After a setback on MEGA, LI is back to its familiar rhythm.

On April 18, the LI L6 was officially launched, available in two versions:

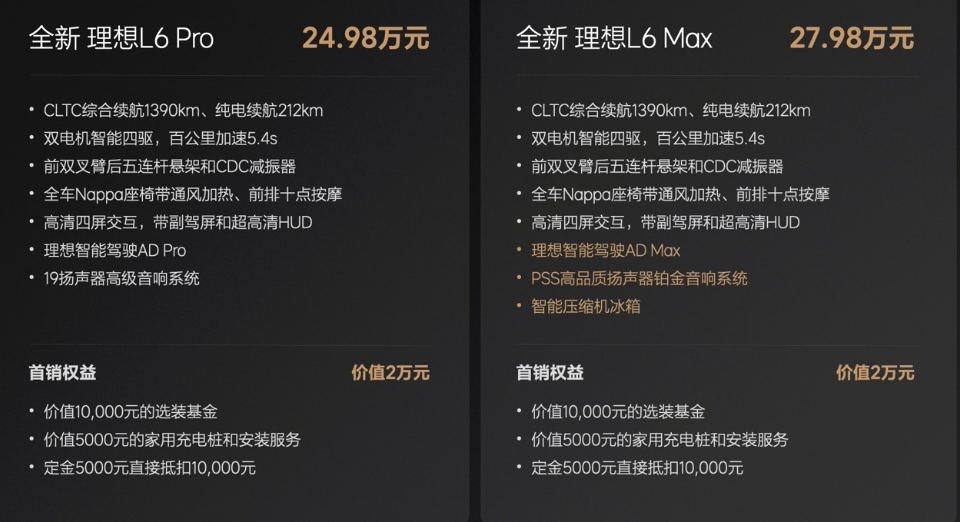

- L6 Pro at 249,800 yuan;

- L6 Max at 279,800 yuan.

In addition, if you make a reservation before May 5, both versions of the LI L6 offer pre-sale benefits worth a total of 20,000 yuan, including a 10,000 yuan optional equipment fund, 5,000 yuan for a home charging stand and installation service, and 5,000 yuan of the deposit that can be used as a 10,000 yuan voucher.

From the launch of MEGA to LI L6, two things have disappeared at LI—which are the weekly sales chart and update of LI Xiang’s microblog, summarised as the sharpness of LI.

With the launch of LI L6, the sharpness of LI seems to be shining again.

The Ambition of LI is Still Great

LI L6 continues the matryoshka-style car manufacture of the L series.

In terms of appearance, the LI L6 still carries the L-series signature designs like the star ring light but the star ring light is 2.2 meters long, the longest one among all the L series products.

However, the overall look and feel of the LI L6 is basically no different from the LI L7/8/9, except that its look is slimmer, but it is still a reliable mid-large SUV—length 4,925mm, width 1,960mm, height 1,735mm, wheelbase 2,920mm.

To differentiate the similarly large five-seated L6 and L7, LI has adopted the design thinking of L8 and L9 in choosing the location of the license plate frame.

For LI L9, the license plate frame is in the middle of the rear bumper, while for the L8, it’s at the bottom. The same goes for L6 and L7, with the license plate frame of L7 in the middle of the rear bumper while the L6’s is at the bottom. This also implies the hierarchy between LI L7 and L6.

Upon entering the LI L6’s interior, we can still experience the typical LI indoor home atmosphere created by the familiar steering wheel, dual screens, and big couch. This time, however, LI has made a disappearance trick on the “color TV” in L6.

The entire LI L6 series does not have a rear screen system, but precisely because it doesn’t have a rear screen, LI decided to install a 1.26 m² panoramic sunroof with electric sunshade for L6. As a result, although there’s no rear screen, passengers in L6 have a better view.In terms of intelligence, the LI L6 bears no difference with the 2024 L 7/8/9, featuring the Qualcomm Snapdragon 8295 cockpit chip. The smart drive includes two versions, AD Pro and AD Max, the former supporting features like high-speed navigation, city LCC, and autonomous parking; the latter supporting high-speed navigation and advanced city NOA.

Regarding city NOA, LI Auto stated that it would gradually open to the whole country, but the precise deployment time was not announced during the conference.

From a driving aspect, the LI L6 does not equip air suspension, rather a CDC sport suspension system across the board. Notably, despite the absence of air suspension, LI has preserved for the L6 a dual-motor four-wheel-drive power structure, and a suspension combination of front double-wishbone and rear multi-link.

In the battery aspect, the entire LI L6 series uses a 36.8 kWh lithium iron phosphate battery, with a pure electric driving range of 212 km under the CLTC condition.

Interestingly, LI Xiang once noted in 2021 that the voltage instability of lithium iron phosphate batteries would be disastrous for range-extended models, pushing their NVH and energy consumption off the charts. Three years on, LI Auto still uses lithium iron phosphate batteries in its range-extended cars. Of course, that’s under the premise that battery technology has made progress during these three years.

At the LI L6 launch event, LI Auto assured that despite utilizing lithium iron phosphate batteries, the vehicle’s range, energy consumption, and performance weren’t compromised. Thus, how the L6’s NVH, range, energy consumption, and performance truly fare is worth looking forward to, and you can keep an eye on our upcoming reviews.

Overall, as prices have gone down, LI Auto inevitably had to make some trade-offs with the L6’s equipment. Although slightly smaller, without air suspension and rear screens, in the 200,000-300,000 price range market, the LI L6 still stands out in terms of space, high configurations, and competitiveness.

Simultaneously, LI Auto highly values reducing users’ decision cost on the L6 — the main differences between the L6 Max and Pro versions lie in the LiDAR, platinum audio system, and 8.8L smart compressor fridge.

Feel free to comment which version you prefer.

Should’ve Risen with the Tide, Yet Struggling to Rescue from Brink

Had MEGA blossomed as LI Xiang envisioned, the launch of the LI L6 would’ve amounted to a smooth ride and a logical consequence.

Regrettably history harbours no what-ifs, the defeat of the MEGA forced the LI L6 to reluctantly inherit the aftermath. It now carries burdens that it shouldn’t rightly bear, under immense pressure.

On one hand, before the launch of MEGA, through intensive marketing, LI Auto fostered extreme user expectations for MEGA, reaching a volume that LI Auto’s pricing and product capabilities can hardly satisfy. Meanwhile, LI Auto’s continuous success on the L series product clouded their initially pragmatic mindset to some extent.Ultimately, the sales of MEGA fell short of LI’s loudly advertised goal of ranking first in passenger car sales over 500,000, regardless of the energy form or vehicle type. More seriously, owing to its design, MEGA was negatively targeted, damaging LI’s brand image.

On the other hand, due to LI pouring too much effort into MEGA, customer service for the L series users significantly dwindled, resulting in a lack of orders for the L series vehicles post MEGA’s launch, which stirred up further discontentment. It even burnt down their key marketing weapon: the weekly sales chart.

To resolve these issues, it’s apparent the breakthrough lies in the sales of LI L6.

Regarding the sales of LI L6, LI Auto’s Senior Vice President of Sales and Services, Zou Liangjun, conveyed their sales aim of 30,000 per month when explaining how LI Auto plans to achieve an 800,000 annual sale by 2024.

Given the circumstances, dispelling the gloom brought by MEGA, compensating for the lost sales, and regaining customer confidence in LI, the sales of LI L6 not only needs to accomplish these goals swiftly but perhaps even exceed them.

Crossing Paths with AITO Again

While LI L6 has been paved by L7/8/9, selling it well isn’t easy.

In the new energy vehicle market priced above 300,000, LI is one of the pioneers. They have achieved significant market success by clearly and unambiguously targeting families with their brand and product definitions; they even landed a spot on the Hurun Global 500 list as the youngest company.

However, coming to the fiercest battleground of the 200,000-300,000 new energy vehicle market, LI is a latecomer, especially when compared to AITO’s new M7.

AITO launched its new M7 in September of last year. To clean up the mess of the older M7 due to crash test results, and to bypass LI L7, AITO unveiled a brand new five-seat version for the new M7, dropping the starting price from its original rate in the 300,000s to 250,000.

Thanks to Huawei’s brand influence, intelligent ecosystem, ADS 2.0, and spaciousness, AITO’s new M7 has become a phenomenal hit. Now, the large orders for AITO’s new M7 have surpassed 174,000, with monthly sales also reaching around 20,000.

It’s clear that to dominate the 200,000-300,000 new energy vehicle market, LI L6’s biggest rival is none other than AITO’s new M7.

Compared to AITO’s new M7, LI L6’s product advantages mainly lie in space and control.

In terms of space, although the LI L6 is smaller than AITO’s new M7, which measures 5020mm in length, 1945mm in width, and 1760mm in height, its wheelbase is longer by 100mm than AITO’s new M7, which has a 2820mm wheelbase.

In terms of control, the LI L6 has sturdier materials than the AITO new M7. The LI L6 is four-wheel drive across all models and uses a front double wishbone + rear five-link suspension combination, while the mid-to-low configurations of the AITO new M7 are two-wheel drive and the suspension combinations across all models are front MacPherson + rear multi-link.

Compared to the LI L6, the biggest advantage of the AITO new M7 is Huawei’s brand appeal and the high-level smart driving emphasized by Huawei that can be used ‘nationally’ (currently the access price threshold is 279,800 Yuan). In addition, there is the Hongmeng cockpit integrated with the Huawei smart ecosystem.

It’s worth mentioning that at the time of launch, the AITO new M7 was priced at 249,800 Yuan. On April 1st, the price of the AITO new M7 Plus five-seat rear-wheel drive model was reduced by 20,000 to 229,800 Yuan – adding a price challenge for LI L6.

L6 is a Challenge for LI

The LI L6 bears a tremendous sales pressure. However, if L6 sells extremely well, it indeed presents a challenge for LI itself whilst turning the tables for the company.

Indeed, the LI L6 is not only a threat to the AITO new M7, but also a threat to the LI L7.

In terms of space, although the LI L7 and L6 are 5,050 mm and 4,925 mm cars respectively, and the former has a wheelbase 85 mm longer than the latter, they are both large vehicles with medium to large SUV bodies. In our actual experience, the difference in space perception between the LI L7 and L6 is not significant.

In terms of configuration, the price of the LI L6 Max is 279,800 Yuan, which is 40,000 cheaper than the L7 Pro, but with more features like laser radar, platinum sound system and a fridge. In comparison to the L7 Max/Ultra, priced at a premium of 70,000 and 100,000 Yuan respectively, the L6’s disadvantage is mainly in size.

To customers who don’t mind an 85 mm space change and lack of rear screens, the LI L6 Max might be a choice of higher cost-performance ratio. As it happens, some orders for the LI L7 may be diverted to the L6.

In Conclusion

For LI, the L6 is an important milestone to adjust pace, regain sales and revive momentum. As a young new player, thriving and continuously copied or attacked by increasing competitor companies, LI cannot afford two consecutive failed products.

Moreover, the launch of the L6 signifies a key turning point for LI’s business from range extending to pure electric power.Li once stated no vehicles under 200,000 would be launched within 5 years. This means, within this 5-year period, LI Auto L6 is essentially the last product of the L series.

Including the LI Auto L6 and MEGA, LI Auto has achieved market coverage ranging from 200,000 to 600,000. With the existing 5 products, huge cash reserves, improved organizational efficiency, and the emphasis on route correction and iteration, LI Auto can continue to strive for higher market sales and reputation once it is ready for the battle.

Indeed, only after the LI Auto L6 has been launched, and the L series of products have achieved increased market sales and reputation, can LI Auto devote enough energy and resources to reorganize and progressively implement the pure electric strategy. As Li reflected after the setback with MEGA, LI Auto’s pure electric strategy “must go through a similar stage of 0 to 1 as the LI Auto ONE’s range extender”.

However, prior to this, the most important task for LI Auto is to ensure successful sales for the L6.

This article is a translation by AI of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.