The main battlefield in the current battery industry is in the field of lithium iron phosphate.

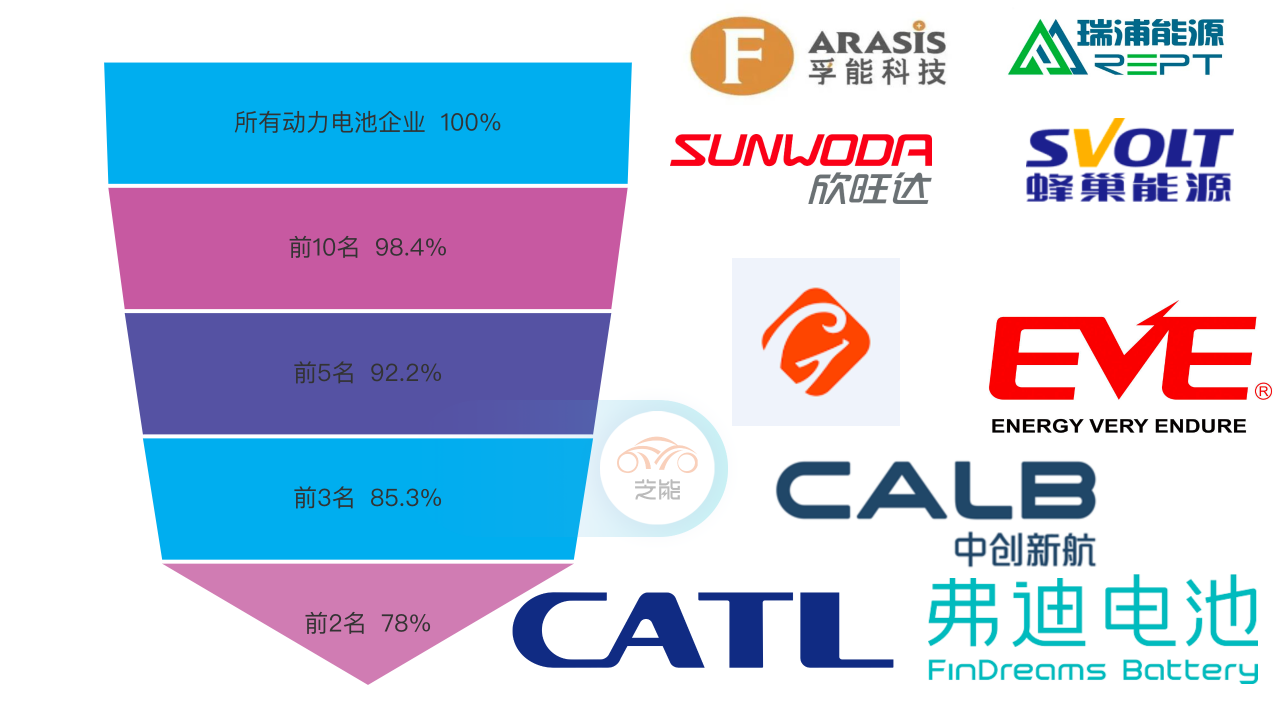

The demand of the second-tier power battery companies is further squeezed. The top 3, top 5, and top 10 power battery companies account for 85.3%, 92.2%, and 98.4%, respectively, of the total installed capacity. For second-tier companies in 2023, binding strategic customers is the most important thing to maintain their capacity utilization rate when demand is declining.

● CATL

In the first two months of 2023, CATL’s premium customers were also affected by the price war. CATL’s biggest advantage currently is its solid customer base.

● EVE Energy

Recovery of installations is relatively quick. EVE Energy has excellent product design, production layout, and customer matching. Based on current installation volume, it is superior to companies with lower foundations and is also opening up new supplies. Opportunities will be greater than challenges in 2023.

● Farasis Energy

As low-cost competition begins in 2023, the gap between Farasis Energy and CATL is narrowing. Lithium iron phosphate batteries are logical for cost-effective models, and every automaker has to participate.

● SVOLT Energy

As the battery company that follows CATL the closest, SVOLT Energy recovered quickly in February, directly impacting CATL.

● Honeycomb Energy

As demand from Great Wall Motors declined and sales of ZEEKR have dropped recently, there have been some difficulties that have affected the shipments of Honeycomb Energy. Honeycomb Energy is prospective in power and energy-balanced batteries for plug-in hybrid vehicles.

● Funeng Technology

After the landing of SPS’s soft pack technology, its combat effectiveness will show. Relying solely on three-element products is indeed difficult in China, and compatibility with various chemical systems is needed to win more customers.

● XWDE Energy

Overall demand is still in an upward trend. XWDE Energy supports the highest installation volume of Dongfeng Group’s battery, accounting for 79%, followed by Geely.

In February, the production of power batteries is recovering, and the entire production in 2023 will gradually increase. The demand for the power battery industry is increasing, but the need for price reduction is imminent. Currently, all material prices, except for major materials, have gradually fallen into place.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.