Author | Xiaoying

Editor | Qiukaijun

In 2021, the penetration rate of new energy vehicles has surpassed the turning point of 10%. In 2022, the penetration rate reached 25.6%, with sales increasing nearly twice as much, and climbing to 6.887 million.

After 10 years of market cultivation, China’s new energy vehicles have entered a period of rapid development. As the quality and diversity of new energy vehicle products continue to improve, consumer recognition is also constantly increasing.

2023 will be the first year that China’s new energy vehicle sales subsidies are completely withdrawn, and the entire market will enter a new development stage, with three obvious trends:

First, the new energy battle has entered the second half, and the competition for new energy has upgraded to the competition for “intelligent new energy”. The competitiveness of intelligent driving, intelligent cockpit and other functions is further enhanced. It can be said that winning the electrification battle is just the ticket to enter, and winning the intelligentization battle can see the final result.

Secondly, whether it is an independent brand or a joint venture brand, whether it is a new force or a traditional car company, the attitude of striving for the high ground of new energy is already very firm, and is quickly laying out the market competition with multi-category and multi-level new energy vehicle models.

Third, from the perspective of car companies, the technological layout needs to be forward-looking and at least “half a step ahead” to form vertical combat effectiveness. If it cannot successfully break through, it will enter a vicious cycle of internal competition. How to find a breakthrough direction has become the top priority in the strategic development of independent brands.

Based on these three trends, it can be seen that the competition in the era of “intelligent new energy” is essentially a systematic capacity competition, including forward-looking strategic capabilities, core technology strength, and cost control strength.

Long-term Thinking of Technological Layout to Occupy the High Ground of the Track

Technology is always the core issue of the automotive industry. Wei Jianjun, chairman of Great Wall Motor, once said in an interview, “Technology is always the foundation of the automotive industry. We have to think about the next generation even when we are making the current generation, or even longer-term.”

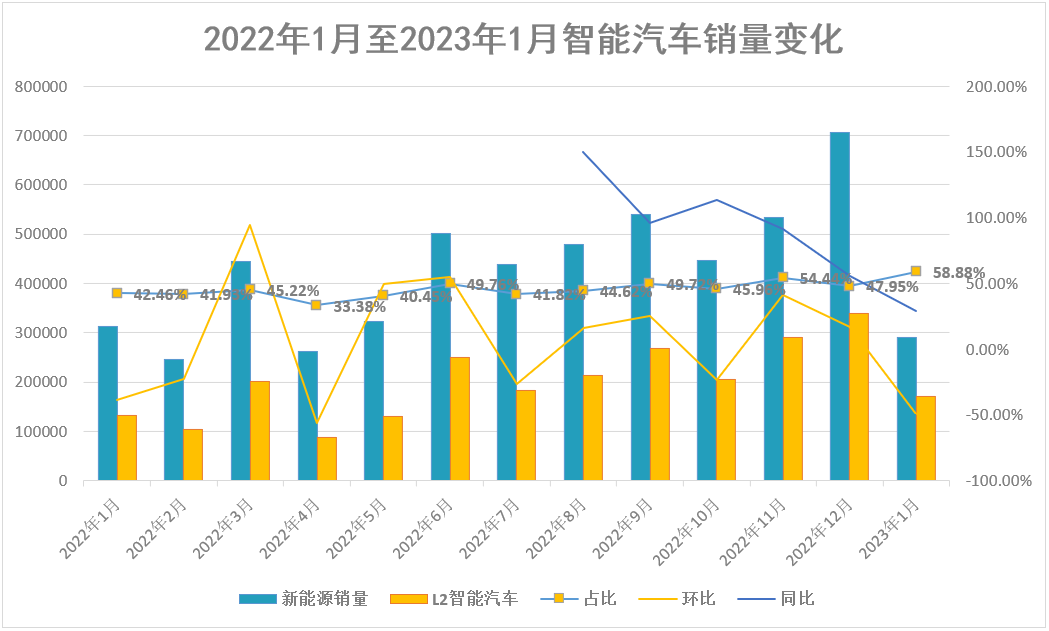

Over the past decade, electric and intelligent vehicle transformations have been the two major revolutions that the automotive industry has faced, both driven by technology. If the first half of new energy vehicles was about the battle for energy, it was about the competition among various routes of pure electric, hybrid and hydrogen fuel, ultimately leading to the development of products that are more price-advantaged, safe and reliable. Then, the second half of new energy vehicles should be a direct collision of intelligent capabilities, and the core competition is the evolution of intelligent driving capabilities.At the beginning of this year, a set of data released by the China EV100 showed that the penetration rate of L2-level intelligent driving passenger cars in the new car market in China has reached 23.5% in 2021, and is expected to rise to 32.4% in the first half of 2022. It is predicted that the penetration rate of L2-level and above intelligent networked vehicles in 2025 will reach 80%.

According to the data on insurance, 88 car companies sold new energy vehicles with a total of 299 models in January 2023. Among them, 56 car companies and 159 models come with or have optional L2-level intelligent driving functions. The sales of intelligent vehicles accounted for 58.9% of the total sales of new energy vehicles. It can be seen that the proportion and sales penetration rate of models equipped with L2-level intelligent driving are increasing. The new energy vehicle market has entered the era of “intelligent new energy”, and intelligent driving functions have increasingly become the core selling points.

So what is the key to breaking through in the “intelligent new energy” era? The industry generally believes that the decisive factors for the mass production of intelligent driving are two points: first, scale data acquisition, and second, efficient data utilization. Behind this is the competition in big data and computing power.

With the mass production of high-performance SoCs and LiDAR, 2022 is called the first year of mass production of advanced intelligent driving. Car companies with a sufficient user base have inherent advantages in the acquisition of scale data. Currently, what everyone is considering is how to efficiently utilize the data. It can be said that whoever can occupy this commanding point will be half a step ahead in the “intelligent new energy” era.

Over-investment in research and development, deep digging and competition to protect the moat

Excessive R&D will bring confidence to the strategic deployment of intelligentization. Doing things that others have not done will undoubtedly require more time and cost, but the strategic return it brings will also be unprecedented.

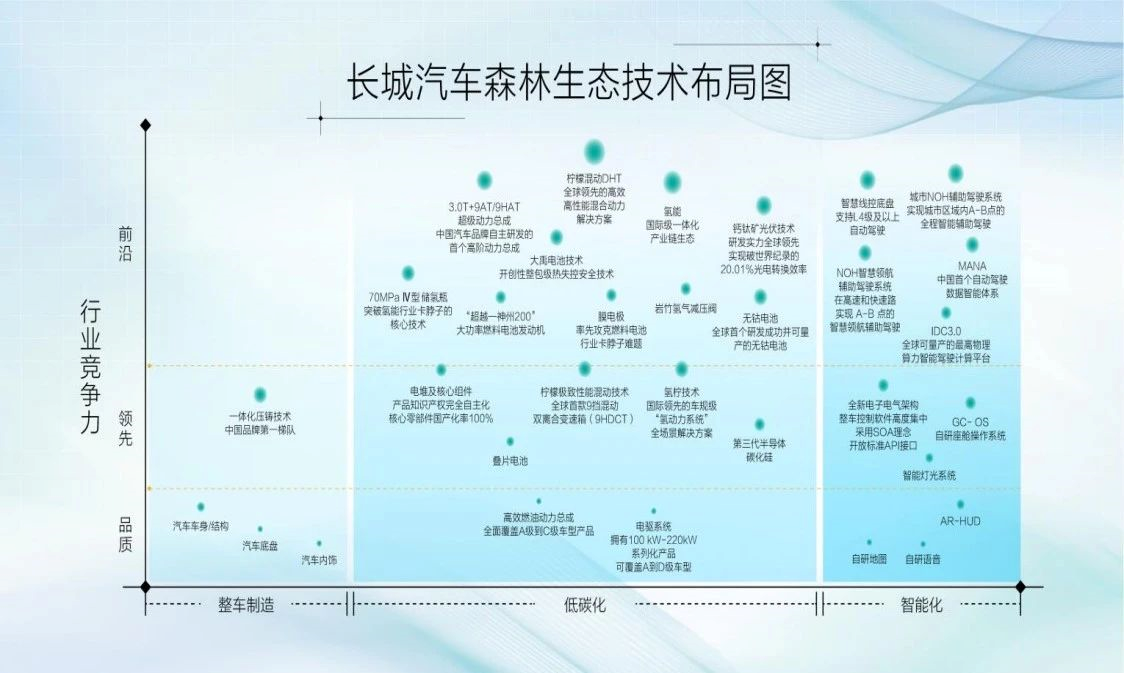

In the era of fuel vehicles, the core technologies of automobiles are engines, transmissions, and chassis. In the era of intelligent new energy vehicles, the core logic based on technology has not changed, but the core technical points have become the three electrical systems, the intelligent driving system, and the wire-controlled chassis. To go further, it is the hardcore technology such as batteries, chips, algorithms, wire-controlled steering, and wire-controlled braking.## For high-tech full-stack layout, it has become a common choice for powerful automobile companies. Whether it is the new car-making force We Small Rationality, or GreatWall Motors and BYD, all are investing heavily in these areas.

With the development of the new energy vehicle industry, GreatWall Motors has deployed core technologies such as Dayu battery, Coffee Intelligence Driving, and Lemon Platform, and has applied for more than 100 patents around the core technology of wire control chassis.

On the 2022 Global Auto Patent Big Data List, GreatWall Motors’ patent publications reach 6042, a year-on-year increase of 62.86\%, ranking first among private auto companies in China; the number of patent authorizations reaches 4652, a year-on-year increase of 42.87\%, ranking first among auto companies in China. In the field of new energy vehicles, the number of GreatWall Motors’ patent publications and authorizations are 1966 and 1650, respectively, a year-on-year increase of 51.11\% and 80.53\%, both rank first among auto companies in China.

GreatWall Motors has an unwritten slogan in technology research and development investment—excessive investment in R&D. It is foreseeable that the deeper the technology investment, the stronger the moat of protection. As the industry develops into a more challenging phase, the advantages of technology investment will be more prominent.

After experiencing the two-year shortage of cores and electricity, players in the entire new energy vehicle track have begun to realize the importance of supply chain security. Coupled with the price war caused by Tesla since the beginning of this year, people have also seen the potential of vertical integration layout in cost control.

The core of supply chain security lies in not being choked and having greater cost control space. GreatWall Motors is a company that recognized this point relatively early and has started to build a “forest-like” ecological model.

During the era of fuel cars, GreatWall Motors paid great attention to the cultivation of the supply chain system, and this strategic advantage has been retained into the new energy vehicle era. GreatWall Motors is one of the earliest two automakers to layout power battery capacity and one of the earliest domestic automakers to establish an intelligent driving department. Both layouts have achieved results: Honeycomb Energy has grown into a well-known domestic power battery company, and Hao Mo Zhi Xing has hatched into a domestic automatic driving track star enterprise.These two companies have become the left and right hands of Great Wall Motors in the competition for the “smart new energy” era.

Self-developed core technology for product iteration control

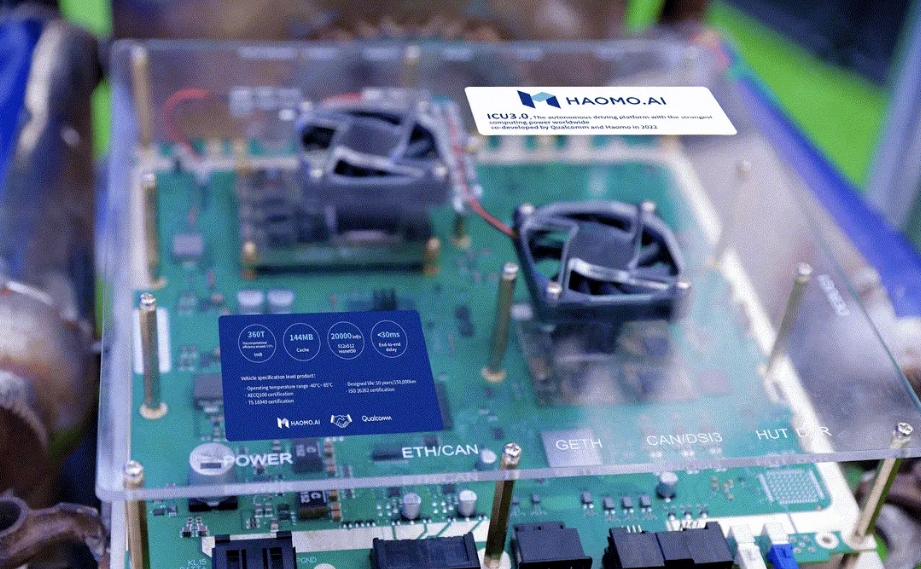

Currently, the competition in the “smart new energy” field has entered a white-hot stage. In the initial stage, the investment in car-side computing resources and the configuration of perception hardware were the main focus. However, in the current stage, the competition for computing power is no longer limited to the car side, and has begun to enter the cloud, namely the construction of the intelligent computing center.

The development of intelligent driving has entered a critical stage of rapid growth, where the efficiency of data acquisition and processing is crucial for algorithm evolution. The huge demand for computing power, which includes massive product data, large-scale data training, and the application of large models, requires the support of the intelligent computing center.

Currently, Great Wall Motors has become one of a few domestic car companies that have taken the lead in mass-producing advanced intelligent driving functions, and has taken an early move to lay out the “Xuehu Oasis” intelligent computing center.

The “Xuehu Oasis” is jointly built by Momenta and ByteDance’s cloud service platform, Volcano Engine. It can achieve 6.7 exaflops of floating-point operations per second, 2 terabytes of storage bandwidth per second, and 800 gigabytes of communication bandwidth per second.

The superefficient computing power of XPeng Motors’ previously released intelligent computing center, “Flying Fox,” was 600 petaflops, or 60 billion billion floating-point operations per second. At that time, XPeng claimed it to be the strongest computing power of an autonomous driving intelligent computing center. In terms of computing power comparison, “Xuehu Oasis” has surpassed “Flying Fox” to become the largest intelligent computing center in China’s autonomous driving industry.

By 2023, supercomputing centers will become entry-level options for autonomous driving companies. It is expected that more companies will start investing in their construction. Great Wall Motors is one of the companies that have taken early moves in this exploration.

With the support of the intelligent computing center, as of the beginning of the year, Great Wall Motors’ HPilot intelligent driving system has gone through 6 OTA upgrades and iterated to version 3.0. The third-generation HPilot product is mounted on nearly 20 models, such as Weipa, Tank, Euler, and Great Wall Cannon, and has assisted driving users with a total driving distance of over 25 million kilometers. It is reported that the model equipped with the NOH system will also be launched in 2023.

Meanwhile, Great Wall Motors has also listed large-scale chip and third-generation semiconductors such as silicon carbide as strategic development directions for 2025, and has invested in Hebei Tongguang Semiconductor Co., Ltd. and established Xindong Semiconductor Technology Co., Ltd.The significance of integrated circuits and high-performance chips lies in two aspects. On the one hand, as we enter the era of intelligent new energy, the demand for chips has significantly increased. A fuel car requires several hundred chips, while the demand for chips for an intelligent new energy vehicle can reach 1,000 to 2,000. Therefore, self-developing chips have become a key direction for automakers to reduce costs.

On the other hand, if the power battery is the heart of a car, then high-performance chips are the brain of a car. The performance of these chips determines the development and optimization efficiency of intelligent driving and intelligent cockpit functions. Connecting the technology from the bottom-up is beneficial to automakers to better develop various intelligent functions.

Therefore, automakers do not necessarily need to have all the technologies in their own hands, but it is still necessary to self-develop and control capabilities such as batteries, chips, and intelligent driving solutions.

As Wei Jianjun said, “In the era of ‘intelligent new energy’, the speed of product iteration represents certain competitiveness, and once a specific supplier is chosen, any changes to the car will be hindered.”

Overall, winning the “intelligent new energy” battle puts increasingly high demands on automakers. The core logic is to achieve cost leadership through technological advancement. This will not only secure the present but also ensure victory in the end.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.