Tesla is facing squeeze from both internal and external risks.

Internally, as Musk stated, along with the stride expansion in the global market, Tesla is suffering from the common maladies of a large corporation, such as personnel redundancy and organizational inefficiency, which hinders cost reduction and productivity progress.

Hence Musk announced a global layoff of over 10% in Tesla on April 15.

Externally, Tesla’s product lineup is suffering from serious aging while competitors’ models, especially those from China, are fast catching up during the gap between Tesla’s aging and new lineup.

Therefore, even though Tesla’s sales volume still holds a crown, growth has been sluggish. Once there is a risk of a decline in sales volume, Tesla points the solution toward pricing – either raising the price to meet demands or lowering the price to promote sales.

From April 20 to 21, Tesla has initiated another round of price reduction, announcing a comprehensive price cut in the U.S. and Chinese market, among which the price of Model Y reached historical lows in both countries, namely CNY 249.9k and USD 42.99k respectively.

Adding to Tesla’s gloomy atmosphere is the disappointing Q1 2024 financial report, released amid the backdrop of ongoing global layoffs and large-scale price reductions in China and the U.S.

Has Musk not tried hard enough?

During the Q1 financial teleconference call, Musk stated that he dedicates time and energy to Tesla every day and that he will continue to strive for Tesla’s prosperity.

However, judging from the financial data of Tesla in Q1 2024, Musk may need to seriously consider whether it is necessary to devote more time and energy to Tesla.

Highlights from the financial report include:

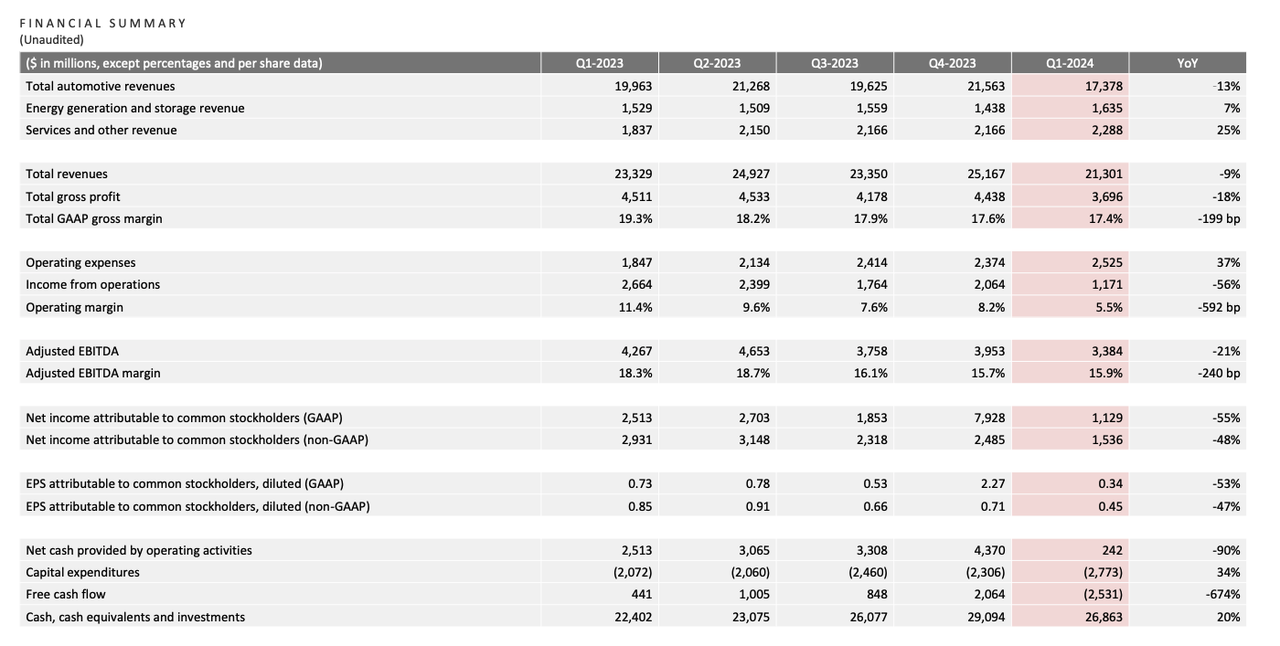

- Total revenue of USD 21.301bn, a YoY decrease of 9%;

- Gross profit of USD 3.696bn, a YoY decrease of 18%;

- Gross margin of 17.4%;

- Total revenue from automobiles: USD 17.378bn, a YoY decrease of 13%;

- Business expenses of USD 2.525bn, YoY increase of 37%;

- Business income of USD 1.171bn, YoY decrease of 56%;

- Cash, cash equivalents, and investments of USD 26.863bn.

As seen from the data, even as Tesla’s primary business, the automobile business has experienced significant decreases both YoY and QoQ, and free cash flow has even dropped by USD 2.53bn.

For the downswing in automobile revenue, the financial report explains it as a result of a decrease in average vehicle sales price and a decrease in vehicle delivery; for the decline in free cash flow, the report cites an increase in Tesla’s inventory of USD 2.7bn and an expenditure of USD 1bn on AI infrastructure during Q1.In stark contrast to the drop in automotive revenues, Tesla’s other business revenues continue to grow steadily:

- Energy generation and storage revenue $1.635 billion, up 7% year-on-year;

- Service and other revenues $2.288 billion, up 25% year-on-year;

In response, Tesla stated in its financial report that the storage deployment had grown to 4.1 GWh in Q1, with a gross profit increase of 140% year-on-year, making it the most profitable of all Tesla’s operations.

Meanwhile, with more and more auto companies adopting the Tesla NACS charging standard and the rollout of FSD in North America, there has been a breakthrough in the rapid growth of Tesla’s service and other revenues.

Overall, Tesla’s Q1 financial report has failed to meet market expectations and is delivering a danger signal to Tesla. However, Tesla also specifically stated in the report:

We will focus on growing profit, including leveraging our existing factories and production lines to launch new and more affordable products.

Demand Crisis Behind Production-Sales Imbalance

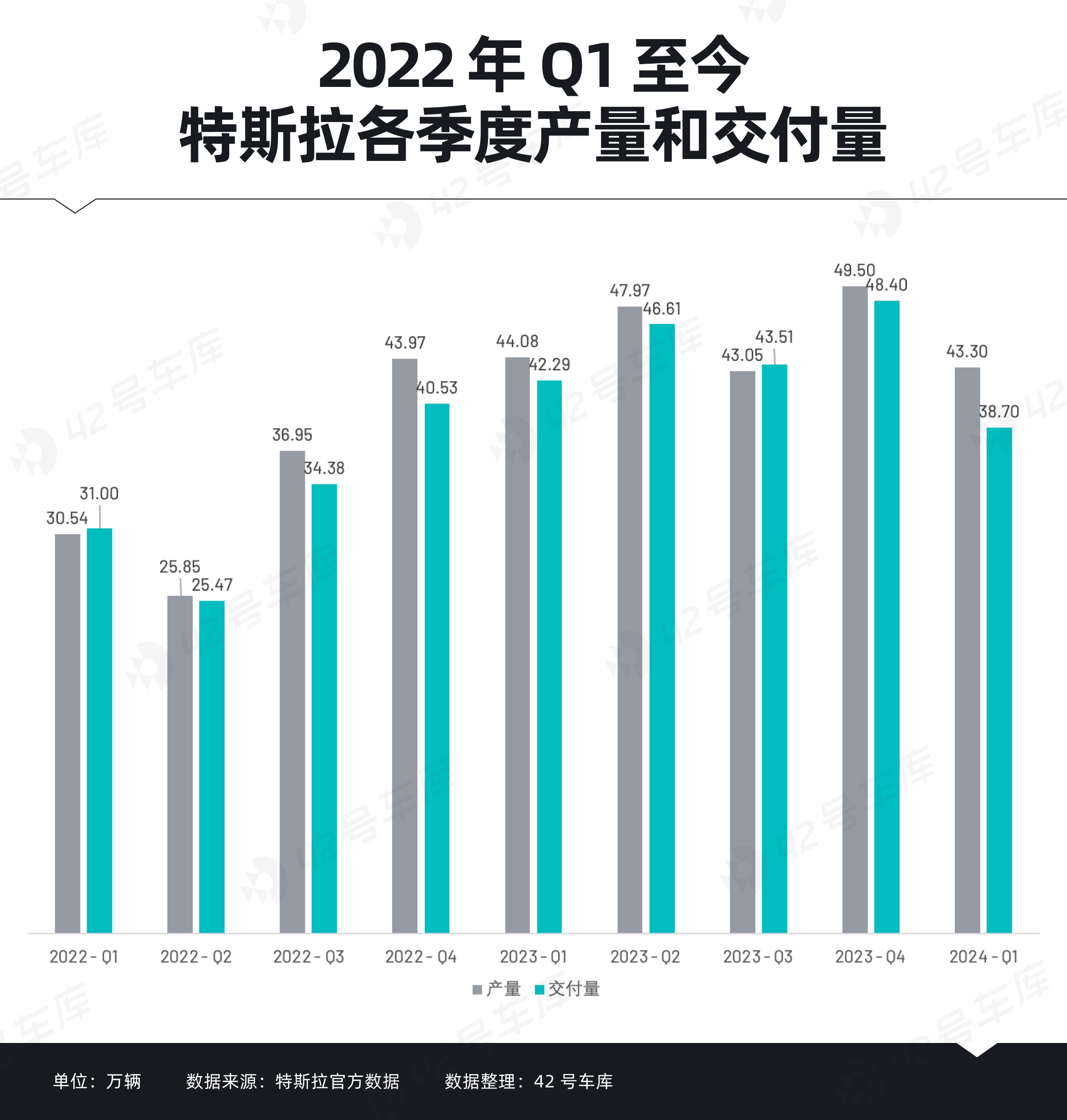

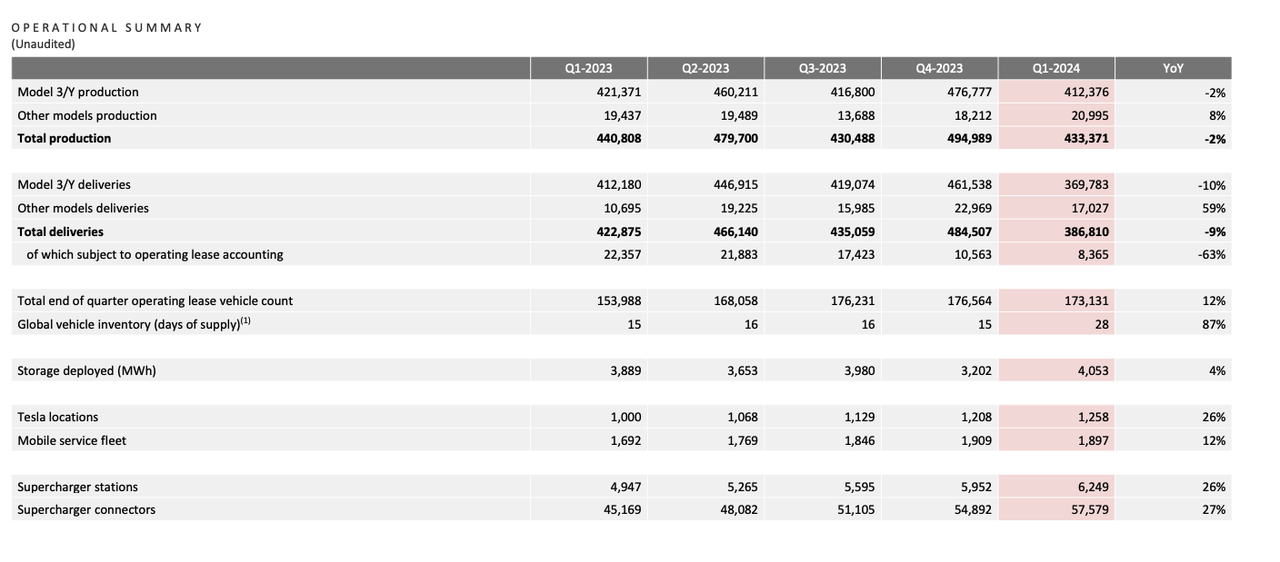

In Q1 of this year, Tesla saw a rare imbalance in production-sales.

According to the financial report data, Tesla’s Q1 production was 433,000, down about 12.5% sequentially and about 1.8% year-on-year; deliveries were 387,000, down about 20% sequentially and about 8.5% year-on-year.

While falling both sequentially and year-on-year, there’s a gap of 46,000 vehicles between Tesla’s Q1 production and sales. This means about 10% of Tesla’s Q1 production ended up in stock.

Although Tesla’s production-sales volume still leads the pack compared to most new energy automotive enterprises, it is clearly a set of numbers that sound an alarm bell for Tesla itself.

Regarding the collective decline in production and delivery volumes, Tesla mainly explained from three aspects, including the capacity climbing of the refreshed Model 3 at the Fremont factory, the outbreak of the Red Sea Crisis interrupting the supply of components from Berlin’s mega factory, and the shutdown caused by environmentalists setting fire to burn the Berlin mega factory.

Obviously, Tesla’s explanations all revolve around the decline in capacity and cannot provide strong support for the drop in deliveries.

As for the reason for the decline in deliveries, Musk supplemented in the conference call that it was due to seasonal factors and bad macro-environment. To put it more bluntly, the key reason for Tesla’s drop in deliveries is actually a problem with customer demand.

Tesla is a bit panicked

As already mentioned, Tesla’s product lineup is “aging” severely.As a global enterprise established for 20 years, Tesla has gained worldwide recognition through its two popular models, Model 3 / Y. Notably, Model Y is an “old horse” that hasn’t undergone any major modifications in nearly five years.

In fact, Tesla is making efforts to offer users something new.

Take the revamped Model 3 that was launched last year, for example. Tesla boldly modified the Model 3’s styling design, steering wheel function design, and cut out the turn signal lever and gear lever. However, these changes failed to bring users the surprises as expected. Instead, they had to invest considerable effort in adapting to them.

In Q1 this year, Cybertruck was officially delivered. Although Cybertruck is not available in China, Musk still brought Cybertruck over the ocean to conduct its tour in China, not only pushing the users’ attention to Tesla to another climax but also generating abundant sales leads for Tesla.

Worth mentioning, Musk also announced in early April that Robotaxi would be launched on August 8 this year. The public knows not whether this promise will be another of Musk’s occasional lapses, but it at least sparks new anticipations for Tesla, and Tesla’s shares rose 5% in response.

In addition, just after releasing the financial report today, Tesla launched the high-performance version of Model 3 with a total of 335,900 units, anticipating its delivery in Q3 this year.

However, the updates for Model 3 / Y, the two most critical popular products, have been too slow over the past two years, and Tesla has failed to provide an innovative experience well received by mainstream users.

Undeniably, Tesla’s monthly sales of Model Y alone exceed the total sales of some emerging automakers in China. But competitors, especially those from China who are pushing ahead in the increasingly fierce price war and elimination round, can’t be dismissed lightly.

In such an intensely competitive situation, Tesla will lag behind without progress, particularly in the Chinese market.

The potential of Chinese automakers is acknowledged globally. Even Musk himself commented that “Chinese automakers are the most competitive. If trade barriers were lifted, they would defeat most automakers globally.”

Over the past two years, Chinese automakers rolled out a series of new products, some of which are rivaling Model 3/Y. These products are not only striving to catch up with Tesla in terms of EV system, manufacturing process, etc., but also willing to take more risks in pricing, even selling at a loss.

Meanwhile, the entry of Huawei and Xiaomi, two leading brands in terms of public recognition and product R&D capabilities, into the new energy vehicle market, puts more pressure on Tesla, threatening not only its product power, but also its brand, feelings, story, and other more emotional aspects.Amidst an increasing number of fierce competitors, Tesla is showing slight signs of panic.

A typical example is the XiaoMi SU7, which essentially mirrors the Tesla Model 3 on a pixel level. Confronting the XiaoMi SU7, which received 88,898 orders within 24 hours of its launch, Tesla, who has always disregarded its competitors, stated on its official Weibo account – “Please do not make hasty decisions before experiencing the benchmark Model 3.”

However, according to Musk, there’s no need to pay excessive attention to Chinese competitors. He said:

We don’t know what the competitor is doing, but we know we’re doing great. Rather than focusing on what the competitors are doing, we want to do our job well. In fact, their sales are declining, and relatively speaking, we are performing better.

Betting on FSD for future growth

Compared to the innovative capabilities of the Model 3/Y, Tesla is more focused on FSD progress.

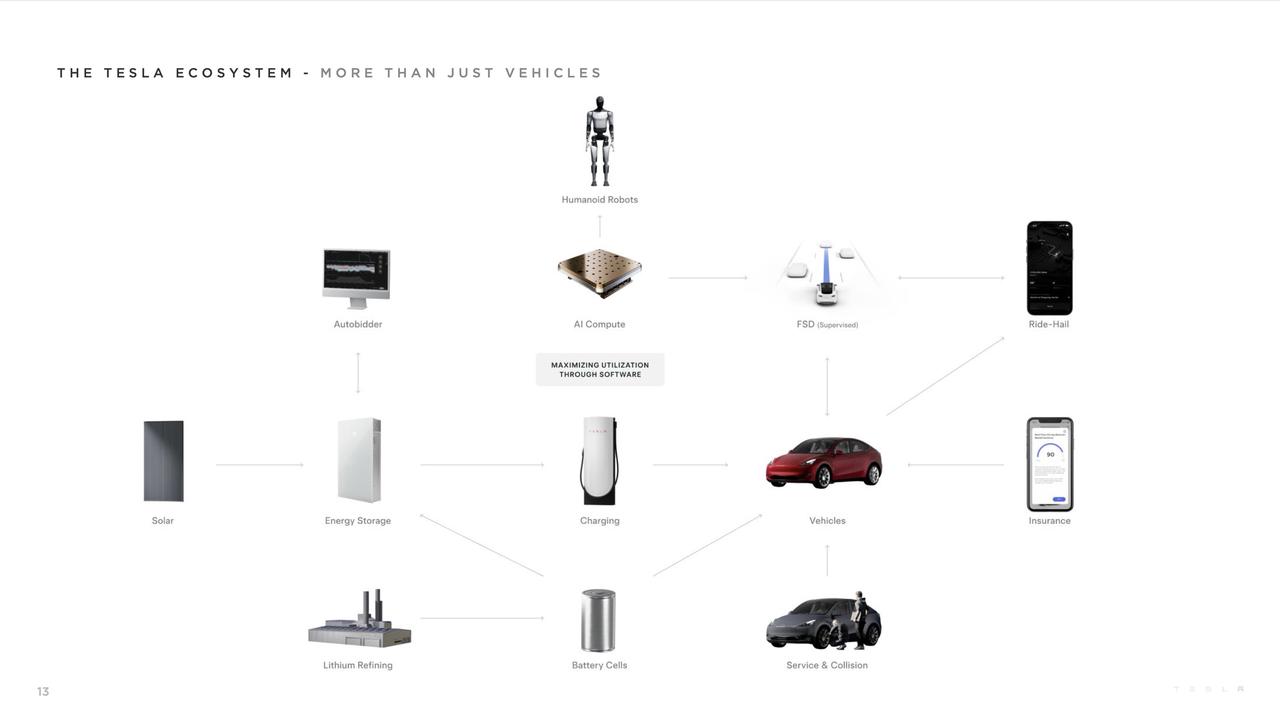

At the Q1 financial report meeting, Musk reiterated that Tesla was not, fundamentally, a car company, but an artificial intelligence company.

Based on this positioning, Tesla is sparing no effort in its R&D for AI, particularly in the progress of FSD.

In terms of FSD, Musk responded to a netizen on Twitter, stating that more than 10 billion dollars would be invested in FSD this year. Indeed, Tesla has made some new achievements with FSD.

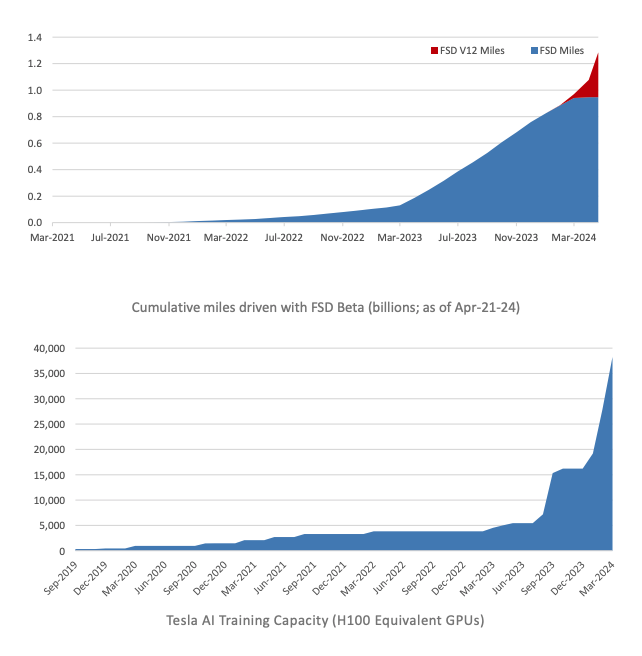

According to official information, Tesla completed the transition of perception hardware to HW 4.0 in Q1 and is gradually pushing out FSD V12. Currently, FSD V12 has been updated to version V12.3.3.

Some users expressed on Twitter that FSD V12.3 represents a significant leap in autonomous driving but with the downfall of slow driving speed. Other users reported that they accepted six carpooling orders using FSD, surprisingly, none of the passengers figured out it was FSD driving.

Meanwhile, the overall miles driven by FSD are skyrocketing. According to financial report data, as of March, FSD has accumulated over 1.2 billion miles. Musk also stated that FSD’s cumulative mileage would soon exceed 10 billion miles.

However, despite FSD’s ‘profound progress’, it is still confronting demand issues.At the end of March, Musk sent an email to all Tesla employees expressing, “Almost no one realizes how good FSD actually is”.

Therefore, in order to let more users recognize the benefits of FSD and stimulate demand, Musk announced at the end of March that trial for FSD will be free for all applicable vehicles across the U.S., and further imposed that vehicles in North America must install and activate FSD V12.3.1 prior to delivery for users to test drive.

Recently, Tesla has made a significant adjustment to the U.S. FSD pricing. To be specific:

- The optional price has been reduced from $12,000 to $8,000.

- Subscription costs have been cut from $199 per month to $99.

At last year’s Q3 earnings call, Musk stated that “FSD pricing is still quite low”. Despite believing that the price of FSD is low, Musk continues to make concessions for its popularization.

Tesla’s core goal, after all these efforts, is to profit from software by expanding its user base.

Based on information from the earnings call, Tesla’s Robotaxi is expected to go into mass production before the second half of 2025. How Robotaxi, being a crucial carrier of FSD, will drive the profitability of Tesla’s software business model is worth looking forward to.

So far, the capital market is relatively optimistic about Tesla’s Robotaxi. After all, despite unattractive financial results, Tesla’s stock price still surged nearly 12% after the opening bell.

It’s worth mentioning that there is a positive note for Tesla, as Musk said Optimus is still evolving and will be involved in limited production activities at the Tesla factory before the end of the year. Also in Musk’s view, Optimus holds value greater than any other existing business.

Conclusion

Although Tesla has been in a slump at this moment, it’s undeniable that it remains a company that’s so powerful it’s hard to find a rival. On the one hand, despite Musk perceiving problems of redundancy and inefficiency, Tesla has managed to far surpass the profit scale of BYD, which has 600,000 employees, with only around one hundred thousand employees of its own. The efficiency, then, is groundbreaking. On the other hand, even with a decline in production and sales, Tesla still outpaced the majority of its competitors, holding a plethora of talents, technology, funds, along with Musk’s top-down driven organizational efficiency.

Therefore, even if it’s in a slump, Tesla retains formidable advantages that are hard to beat.

Currently, under Musk’s autocracy, Tesla is directing most of its energy to autonomous driving, with an all-out effort by the entire company. This might astound the world once again, but it could also lead the company into a whirlpool of risks. However, this dramatic turn of events is perhaps what the risk-loving Musk prefers.

This article is a translation by AI of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.