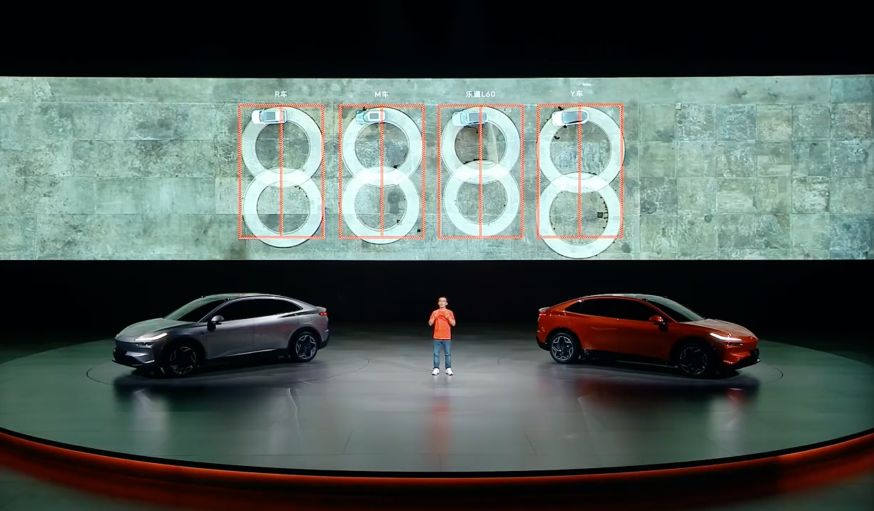

On May 15th, coinciding with the International Family Day and National Low-Carbon Day, NIO’s second brand, ONVO, was officially launched. At the same time, the first car under the ONVO brand, ONVO L60, made its debut with a pre-sale price starting at RMB 219,900.

This Model Y targeted car model will be officially launched and delivered in September, nearly four months from now. As for the pre-sale order performance of the ONVO L60, ONVO’s President Ai Tiecheng stated in an interview: it far exceeds expectations.

For NIO, a car company, the ONVO L60 carries a nodal significance.

On one hand, it embodies the company’s ambition to fully acquire more sales in the more mainstream price segment below 300,000; on the other hand, this car is also a touchstone to test whether the entire product, technology, and service systems built by Li Bin have truly strong market competitiveness.

ONVO L60: Fully Targeting Model Y

From the very beginning, the ONVO L60 aimed at Model Y.

As early as March this year, when the ONVO L60 was still in disguise and the brand was kept confidential, the slogan “Better than Bean Y” was posted on the rear window glass. During the official preheating stage, Li Bin and Qin Lihong repeatedly mentioned the direct competition between this car and Model Y on multiple occasions, including product points such as energy consumption, price, and cost.

On the May 15th launch event, the product comparison with Model Y became the central thread throughout the ONVO L60 product briefing.

One of the most direct benchmarking points is energy consumption.

At the launch event, ONVO’s President Ai Tiecheng announced that the energy consumption of the ONVO L60 is 12.1 kWh per 100 kilometers, which exceeds the 12.5 kWh per 100 kilometers of the Tesla Model Y. From this, Ai Tiecheng stated that the ONVO L60 has the “lowest energy consumption in the mid-sized SUV industry”.

Based on such energy consumption performance, the ONVO L60 has three range versions, namely 555 kilometers of standard range, 730 kilometers of long range, and over 1,000 kilometers of ultra-long range. Notably, the 555 kilometers of standard range just surpasses the 554-kilometer range of the Model Y rear-wheel drive version.

In order to achieve such a range standard, multiple product aspects of the ONVO L60 are also devoted to this goal.

Among them, based on the WAY UP design concept, the overall body shape of the ONVO L60 adopts a fastback styling similar to the Model Y. The integrated spoiler, hidden door handles, low-resistance hub design, frameless outside rearview mirror, and vehicle diffuser configurations have also helped the ONVO L60 achieve a drag coefficient of 0.229.

Consequently, the ONVO L60 proclaims itself as the “SUV with the lowest air resistance coefficient in global mass production”.

Beyond air drag, the ONVO L60 has implemented a universal 900V high-voltage system that incorporates the electric drive, heat pump air conditioning, auxiliary heater, onboard charger, and direct current voltage converter among others. Primarily, it uses a 900V silicon-carbide main electric drive system, boasting an overall efficiency of 92.3% in CLTC cycles.

Besides energy consumption and range, ONVO L60 targets the same parameters as Model Y regarding space and turning diameter.

For example, given its larger overall size (4,828 * 1,930 * 1,616 mm) and wheelbase (2,950 mm) compared to Model Y, ONVO L60 surpasses Model Y in aspects like front row headspace, rear row headspace, and net knee space in the back seat.

In terms of turning performance, the turning diameter of ONVO L60 is 10.8 meters, less than Model Y’s 11.5 meters and RAV4’s 11.1 meters, even less than MINI COUNTRYMAN’s 11 meters.

Additionally, beyond these specifications, ONVO L60 adopts a larger and clearer 17.2-inch 3K retina screen for the in-car display than that of Model Y. As for intelligent driving, it employs a purely visual solution similar to Model Y with standard NVIDIA Orin-X chip and 30 high-performance sensory hardwares, supporting high speed NOP and urban NOP functionalities.

Of course, compared to Model Y, ONVO L60 has a unique advantage in energy sourcing, supporting both battery swapping and charging (including AC charging), thus enabling the accessibility to over 1,000 battery swap stations and over 20,000 charging piles at the time of delivery. Its charging capacity is claimed to be “second in the industry”, with NIO leading the list.

Overall, from a product perspective, ONVO L60 is constructed as a competitor to Tesla’s Model Y across all aspects, asserting its potential to challenge Model Y in key product aspects such as energy consumption and space – implying an ambitious market outlook that NIO has yet to demonstrate.

Aggressive Strategy Targeting $200,000 – $300,000 customers

Li Bin harbors great expectations for ONVO’s market potential. Therefore, the pricing and market strategy for ONVO L60 reveals aggressive competitiveness.

At the launch event, Ai Tiecheng announced a starting presale price of $219,000 yuan for ONVO L60.

Indeed, compared with Model Y, the presale number is lower than Model Y Rear Wheel Drive version’s starting price of $249,000 yuan, by a significant $30,000.Earlier, Li Bin had publicly stated that ONVO’s first model would be priced lower than the Tesla Model Y. With a $3,000 price difference, it clearly demonstrates ONVO L60’s ambition to outperform Model Y in cost-effectiveness.

This is easy to comprehend, after all, as a benchmark product within the price range of $20k-$30k, the Model Y led the national sales in 2023 with over 450,000 units and global sales exceeding 1.2 million units, ranking first in their respective sales dimensions.

In addition to benchmarking against Model Y, the ONVO L60 has some unique pricing strategies.

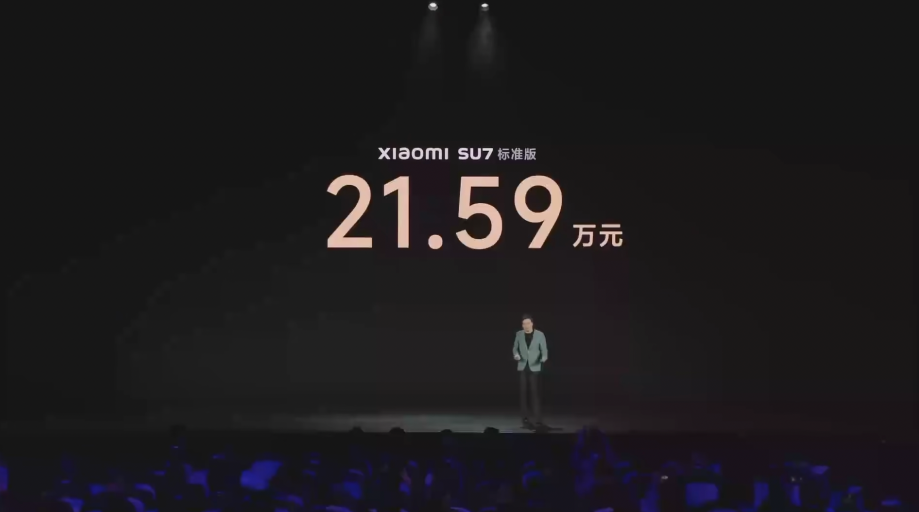

For instance, at the launch, Ai Tiecheng announced that users who opt for the ONVO L60 could pay a deposit of $200 before its official launch in September, which will offset $600 of the purchase price. This is essentially a disguised discount of $400, lowering the pre-sale threshold for the ONVO L60 to $21.59k.

And $21.59K is the starting price for the Xiaomi SU7.

Interestingly, after the Xiaomi car’s release, Li Bin and Lei Jun stated in a joint video that the launch of the Xiaomi SU7 had made it rather difficult to price ONVO’s first product. In retrospect, the ONVO L60’s pre-sale pricing strategy is a response to the Xiaomi SU7’s pricing.

In fact, it is not hard to understand why the ONVO L60 comes across as aggressive with its pre-sale prices.

The $20K-$30K range is arguably the most competitive in the current Chinese new energy vehicle market, and it is extremely unfriendly to newcomers.

In this arena, besides Tesla, there are high-end new energy brands from traditional automotive giants like ZEEKR, DENZA, avatr, IM, as well as emerging brands like Xpeng, LI, Xiaomi, and AITO.

Each of these brands offer their own advantageous product features in terms of electrification and intelligence. Besides the added fuel tank advantage of range extender models from brands like AITO and LI Auto, features like 800V and advanced intelligent driving have been continuously deployed to the whole price range, resulting in observable product homogenization.

In this context, as a latecomer, the ONVO L60 inevitably faces extremely rigorous product scrutiny and comparison, hence the importance of pricing.

Worth mentioning, during the interview, Li Bin also discussed the competitive relationship between the ONVO brand and LI Auto.

He asserted that both ONVO and LI cater to family users and share some overlap in their pricing ranges. The competition is normal and beneficial for consumers by offering more choices. He emphasized that Li Xiang, as an early investor in NIO, welcomes all companies producing electric vehicles.Additionally, Li Bin stated that presently, customers still choose range extension, plug-in hybrids, and gasoline vehicles due to the insufficiency of charging infrastructure. This issue needs concerted industry effort to resolve, enabling the use of electric vehicles as convenient as gasoline ones; meanwhile, NIO will strive to construct more battery swap stations and charging piles to reassure the users of pure electric vehicles.

The Synergy and Distinction between NIO and ONVO

As the first product of NIO’s sub-brand, ONVO L60 naturally benefits from the support of NIO’s overall capability architecture.

During the interview, Li Bin communicated that the funds for the research, marketing, supply chain system, etc., of the ONVO brand have been incorporated into NIO’s investments, and separate listing will not be considered in the future. He highlighted that despite ONVO L60’s presale price of 219.9 thousand, it still maintains decent margins, stating that the brand is not in the business of selling at a loss.

Another system support that the ONVO brand has received comes from battery swapping.

According to Ait Cheng, at the beginning of ONVO L60’s delivery, it is viable to use over 1,000 battery swap stations. These stations mainly rely on over 1,000 third-generation battery swap stations already established by NIO. According to NIO’s official statement, simple modifications implemented over several hours can make these stations compatible with the ONVO brand.

Similarly, the NIO brand has already adopted the BaaS sales model – meaning all models under the ONVO brand, including L60, can utilize a vehicle-battery separation sales model. This will inevitably make the sales model of ONVO L60 considerably more flexible, significantly lowering the access threshold.

This could potentially be ONVO L60’s trump card when officially launched.

Apart from the battery swapping mode, the service capabilities of the ONVO brand can also benefit from NIO’s existing system. According to NIO’s previous public statements, ONVO will utilize NIO’s service network.

However, as Li Bin and his management team consider the effective synergy with the NIO brand, they also contemplate how to maintain NIO’s high-end positioning while ensuring the quantity of ONVO’s deliver. After all, a common concern about the market release of ONVO L60 is that a high quantity could impact the sales of high-priced NIO brand vehicles.

In response to this, Li Bin emphasized during the interview that he believes the combination of NIO and ONVO is a 1 + 1 greater than 2 because they can meet more user demands; he also underscored that as automobile brands become increasingly stratified, this type of segmentation is necessary.

Dehua Qin also clearly expressed that there will be both synergy and separation between the ONVO and NIO brands.

In fact, in terms of battery swapping, while NIO vehicle owners can use all battery-swap stations, ONVO brand can only utilize over 1,000 stations – indicating a certain distinction between the two brands.

In sales, ONVO will be separated from the NIO brand and have an independent sales network.

About the sales channel of ONVO, Ait Cheng stated in an interview that ONVO’s sales channel will mainly focus on business circles and automotive city stores, introducing some partners and expanding to lower-tier cities. However, it will continue with a direct operation model. He emphasized that when ONVO L60 hits the market, there should be at least 100 ONVO sales outlets, and the service network should rapidly extend to several hundred outlets.

As stated by Li Bin in a previous financial report conference call, the ONVO brand plans to establish 200 stores within this year.

This channel construction intensity implies a significant enhancement in sales capability for the ONVO brand, in parallel, it indicates a hefty investment in infrastructure. Therefore, the ONVO car models will have to maximize potential sales, possibly extending to lower-tier cities to maintain the positive operation of this channel system.

It is noteworthy that, in the interview, the NIO side announced that ONVO brand will release 6-seater and 7-seater products next year, which will be incorporated into the ONVO product matrix to boost sales.

In addition, NIO is planning to launch a third brand within about a year, in Li Bin’s long-term plan, besides NIO and ONVO. This new brand aims to reach a lower price segment market. Li Bin insists NIO is committed to EV, regardless of the market condition.

In conclusion

For NIO, the launch of the ONVO brand and the ONVO L60 model can be seen as a crucial point.

On one hand, in the past decade, NIO has been dedicated to a high-end EV strategy, it has succeeded nearly 500,000 volumes in the pure EV market priced 30k+ through the support of technology R&D, battery swap model, and service capabilities, thereby proving itself. This initial validation served as the critical starting point for the ONVO brand.

However, on another hand, given the automotive industry’s high demand for scale effects and multiple years of deficit, NIO indeed needs an effective approach to compete in markets of price segment less than 30k with other brands, to maintain the enterprise’s positive operation through achieving profitable sales.

This is the mission that the ONVO brand and subsequently launched third brand under NIO must undertake.

Of course, after a decade of over RMB 43 billion invested into R&D and capability-building, NIO inevitably needs to step into a new phase: launching more new products into a more challenging, larger-scale market with increasingly discerning customers, thereby realizing the valid monetization of its technical and product capabilities.

From this perspective, the ONVO L60 is just the starting point of this phase – whether it can gain market recognition will be answered after September.

This article is a translation by AI of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.