What is the hardware cost for urban autonomous driving? The answer can be ¥7,000.

In the China Electric Vehicle 100 People Forum on March 17, Shen Shaojie, the head of DJI Automotive, stated that DJI Automotive can achieve urban autonomous driving under mapless conditions using a 7 V + 100 TOPS solution. This solution will equipped in vehicles priced at about ¥150,000 this year, with the hardware cost for manufacturers only being ¥7,000.

This means that with decreasing costs, urban autonomous driving will no longer be exclusive for vehicles priced over ¥200,000. Now, even owners of vehicles under ¥200,000 can also enjoy the benefits of urban autonomous driving for even less.

However, that is not the end-goal for DJI Automotive. The real pursuit for DJI Automotive is making autonomous driving a standard feature on vehicles. At the same time, DJI Automotive does not want to limit itself to low-to-mid end markets but expand its vision, from vehicles priced at ¥80,000 to vehicles priced up to ¥300,000.

Carving a Forest on a Watermelon

What does a 7 V + 100 TOPS solution with a hardware cost of ¥7,000 entail?

First off, considering the cost of ¥7,000 that DJI charges manufacturers, the consumer price offered by manufacturers will not be an unaffordable number for customers of vehicles priced around ¥150,000. Even now, some manufacturers may reduce their markups to increase sales volume.

In comparison, if customers want a higher-end vehicle that supports urban autonomous driving, they need to pay at least an additional ¥20,000. For brands like AITO and Xpeng, customers need to spend over ¥20,000 more for the autonomous driving feature, while the price for Tesla’s Full Self-Driving capability is an astonishing ¥64,000. The price difference between these brands and the 7 V + 100 TOPS solution is quite evident.

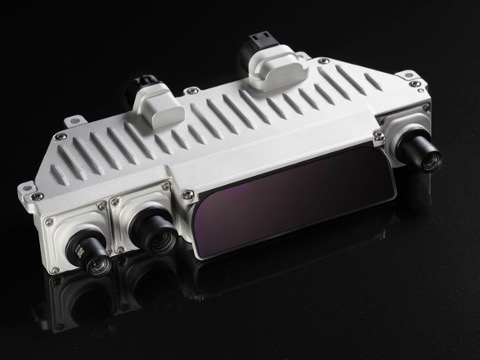

Next, let’s discuss the 7 V + 100 TOPS solution. According to Shen Shaojie, 7 V refers to the seven cameras – a pair of forward-facing 8-megapixel inertial stereoscopic cameras, a rear-facing 3-megapixel monocular camera as well as four 3-megapixel surround-view cameras; 32 TOPS refers to the computational power of the TDA4-VH chip from Texas Instruments.

In terms of algorithms, the 7 V + 100 TOPS solution adopts a Transformer-based road topology perception model and a predictive decision joint model. It also applies a 4D scene flow based on a binocular and omni-directional fisheye lens.

In addition, the 7 V + 100 TOPS solution can be used in conjunction with, or without, millimeter-wave radar and ultrasonic radar. The solution is not reliant on high-definition maps, doesn’t discriminate against the vehicle’s powertrain whether it’s electric or fossil fuel-powered, hence offering high levels of flexibility.

Evidently, DJI Automotive’s 7 V + 100 TOPS solution could be considered the ‘one-size-fits-all’ solution for vehicles priced around ¥150,000.

Actually, the 7 V + 100 TOPS solution comes from DJI’s Chengxing platform announced last year. The Chengxing platform encapsulates DJI’s full-stack hardware and software design and delivery solution, which is the core product for providing smart driving solutions to car companies.

Actually, the 7 V + 100 TOPS solution comes from DJI’s Chengxing platform announced last year. The Chengxing platform encapsulates DJI’s full-stack hardware and software design and delivery solution, which is the core product for providing smart driving solutions to car companies.

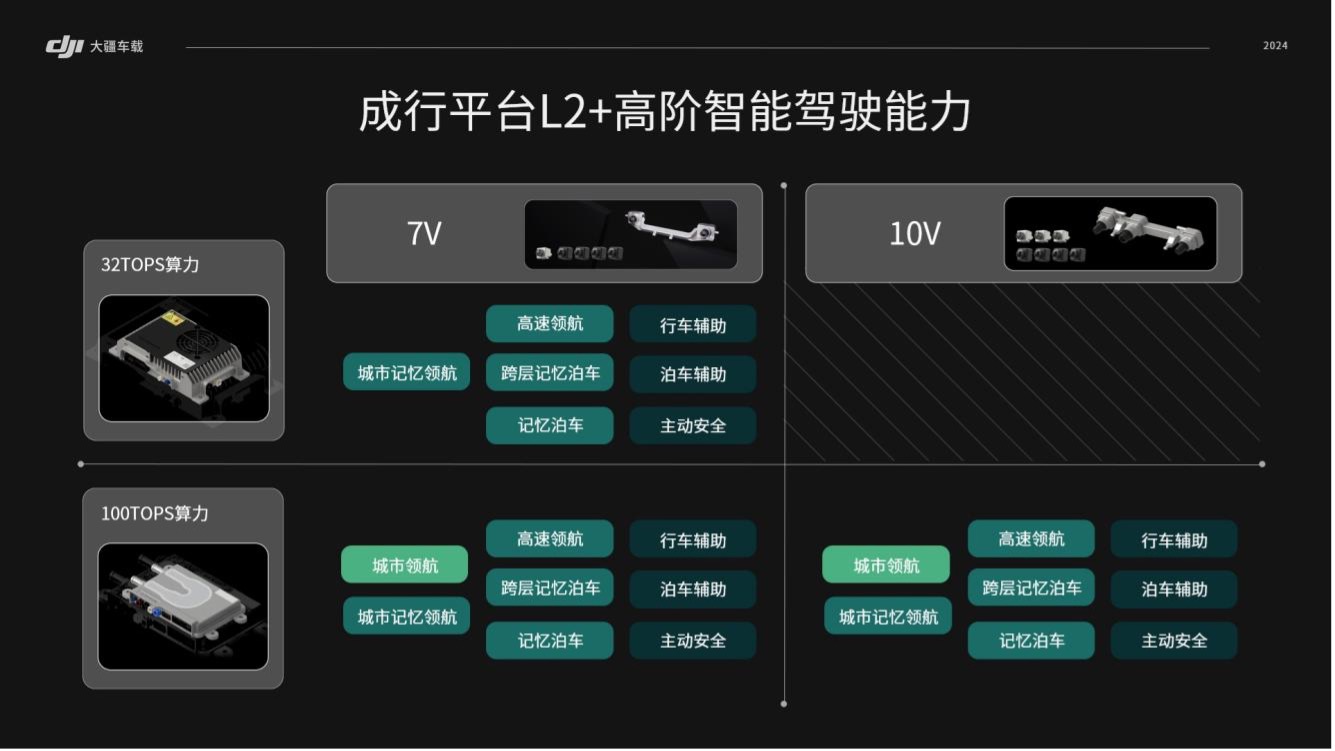

At this year’s conference, Chengxing platform has evolved into 3 versions, including:

- The basic version of 7 V + 32 TOPS;

- Upgraded version of 7 V + 100 TOPS;

- High-end version of 10 V + 100 TOPS.

Reportedly, the basic version can achieve smart driving functions such as high-speed navigation and parking memory, and it has already been mass-produced. The version used on Cloud Rhino, iCAR 03, and Yueye Plus is this one.

Starting this year, DJI will gradually promote the standardization of the basic version in cars priced at 80,000 to 150,000.

Compared with the basic version, the perception hardware of the upgraded version hasn’t changed, it’s just that the chip was replaced from Texas Instruments TDA4-VH to Qualcomm Snapdragon 8650, and the computing power was upgraded to 100 TOPS. This can achieve high-level urban navigation, suitable for cars over 150,000.

The upgraded version will be implemented on new mass-produced cars this year. DJI plans to promote the standard configuration of the upgraded version in 150,000-level models within the next two years.

Compared to the upgraded version, the high-end version remains unchanged on the Qualcomm Snapdragon 8650, but enhances the perception hardware from 7 V to 10 V. It substitutes the forward inertial binoculars in the 7 V with the “inertial tri-eye and LiDAR assembly”– which includes a pair of inertial stereo binoculars, a long-focus monocular, and a LiDAR, it can achieve L3 level autonomous driving.

DJI predicts to apply the high-end solution on models about 250,000 by 2026, and standardize the high-end solution in cars priced at 200,000 within 3 years.

Worth noting is, based on the characteristic of identical perception hardware between the basic and upgraded versions, the basic version can change its chip in a pin-to-pin manner, thus transforming it into an upgraded version.

Overall, DJI’s smart driving solution is known for being cost-efficient and mass-produced, and it caters to manufacturers’ needs. Regarding DJI’s smart driving solution, Shen Shaojie stated at the conference forum:

People say DJI’s strength is ‘carving flowers on a sesame seed,’ I think this is half right – sesame seeds are too small. It’s not about carving flowers on a sesame seed, but carving a forest on a watermelon.

A good cat catches mice

How can DJI implement urban navigation with so few perception devices and computing power, and keep the hardware cost as low as 7,000? The following words by Shen Shaojie might explain it:

Is DJI purely visual? We just want to make a useful product, we don’t obsess over this. It’s just that for cost-sensitive products, we use vision, and we might even use it to an extreme, resulting in pure vision, cutting out millimeter-wave radar, ultrasonic radar. But we are in no way resistant to LiDAR.”Demanding only excellence in production”, being “unfazed by the roadmap of smart driving development”, translated, indicates DJI Automotive’s clear and focused product goals, along with a commitment to pragmatism in their actions – regardless if the cat is black or white, if it can catch mice, it’s a good cat.

Nonetheless, it’s far from easy to deliver a high cost-performance ratio solution. Shen Shuojie, during a Hundred People Conference interview, stated, “Truthfully, developing a high-value solution is extremely challenging, it’s more than just the choice of chip or sensor”.

However, according to Shen Shuojie, DJI Automotive’s capacity to deliver a favourable smart driving solution hinges on two main characteristics- their engineering capability, and the company culture that backs this ability.

In terms of engineering capability, DJI Automotive’s blood flows with the genetic coding of DJI’s core engineering skills, whether it be hardware and software development, or supply chain management, and engineering manufacturing, they possess innate advantages.

On the matter of company culture, as described by Shen Shuojie, DJI Automotive fosters a strong atmosphere of engineering culture. Engineers believe that creating a high-value solution accords with the company’s mission and vision, and are thus driven to continuously optimise algorithms and maximise hardware performance.

This efficient usage of hardware, combined with the capability in supply chain management and engineering manufacturing, allows DJI Automotive to assure the ground efficiency of the smart driving solution.

Shen Shuojie announced at the Hundred People Conference that the current timeframe needed for DJI Automotive’s smart driving solution to adapt to existing vehicle models is 3 months, and for new models, 6-9 months. This aids greatly in helping manufacturers keep up with the constant forward surge of the smart driving market.

Being low-cost, efficient, and effective, DJI Automotive has garnered much appreciation from many manufacturers. DJI Automotive continues to maintain its pragmatic attitude, be it new energy manufacturers or fuel car manufacturers, DJI Automotive extends its warm welcome to all.

Currently, DJI Automotive’s clients include Chery and Wuling, etc. At the Hundred People Conference, Shen Shuojie announced a new client – Volkswagen, with the adapted model being the Tiguan L Pro. Shen Shuojie expressed:

“The penetration of advanced intelligent driving in gasoline cars is nearly 0, we try to break this limitation…… it can arguably be said that the Tiguan L Pro equipped with DJI Automotive’s advanced smart driving system could be the smartest gasoline car, this should also count as part of our efforts to advance smart driving regardless of fuel or electric engines.”

Simultaneously, we learnt from DJI Automotive’s official personnel that there are even more significant clients who have initiated collaboration with DJI Automotive.

The expansion of their client base signifies DJI Automotive’s smart driving solution’s further production scale expansion, enabling continued cost dilution of smart driving solutions, and a progressively fertile terrain for DJI Automotive itself.

$150,000-tier urban smart driving has started?

The demand for smart driving has risen, yet the supply is unbalanced.

Shen Shuojie released a data set at the Hundred People Conference:

-

In 2021, functions related to smart driving only came in 14th place when users were deciding on a car purchase, by the past year, it had already reached 5th place;- In the new energy vehicle market, models priced under 200,000 yuan significantly lag behind those over 200,000 yuan in the use of L2+ level intelligent driving;

-

In the gasoline car market, the use of L2+ level intelligent driving is extremely rare in all price segments.

As for DJI Cars, they have already gained a step ahead by securing the sub 200,000 yuan new energy and gasoline car markets, not to mention that DJI Cars have few competitors.

However, competitive pressure on DJI Cars from the market is forthcoming.

Just the day before Shen Shaojie announced the pilot project in the urban area with 150,000 yuan models, He Xiaopeng announced at a conference with hundred participants that Xpeng Motors will launch a new brand priced 100,000-150,000 yuan, which will be dedicated to creating “the first AI intelligent driving car for young people”.

It is clear that in the 100,000-150,000 yuan market, the intelligent driving capabilities of DJI Cars will compete with those of Xpeng Motors.

Now it’s hard to predict who will be the stronger one, but it is foreseeable that in the 100,000-150,000 yuan new energy vehicle market, the involvement of Xpeng Motors and the rising momentum of DJI Cars will convert many existing intelligent driving enthusiasts into actual users. Also, many who were not previously interested in intelligent driving will start to pay attention, understand and experience it, and eventually become intelligent driving users.

In the not-too-distant future, the journey that intelligent driving has taken in the market at above 200,000 yuan may have to be treaded again in the 100,000-150,000 yuan market.

This article is a translation by AI of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.