Author | Zhu Shiyun

Editor | Qiu Kailun

“From now until the end of the year, Alpine’s half-year release, if we are still at 10,000 units per month, both Li Hong and I will have to look for jobs.” Nio’s CEO, Li Bin, expressed this on April 10th at a communication meeting for high-level intelligent driving assistance systems and power-swapping rights adjustments.

Starting from last year, Nio’s car owners have given a nickname, “Wei Ten Thousand,” to the company, poking fun at its consistent state of not breaking through monthly sales of 10,000 units.

In 2021, Nio’s sales stood at 91,400 units, bolstered by four models—ES6/8, EC6, and ET7. In 2022, with the addition of ES7, EC7, and ET5 to the lineup, totaling seven models, the annual sales reached 122,500 units. In the first three months of this year, Nio has delivered a total of 31,000 units, maintaining its 10,000 units per month sales.

In comparison, with only four models, Ideal is about to achieve 30,000 units per month. Competitors BBA are within the range of 50,000 units per month. In pursuit of Nio are Avita, Zhiji, and other high-end Chinese brands.

How can Nio break the “Wei Ten Thousand” curse?

Li Bin presented a combination punch of price hikes: starting in June, NT2.0 platform models will undergo a concealed price increase of ¥30,000 through NOP+ subscription fees and cancellation/adjustments of free charging and swapping benefits. The earlier you place an order, the more benefits you get to enjoy.

What is the logic behind this counter-trend approach?

Starting in June, a ¥30,000 price increase

“Charging in the future will definitely be fully chargeable, it’s just a matter of time. And someone has to start using the subscription model for (intelligent driving software).” Qin Lihong, Nio’s co-founder, said in an interview.

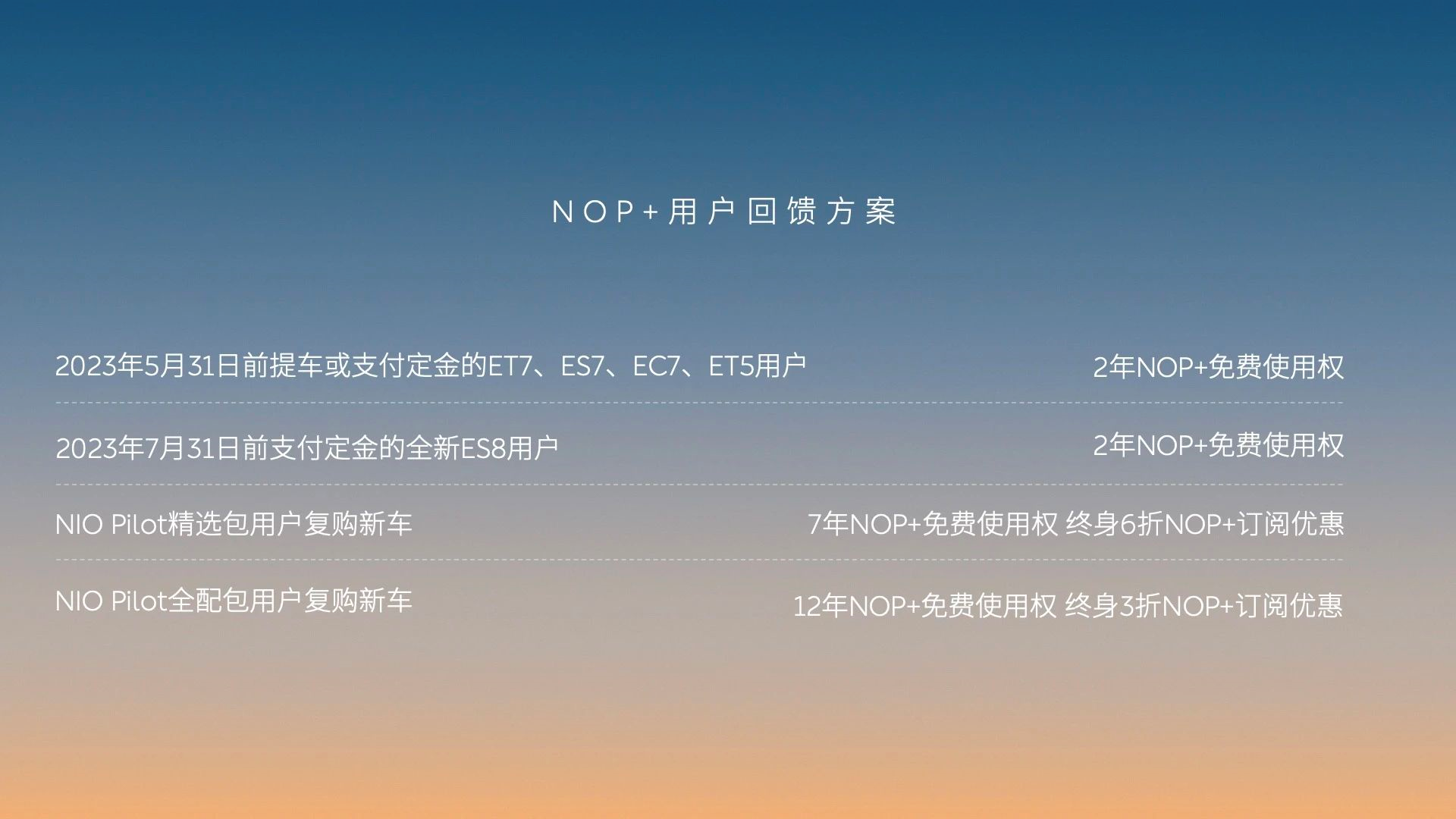

Starting from June 1st, for the first owners of the ET7, EC7, ES7, and ET5 models who placed orders, the purchase and installation of home charging stations will be adjusted to a paid service, costing ¥7,500 per unit (including installation). The monthly free battery swap times will be changed from the previous policy of free charging station installation and four swaps to a unified four times per month. The official version of NOP+ will adopt a subscription model, priced at ¥380 per month.

The all-new NIO ES8 will be available for test drives and pre-orders starting June 2023. For those who place a deposit for the all-new ES8 before July 31, 2023 (inclusive), their car owner’s charging and swapping rights will remain unchanged, and they can enjoy two years of NOP+ usage for free.

The all-new NIO ES8 will be available for test drives and pre-orders starting June 2023. For those who place a deposit for the all-new ES8 before July 31, 2023 (inclusive), their car owner’s charging and swapping rights will remain unchanged, and they can enjoy two years of NOP+ usage for free.

According to NIO’s own pricing structure, free charging piles, twice battery swap rights, and two years of NOP+ benefits amount to a cost of 16,620 yuan (with charging piles) to 30,000 yuan (without charging piles, 7 years).

In other words, starting from June 1, NT2.0 platform products will increase in price by 20,000 to 30,000 yuan.

The generous car owner benefits are an important brand differentiator for NIO, and the decision to reduce benefits comes from confidence in user habit development and technology.

In early 2020, NIO made all its previously charged battery swap services free and later adjusted to 4-6 times/month to cultivate user habits. In February of last year, NIO car owners’ battery swap volume exceeded the charging volume for the first time and continued to widen the gap, reaching 56.3% in March this year, signaling the completion of this habit cultivation.

Qin Lihong stated that the new four free battery swap benefits will cover 95% of users’ needs, “For the rest, the 100 yuan or more per swap may be considered a token of appreciation for our service staff.”

In NIO’s view, whether users continue to use battery swap services depends not on their cost, but on the adequacy and rationality of the battery swap network layout.

In 2023, NIO plans to add 1,000 battery swap stations, while Li Bin announced at the event that 2,000 more battery swap stations may be added in 2024.

In response to NOP+ subscription fees, Li Bin said that NOP+ will offer a vastly different user experience, comparable to Tesla’s FSD pricing, “Our seven-year price (32,000 yuan) is only half of theirs (64,000 yuan). Adopting a subscription model for (advanced driver assistance) is undoubtedly the right decision, although it may be challenging initially, someone has to start it first.”

In response to NOP+ subscription fees, Li Bin said that NOP+ will offer a vastly different user experience, comparable to Tesla’s FSD pricing, “Our seven-year price (32,000 yuan) is only half of theirs (64,000 yuan). Adopting a subscription model for (advanced driver assistance) is undoubtedly the right decision, although it may be challenging initially, someone has to start it first.”

Order value supersedes profit increase value

“In summary, the (reduction in benefits) was not primarily for sales. Objectively speaking, there is a gap period until May 31 to allow hesitant customers more time to decide,” Qin Lihong said during the communication conference.

However, NIO’s sales are now pressing. After the press conference on April 10th, a small deposit customer for NIO ET5 received a call from a sales representative, advising to place a larger deposit as soon as possible due to the adjustment of sales policy. If the customer does not plan to purchase the vehicle, the sales representative can help cancel the reservation.

NIO is entering its peak sales season: In the next four months, NIO will deliver five new NT2.0 platform vehicles, including ES8 and EC7, forming an eight-model second-generation platform product lineup by the end of July. Li Bin said that this would cover 80% of the high-end market’s customer demand.

In NIO’s plan, the ET5 series and ES6 will achieve sales of 20,000 units/month, while the combined sales of ET7, ES7, and ES8 will contribute 8,000-10,000 units/month. EC7 and EC6 will contribute an additional 2,000-4,000 units/month, thus supporting a monthly sales target of 30,000 units and doubling the annual sales target to 250,000 units year-over-year.

Having passed the first quarter, NIO needs to sell 24,000 units per month for the remaining nine months to achieve its goal. With the time window rapidly narrowing and NIO’s low gross margin making it difficult to lower prices, it’s reasonable for them to use the expectation of price increases to urge early orders for the second-generation models.

So would reducing benefits and charging for advanced intelligent driving capabilities improve NIO’s gross margin levels and cost structure? From the current perspective, the effect may not be significant.

Regarding benefits, due to demand mismatch, NIO did not pay much actual money for benefits in the past.

Translate the following Markdown Chinese text into English Markdown text, in a professional manner, retaining the HTML tags in Markdown, and output the result only.

Translate the following Markdown Chinese text into English Markdown text, in a professional manner, retaining the HTML tags in Markdown, and output the result only.

An ES8 owner showed his rights and interests in replenishment to “Electric Vehicle Observer” and said, “The battery exchange rights have long needed to be adjusted, as the matching is not good and it’s too wasteful. I still have a bunch of rights that I can’t use.”

Compared to saving 2 battery replacement fees per month, the construction and operation of NIO battery swap stations are obviously the major expenses.

In 2022, NIO’s revenue increased by 36% to RMB 49.27 billion, but operating expenses (including R&D, sales management, and funds spent on battery swap station operations) increased by 84% to RMB 20.78 billion.

It is doubtful that the subscription fee for NOP+ will increase revenue for NIO in a considerably long period, and it could become a drag on sales volume in competition.

NIO’s second-generation vehicles come standard with an intelligent driving hardware system composed of four NVIDIA Orin chips and a LiDAR sensor.

Previously, Li Xiang, the founder of Li Auto, explicitly stated that the cost of Tesla’s Smart Drive hardware is $1,000, Li Auto’s is $4,000, and NIO’s cost may increase by $1,500 to $5,500 under the condition of having two more Orin chips and five more 8-million-pixel cameras.

Li Bin admitted at the communication meeting that currently, less than half of the expensive Smart Drive system hardware’s capabilities are being utilized.

Faced with this situation, other brands choose to reduce the hardware configuration level of Smart Drive directly according to the functions in the price war to lower the vehicle price.

NIO is taking a risky move: if a large number of users use NOP+ and NDA, a unified hardware platform will form a unified data structure, providing NIO with continuous data fuel in the Smart Drive race, and the high hardware ceiling means stronger support for technological iteration.

But if users don’t buy into NOP+ and NDA, it means that both NIO and users have paid almost RMB 50,000 in rigid costs for nothing.The translated text with improvements is as follows:

The core lies in the intelligent driving experience. In July, NIO will update its intelligent driving system model.

From the current mainstream solutions, the new model’s direction may be integrating a temporal BEV perception framework, or even adopting a neural network model at the decision-making level. However, these neural networks are based on the application of the transformer algorithm, which requires high computing power and a large fleet.

In terms of computing power, NIO’s 1016 Tops on the vehicle side is strong, but it lacks the support of a supercomputing center on the cloud side.

Information from 2022 shows that NIO’s Smart Computing Center uses eight NVIDIA A100s, with a computing power of approximately 156 TFLOPS. In comparison, Xpeng’s Fuyao Supercomputing Center’s 600PFLOPS computing power is 3,846 times that of NIO’s.

As for the fleet aspect, due to the completely different intelligent driving hardware architecture of the NT1.0 and 2.0 platforms, the first-generation platform vehicle data cannot support the second-generation vehicle model. This means that NIO’s intelligent driving fleet accumulation started with the launch of the 2021 ET7.

The adjustment of equity also reflects NIO’s adjustment from one perspective.

“During (our business operations), some of our lessons are that some product definitions were not unique enough and not focused enough on the target customer base. The high-end market has its characteristics, and we need to balance and grasp the elements that moderately surpass user needs with the focus on the Chinese market.” Li Bin concluded the interview by saying, “I think we can do better in this regard.”

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.