Weekly Index

Weekly Headlines

NIO Q3 Revenue and Deliveries Reach New High

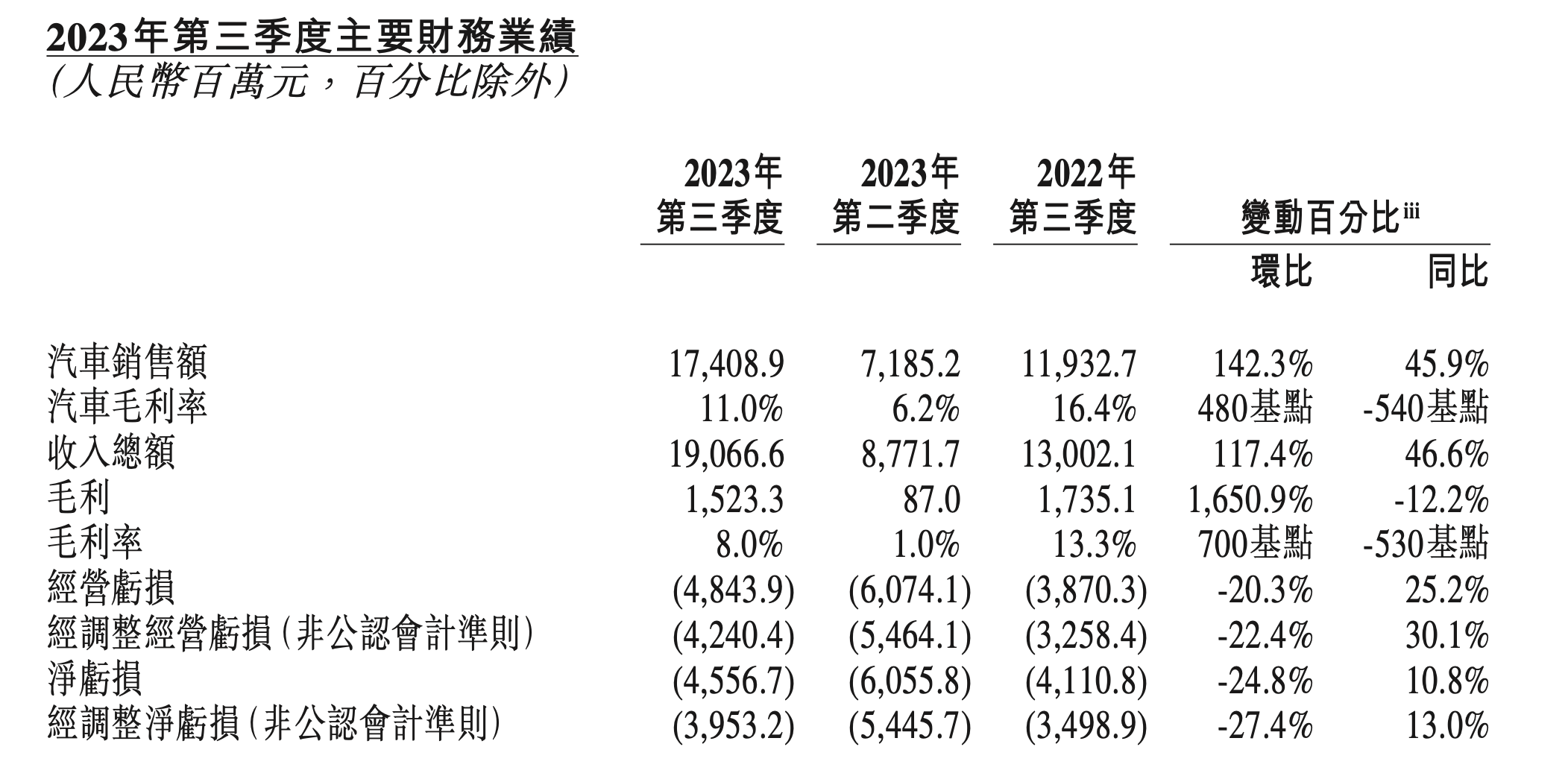

NIO can breathe a sigh of relief following the release of its Q3 financial report. Here are the specifics:

- Vehicle sales reached 17.41 billion, up 45.9% YoY. Sequentially, it’s up 142.3%;

- Vehicle gross margin was 11%, down from 16.4% a year ago. It stood at 6.2% in Q2 of the current year;

- Total revenue was 19.07 billion, up 46.6% YoY and up 117.4% sequentially;

- Gross profit was 1.52 billion, down 12.2% YoY, but up 1,650.8% sequentially;

- Gross margin was 8%, down from 13.3% a year ago and 1% in Q2;

- Net loss was 4.56 billion, up 10.8% YoY, but down 24.8% sequentially;

- As of September 30, 2023, cash reserves stood at 45.2 billion, which was 31.5 billion at the end of the second quarter;- The total delivery volume is 55,432 units, a year-on-year increase of 75.4%, and a sequential increase of 136.7%.

Evidently, NIO’s Q3 financial report is no longer pervaded with pessimism, but rather heartening due to the surge in revenues and other financial statistics.

Revenues, gross profits, and cash flow all rose, with a decrease in losses being the result of a significant increase in automotive sales revenue.

According to the financial report, NIO’s Q3 car sales reached ¥17.41 billion, a year-on-year increase of 45.9% and a sequential increase of 142.3%; the car gross margin was 11%, compared to 16.4% in the same period last year and 6.2% in Q2 of this year.

Though car sales and gross margins achieved substantial growth, the input-output ratio for NIO to achieve this growth was not high. The financial report shows that NIO’s Q3 sales cost was ¥17.54 billion, a year-on-year increase of 55.7%, and a sequential increase of 102%.

NIO believes that the rapid increase in sales costs mainly includes factors like vehicle delivery volume, providing energy solutions, and growth in charging pile sales. Behind this, however, lies the issue of NIO’s organizational efficiency, as Li Bin (CEO of NIO) stated:

“We have recently completed a comprehensive planning of the company’s two-year operation plan to determine key goals, priorities, and action plans. We have identified opportunities for organizational optimization, cost reduction, and efficiency improvement. We will continue to focus on advancing core technologies, developing key products, and enhancing sales and service capabilities. We are confident in NIO’s long-term competitiveness in the intelligent electric vehicle market.”

Although confident in their long-term competitiveness and substantial improvement in Q3 performance, NIO’s Q4 outlook remains conservative.

In terms of revenue, NIO expects Q4 revenue to be between ¥16.079 billion to ¥16.701 billion, ¥3 billion less than Q3.

In terms of sales volume, NIO expects Q4 sales to be between 47,000-49,000 units. This means that NIO would achieve its Q4 sales target just by reaching a monthly sales volume of 14,967 units in December this year.

Quick Comment:

The release of NIO’s Q3 financial report comes at a time when NIO has recently been announcing great advancements. Through the increased figures in the financial report, the expansion of its battery swapping business, and the purchase of factories, NIO may be injecting confidence into the market and illustrating potential growth.

However, NIO should really demonstrate its true strength through solid market performance to retain and enhance trust from the market and consumers, or they risk coming off as overly optimistic, thus losing trust.

Simultaneously, against the backdrop of a price war, other automakers are constantly rolling out new vehicle models, audaciously focusing on product progression. Under these circumstances, whether NIO can withstand successive onslaughts from competitors remains a significant question.Regardless, NIO’s primary objective now should be to drastically improve organizational effectiveness and strive to sell as many cars as possible, as their founder Li Bin mentioned in a layoff letter,

To gain eligibility to participate in the final competition, we ought to enhance our execution efficiency further, ensuring adequate resources for our key business segments.

LI Auto Launches OTA 5.0

On December 10, LI Auto officially launched OTA 5.0.

As for intelligent driving, LI Auto employs technologies such as BEV, MPC predictive modeling, and spatio-temporal unified planning for a complete upgrade of AD Max and AD Pro.

According to the official information, based on the profoundly renovated Intelligent Driving 3.0 algorithmic framework, LI Auto’s NOA has fully covered highways, urban loops, and urban roads. It can also handle the maneuvering of construction sites and lane changing in congested driving situations.

Currently, LI Auto has opened NOA’s full-scenario intelligent driving to 110 cities nationwide.

Furthermore, LI Auto’s LCC can autonomously infer lane lines for lane maintaining; automatically recognizes traffic lights when passing intersections. The valet parking can manage multi-story driving, and the working speed range of AEB in AD Max 3.0 can reach 4-135 km/h.

In terms of intelligent space, the most significant upgrade of this OTA 5.0 is the introduction of Mind GPT. It can deliver more complex and continuous vehicle commands, intelligently recommend travel destinations, and can function as an encyclopedic resource to answer various questions.

Finally, the aspect of intelligent extended range. The OTA 5.0 optimizes the pure electric range in winter by upgrading the battery control algorithm, optimizing the intervention timing of the range extender, intelligent regulation of air conditioning power, and more. According to official data, the pure electric range of LI Autos in winter has been increased by 15-20%.

According to LI Auto’s current plan, the OTA 5.0 is expected to launch on December 19. At that time, Intelligent Space will push to Max, Pro, and Air models, and AD Max 3.0 will push to Max models. Moreover, OTA 3.4 for LI ONE will start pushing on December 26, and AD Pro will be pushed to Air and Pro models in June next year.

Fast Review:

For LI Auto, OTA 5.0 has achieved vast progress in smart driving and intelligent space, becoming deservedly the most robust OTA in LI Auto’s history.

While realizing user experience enhancement, LI Auto has also emphasized its power in intelligent development through a specially held launch event for OTA, and the determination to seize and hold the top spot in this field.Of course, whether LI Auto can maintain a strong footing and continuous influence in intelligence, especially in intelligent driving, depends on whether its performance after the OTA 5.0 update can satisfy users.

Geely’s New Pure Electric MPV ‘L380’ Coming Soon

Recently, LEVC, a brand under the Geely Group, released design images of its new MPV model, codenamed ‘L380’.

The L380 follows the latest Space-Oriented Architecture (SOA) from LEVC, which was formally launched in the UK in May this year. The core feature of the SOA architecture is its high flexibility and scalability, providing broad bandwidth and a 75% high cabin rate. The wheelbase can be flexibly adjusted within the range of 3,000 mm to 3,800 mm to adapt to different models and market demands.

The appearance of the new L380 features a modern and sophisticated style, including a closed front grille, through-type LED light strip and split-type headlights, giving the vehicle a futuristic look. In terms of interior, the L380 may offer a three-row six-seat layout, providing passengers with spacious and comfortable room.

LEVC is an important brand in Geely’s globalization strategy. It focuses on the research and development of spatial innovation technology and can share the global supply chain resources of the Geely Group. This not only helps LEVC maintain a leading position in product development, but also provides powerful support for the global layout of its products.

Quick comment:

Facing the increasingly fierce competition in the market for new energy vehicles, what LEVC needs is not just a uniquely designed and highly performing model, but a complete market strategy and brand positioning. The role of LEVC in the globalization strategy and its relationship with Geely Group will greatly affect its future development.

Overall, the launch of the L380 is an important attempt by LEVC in the new energy vehicle market. However, whether it can find its own place in this highly competitive market with its unique design philosophy and technical advantages still remains uncertain.

2024 model FORD Mustang Goes On Sale

On December 10, the 2024 model FORD Mustang went on sale with a guide price ranging from 239,800 yuan to 359,800 yuan.

While inheriting the performance genes of the Mustang series, the 2024 FORD Mustang has undergone a complete upgrade of the battery system, significantly improving vehicle’s endurance and power performance. The new model also comes standard with the BlueCruise 1.2 system, adding many safety-assistance features to improve driving safety.In terms of design, the 2024 FORD Mustang retains essential elements of the Mustang series, such as the distinctive “Shark Nose” front face and triple pillar LED tail lights, all packed in a fashionable coupe-style SUV exterior.

The GT Storm edition pays homage to the classic Mustang Twister with its unique color palette and fine details. A variety of new color options are available in the interior to satisfy diverse customer individuality.

To optimize vehicle control, the 2024 Mustang underwent thorough testing on a race simulator and incorporates an aluminium alloy suspension and ultra-high-strength steel materials to enhance the vehicle’s rigid structure. It offers three different driving modes to adapt to various scenarios, and the GT model also features P Zero high-performance tires and red Brembo front brake calipers to elevate sporting performance.

In terms of power, the new Mustang is equipped with FORD’s independent “1T40” Trinary Electric Drive System, where the GT model’s maximum output reaches 359 kW, and the maximum torque is 860 N・m, pushing the vehicle’s 0-100 acceleration time down to merely 3.57 seconds.

In terms of battery technology, the new generation CTP lithium iron phosphate battery pack of the Mustang model collaborates with CATL, extending the range to over 600 kilometers, and potentially up to 700 kilometers. The energy consumption is controlled to 12.4 kWh per 100 kilometers. Additionally, it features a new generation BMS battery management system, ensuring battery stability and safety.

Concerning intelligent technology, the 2024 Mustang features a Qualcomm Snapdragon 8155 cockpit platform and a SYNC®+2.0 Intelligent Link System, supporting wireless CarPlay and offers cards services like camping mode and commute mode to enhance user experiences.

In terms of safety performance, the 2024 Mustang takes measures against thermal diffusion in its battery pack design. The battery case passes the high-pressure squeeze test and salt spray erosion test, both standing up to industry high standards. Its body structure, using 1,700 MPa ultra-high-strength steel material, received high ratings in international authoritative IIHS, E-NCAP, and C-IASI collision tests.Quick Review:

The launch of the 2024 FORD Mustang EV is undoubtedly a significant step for FORD in the field of new energy vehicles.

In terms of performance and design, the 2024 FORD Mustang EV significantly demonstrates FORD’s thoughtful understanding of electric vehicle technology. However, for the 2024 FORD Mustang EV to gain a foothold in the fiercely competitive new energy vehicle market, it is imperative to reshape the image of the FORD Mustang in the Chinese market through price, brand, service, etc., thereby boosting sales.

This article is a translation by AI of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.