Undeniably, NVIDIA today is a giant being looked up to.

After all, under the leadership of Huang Renxun, NVIDIA, whether it is from the practical influence in the AI field or from the financial achievements it has already obtained, is indeed an AI technology giant that is paid much attention to by many industries in the world today-duplicating to the automotive industry that is being driven by the AI field for change, is naturally no exception.

Nonetheless, upon close inspection, one can easily spot a contradiction: the role that NVIDIA plays in the automobile industry does not necessarily reflect the financial achievements it has made in this field.

A case in point is the 4th quarter of 2023, when NVIDIA’s total revenue reached 22.1 billion USD, causing a surge of 265%, and with a surreal profit rate of 76.7% ; by contrast, the revenue from the automobile business was merely a feeble 281 million USD, not only has an extremely low overall proportion (less than 1.5%), a YoY decrease of 4% was also observed, not to mention the long-term loss from this particular business segment.

Hence, there is some skepticism from the outside world about NVIDIA’s constant involvement in the automotive business.

However, at the annual GTC conference, NVIDIA released the latest trends in AI technology development and commercial applications, as well as its latest initiatives in the automotive business and other related sectors, which have indeed provided the best feedback to these questions.

The Redefined DRIVE Thor

In the keynote speech of the GTC, Huang Renxun personally announced a major automotive-related move: The world’s largest electric car manufacturer, BYD, has expanded its cooperation with NVIDIA, and chose to build its next generation of intelligent electric vehicles based on DRIVE Thor.

Given BYD’s size and the future direction of DRIVE Thor, this collaboration is indeed a significant advancement for NVIDIA’s car business in its commercial application.

Nevertheless, very few have noticed that, compared to the claimed technical capabilities and specifications when it first appeared, DRIVE Thor has undergone some very apparent adjustments.

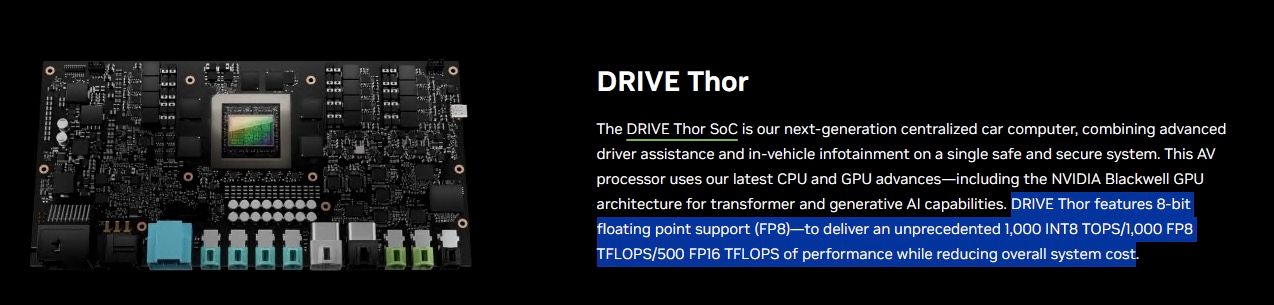

For instance, in terms of computational power, in September 2022, when DRIVE Thor was launched, NVIDIA mainly professed that its AI computational power could reach up to 2,000 TOPS, and it could also provide 20 trillion floating-point operations per second.

Alongside, NVIDIA also stresses that DRIVE Thor is the first self-driving car platform in its lineup to use an inferencing Transformer engine; it also employs an enhanced ARM Poseidon AE kernel, making it host one of the highest performing processors in the industry.In terms of functionality, as a central computing platform, DRIVE Thor can aid automakers in efficiently integrating multiple features like digital dashboards, infotainment, parking, and driver assistance on a single system-on-a-chip, significantly enhancing development efficiency and accelerating the pace of software updates. Moreover, it can even support simultaneous operation of Linux, QNX, and Android on one computer.

Given the technological parameters at the time, DRIVE Thor indeed embarked on a path highlighted by vast AI computational power, central computing, and the Transformer engine. Particularly in terms of AI capability, the power standard of 2,000 TOPS genuinely stunned the entire industry.

However, the positioning of DRIVE Thor appears to have shifted based on this GTC’s conditions.

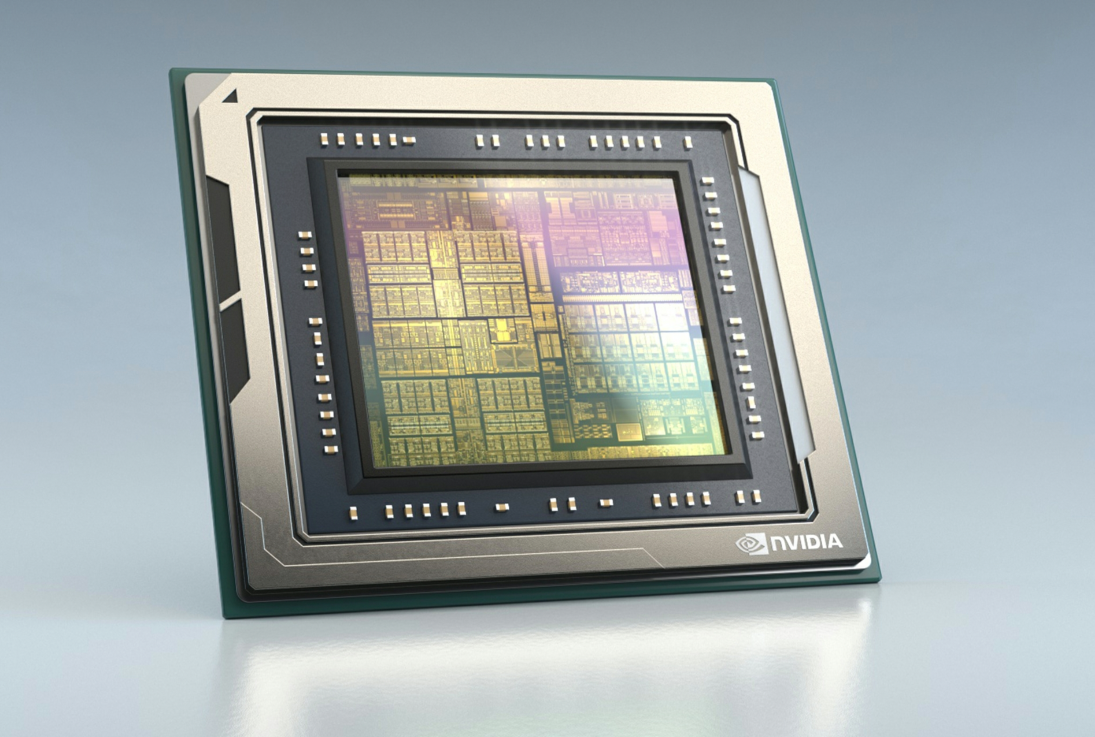

For instance, Nvidia DRIVE Thor is positioned as an automotive computing platform, specifically built for increasingly crucial generative AI applications in the automotive industry. Importantly, it is equipped with the all-new Nvidia Blackwell architecture, designed specifically for Transformer, large language models (LLMs), and generative AI workloads.

Therefore, it’s apparent that with the explosion of large language models and generative AI, and the gradual application of these technologies in vehicles, Nvidia has slightly adjusted the product positioning of DRIVE Thor, augmenting underlying support for LLM and generative AI.

Importantly, from a computational performance perspective, according to Nvidia’s latest information, DRIVE Thor’s performance is 1,000 TFLOPS. However, for comparison, Nvidia reported in September 2022 that DRIVE Thor’s floating-point operation performance was 2000 TFLOPS.

Regarding this, some industry insiders commented that DRIVE Thor’s computational power has noticeably reduced.

Notably, Nvidia officially announced that DRIVE Thor, featuring cutting-edge features such as a generative AI engine under the all-new NVIDIA Blackwell architecture, will begin mass production at the earliest next year. As a specific comparison, the broadly deployed DRIVE Orin uses GPU based on the Ampere architecture, which was launched in March 2020.

Thus, from this perspective, DRIVE Thor is not just an adjustment in technical parameters; it is also an example of Nvidia driving the latest technological development outcomes towards commercial deployment in the automotive and autonomous driving industry under current AI development trends.

Deployment to Begin in 2025, Not Limited to OEMsAs a next-generation autonomous driving computing platform, NVIDIA’s Drive Thor represents to some extent the direction of development in underlying computing power in the field of autonomous driving. As such, DRIVE Thor is a crucial product that needs to be invested and planned in advance in the eyes of manufacturers dedicated to promoting the advancement and commercial development of autonomous driving technologies.

For NVIDIA, the involvement of other manufacturers means the realization of DRIVE Thor, which is not an easy task.

In fact, since the launch of DRIVE Thor, only ZEEKR, a Chinese automobile manufacturer, had confirmed to use DRIVE Thor chips in their next-generation models, from its initial release in September 2022 till before the CES 2024.

An insider told us that before the official announcement of DRIVE Thor in 2022, NVIDIA had been engaged in deep discussions with a number of Chinese vehicle manufacturers. Both new energy vehicle companies and state-owned enterprises hoped they would be the first to adopt DRIVE Thor. However, eventually, ZEEKR became the first brand to announce the adoption of the DRIVE Thor chip.

By the year 2024, DRIVE Thor has won an increasing number of automobile manufacturer clients. For example, during the CES 2024 event, LI Auto announced that it would build its future automotive products on DRIVE Thor.

What was even more eye-catching was that at the GTC event, BYD announced that it would build its next-generation electric vehicles based on DRIVE Thor. Meanwhile, AION announced that the next generation of electric vehicles from its luxury brand Hyper would use the DRIVE Thor platform and that the new model, which will start mass production in 2025, can achieve L4 level autonomous driving.

In addition, Xpeng announced that it would use NVIDIA DRIVE Thor platform as the ‘AI brain’ for its next-generation electric vehicles. This new-generation in-vehicle computing platform will assist in the self-developed XNGP intelligent driving assistance system of the electric vehicle manufacturer.

Apart from vehicle manufacturers, DRIVE Thor is also being adopted by a group of manufacturers in other niche areas such as trucks, autonomous taxis, and delivery vehicles. Specifically:

- Nuro, a self-driving delivery vehicle manufacturer from Silicon Valley, has chosen DRIVE Thor to support its integrated autonomous driving system, the Nuro Driver.

- Plus, a global provider of autonomous driving software solutions, announced that its next-generation product for the L4 solution SuperDrive will be run on the DRIVE Thor standards-compliant centralized computing platform.* Waabi, working on autonomous driving AI, will use DRIVE Thor to launch its first trucking solution with generative AI technology, greatly enhancing the safety and reliability of autonomous trucks on a large scale.

- WeRide is partnering with Lenovo Car Computing to create various commercial L4-level autonomous driving solutions based on DRIVE Thor. These solutions are integrated into Lenovo’s first autonomous driving domain controller AD1.

Overall, the commercial applications of DRIVE Thor are not only targeting capital-rich OEMs, but also include a group of solution providers dedicated to advancing the development of cutting-edge autonomous driving technologies.

So, why has DRIVE Thor attracted so many potential customers?

An industry analyst informed us that when NVIDIA’s DRIVE Thor was first launched, its literal 2,000 TOPS computing power was indeed high. However, the tech route for autonomous driving was not clear at the time, and the industry was not entirely sure whether such high computing power was necessary. In addition, the cost of NVIDIA’s DRIVE Thor was exceptionally high, straining even the relative wealth of OEMs.

However, the scenario changed in the second half of 2023.

With the advent of ChatGPT and the popularity of large models, Tesla pivoted towards end-to-end solutions under this influence. The entire autonomous driving sector suddenly saw another round of technological advancements with large models and generative AI in the field of autonomous driving, leading many OEMs and L4 solutions to seize this opportunity to seek cooperation with NVIDIA on the development of DRIVE Thor.

Of course, this industry analyst pointed out, from NVIDIA’s perspective, it surely downgraded the computing power standards of DRIVE Thor after negotiations with OEMs and solution providers, which correspondingly lowered costs and finally obtained the approval of downstream OEMs and some solution providers, making them willing to pay.

From Vehicle-End to the Entire Auto Industry Ecosystem

For Nvidia, creating an autonomous driving chip for vehicle-end is just one of the pillars of its business in the automotive industry. Looking at the trends announced at this GTC, NVIDIA’s ambitions in the automotive field far exceed the DRIVE Thor business itself.

Apart from DRIVE Thor, Nvidia’s partnership with OEMs covers other business sectors as well.

For example, in the collaboration announced with BYD at the GTC event, BYD also plans to use Nvidia’s AI infrastructure for cloud AI development and training technologies, and use Nvidia Isaac and Nvidia Omniverse platforms to develop tools and applications for virtual factory planning and retail configurators.

In fact, a number of automakers have already chosen AI infrastructure from Nvidia for their cloud-based AI development and training.

One of their key customers is, of course, Tesla.

In August 2021, to train autonomous driving algorithms in the cloud, Tesla’s supercomputer deployed in the cloud already possessed 11,544 GPUs, all of which came from Nvidia. Later, although Tesla kick-started the development of the Dojo supercomputer system and has already put it into operation, even today, amidst the AI boom, it still purchases Nvidia’s GPUs.

It can be said that besides Tesla, Chinese automakers like Xpeng, NIO, and LI Auto also purchase Nvidia’s GPUs for cloud-based deployment and training. The revenue from this sector is not insubstantial, but it is not attributed to the auto business in the financial report, but incorporated into Nvidia’s data center business.

In this regard, Danny Shapiro, Vice President of Nvidia’s auto division, once stated in an exclusive interview with 42 Garage:

For us, the competition is not just about chips, but also software. And that’s just inside the car. The data center is also an important part of artificial intelligence. I don’t know if there is any other company that cooperates in vehicle artificial intelligence and data center artificial intelligence outside of Nvidia. And from a data processing perspective, the ongoing process of collection, training, testing, validation, and deployment, is our advantage.

Looking at the financial report, our business segment’s revenue is indeed very small. But in fact, if we calculate the revenue we get from the auto industry, including the revenue we get from the data center business of auto manufacturers, it is very substantial.

Other than the data center business, Nvidia’s collaboration with BYD also involves Nvidia’s Omniverse virtual reality and simulation platform, which is part of its significant arrangement for the auto industry.

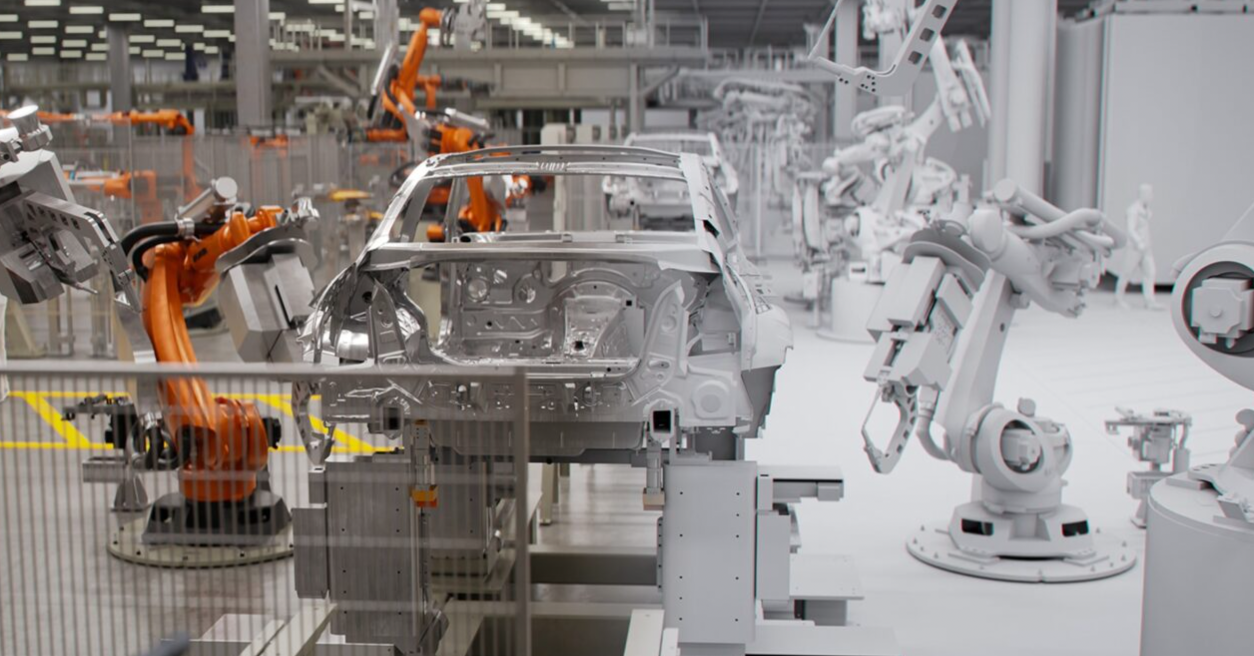

According to Nvidia, Omniverse can help automakers drive the digitalization process of the product lifecycle, including all stages from concept output, style setting, exterior design to retail. For instance, during the vehicle development process, developers can modify in-car designs in the virtual world with Omniverse, and achieve efficient design improvement and validation through collaboration and sharing. In factories, automakers can also utilize Omniverse to design and operate complex AI virtual environments for factories and warehouses.

In fact, BMW Group has already launched the world’s first virtual factory through Nvidia’s Omniverse as part of its digital transformation and efficiency enhancement. For Nvidia, this is an extension of its virtual reality and simulation platform for the auto industry.

Indeed, at this GTC, NVIDIA has also upgraded business related to the robot platform, which is closely related to the automotive industry.

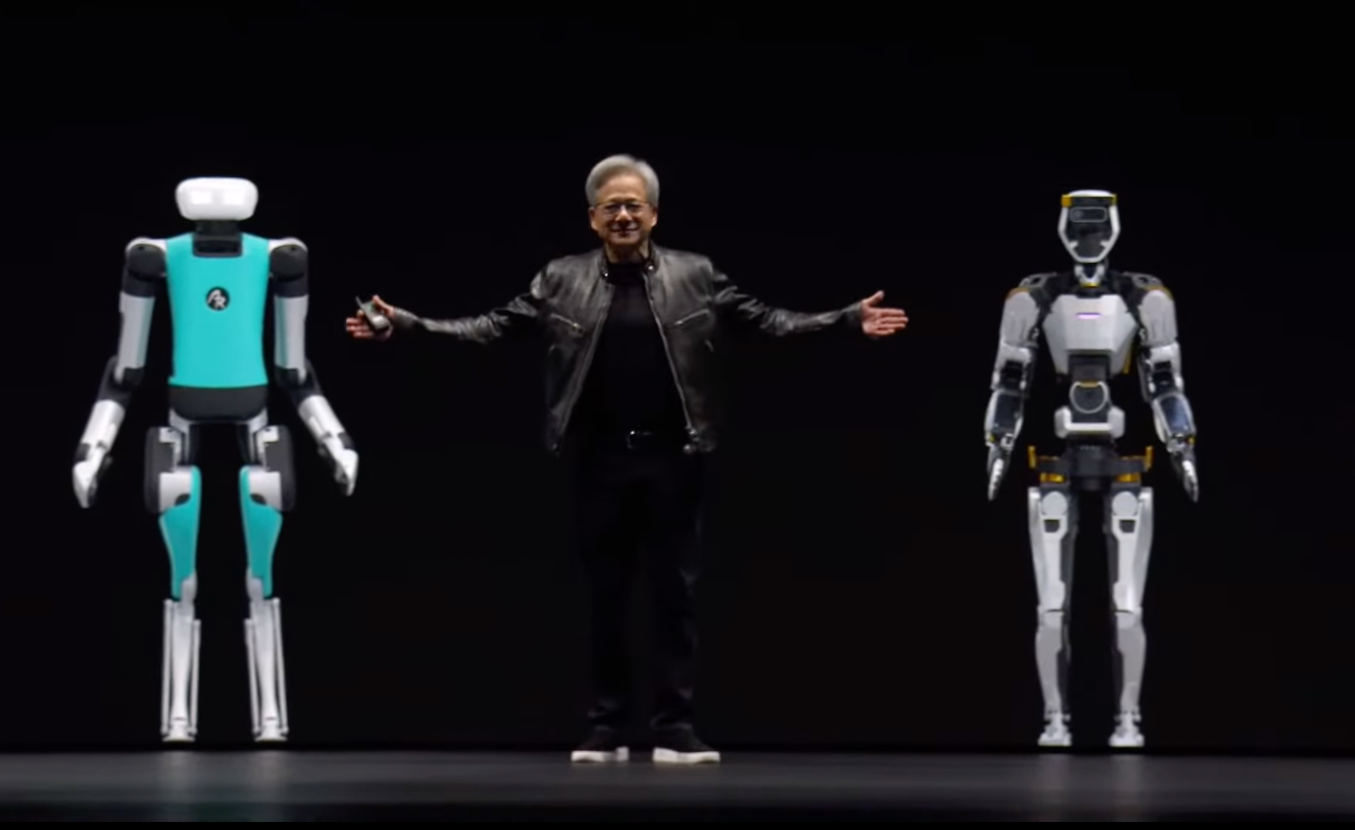

Specifically, NVIDIA officially released a humanoid robot universal basic model Project GR00T, targeting humanoid robots and embodied intelligence. At the same time, NVIDIA also released a new humanoid robot computer Jetson Thor based on the NVIDIA Thor System-on-Chip (SoC).

Jetson Thor includes a next-generation GPU with a transformer engine, which adopts the NVIDIA Blackwell architecture, can provide 8 trillion 8-bit floating-point AI performances per second to run generative AI models such as GR00T.

To some extent, NVIDIA’s business layout coincides with Tesla’s use of FSD chips for its Optimus robot business. In Tesla’s plan, once the Optimus robot business matures, it will have the opportunity to become the most valuable sector in Tesla’s business.

Apparently, NVIDIA’s move is also drawing inspiration from Tesla’s business vision and making early layout.

It needs to be emphasized that NVIDIA is developing a comprehensive AI platform for a group of leading humanoid robot companies, including 1X Technologies, Agility Robotics, Apptronik, Boston Dynamics, Figure AI, Fourier Intelligence, Sanctuary AI, Yushu Technology, and Xpeng PENG.

Among them, Xpeng PENG is a business sector under Xpeng Motors.

Overall, with its platform layout in multiple fields, NVIDIA has various business landing spaces in the intelligent transformation process of the automotive industry, and the revenue brought by these landing businesses is not reflected in the financial statements—the DRIVE computing platform business based on vehicle-side automatic driving computing power is just one of the more noticeable parts.

Final Words

From the overall business logic, the core logic of NVIDIA’s layout in the automobile industry is closely related to a persistence of Jen-Hsun Huang himself.

An industry insider who once worked at NVIDIA and had direct contact with Jen-Hsun Huang told us that after the AI exploded in 2012, Jen-Hsun Huang didn’t look at the autonomous driving market at first, because he felt that the profit margin of this market was not high, after all, the profit rate in the server field could reach 60% to 70%.However, Jensen Huang has a persistent devotion to edge deployment for AI. It’s this commitment that led him to discover use-cases for Nvidia in fields such as autonomous vehicles and robotics; despite these areas not bringing substantial financial returns to Nvidia, under Huang’s stewardship, the company has persevered, persisting until today.

At the heart of it, what Huang and Nvidia insist on is building an ‘end-to-end’ (cloud to edge) business platform for the automotive industry – the value of this platform, clearly, cannot simply be measured in financial figures.

Thus, in this digital, intelligent revolution in the automotive industry, there’s no question that Nvidia will continue to play a significant role, with Huang himself having sufficient patience and resolve to advance this role.

As Danny Shapiro, Vice President of Nvidia’s automotive business, stated in an interview with 42 Garage at the Munich Auto Show in September 2023:

Autonomous driving is incredibly important for NVIDIA. Jensen Huang is very patient. In fact, he invested over a decade in the AI field before seeing any tangible revenue returns. So, he will undoubtedly continue to invest in the autonomous driving business – this sector is still small, but it has great potential growth opportunities. We see this as a long-term business that requires heavy investment and has a relatively slow growth curve. Over the next six years, we expect to garner 14 billion USD in automotive hardware and software revenues.

This article is a translation by AI of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.