Weekly Index

Weekly Headlines

NIO Battery-Swap Technology: Approaching the ‘iPhone Moment’?

The relationship between NIO and ICU is always complicated, yet NIO has the knack of turning adversity into opportunity at critical moments.

On November 21, NIO announced battery-swap cooperation with CCAG.

For CCAG, to participate in NIO’s battery-swap system and improve the recharging efficiency of its models is a valuable addition to its already abundant resources.

For NIO, having CCAG join its battery-swap system is not merely a significant return from the strategic distribution of battery-swapping, but also a refill of the company vitality.

Meanwhile, the milestone victory in the field of battery-swapping cannot be overlooked.

Beyond Battery-Swap Cooperation

Centered around battery-swapping, CCAG and NIO have reached an extensive cooperation.

Reportedly, the cooperation between CCAG and NIO will primarily concentrate on the following aspects:

- Construction and sharing of the battery-swap network;

- Research and development of models suitable for battery swapping;

- Advocating standardization of battery-swap batteries;

- Establishing an efficient battery asset management mechanism.

From the content of the cooperation, it not only piles up the advantages of both CCAG and NIO but also includes the pursuit of industry and social values.

Zhu Huarong, chairman of CCAG, attaches great importance to the cooperation with NIO. He stressed that the significance of the battery-swap business cooperation between CCAG and NIO is profound and hopes that CCAG can strengthen the cooperation with NIO continuously in other platform-based and fundamental fields, from energy, charging, vehicles, ecology, and other aspects.

Obviously, with battery-swapping as the nexus, CCAG is on the lookout for new transformation momentum via NIO.

At the key stage of the whole auto market transitioning to new energy, CCAG has always been apprehensive about falling behind. In the current new energy vehicle market, CCAG has already deployed the three brands of avatr, DEEPAL, and Qiyuan, stepped into both pure electric and extended-range fronts, and launched in-depth cooperation with industry giants such as Huawei and CATL.However, these transition measures are more geared towards product development. In terms of energy supplement systems, Changan Automobile (CCAG) still has shortcomings, and energy supplement system happens to be NIO’s strength.

According to the latest official data, NIO currently has over 2,100 battery swap stations and over 20,000 charging piles. Such a scale of energy supplement infrastructure in the new energy industry is matched by few, especially in terms of battery swap stations.

CCAG spurs its efforts in energy supplement systems, making NIO an optimal choice for a cooperative partner.

Regarding the cooperation between CCAG and NIO, Li Bin mentioned:

This cooperation is the first time NIO has reached a cooperative agreement for a battery swap service with an automobile enterprise, making it very significant for both NIO and the industry of intelligent electric vehicles. I believe that through this cooperation, NIO and CCAG will jointly promote the high-quality development of the new energy automobile industry, and encourage a low-carbon transition in the automotive industry.

Once again, NIO’s future looks promising

Why did the cooperation between CCAG and NIO begin with battery swapping? The answer is simple: battery swapping has great practical value.

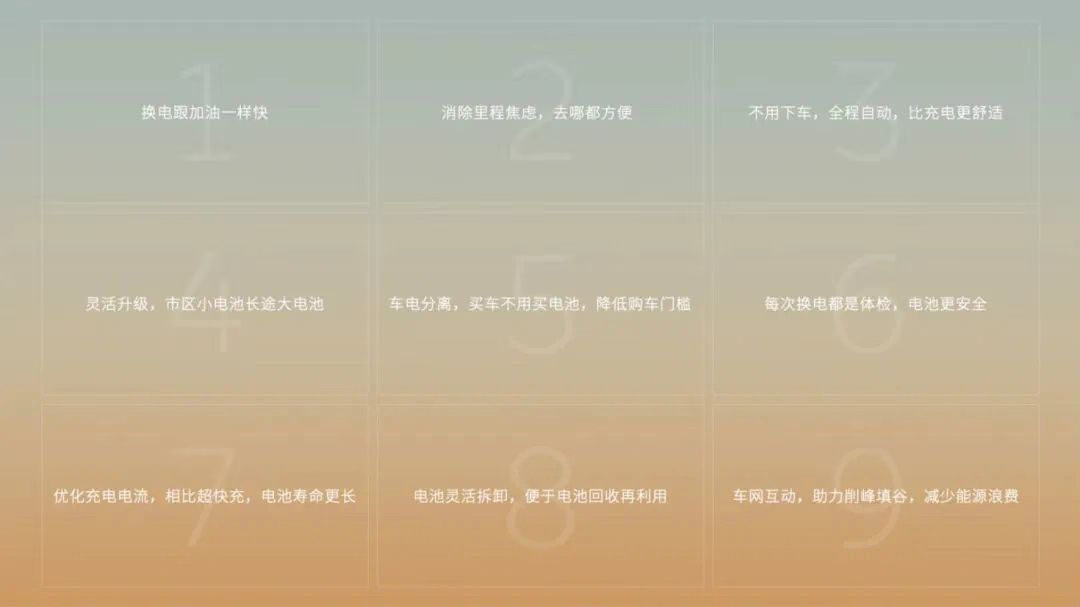

At this year’s NIO Power Day, NIO officials had summarized the following nine points:

- Battery swapping is as fast as refueling, taking only three minutes;

- It eliminates range anxiety, making it convenient to travel anywhere;

- There’s no need to leave the car, everything is automatic, making it more comfortable than charging;

- Flexible upgrade, small batteries for the city and large batteries for long distances;

- Separation of car and battery, no need to buy batteries when buying a car, lowering the threshold of buying a car;

- Each battery swap is a health check, making the battery safer;

- Optimized charging current, compared to super charging, battery life is longer;

- The battery can be easily dismantled, making it easier to recycle and reuse;

- Interaction between vehicle and network, helping reducing peak loads, and saving energy resources.

Among these nine values, both user and social values are included. If put into practical operation, it’s nearly a monumental task too large to be undertaken singlehandedly by NIO as a private enterprise.

Therefore, since the beginning of the layout of the battery swap business, NIO has been questioned by the outside world. Indeed, the construction of battery swap stations is costly, slow to layout, and affects financial performance over time, causing NIO to be subjected to doubts.

What’s even more disconcerting is that, according to a report by IFENG Technology, on the day before the official announcement of the cooperation, NIO employees were questioning the sustainability of the battery swap business. Despite this, Li Bin stated that battery swapping is a great first-mover advantage for NIO.

Despite questions about the battery swap business both inside and outside NIO, Li Bin has never slackened the promotion of battery swap business.

Starting on May 20, 2018, when the first battery swap station was completed in Nanshan Technology Park, Shenzhen. NIO’s construction progress of battery swap stations has been accelerating.

According to official data, NIO took 1,508 days to construct the first 1,000 battery swap stations, and 477 days from the 1,000th to the 2,000th station.So far, the number of NIO’s battery swapping stations has exceeded 2,100, with 646 being high-speed stations, creating a battery swapping network across nine major urban clusters with six vertical and four horizontal connections.

According to the latest official data released by NIO, the total number of battery swaps by NIO users has exceeded 32 million times, with an average of 60,000 times per day.

Next, with the advancement in battery swapping station technology, accumulated construction experience, and the joining of CCAG, the expansion speed of NIO’s battery swapping stations is expected to accelerate further, and its utilization rate should increase quicker.

Clearly, whether in terms of station numbers or usage rates, NIO’s battery swapping business has reached a certain level of maturity. Its application value is surging, and its current state is just as Li Bin described:

It’s time to open to the entire industry.

It’s worth noting that national policies are also encouraging the development of the battery swap business.

Since 2020, several documents including the “Plan for the Development of New Energy Vehicle Industry (2021-2035)”, “Implementation opinions on further improving the service guarantee capacity of charging and battery swap infrastructure”, “Notice on launching the pilot work of battery swap mode application for new energy vehicles”, etc., have been issued in succession, pushing the development of the battery swap on a macro level.

In fact, Li Bin also said that the collaboration between CCAG and NIO is a concrete implementation of these documents, and more auto companies will join the battery swapping collaboration in the future.

With the expansion of battery swap stations and swap communities, NIO’s ‘iPhone moment’ for its battery swap business may not be far off.

Quick Review:

In the era of universal cost reduction and efficiency increase in the new energy vehicle industry, NIO’s considerable investment in heavily promoting the construction of battery swap stations is undoubtedly a counter-current in the industry.

But from NIO’s perspective, this is actually a response to national policies and the pursuit of long-term value.

As NIO’s battery swap stations scale up, the concept of battery swapping becomes well ingrained in public mind, and its user and social value continues to increase, it’s almost impossible for NIO to cut off its battery swap business to take on market competition in a lighter way.

Especially for NIO users or potential NIO users, battery swapping has become a part of the NIO automotive product offering.

Although there is no way back, NIO has planned its way out from the start, as Li Bin mentioned:

NIO was ready to open its charging and swapping business to the industry from day one.

Proving that their preparation was not in vain were the developments in battery swapping, with the joining of CCAG and even more car companies telling NIO that even though the road may be rocky, it’s still there.

Of course, with the expansion of NIO’s swapping community, a new problem is presented — the battery swapping was originally an exclusive experience for NIO car owners, now with the addition of other brand models, how will NIO balance the experience between NIO car owners and owners of other brands?### LEAPMOTOR and Stellantis completed equity delivery on November 20th

According to the announcement, 194,260,030 new H-share subscription shares have been issued to Stellantis, and two members of Stellantis have also entered the LEAPMOTOR Board of Directors.

Worth noting, alongside the completion of the equity delivery between LEAPMOTOR and Stellantis, Dahua officially left LEAPMOTOR. Currently, Dahua no longer holds any LEAPMOTOR stocks.

The completion of the equity delivery implies that LEAPMOTOR and Stellantis have confirmed their ‘marriage’ relationship, and the two parties can have substantial progress in their business.

Wu Qiang, the joint president of LEAPMOTOR commented that the overseas journey of LEAPMOTOR is like climbing a siege ladder, but there are still significant challenges to face.

At today’s media communication meeting, Wu Qiang mentioned many points about the cooperation between LEAPMOTOR and Stellantis.

Here is the main content of the Q&A, we made an edit without changing the original meaning:

Speed of LEAPMOTOR’s future internationalization?

Our current cooperation with Stellantis is equivalent to building a siege ladder for overseas business. There is still a lot of long-term and heavy work to do.

Our plan is to start from the European market, we estimate that delivery can start in the third quarter of next year, selling our cars through export, this is a rough prospect. Before that, we will promote various work according to our timetable.

Is LEAPMOTOR’s funding sufficient?

Because of the high competition in our industry and the development of the company, the need for funding is a perpetual topic.

LEAPMOTOR had over a hundred billion in cash at the beginning of the year, and by the end of September, the company had 11.6 billion. With the collaboration with Stellantis, we also have an income of 8.5 billion Hong Kong dollars.

However, LEAPMOTOR does not see problems from the perspective of how much cash and funds it has, and will raise funds and do business when necessary.

Is there a plan for overseas sales channels?

In key European markets, we will start from more developed markets like Germany, France, Italy, Spain, and other countries will also be launched simultaneously.

The construction, selection of sales channels and after-sales service channels will adopt a combination of approaches, depending on our brand positioning in Europe. LEAPMOTOR is not going to be an absent shopkeeper after having Stellantis’s channels.

We had a very detailed discussion on this yesterday and the day before. We aim to utilize the channel resources over there and also apply our powerful strategy formed in China, including how to let customers place orders and master customer resource information.

After the equity delivery with Stellantis, what exactly does this ‘delivery’ mean?The funds have been successfully deposited into our company’s account, and its two directors have taken their seats on our board; henceforth, we have established a business partnership with them.

In a nutshell: The relationship is solidified, time to get to work.

Chinese companies venturing overseas often face barriers like double opposition in Europe, how does LEAPMOTOR prepare for these challenges?

These regulatory challenges apply to the entire industry, not just a specific company, and we have made appropriate planning for this. By ‘planning’, we mean strategising in terms of our mutual business structure.

To begin with, the establishment of ‘LEAPMOTOR International’. This is a joint venture in the Netherlands, with Stellantis owning 51% and us owning 49%. As Stellantis owns 51%, they should have the capability to alleviate or solve such problems. We also provide Stellantis with adequate benefits to motivate mobilisation of resources to boost sales.

In terms of implementation, our main challenge stems from entering a completely new market. Although our collaboration has huge potential, there are many challenges that we need to overcome.

As Stellantis joins the board, how will this affect LEAPMOTOR’s management and decision-making?

Stellantis becoming a shareholder and joining the director board will not alter LEAPMOTOR’s shareholding structure, shareholder composition, or day-to-day operations and management.

With LEAPMOTOR beginning to export, what changes will occur in product development?

Different countries have different product needs, such as car system software, maps, languages, etc. We will negotiate with suppliers like Google to meet the different needs of each country.

Additionally, our LEAP 3.0 third-generation central integrated electronic architecture comes with three arrangements, high, medium, and low, which are adaptable for different car models and sizes. Therefore, this framework allows us to flexibly meet requirements.

Hence, it is not a matter of developing for the European or Chinese market. Ultimately, the cars manufactured in our R&D system can be switched freely between the European and Chinese markets.

Will the new joint venture model become a trend?

We don’t think that this will become a trend. Each company has its own business development needs. Our collaboration with Stellantis is based on our current situation and overseas strategy.

To summarise this matter, every company should develop its business based on its circumstances.

Stellantis has its cars to sell, how can it be incentivised to sell LEAPMOTOR cars?

Firstly, Stellantis does not have products similar to LEAPMOTOR.

Secondly, the various brands under Stellantis have different orientations and internal competition, thus maintaining a balance.

Stellantis, as the joint venture partner owning a 51% stake, would also be a fiscal winner if LEAPMOTOR sells well.

Can China’s Production Meet Overseas Demand?

If LEAPMOTOR’s current production capacity in China is fully utilised, it can support sales of 700,000 cars. Moreover, if this number is exceeded, LEAPMOTOR won’t plan heavy investments into factories but leverage the existing capacity of Stellantis or other third parties.

Short Comment:

From the Q&A above, LEAPMOTOR has made ample preparations in the face of the brutal culling in the new energy vehicle market, including for overseas expansion, production capacity, and technical architecture.

With continuous growth in LEAPMOTOR’s monthly sales, its brand recognition and reputation will undoubtedly strengthen, helping LEAPMOTOR maintain its footing in the culling and tread further. However, the domestic market’s development continues to be highly uncertain, and as Wu Qiang said, the overseas market has just started to climb the siege ladder, posing great challenges.

Yet amidst uncertainty and challenges lie ample opportunities. LEAPMOTOR has undoubtedly achieved phased success in sales, and its future development holds considerable scope for imagination.

Guangzhou Auto Show: SenseTime’s Automotive Tech Shines

At the 21st Guangzhou Auto Show on November 20, 2023, SenseTime showcased its latest achievements in autonomous driving and smart cockpit fields.

In autonomous driving, SenseTime’s BEV target perception algorithm, BEV lane line perception algorithm, and NN-Fusion integrated perception algorithm were integrated into models such as Hyper GT. The core of these algorithms is to enhance target detection accuracy, ensure vehicle stability in varying driving conditions, and optimise lane line recognition.

Not only adopting the aforementioned autonomous driving technology, but Hyper GT’s smart cockpit ADiGO SPACE 5.0 also standardised SenseTime’s DMS driver monitor and OMS passenger monitoring solutions. These systems with advanced perception can monitor driver fatigue and potential hazardous behaviours in real-time, ensuring a safe driving environment. Additionally, SenseTime’s gesture awareness and child care options provide extra safety and convenience for passengers.

Moreover, SenseTime’s technology is also applied in JT Traveler, Guzzi ES9, E8 series and Honda Accord’s smart cockpits. In the OTA updates for ZEEKR X, the newly added ‘sentinel mode’ and ‘B-pillar interactive system’ are also based on SenseTime’s AI technology.

Up until the first half of this year, the performance of SenseTime’s Autofocus technology has been standout in the market, with production and delivery numbers reaching 390,000 units, new installed capacity exceeding 5 million units, and a cumulative installation of over 160 models. This reflects SenseTime’s continual effort in providing intelligent product solutions, and its constant advancement in developing and applying cutting-edge technologies like large-scale models. With the further maturation of its technology and wide market acceptance, SenseTime’s Autofocus is expected to occupy an even more significant position in the field of intelligent vehicles.

Up until the first half of this year, the performance of SenseTime’s Autofocus technology has been standout in the market, with production and delivery numbers reaching 390,000 units, new installed capacity exceeding 5 million units, and a cumulative installation of over 160 models. This reflects SenseTime’s continual effort in providing intelligent product solutions, and its constant advancement in developing and applying cutting-edge technologies like large-scale models. With the further maturation of its technology and wide market acceptance, SenseTime’s Autofocus is expected to occupy an even more significant position in the field of intelligent vehicles.

Quick review:

SenseTime’s Autofocus demonstrated its latest achievements in intelligent driving and intelligent cabin at this Guangzhou Auto Show, undoubtedly taking an important step in the new energy vehicle industry. The application of its BEV target perception algorithm, lane line perception algorithm, and NN-Fusion fusion perception algorithm not only improve the accuracy of target detection, ensuring vehicle stability in various driving environments but also optimize the process of lane line recognition. SenseTime’s Autofocus AI technologies have also been applied in the intelligent cabins of models like JT Traveler, GS9 and E8 series, Honda Accord, showing its wide applicability and generalizability.

This article is a translation by AI of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.